"At the moment MTN finds themselves on the wrong end of the stick as far as developing markets are concerned, the wrong ones. Emerging market stocks, the market tells you those are finished."

To market to market to buy a fat pig. Drop your pom-pom gun, here is my bazooka. That is kind of the message that European Central Bank (ECB) chief Mario Draghi sent when he showed the market his cards. Draghi suggested in the press conference post the ECB decision (watch the YouTube video -> ECB Press Conference - 21 January 2016) to leave rates on hold (that wasn't a surprise) that "we have the power, the willingness and the determination to act. There are no limits to how far we are willing to deploy our instruments within our mandate to achieve our objective of a rate of inflation which is below but close to 2%."

It is probably easier to read the statement and then the questions and answers segment: Introductory statement to the press conference. I remember that we had a headline that went something along the lines of "Mario Draghi, cool, suave, measured, obviously Italian". Central Bankers need to give off the I am large and in charge message. The obsession with the actions of the Central Banks is something that has been around for years, in all of my readings of the historical stock market post the second world war, the various authors are always pointing out the market waiting for the Federal Reserve. If you wait for the Fed your whole life before making an investment commitment, it may be never.

In some of the questions and answers, and this shows how much of a mugs game it is to even interpret the minutes of the banks meetings, the ECB president corrects various assumptions of the folks asking the questions. As he was there. And that of course is central to my argument of not trying to second-guess what central banks are going to do, and what impact that is likely to have for equity markets. Nevertheless and having said that, stocks globally rallied on the basis that Mario Draghi's ECB (it is not his, rather he is in charge) are ready to act and will likely come with continued programs to continue to lend a hand to the soggy European rate of growth.

Our market locally may have ended down 0.1 percent, that was comfortably off the lows of the day, we were briefly in the green during the second half of the session. There was a trading update from the Clicks Group that looked pretty decent, the market cheered the news and sent the stock up 4.4 percent. Since the November highs however the stock is down around 19 percent. Is it fair to say that until yesterday, if I am using the technical terminology correct, Clicks was in a bear market? Ha ha, I dislike the technical terms, they can be used how and when you like, they are used to generate headlines and that in turn leads to emotional responses from investors.

MTN was out with another bit of bad news during the day, the authorities in Cameroon suggesting that the company is involved in bribery, along with the other operator, Orange. And guess what, they are seeking to hit the company with another fine. No fine yet and MTN haven't been given any official documentation so they haven't released a SENS, that didn't stop the stock tumbling over 4% yesterday. We certainly are in the midst of a terrible storm for the company, the Nigerian overhang of a court case pending and now this, it really feels awful. And by the way, we certainly called this one wrong in the short term. Wrong, wrong, wrong. Currently trading on eMpTyN. We will continue to evaluate and for the time being continue to suggest that one holds the line here, uncertainty always leads to selling and with lower prices the faith is lost. As Byron pointed out yesterday, MTN has 4 times as many subscribers compared to Vodacom but now has a lower market cap. At the moment MTN finds themselves on the wrong end of the stick as far as developing markets are concerned, the wrong ones. Emerging market stocks, the market tells you those are finished.

Talking about emotions, it is important to keep them in check. A nice piece from the Psi-Fi blog on what to do when moments like these strike: Be Prepared, Be Resilient. All the important points are to be made there, nobody really knows how markets are likely to react in the very short term. Everyone panics. The worst thing to do is to throw in the towel, either early or late as the author points out. Stick to your savings plan, stick to the quality in your portfolio. Let us throw in a few lines that are worth regurgitating, if you are not going to read the whole thing:

"There's no point being the best darned stockpicker in the known universe if you flee for the hills at the first sign of trouble - or, even worse, at the last."

"Indeed, there's an argument that any strategy that works in the long term must occasionally go wrong to shake out the feeble and fickle, otherwise it becomes a crowded trade and fails by definition."

And lastly: "We absolutely know that markets don't stay the same but all we suffer from the curse of myopia - the ability to disregard painful past experiences just as soon as they're no longer current."

In the words of the worst limousine driver in history, Lloyd Christmas, "be strong" as he said goodbye to the girlfriend who never was, Mary Samsonite. Stay strong, stick to the plan, don't be frazzled and remember what the objective is likely to be. Saving is hard at the best of times, when equity markets turn down, it can be even harder.

Stocks across the seas and far away started on a roaring note, and then the rally fizzled a little, the nerds of NASDAQ ended flat, whilst the S&P added half a percent. The Dow Jones added three quarters of a percent, the oil price did an about turn, on comments from the Saudi kingdom that current prices were a little crazy. Agreed, what however is the cost of production and what about a windfall for Joe Consumer across the globe?

Linkfest, lap it up

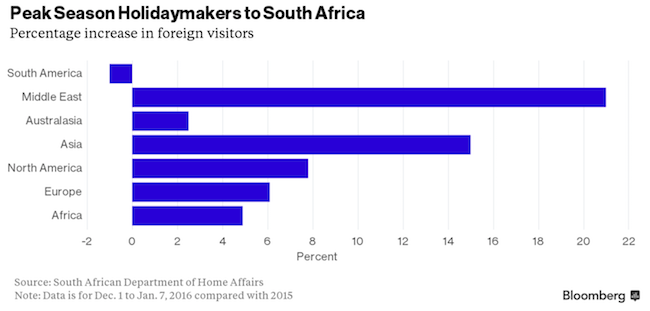

The one advantage of the weaker Rand is that traveling to South Africa is now very cheap - Buy Your Ticket to South Africa on This Rand.

Here is the Barmy Army singing about the good exchange rate at the cricket the other day - 23 Rand to the Pound - Barmy Army

European furniture sales has hit a peak according to IKEA. The good news is that reaching these record numbers in furniture sales points to a strong underlying economy, the bad news is that there is not much growth for Steinhoff's assets in Europe - "We've hit peak curtains:" Even IKEA thinks everyone's bought enough useless stuff

Is it a problem that 50% of the planet can't name a single CEO? I wonder if it stems from an overload of information from social media, with the result being that no knowledge is retained? - More than half of people can't name a single CEO. I was shocked to see that 80% of Germans couldn't name a single CEO.

Using mosquitoes to fight other mosquitoes seems like a good idea - Brazil's fighting its biggest epidemics with weaponized mosquitoes.I suspect that there will be some pushback to using genetically modified mosquitos in the wild but if we can stop the spread of the diseases that they carry, it will improve the lives of millions.

Home again, home again, jiggety-jog. Markets across Asia are mostly higher, with the exception of Shanghai. We know the deal, 100 million retail accounts, a propensity to speculate on top of a desire to save at all costs, inside of a limited pool of assets, it is truly a strange cocktail. The Japanese market is up over three and a half percent, the Hong Kong market is up just a little less than half of that.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment