"Investing, or having the ability to invest in another business that someone has taken public is somewhat magical. You see examples around you, your friends, ex colleagues and family with successful businesses and wonder what it may be like to have a few shares in that business. In the equities markets you have many, many choices. Locally there are (ordinary companies) a little more than 350 choices."

Golden eggs, magic beans, cinders and hair, giants and Englishmen, red hooded girls beware There are very few days that I hit a blank, or indeed have very little to say. Sadly I am one of those people who talk too much, I cannot imagine that it came from anywhere other than trying to share, trying to make people have a little more fun in their lives. You know what they say about opinions, yet here we try as best as we can to give our opinion and make it balanced. A day in this office is always full of twists and turns, you learn many different things that you never knew before. You try and read and absorb as much as you can, in an attempt to improve your knowledge so that you can make better investment decisions in the medium and long run.

Investing, or having the ability to invest in another business that someone has taken public is somewhat magical. You see examples around you, your friends, ex colleagues and family with successful businesses and wonder what it may be like to have a few shares in that business. In the equities markets you have many, many choices. Locally there are (ordinary companies) a little more than 350 choices. Meaning that you can own that many different companies. You might be forgiven for thinking that is not really enough choices, bearing in mind that the total market capitalisation of the JSE is more than 11 trillion Rand (not all of that is here on the local share register), less than 1 trillion Dollars. Remember that companies like British American Tobacco may have a secondary listing here, around 16.8 percent of all the shares in issue are on the South African share register, the reminder in the UK.

As a result of many secondary listings here, the value, or the market cap of the market is a little inflated. If you take the 16.8 percent number and apply it to the market cap of British American Tobacco, you get to around 233 billion Rand worth of value held here in South Africa. Or equal to the entire market capitalisation of Sanlam and Rand Merchant Insurance put together. Sizeable! Not however nearly 12 percent of the overall market, if memory serves me, the JSE account for this in terms of the overall weighting. The whole idea that the entire market cap is not traded here means that only the percentage which actually appears on the local share register contributes to the index moves. Equally the same could be said of SABMiller, I could not find the same number in the annual report, I emailed the IR person (as per their website) to ask them whether or not he had the number.

I had to have a chuckle when reading the SABMiller annual report, and you can excuse me here for a second: "Our industry is traditionally perceived to be male-dominated, and we are working towards better representation for women. On 31 March 2014 19.7% of our workforce was female." The company employs 70 thousand people globally, so roughly 14 thousand of those are female employees. Really? In 2015 are there industries that are still perceived as having a gender? I guess so. I saw a chart published by a fellow by the name of Mark J Perry that showed us that 100 percent of all folks who are loggers in the US are male. 100 percent. It is also the most dangerous job in the US, cutting down trees. Why can't that job be automated? In the same way that other dangerous jobs are?

Anyhow, getting a little distracted. If we can presume that even half of the South African share register owns SABMiller (possibly unlikely, bearing in mind that Altria own 26.99 percent and the Santo Domingo Family owns 13.99 percent, both those are on the UK register), the value relative to the shares in issue would be around 550 billion Rand. That would then make Naspers the biggest company in terms of ownership on the local register, in Rands that is, not Pound Sterling. Bearing in mind that Naspers often trades as a proxy for TenCent, do we go down another rung on the ladder to Glencore, which is a recent listing here, so possibly has an even smaller South African register.

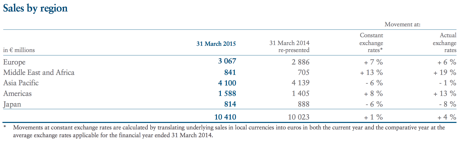

In fifth place on the ranking table is Richemont, which you may (or may not) know that ten shares here equals one share in Zurich, these are the global depositary receipts. Or, as the annual report suggests, South African Depository Receipts: "At 31 March 2014, Richemont Securities held 104 510 832 'A' shares in safe custody in respect of the DRs in issue. This amount represents some 20 % of the 'A' shares." See? Only 20 percent of the value of Richemont are held here, the market cap was 565 billion Rand as at the close last evening, only around 113 billion Rand held by South Africans. Which is about the size of Capitec and Pioneer Food Group put together, again, not an amount to be sneezed at.

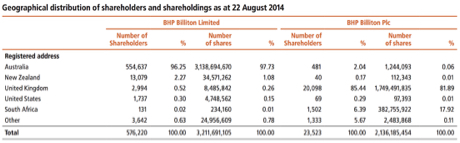

Next place on the ranking tables is BHP Billiton, although that is just the single share register, the London one. If you combine the share registers of BHP Billiton, London (and Joburg) with Sydney, the business is actually worth 1.425 trillion Rand. There are 5.3 billion shares in issue (roughly), only 2.11 billion on this share register combined (London and Joburg). Check it out, only 17.92 percent of the shareholders of BHP Billiton Plc (2.1 of the 5.3 billion shares) are South African.

So, 17.92 percent of the PLC register, the one we share with London is around 96 billion Rand. That is the quantum of the South African investors in BHP Billiton. That is roughly the same size as the whole of Mediclinic, 96 billion Rand, again not to be sneezed at. I think that the point that I am trying to make here is twofold, firstly the share prices of the majors listed here are not really controlled by local shareholders, even Naspers which trades as a proxy for Tencent is held sway by the moves on the Hong Kong market and two, there is a bigger investable world out there.

The total market cap of the NYSE (which is not everything listed in the US, it excludes the NASDAQ) is around 19 trillion Dollars. There are many, many more listed businesses on the NYSE. If I use the Google Stock Screener and I check the NYSE, there are 3892 companies. If I check businesses with a market capitalisation of at least 1 billion Dollars, there are still as many as 1910 companies. Which suggests that there is a lot more to be done from a sorting point of view. Sometimes too many choices is not necessarily a good thing.

There are exactly 100 companies listed here (using the same stock screener) that have a market cap of more than 12 billion Rand (roughly one billion Dollars). If you read through the list I am not too sure that you would own all of them, in fact you don't. That is the luxury that private client investors have. If they have monthly obligations, they are flexible, somewhat. Pension funds have obligations to the holders, who are many. As individuals, not tied down and owning equities directly, you have far more flexibility than you think.

Lastly, remember not to sweat the stuff that you cannot change. You cannot change what the Fed or the ECB will do with interest rates. You cannot change the next data read, be that durable goods orders, be that the jobs number, be that the machinery sales in Japan, the list goes on and on. What you can change is the shares you own, you can choose to own businesses that make advances for humanity (Tesla) or that supplies organic food (Woolies or Whole Foods). You can change that part, that is worth sweating about. I think that part is clear, do you agree?

Things that we are reading

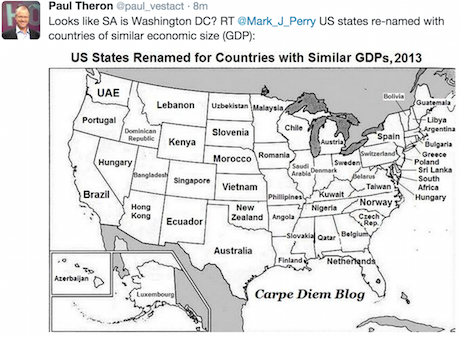

Paul found this tweet yesterday. It wasn't DC in the end, it was Maryland. It highlights the enormity of the US economy -

An interesting look at the hedge fund industry. There are very few managers who control the bulk of the assets and they are the funds that have a long track record. It makes sense, if you are going to pay those fees and take the risk that comes with leverage you want an established track record.- The Billion Dollar Club.

I always enjoy reading this blog and in this entry Ben is giving perspective to the bonds and equity returns over the last 35 years - The Golden Age of Asset Allocation

Behavioural finance is fascinating, watching my two kids I can see their different approaches to life and to how they go about spending their pocket money. This piece is a review by author Michael Lewis of the observations of possibly the first behavioural economist, Richard Thaler and his memoirs: The Economist Who Realized How Crazy We Are. The conclusion of the Lewis piece is hilarious, if you only read that part, make sure you give this article a go.

Greece are about to do something with the IMF that only Zambia has ever done, the IMF Zambia option, bundled payments. Or so it seems, the Greeks are confident that they will reach a deal by Sunday, the Troika officials are less confident. Ekathimerini reports: PM speaks to Merkel, Hollande as lenders increase pressure. Sigh, until there is a conclusion, there is not conclusion.

Google are busy having their developer conference, something that is pretty big. PC Mag has a piece: Google Project Brillo Is an OS for Your House. The interconnected house. Is this just being smart for the sake of it, at least your house? No. As the Business Insider Tech segment points out: 'Big data' is solving the problem of $200 billion of wasted energy. Technology is designed to make us do everything better than before.

Everybody thinks that their kid is way smarter than the other kid, contests between their children are more intense than when national teams take each other on. Imagine being the parent of a contestant in the intense national spelling bee in the US, which ended in a tie. Not for the first time, this has happened five times, two years in a row. Perhaps this represents children getting smarter. US spelling bee ends in a tie - again. I for one am thrilled that nowadays we have spell checker.

And they all lived happily ever after. I just realised that we covered absolutely no market activity, sorry about that! The S&P closed lower on the day, off the worst levels however. Briefly the Chinese mainland markets were down 4 percent on the day, for those of you technically inclined it entered a "correction" which is ten percent off the highs. An about turn ensued. Today, here, in Europe and almost everywhere people are "worried" about the ability of Greece to meet their obligations. I am afraid that since independence in 1825, Greece has technically been in default for 1 out of every two years. Mr. Market is still selling first and asking questions later.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939