"This then translated through to basic normalised earnings per share of 408.2 cents, this is an increase of only 9 percent. I say only, the market is looking for more here, the stock is primed for higher earnings. The dividend increased 11 percent, 75.5 cents for the second half (31 in the first), not exactly a kings ransom, with a yield of less than one percent. Switzerland represents 53 percent of revenues, the Untied Arab Emirates 12, and the balance South Africa. From a profitability point of view, of group EBITDA, exactly half is Switzerland, 13 percent the UAE and the balance (37 percent) South Africa. You get a fair idea that this is pretty much a private hospitals group with roots here in South Africa, certainly the lions share comes from outside of South Africa."

To market, to market to buy a penny bun. The big news (not unexpected though) is that it seems unlikely that the FED will raise interest rates at their June meeting. The market is anticipating pricing September as the most likely time for the first interest rate increase since 2007. The expectation is for interest rates to stay below the 40 year average of 6%, for the foreseeable future. As long as inflation stays under control, in the case of the US and Europe the spectre of deflation hovers around, interest rates will stay low by historical standards. If your pension or income is linked to interest rates, that is not great news, if you are a business owner low interest rates makes it easier to expand and take advantage of new opportunities. The danger that low interest rates presents is that 'cheap money' does not get the respect that it deserves and flows into assets/projects that should not be funded.

Moving to the home front we have the MPC giving their interest rate decision this afternoon, the expectation is for rates to stay the same. Why? CPI data yesterday says that our inflation rate is sitting at 4.5% which is in the middle of the 3-6% target band, add to that our very dismal GDP growth rate. The only reason I can think of left in favour of a rate increase is that policy makers are uncomfortable with low interest rates, which isn't a good reason to be raising.

An interesting number that I stumbled upon is "Inflation Rate in South Africa averaged 9.37 percent from 1968 until 2015, reaching an all time high of 20.90 percent in January of 1986 and a record low of 0.20 percent in January of 2004." (Thank you Trading Economics). With such a high average inflation rate, you can see why there is a steady weakening of the Rand. If our inflation is on average higher than our trading partners, the Rand needs to depreciate to balance the prices. There is nothing wrong with having a higher inflation rate, the key point is having a stable inflation rate. If you are an investor, having a stable inflation rate allows you to plan your strategy. If you are a saver, remember that Fiat currencies are units of account and not storers of value, so don't keep your cash under the mattress.

I am not too sure that I understand the outrage around the pay per use, the etolls debate that rages on in Gauteng. The highways are pretty darn awesome, multiple lanes, they certainly ease the congestion. I cannot imagine a world without the highways, getting to and from work for me in a timeous manner is critical. Equally I am lucky enough to be able to afford paying for these luxuries, or are they luxuries? Is the maintenance of the roads and highways supposed to be collected via fuel levies? Surely that would be the very best collection methodology. Whilst you may, or may not use the highway, your goods and services certainly do. How does that fresh produce get to your grocery store? Using the backroads? No. That would snarl up traffic and create more pressure on the byways.

Public transport is exempt from paying, which is good. And public transport would then be further subsidised by the rate and tax payers. That is how it works in most places around the world, the city wants more people off the roads. Whether or not public transport is effective or not, whether or not it is perfect or not, that is another argument altogether. The infrastructure needs to be funded from somewhere.

The way I view it, it is simple. Citizens vote for the powers that be, the powers that be set the laws, citizens obey as they have entrusted the powers that be to set the laws. It can of course change, citizens can vote the powers that be out of office. Either at a city, provincial or national level, or a combination thereof. As a collective we voted in the incumbents, it is our duty to pay for the projects that the powers that be have embarked on. Simple, that is the way that I see it.

If we cannot pay back our bills, or struggle to pay back our bills, two things will happen. One, when there is another infrastructural project, bond investors will demand a higher yield in return for lending us the money, in other words the cost of money will become more expensive. Two, the demand from investors will be muted, it will become harder to raise money at a higher rate. Harder and costlier. Unless of course the citizens bear the brunt of the cost, that has a negative impact on the broader economy.

Here is what I think will happen, however. If there has been push back from civil society on the whole idea of having to pay for the roads, we will continue to see the same push back. Of course there will be some people scared of not being able to renew their licence, they will pay their etoll bill. The delivery method is crucial here. If your bill is connected to your physical address or PO Box, just remind me how the Post Office has been performing lately? We have no abundance of court space nor the resources to deal with all the potential court dates. I suspect that if someone shows up to pay their licence renewal and gets told that you must get your etolls in place, they will just leave and not renew. If they are fined by a traffic cop, they will file the fine in the same place, file 13 (the dustbin).

The best way to collect the money is at the pumps. There is no doubt about it. You cannot ask for a few litres less when the tank is filled up as you object to the payment methodology. The system is too expensive and would work in a society where all people were compliant. Unfortunately we are NOT compliant. Less than one-fifth of all traffic fines are paid. Why would people suddenly start complying at this late stage? This is, I think, a collective stand. People are saying, enough is enough. It does not solve the issue of where the money is going to come from however and how much more it is going to cost in the future.

Company corner

Aspen is selling more non-core assets, this time to Stride Entities in Australia: Divestment Of Portfolio Of Branded And Generic Products To Strides Entities. They are doing two transactions the first is a deal to sell 130 products for A$265 million, which contributed A$26 million in pre-tax profit. The second is the selling of 6 branded products for $92 million, which contributed $10 million in pre-tax profits. Given that these are non-core assets and they are being sold for what would appear good prices, I think it is a good move. These funds can be used to pay down debt or used to purchase other assets that Aspen feel they can get better growth and value out of. Remember that they are still trading under a cautionary because there is a possible baby formula deal in the pipe line, which could be huge and require the funds that they are freeing up. The management team have proved that they are solid and shrewd deal makers, we back them to know where the best returns can be made for shareholders.

Another one of our core holdings that had numbers this morning is Mediclinic, Summarised Audited Group Results For The Year Ended 31 March 2014. First things first, it is always necessary to interrogate why we would want to hold this business. In other words, what are the prospects for the business and by extension, you, the shareholder. Ultimately all we care about are the relative returns of the overall portfolio which is made up of different companies. What times frames do you give to a normal investment? I would think a minimum of five years. That is more than enough time for management to execute.

So what happened during the year for Mediclinic? The company managed a few things, they managed to raise 3.1 billion Rand, they bought 2 Swiss hospitals and one site in Dubai and one here in South Africa was commissioned, Mediclinic Midstream in Centurion. They managed to refinance their Swiss debt at more favourable terms. Total number of beds at the end of the current financial year will be 8 044, at the beginning of the prior year it was 7 614. Over 400 beds added during the course of 24 months, I guess that is pretty breakneck speed when talking about hospital beds. Revenues, up ten percent, were driven by an increase in bed days sold and the average income cost per bed. Patients admitted grew 2.3 percent whilst the average stay actually increased 2.1 percent.

This then translated through to basic normalised earnings per share of 408.2 cents, this is an increase of only 9 percent. I say only, the market is looking for more here, the stock is primed for higher earnings. The dividend increased 11 percent, 75.5 cents for the second half (31 in the first), not exactly a kings ransom, with a yield of less than one percent. Switzerland represents 53 percent of revenues, the Untied Arab Emirates 12, and the balance South Africa. From a profitability point of view, of group EBITDA, exactly half is Switzerland, 13 percent the UAE and the balance (37 percent) South Africa. You get a fair idea that this is pretty much a private hospitals group with roots here in South Africa, certainly the lions share comes from outside of South Africa.

The company is keeping pace with medical innovations, a da Vinci surgical robot. Huh? Check it out, absolutely fascinating and less invasive than before: Surgery Enabled by da Vinci. See how the robot can peel a grape. Any surgeons out there want to let me know how robotics improves your lives, please let us know. It is NOT cheap, costing around 2 million Dollars each. Any Cape Town folks visiting the Durbanville Mediclinic, let me know if you can ask to see it. For the time being, in terms of the reading that I am doing, the service cost each year is around 15 percent of the purchase price. Yowsers. And the average cost per procedure is more expensive, at least in the US. Of course if the industry does not start somewhere, we will never know whether or not this MUST be the direction that medical science moves.

Medical care is a very emotive issue, most particularly when it impacts on your life, or that of a relative close to you. I believe that capitalism can do a better job than governments any time, in any territory. I believe that many public health systems could be managed, even on a localised basis, by people with profit motives. At the end of the day the ship will be tighter. One thing that you do not skimp on is medical, your health. World class facilities operating in their respective environments backed by a strong shareholder (Remgro owns over 43 percent of the shares) will see the acquisitive nature remain at the forefront. The stock is certainly not cheap, the earnings are below what the market expected. Mediclinc's share price is down 5.5 percent, we view this as an opportunity to buy some more shares!

Things that we are reading

Uber are trying to stay ahead; I think self driving taxis will be the first place where most of us get exposed to self driving cars - Uber gutted Carnegie Mellon's top robotics lab to build self-driving cars

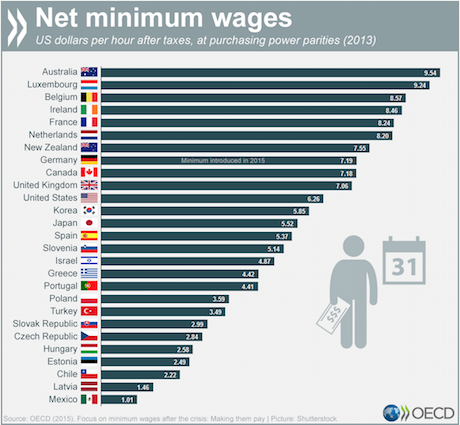

Where is the best place in the world to be earning minimum wage? - What is the minimum wage around the world?.

Buffett is no doubt very clever, this is how he puts the intellect to use. Reading, then a great deal more reading - Warren Buffett on How he Keeps up with Information

Home again, home again, jiggety-jig. Forex market and banks have been big news lately, triggered by the international investigation (Global banks admit guilt in forex probe, fined nearly $6 billion). I don't fully understand how a couple banks can manipulate a market as big and liquid as the currency market? The way I understand it is they colluded to not under-cut each other when it came to giving big clients the rates at which the banks would buy/sell currency. In any case the Rand is below 11.80 to the dollar at the moment; use the strength to add to offshore investments? The market is very slightly in the green with Aspen being up 1.5% on their news, Mediclinic down 6% and Tiger Brands down 2.7% on their respective numbers.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment