"I asked him, how many chickens do we eat a year in South Africa, reminding him of an Astral presentation I once read, which said we consumed over one billion birds a year. He answered that we slaughter 19 million birds here a week and import another 7 million, I guess that means that we consume that many a week too. There are 52 weeks a year, multiply that by 26 million and you get to 1.352 billion birds a year."

To market, to market to buy a fat pig. One of our readers suggested that I should be more mindful that our Muslim, Jewish, Xhosa and Vegetarian readers don't eat pork, for the sake of transparency, neither do I. He suggested that we start: "To market, to market to buy a plum bun". That could be a potential tongue twister, I have not read the book, nor have I tasted the British (Austrian?) culinary delight. We all eat vegetables and fruit, perhaps not carbs so much.

On the topic of eating, at the CNBC studios at the JSE yesterday, after my usual 12 midday slot on Power Lunch, I crossed paths with Chris Schutte, a very friendly man who happens to be the CEO of Astral Foods, the chicken and feed producer. I asked him, how many chickens do we eat a year in South Africa, reminding him of an Astral presentation I once read, which said we consumed over one billion birds a year. He answered that we slaughter 19 million birds here a week and import another 7 million, I guess that means that we consume that many a week too. There are 52 weeks a year, multiply that by 26 million and you get to 1.352 billion birds a year.

26 million birds a week, 54 million South Africans (StatsSa mid year estimate last year) is nearly half a chicken each consumed by every man, woman and child that lives within our border per week. Or roughly 25 birds per person, per annum. That is a whole lot of chicken. So, perhaps, based and armed with this information, we should be going to market to buy some thighs, wings and legs? Or perhaps the revised version of the 17th century one, two centuries later had absolute no mention of an oinker: To market, to market to buy a penny bun. Sounds more like it, a penny bun, which had a legislated size, believe it or not. We should change it to that, a penny bun, to a) be all inclusive (we like that here) and b) to observe the classics (we like that here too).

Locally Mr. Market ended at the top of the days trade, driven by a bounce in resource stocks, by the time the closing bell (figuratively rang) we had added 0.7 percent. Results galore, the one that possibly caught the market most by surprise (a positive surprise) was Netcare, the stock ended the day up 6.29 percent after all was said and done. They did not release a trading update, earnings came in just under the level required to be obliged to release one. In other words, if you are certain that earnings are likely to be 20 percent or more than the corresponding period, you have to let the market know about this. In this case, adjusted HEPS registered an increase of 19.6 percent. No wonder the market was surprised. We like the sector, we like the company, our preferred investment is Mediclinic. You cannot own everything I guess.

Over the seas and far away, the US markets, Wall Street closed at another record high. The broader market S&P 500 closed up one third of a percent, last at 2129.2. Paul was actually on Wall Street yesterday. True story. He is away for the week and will return next week. What is amazing about technology is that even whilst he is NOT here physically, we can chat. The only extraordinary thing is that when I woke up real early this morning, he was still awake and we were able to chat on WhatsApp. Thanks for making the world easier technology, thanks so much.

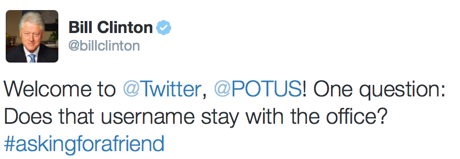

Barack Obama joined Twitter in a separate capacity last evening, as @POTUS, the President of the United States. He does have his own account, with a whopping 59.3 million followers. In what must count as the most epic conversation between two people, two very powerful people, ex president Bill Clinton asked a public question. Oh, and let us just point out that the account now has 1.5 million followers, in the blink of an eye. 3 tweets, 1.5 million users and an introduction: Hello, Twitter! It's Barack. Really! Six years in, they're finally giving me my own account. The Bill Clinton question first:

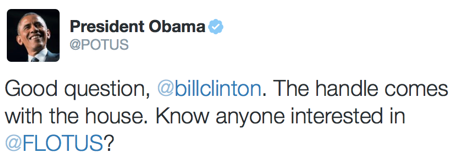

The reply was equally funny, implying that Bill Clinton might be, along with his wife, the only two people to serve as president and "first lady" ever in the history of the USA. Or at least the first, should some other couple achieve that. Remembering that @FLOTUS is the official account of the First Lady of the United States, which coincidentally has 1.9 million users. Bill Clinton might need 2 phones, if his wife becomes the next president, one for himself (and his 3.46 million followers) and one for @FLOTUS, which no doubt he can manage.

An epic exchange between two of the most powerful people in our generation, another reminder of how powerful the platform can be. Now .... if only the platform itself would become better. As we allude to below, Periscope could become something epic, it needs user adoption however. We may start experimenting with Periscope, do you know of any decent iPhone 6 tripods? That is the start of course, a stable view.

Company corner

You cannot keep a good man down. I had to laugh when I saw the Reuters headline: Icahn says "dramatically undervalued" Apple should trade at $240. This link above refers to the open letter to Tim Cook, the Chief Executive Officer of Apple Inc. I like the self back slapping, Carl Icahn is not short of confidence. He speaks about the company having heeded their advice: "We are pleased that Apple has directionally followed our advice and repurchased $80 billion of its shares (yielding the company's shareholders an excellent return), but the company's enormous net cash position continues to grow while the company's shares are still dramatically undervalued." Thanks Carl for that. Stop saying that you are not able to do something, rather adopt the mantra: "Icahn, like Carl". The stock closed up 1.1 percent on the day.

Yesterday Vodacom released their Annual results for the year ended 31 March 2015. The number that first catches your eye is the impact of the 50% decrease in the mobile termination rate (MTR). The MTR impact was R 2 billion in revenues and R 1.2 billion in EBITDA, it is not great to see these numbers but the impact has now been felt. Interconnect rates now account for less than 5% of revenues and even though MTR will continue to drop over the coming years, the drop will be nowhere as big as last years one.

Revenue grew 2.1% to R77.3 billion, EBITDA dropped 1.5% to R26.9 billion and the number that matters the most HEPS, dropped 4% to 860c. Their customer base is up 7.2% to 61.6 million, active data customers are up 15.9% which has translated into data revenues up 25%. In South Africa data traffic for the 4Q was up 48% compared to the same quarter last year, with the result that data now accounts for 29% of revenue.

Data is no doubt where the growth is going forward and will eat into the revenues and profits from voice. There is still huge room for growth though, the average amount of data used by smartphones in South Africa (which they have 9.3 million on their network) is only 342Mb. As speeds and coverage increases; as webpages become more data intensive; as the number of smartphones increase; as the middle class grows; so the average data consumption will continue to grow exponentially. To cope with the increased data consumption Vodacom spent R13.3 billion (17.2% of Revenue) on Capex last year, R8.6 billion which was in South Africa.

A frustrating point in the results is that the Neotel deal has been waiting approval for nearly a year. If it is approved, Vodacom is hoping to target the business community and they will get access to the Neotel spectrum which will make them the leaders in the South African data network.

A Vodacom discussion is never complete until you visit their dividend. Given their dividend policy to pay at least 90% of headline earnings, they are a solid dividend payer. They are paying a final dividend of 400c (down 7%) and a total dividend of 775c (down 6%). After dividend tax you will get 658c which at current prices puts the after tax yield at 4.7%. Given that Vodacom is expecting single figure growth going forward, you wont see a huge increase in the share price. If you are after a solid dividend flow in an established company, Vodacom is a good option.

Things that we are reading

This is kind of old, the trend is still in tact however, out with small phones and large tablets, perfect timing for Apple with the iPad mini and more importantly, the iPhone 6 (and plus): Flurry: Phablet Usage Grew 148 Percent in 2014.

TV is not quite on the way out, what is happening however is that people are watching a lot of "stuff" online. In their own time. And a whole lot quicker than you might have anticipated. I am guessing that the people that are most worried about this are the regulators, you cannot give a licence to everyone, they just need to know that when they broadcast, they should obey the laws: YouTube: The Power of the Global Everything Network. I am getting more and more excited about Periscope, the Twitter application. They need to integrate it into the existing app, somehow.

The market always finds a way to get things done - Venezuela's Hyperinflation Is Working Out Very Well for Mastercard

As the value of companies increase so does the lure of going public. This is one way that the market tries to stabilise the valuations of companies; as more and more cash goes into the stock market, valuations go up and more companies IPO, thus creating more 'homes' for the cash and keeps valuations in check (well thats the theory anyway) - Private equity firms are finally dumping the deals they did before the financial crisis

It is great to hear good things about the companies that you own - An ex-Facebook intern describes what it was like to meet billionaire CEO Mark Zuckerberg. The one line that stood out to me, because of the Zucks relatively young age; "It was intense because he just spews wisdom at you,"

You can have some fun; this a great way to get people to buy stuff they really really don't need? - Texting this phone number signs you up for 'Drunk Shopping,' a service that shows you weird things to buy every Saturday at 2am

Home again, home again, jiggety-jog. This part is right, or in fact, you can say "jiggety-jig" or "Home again, home again, market is done.". In our case, the modern era, markets never really close. They are always open. Asian markets are higher, we should start a whole lot better here, not so? The Greeks, they continue to search for a deal with their European sisters and brothers, we are only watchers in this, like everybody else of course.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment