"Revenues were driven by an eye popping increase in their advertising business (online advertising business revenues increased 131 percent year on year), thanks to stronger mobile video sales. Still, the big daddy of them all, mobile gaming strong (revenues up 82 percent year on year) alongside the main part of the business, PC gaming."

To market, to market to buy a fat pig. Yesterday we had a number of data points come out across the globe, resulting in a very mixed market. The most relevant to us was the Tencent 1Q numbers which we will chat about below; Naspers finished solidly green.

A number with more global consequences was the US retail sales figure, which missed estimates. The estimates were for a month on month rise of 0.5% but the number came in flat, which is not a small miss. It has to be noted though that the number is very volatile will most likely be revised later down the road as more data comes in. What does weaker sales data mean though? The markets think that it means a FED rate hike won't happen this year anymore, the US economy isn't sufficiently strong enough to constitute an interest rate increase. The biggest impact from this was a weaker US Dollar, money that had flowed into the US expecting higher interest rates in the near term flowed out. Or more likely, currency traders who were buying the US dollar in anticipation of money inflows from a rate hike, these traders were selling their long dollar positions. The Rand is sitting at R/$ 11.85.

Another piece of data which was not good for resources is a Reuters poll which showed analysts expect the Iron ore price to continue to drop. BHP Billiton is currently down 1.9% in Australia and will be down here when the markets open at 9:00. Lower iron ore prices is not great for the companies that sell it or the countries that get taxes and employment from the mines, it is however better for everyone else. It means that us as humans can do more with the scarce resources that we have to work with. In hindsight we can probably say that iron ore above $100 a ton was too high, thanks to Indexmundi here is a 15 year graph of the iron ore price. Even at these 'depressed' levels, the price is still up 357%.

Time frames matter in determining our perspective and views on something. Given the life spans of these mines, the amount of capital and time taken to build them, a 15 year perspective wouldn't be too out of place. In any event, when markets adjust to the 'new normal' it is painful, change normally is.

Company corner

Mediclinic released a trading statement yesterday morning. This is ahead of their results release, which is expected to be on the 21st of May. That is not too far away, a week today, all will be revealed. There are some accounting issues that have not been dealt with immediately in the trading release. Normalised HEPS, which excludes one-off and exceptional items, is expected to be between 8 and 10 percent higher than the 375.8 cents at the same stage last year. Somewhere around 411 cents for the full year. Basic EPS however is expected to be as much as 521 cents. Basic headline earnings per share is expected to be around 485 cents worth of earnings. Why all the different numbers? It is enough to make you want to weep. The interpretation of all the numbers is found in the interim numbers, IAS 33 reveals a little more.

Huh? What is IAS 33? International Accounting Standard 33, Earnings per share. I think what is important to remember too, is that in as much as the Swiss National Bank removing the Euro peg has been good for Mediclinic (more Rand earnings from their Swiss operation), the debt in Rand terms (three quarters of it issued in Switzerland) would have grown too. The question is either for the CFO, Craig Tingle, or quite simply, you can know that this relates to the weighted average number of shares in issue.

According to an IFRS IAS 33 paper I found, this is the reason, (Paragraph 26) "The weighted average number of ordinary shares outstanding during the period and for all periods presented shall be adjusted for events, other than the conversion of potential ordinary shares, that have changed the number of ordinary shares outstanding without a corresponding change in resources."

I am glad that you are all familiar with paragraph 26 now of IAS 33. It is seemingly important. Not too worry, all will be revealed a week today, remembering that the company raised a significant amount of money back in June last year, the number of shares in issue increased. We explained what they did with the money, they issued another 41 million shares to raise 3.177 billion Rand. This will jog your memory: Two transactions in Switzerland, raising cash. More on the results this time next week. The stock price sold off, we used it as an opportunity to buy people more shares who were underweight.

Tencent released their first quarter numbers yesterday, after the Hong Kong market had closed for business. There is a Tencent ADR in New York (I was watching that too closely yesterday afternoon) and of course you get the sense that Naspers trades as a proxy for Tencent. Huh? Remember the old trust calculator? No, OK, there is no harm in doing the simple math again:

Take the Tencent market cap in Hong Kong, which right now is 1.50 trillion HKD. Naspers owns 33.85 percent of TenCent, that translates to 508 billion Hong Kong Dollars. One Hong Kong Dollar at the current exchange rate is around 1.53 Rand. So, quite simply, multiply 508 billion HKD by the prevailing rate and that equals 779.34 billion Rand. Naspers had a market capitalisation of 771 billion Rand at the close last evening, that included a sharp move higher of 3.6 percent during the day. Obviously the wind at their backs following these results. The difference between what the stake in Tencent is worth, relative to what the JSE buyers are willing to pay is minus 8 billion Rand.

That is apparently what all the rest is worth, negative. Thanks for that South Africa. No wonder people trade the "Naspers stub", the difference between the two, provided you have access to all the markets. Here are the Tencent results, to jump back to where we started: Tencent announces 2015 Q1 results. A 22 percent increase in revenue, a 20 percent increase in operating profits year on year. Basic EPS for the quarter was 0.741 Renminbi per share.

The stock however trades in Hong Kong, represented in Hong Kong Dollars. The company also translates a lot of their numbers back to US Dollars, so you need to do a number of currency translations here. Diluted EPS was 0.733 Renminbi, convert both those numbers to Hong Kong Dollars and you get Basic EPS of 0.93 Hong Kong Dollars and Diluted EPS of 0.92 Hong Kong Dollars. The stock trades at 161 Hong Kong Dollars, as I write this.

Revenues were driven by an eye popping increase in their advertising business (online advertising business revenues increased 131 percent year on year), thanks to stronger mobile video sales. Still, the big daddy of them all, mobile gaming strong (revenues up 82 percent year on year) alongside the main part of the business, PC gaming. League of Legends you will be less familiar with over FIFA Online 3 (a variant of the EA one I guess), where people swap cards. In the outlook the company says: "Looking ahead, we aim to enrich our PC and mobile game portfolios in different genres and solidify our market leadership."

Tencent is an entertainment platform. Think about what passes for entertainment in China, online platforms are perfect ways of escaping the humdrum on "ordinary" life. State TV, State Radio, censored internet, that is the alternative. Heck, some movies don't make it past the censorship board, they are too saucy. I can think of a recent movie adaption of a bunch of poorly written yet exciting books that had to be sliced and diced. Escaping into a world where you have more control than normal, I can see the attraction of the platforms. More recently however there are other arms to the business, the number of subscribers in the chat business seems to have peaked, I guess it was bound to at some stage. The number of users on mobile networks, that continues to grow strongly. This is the shift to mobile, all businesses seem to be coping just fine.

We continue to recommend Naspers, remembering that you are effectively getting all the new (online retail) and older businesses (satellite TV) for basically nothing. This asset will continue to be the steer for the Naspers share price, I could think of a whole host of worse investments however to be in! Until the powers that be at Naspers decide that they will unlock value in a mother way for shareholders, you should not get that anxious about the Tencent share price, the multiple is unwinding as predicted (at above 40 times earnings it is still expensive however), the growth rates are still there. There are new and exciting businesses, Tencent spends a large sum on R&D and allocates many resources to their future.

Things that we are reading

The impact that driverless cars will have is huge for society - Autonomous cars will destroy millions of jobs and reshape the economy by 2025. Less accidents (money saved), more efficient (money saved) and probably a move to not owning your own car (less traffic, time saved).

Buffett and Gates are two people who have had a substantial impact on society and are both very clever - Warren Buffett tells Bill Gates why he's such an optimist.Take 2 minutes to watch the video."put 3 of me end-to-end and you're back before the Declaration of Independence was written. That progress, in 3 lifetimes like mine, is mind-blowing."

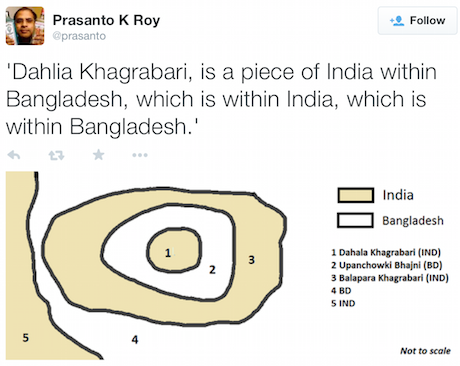

I wasn't sure if to believe this or not, here is a picture of what the India/ Bangladesh boarder looks like:

Wikipedia confirms that it is true - Dahala Khagrabari. How do you think boarder controll works?

Wikipedia confirms that it is true - Dahala Khagrabari. How do you think boarder controll works?

Home again, home again, jiggety-jog. That market is down this morning, Naspers is up a further 1.5% today and Kumba is down 4.5% on the lower iron ore price. The big data for today is the initial jobless claims out of the US.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment