"The products are still incredible, I am seeing more and more Macs on the "streets", people getting deeper into the Apple ecosystem. I remember once upon a time when a certain smartphone maker Blackberry ruled the world, just the other day on the Vestact closed WhatsApp group I found a WSJ quote from the related story: How the iPhone Crippled BlackBerry, in which Larry Conlee, then CEO and Mr. Lazaridis's right hand man, say the following about the iPhone: 'It wasn't secure. It had rapid battery drain and a lousy [digital] keyboard.' "

To market, to market to buy a penny bun. Days off for all and sundry, we traded a measly half of normal volumes, as both the US and UK enjoyed holidays, along with a vast amount of folks in Asia. Have you ever seen that map of the world, with the circle, more people live inside of this circle than outside of it? Apparently it is credited to Conrad Hackett, who is a must follow on Twitter, he found the chart via the World Bank -> you can find the related status here: World bank circle, population.

All it is, the map, is a representation of the very populous areas of Asia collectively. More people live between the areas of Pakistan to Indonesia, Japan to Mongolia and Malaysia to the Koreas than outside of this area. Outside of the area (if you include all continents) are basically the other six continents. I guess if Adam Smith were alive today he would have a perfectly reasonable explanation for that. Adam Smith of course is seen as the "father" of modern economics, a fellow that advocated free markets. He would have had his theories around food production, human spirt and free trade (good weather generally) leading to larger populations than in other territories. Any modern day explanations on why there are such large populations in modern day Asia, better long term diets, better medicine relative to the rest of the world and/or religious reasons? Yes, no?

MTN dominated trade locally and was at the forefront of the losers columns, all to do with their largest market where power constraints could see widespread outages on their network. We are talking Nigeria. If you think that we have power problems (I mean challenges) here, forget it, Nigeria has monster issues. So much so that MTN has to power a large part of their network with diesel generators, and diesel seems to be running really short. Michael told me yesterday that his mate was up there, and the queues for fuel are three hours long. Why? The government has set price controls on fuel. The irony is palpable. For a country that produces vast quantities of oil and then imports the finished product. A shortage of diesel could see the base stations power down, there is one thing worse than running out of fuel and being forced to walk, and that is running out of battery power. MTN closed down 2.3 percent on the day.

At the opposite end of the spectrum was Mediclinic, bouncing after their market disappointing results late last week, Woolworths also at the top of the leaderboards as the investment community continues to appreciate their recent plans on David Jones and the Country Road group. Recent announcements and plans to continue to push the local brands and get busy, has been met favourably by Mr. Market. Another good trading day and Woolworths might well raise their bat, 100 (Rand) up. Perhaps a Hashim Amla head wobble and a business as usual look would be in order. And whilst we are on that score, the Mumbai Indians made one of the greatest revitalisations in any tournament, the first two weeks they were nearly dead and buried. Spare a thought for JP's Delhi Daredevils, the only major team to never have made the final of the competition. Spare a thought for Michael and my team, the Royal Challengers Bangalore, they have never won a title, and twice been the bridesmaid, or should I say groomsman.

Markets resume today across the rest of the globe, Greece and their potential default will continue to dominate the conversation short term, not everybody seems to be as worried as I thought. Obviously there has been significant weakness in the Euro, that is lending a hand to relative weakness in the Rand, i.e. Dollar strength. Currencies? Your guess is as good as mine, I am afraid.

Company corner

I could not find the official news on the Apple Inc. website, I had however noticed that Sir Jony Ive had been promoted to Chief Design Officer at the company. If you have been watching the company over the years, you will know exactly who Jony is. According to Wikipedia, Steve Jobs said that Jony was his spiritual partner at the company. They designed many of the products together. Ive has been at the company since 1992, 23 years of being involved with all of the products at the business, having an intimate knowledge of all of them, all of their launches and the inner workings. There are apparently only 22 folks at Apple and the core (no pun intended) have been there for the better part of two decades, they must know each other pretty well. Cult of Mac (yes, really) says that this team rarely gets together for photos of the public kind, here they did recently for the announcement of the watch: Here's the first group picture of Apple's new Industrial Design team.

If you read further down the article, it refers to the secretive design studio: "a steel-and-concrete enclave locked behind a very big door and frosted windows on Apple's campus." I managed to find an incredible article by the New Yorker on Jony, it is really long, it is worth the read in your spare time. Or the next seven minutes, do it now and read it: How an industrial designer became Apple's greatest product. As we well know, in 1997 Apple was on its knees. Now it has a market capitalisation of 763 billion Dollars, they basically are kings and queens of the world. Great interactions there between the individuals (we forget that companies are made up of exceptional people), when the going was tough.

The products are still incredible, I am seeing more and more Macs on the "streets", people getting deeper into the Apple ecosystem. I remember once upon a time when a certain smartphone maker Blackberry ruled the world, just the other day on the Vestact closed WhatsApp group I found a WSJ quote from the related story: How the iPhone Crippled BlackBerry, in which Larry Conlee, then CEO and Mr. Lazaridis's right hand man, say the following about the iPhone: "It wasn't secure. It had rapid battery drain and a lousy [digital] keyboard." The WSJ article is actually a part of the book titled "The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry."

Perhaps Conlee was right about all of those things, the one thing that you can never doubt is that the consumer is always right. Does this Apple appointment suggest Jony Ive will be less involved, I think not, it is just the company rewarding an exceptional engineer and one of the most important folks at the company. Of course the risks are new products, individuals leaving, the truth however is that the legacy of people like Steve Jobs, incredible individuals (if not prickly characters) attract young up and coming engineers, designers, coders to a company. It is worth noting that in a world of brutal hardware and software evolution that you ALWAYS pay attention.

Why did Aspen seemingly sell a sizeable portion of their Australian business? It took me a little while to figure it out, first and foremost the Price Disclosure Reductions for 2015 April Cycle from the Australian government Department of Health might reveal that margins for manufacturers Down Under are going to become harder to maintain. If the government, anywhere in the world, wants to get your business to sell your manufactured goods at a lower and lower rate (and not let the market decide ultimately) then I guess it may be a good idea to sell that business. I think if the Australian government covers all and sundry for their healthcare needs, then I guess they can set or stipulate the prices, all I know in the long run, setting prices promotes less and less competition. If you do it in an orderly manner, then I suspect you still attract business.

It seems from what I could ascertain, Aspen had indicated that they were moving some of the Australian production to their Port Elizabeth manufacturing facilities and more importantly had committed to shutting down two facilities in Australia. From what I could gather, from the details of the sales of businesses in Australia and Singapore (refresher, download the document: Aspen Strides Product Divestment Agreement), it is effectively one eighth of the business. And it is noncore, see from the release: "These transactions form part of Aspen's communicated strategic intent to focus attention in areas where most value can be added and to lessen complexity." Simpler and making sure that the focus is on the growth areas of the business, using the cash from these transactions to either pay down debt or to continue to expand in the region.

Things that we are reading

Via Abnormal Returns daily email came a piece from Justin Paterno, the StockTwits "President", if there is such a thing, here are some observations: My takeaways from a week in China. Two things interested me, one, the Apple observations, two, the Chinese are patient and invested for the long term.

More on Apple, this time through the eyes of Stephen Fry - When Stephen Fry met Jony Ive: the self-confessed tech geek talks to Apple's newly promoted chief design officer.

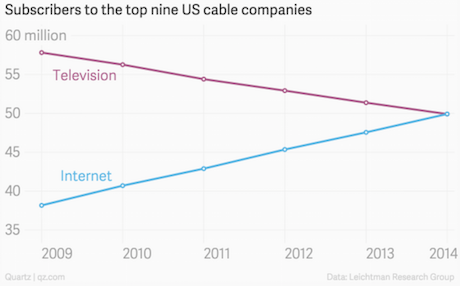

The internet is causing a consolidation in the entertainment industry - The charts and maps you need to understand why Charter is buying Time Warner Cable and Bright House

With the ice melting, the arctic circle becomes more important to countries as a trade route and the possible resources. - How a 19th Century Shipwreck Could Give Canada Control of the Arctic. To make the story more interesting, Jim Balsillie the co-founder and former CEO of RIM (blackberry) is involved.

The private sector is doing its bit to help - Rupert, Nhleko's African infrastructure fund raises R4,1bn.

Home again, home again, jiggety-jig. What happened? The market opened in the green this morning and now has turned red. Gold is leading the way, down 2%. After solid looking results and a pop to R120, Famous brands has slipped back to R114 a share, I suppose the market was looking for a higher growth number. The Rand is back at R/$12.00 after a brief visit to the R/$11.75 levels, with so many moving parts when it comes to currencies it is hard to know which factor is responsible for the moves. Keep focused on the long term and don't let the short term noise give you heartburn.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment