"What became apparent to me reading both presentations is that the David Jones outlets, the department stores, are going to start carrying more Group merchandise. A stronger focus on the in-house affordable luxury brands. The "stuff" in the middle between everyday casual wear and absolute luxury is the target market. The whole premise is that the more disposable funds middle income people have, the more likely they are likely to be attracted to something a little more luxurious. Woolies highlights this group as Medium-upper in the Country Road presentation."

To market, to market to buy a fat pig. We slipped from the best levels of the day on Friday, around midday all the way through to the close. The stronger Rand did not help the dual listed stocks, as we have discussed often enough, the Dollar is weaker, the Rand is not stronger. Of course the one translates to the other. The Dollar is weaker, understood? In the end the local market closed nearly one-third of a percent higher, resources down nearly one and a half percent dragged us off the best levels. Over the seas and far away markets closed in the green, other than the nerds of NASDAQ, marginally lower.

Another record close for the broader market on Wall Street, 2122.73 for the S&P 500 by the end. I guess for those that agonise over the absolute numbers, it is important to know where the level is. There are often days when I know exactly what happened, yet I could not tell you the level of the market within a few hundred points (the local market that is), I would tell you where the share prices closed of the specific companies that we own, I have a fairly good idea of that. However, in our world we do not have to know to the nearest cent where the share price of a specific company is. No, it is a company that happens to trade at a specific price, we should be so lucky that we can own some of it.

Greece. Well. They are still really running on fumes. It is like being a student trying to eke out the last litre of petrol, I recall a friend of mine at university running out of petrol frequently. He tried his level best to get the maximum out of his resources, sadly it was not to be, the "silver bullet" (a mid seventies Audi Passat) was seen in strange locations around Grahamstown. And that was when petrol was relatively cheap.

What is cheap is funding to the broader EU, if you are in a position to stick to the rules that is. Check this FT article out: Tsipras letter reveals precariousness of Greece's finances. Rather them than us. Just this morning our Finance Minister was on Bloomberg, they were asking Minister Nene about the energy crisis, the PIC is rumoured to be an investor in Eskom. I wonder what government employees feel about their pension money being sunk into the energy supplier? The more I have the conversation with the many people around, the more people tell me of their marginal and smaller moves off the grid in any way possible. Gas, solar, that is what we can do here in Gauteng, you have more wind down there at the coast.

Company corner

BHP Billiton, the share price that is, will trade around 7 percent lower at the get go today, if the Aussie market is anything to go by. An email to a client that asked the question last week (what will it be worth) saw me answer this way: Good question. The simple answer is that nobody knows. South32 represents 4 percent of BHP Billiton EBITDA. Work on somewhere between 5-7 percent of your current BHP Billiton value. In a way I am glad that I was close (phew), in a way I was hoping that the market response might be a little more favourable. You know, the whole idea that these manganese and silver assets could be worth more to somebody else. Anyhow, you will recall that we advised most clients to take the cash, this is a good opportunity to exit the assets that management and shareholders view to be non-core to BHP. As simple as that. If management and shareholders approved the entire demerger and recommended it, then we want to hold the rump of the business and not the smaller assets. Understood?

Apple HomeKit, what is it? It is basically your home connected everywhere at any time, i.e. reachable from your mobile phone. Let us say for instance that you go away for the weekend. You do not need the same power that you needed before, right? Less power to be used is a cost saving to you. You can visit the HomeKit developers page for now, that is available. Set your home into zones, connect all the devices, it is all part of the internet of things. Things being devices that we would not necessarily associate with having connectivity, more recently we accept that TV's, fridges, cars, all our lighting and central heating/cooling systems will be integrated into the phones/notebooks/tablets that already connect to the TV. One extra "thing" to remember, the Internet of Things has an acronym that I saw for the first time, memorise it, it is here: IoT.

The first devices to use the Apple HomeKit won't surprise you, locks (no more keys) and garages (no more remotes), equally alarm systems activated with your voice via Siri. This does not always apply here, in the harsher environment of North America, (your Cape Town winters), most of Europe, all of Asia north of Southern Japan, heating is more important. Remembering that most people who could help it, did not live in the tropics as a result of more diseases prevalent in those areas. Nowadays we have vaccines, humans are working hard to find ways to make malaria a thing of the past. That important note aside, the Apple HomeKit is a small step in delivering savings on energy bills and completely integrated houses. About that security ....... (dot dot dot) Release date? Sometime in June, although some are suggesting that there is a delay on the cards, perhaps that would be pushed out to August or September.

Woolworths released a strategic view and investor update of both David Jones and The Country Road Group on their website Friday, the actual presentation was the week prior. The Woolies share price has been moving northwards, getting close to raising its bat (a cricket term when a batter reaches a milestone, some like AB do it often in a single innings, fewer balls faced), 100 Rand has a nice ring to it.

What became apparent to me reading both presentations is that the David Jones outlets, the department stores, are going to start carrying more Group merchandise. A stronger focus on the in-house affordable luxury brands. The "stuff" in the middle between everyday casual wear and absolute luxury is the target market. The whole premise is that the more disposable funds middle income people have, the more likely they are likely to be attracted to something a little more luxurious. Woolies highlights this group as Medium-upper in the Country Road presentation. Those are the brands that we will become more familiar with as South African Woolies shoppers, Mimco, Witchery, Trenery and Country Road itself. More recently you may have noticed (ladies, help me out here) the activewear segment, a fast growing global theme. Activewear replacing casual wear as everyday attire. Darn, I should have known, just as I was embracing jeans again.

Mimco is new here in Msanzi, only a year old. Bags, accessories, soft luxury. Trenery looks to target the older affluent market, read into that richer and older people. I really think that this business is going to deliver on their aim, to become the best retailer in the Southern Hemisphere. In other news however, the split of the population by hemisphere is 88 percent Northern, the rest us lonely souls are down in the Southern Hemisphere. 7.3 billion people globally, 12 percent in the Southern Hemisphere, that equals 876 million people. I can live with that.

Things that we are reading

The life expectancy graph shows how far we have come in the last 200 years. "For 1800 (red line) you see that the countries on the left - India and also South Korea - have a life expectancy around 25. On the very right you see that in 1800 no country had a life expectancy above 40" - Everyone is better off - Life expectancy increased in all countries around the world.

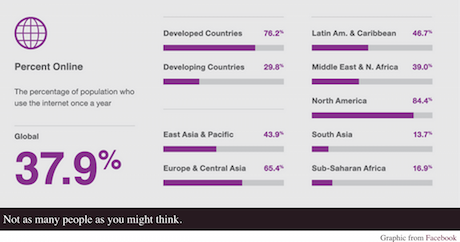

We show you this stat probably every 6 months, as a Google, Facebook and Naspers shareholder it is important to remember the growth that these companies can still tap into. - Less Than 40 Percent of People Worldwide Have Ever Connected to the Internet. Over and above the tech companies, as more people have access to the internet there will be great shifts in how societies operate.

I thought of "Lord of the Rings" when I saw this article - Sweden is fighting to preserve Elfdalian, its historic, lost, forest language

I have seen more and more articles talking about the productivity lost from working long hours - Why successful people leave work early.

Take the underground. Not you, rather your goods. For real: Amazon trolleys take a ride on New York subway. Anyone who has used the underground knows what the article points out, it is far quicker than driving.

Home again, home again, jiggety-jog. A whole slew of results here today, Vodacom, Pioneer Food Group, Astral and Barloworld. Some decent, they all kind of point towards an iffy looking local economy. Quite.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment