"Pithy quotes attributed to him are common sense ones mostly, like "One hundred percent of a company's information reflects its past, while 100 percent of its value reflects its future." I like that. There are many stock market historians that suggest today feels like another era and X is probably going to happen next, on my analysis of the past. I disagree with that sort of historical era connecting, after all, how many smartphones did they sell in 1981, or 1954 or 1937. The answer is of course is zero."

To market, to market to buy a penny bun/fat pig. The Dow Jones Industrial average had an OK time of it, after all was said and done, closing at another record high. Not to be though for the broader market and the nerds of the NASDA; marginal losses on the overnight session. Energy and basic materials coming back sharply in the US session, locally it was exactly the same. Oil prices and metal prices slipped, it is becoming apparent that the supply side is still "just fine", if anything we are seeing a more supplied market. This could and should lead to lower prices, the broader commodities complex was sent nearly three and a half percent lower by "worried" investors. I guess throwing in the towel is a loosely used expression that may apply here. If the returns in a specific sector are likely to be of a lower quality in the coming years, relative to the market, then perhaps it is best to be invested elsewhere. The whole debate of can I do better in the short term is a very tricky one.

That is why I guess some legendary investors like Bill Miller tended to ignore businesses that had deep peaks and troughs in their respective business cycles. So mining, materials, energy and construction was a definite no-no. Miller was possibly one of the best through the 1990's. Pithy quotes attributed to him are common sense ones mostly, like "One hundred percent of a company's information reflects its past, while 100 percent of its value reflects its future." I like that. There are many stock market historians that suggest today feels like another era and X is probably going to happen next, on my analysis of the past. I disagree with that sort of historical era connecting, after all, how many smartphones did they sell in 1981, or 1954 or 1937. The answer is of course is zero. Oh, and for the record, Miller was an economist, disproving that old theory of, economists can't be great investors.

Wal-Mart stock sank to levels last seen in November last year, a sizeable revenue miss by the analyst community of around 1,5 billion Dollars. The company might have missed estimates, those estimates were set by the financial analysts, it was they who missed, not the other way around. The stock was beaten down 4.37 percent. It turns out that Americans now are savers, which makes sense. If many a market commentator and financial blogger, as well as mainstream media reporter have been lamenting the lack of wage growth on main street (i.e. the whole idea that middle income American workers have missed the recovery, their wages are stagnant on a relative basis) then it is not really a surprise that when times get a little better, the collective starts to provision better. Pay down debt, save a little more for a rainy day, perhaps I do not need all those things. It was groceries that took the biggest knock, sales were flat there, proving once again that eating (too much) is cheating. The outlook is also worse than anticipated, a big chunk taken out by minimum wage increases across the board.

On the local front the market cheered the Pioneer Food Group results for the second day in a row, the stock is up ten percent since this time last week. Yowsers. On the flip side of that is Vodacom, the stock closed another 2 percent lower yesterday. At 125 Rand (15 Rand lower than it is now) the company has a yield of 5.27 percent AFTER tax. Their growth prospects are not flat, we are experiencing a transitory phase through to the era when we will communicate more with one another, less so in the traditional way of "picking up the phone". That saying will have less and less meaning, FaceTime, Facebook, Skype and WhatsApp through groups, we will keep people more in the loop. And I am starting to also develop this minor obsession with Periscope, the fact that I have not used it effectively is weighing on me heavily. At 140 Rand, Vodacom has a yield of around 4.7 percent after tax, if the company expects middle single digit earnings and should continue to payout 90 percent of earnings, the yield forward post tax is closer to 5 percent. We obviously believe that MTN has better growth prospects however, more geographically diversified in higher growth countries, admittedly with lower spending consumers.

European markets took off yesterday, the ECB suggesting that they could do more, with ECB member Benoit Coeure suggesting that the current bond buying program could be met in May and June, making sure that the ECB did not fall below the target for their current program. That sent the Euro sharply lower, the sentiments of the French economist and one of the inside 6 of the ECB were echoed by France's Central Bank chief, Christian Noyer. Did they have lunch or dinner together on Monday? Yes/No, I want to know! The recent spike in bond yields has led to the comments from Coeure, he is marginally worried that the outcome will not be the desired one. I cannot see the might of any central bank against the market, other than the fact that they assume the same "power" that a headmaster does to their respective pupils. Wave a big stick and be present in your approach, do not use the stick, it is an act of weakness.

Weakness turning to strength however is the Japanese GDP growth number, the growth is the fastest in a year. Perhaps the relative currency stability has had something to do with that. Sales tax increases have squashed the recovery a number of times, you could argue that the recovery period has been over one quarter of a century, fits and starts and the Japanese economy is no different, external events take their toll. Some pretty awful internal ones, the notable earthquake in 2011 that struck Sendai, perhaps changing our views on the use of Nuclear energy forever. Time will tell whether or not that was the tipping point, more off the grid and closer to home usage of alternative energies. Perhaps Elon Musk and Tesla are just as "lucky" as they are good at what they manufacture. See this WSJ article: Japan's First-Quarter GDP Growth Is Fastest in a Year

Lastly, perhaps a storm in a teacup and rather just an extension of the global investigation into currency rigging by the larger banks, they have of course admitted fault and paid fines. As this Bloomberg article (Banks Face Scrutiny in First Rand-Rigging Probe Since 2002) points out, the Rand accounts for around 1.1 percent of global turnover in foreign exchange markets. I will be forced to eat my words should the authorities come up with concrete evidence suggesting that there was indeed collusion. At the end of the day, greed is a human trait that is given more power by the allure of fortune. We will see.

Company corner

Tiger Brands came out with their Unaudited Group Results and Dividend Declaration for the six months ended 31 March 2015 this morning, HEPS are flat, turnover is up 7% and the dividend is up 3%. They also had another ANNOUNCEMENT RELATING TO THE PROPOSED ACQUISITION BY OCEANA GROUP LIMITED OF DAYBROOK FISHERIES INCORPORATED. Daybrook are a US based fishery who supply fish meal and fish oil. A more detailed look tomorrow on the numbers.

Exxaro released a trading statement late yesterday afternoon, TRADING STATEMENT FOR THE SIX-MONTH PERIOD ENDING 30 JUNE 2015. Due to the weak iron ore price they are feeling the pain, we haven't reached the end of the period yet and they are certain that HEPS will be at least 20% lower. The share price has reflected the tougher conditions, with it being down 37% over the last year.

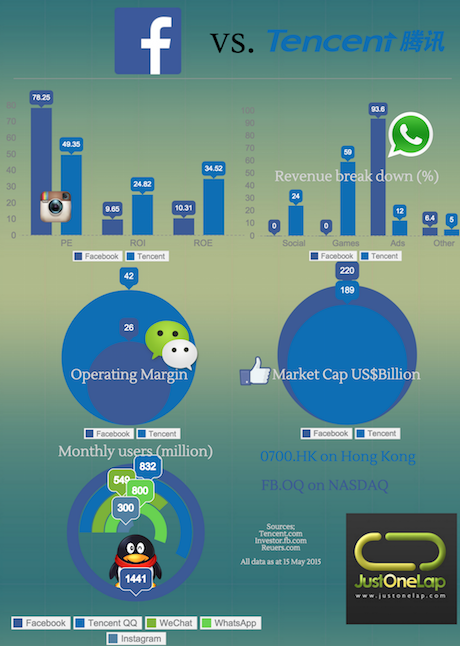

Thanks to the guys at Just One Lap for making this very interesting infographic comparing Tencent (Naspers) and Facebook - Infographic: Facebook vs. Tencent. The big difference between the two companies is that Facebook makes most of its money through advertising and they have more eye balls actively looking at their screens. Different business models but it still gives perspective.

Things that we are reading

I am starting to see more and more of these, admittedly much from the same source. Economics is as much a science as it is statistics. Perhaps someone will have a revision of GDP soon: Martin Feldstein on how GDP accounting underestimates growth and improvements in economic well-being. And perhaps this is closely linked to the Wal-Mart numbers, that is however groceries and not electronics.

Related, a reader pointed out the engineering in chickens, as per the message yesterday and related productivity gains means more for less: "I think you may find that there is RSA chicken meat exported weekly from RSA - or there used to be. Also a lot is used in processed meat products, possibly sometimes without the consumer knowing this. Nevertheless it remains the animal protein of choice because of its low cost. Also 45 years ago it took 70 days to grow a 4lb bird, using 8 lbs of chicken feed. Today it reaches the same weight in 35 days using half the amount of feed. So productivity has gone up 8 times - this is the answer for food for the growing world population. Better genetics, better housing, better diets, better management."

Healing quicker in old age, might not make us live longer but will definitely make our lives more comfortable - Giving 'young blood' to old mice helps broken bones heal more quickly

This is a really clever way of harnessing wind power, with the added benefit of costing half of current wind turbines. In my personal opinion they are also far better looking than the current wind turbines - This wind turbine generates power without blades

Elon Musk tweeted this article yesterday - Fossil fuels subsidised by $10m a minute, says IMF. The article does not make it very clear but the 'subsidies' spoken about are the indirect costs of using fossil fuels (costs that we don't pay upfront). The only way to 'remove' the subsidy would be to add a tax to fossil fuels for the theoretical cost to society for using the fossil fuel. I think that there is already a great push toward clean energy; the only way to get to clean energy is if you are wealthy. The wealthy will do the research, implement the technology until it is mass produced and cheap enough for developing economies. China may be a huge polluter now but I think it will only be a phase in their history and growth, as they get richer people will start demanding cleaner air and they will be able to pay up for the cleaner energy.

Another very interesting development thanks to technology - L'Oreal is 3D printing its own human skin to test cosmetics.

A follow on from yesterday - President Obama joins Twitter with @POTUS account, breaks fastest million follower count record. I have been on twitter for years and haven't broken a thousand yet, so breaking 1 000 000 in 5 hours is very impressive (admittedly I am not running the biggest economy in the world).

Home again, home again, jiggety-jig. The market is down around half a percent this morning. The dollar is on the up again with the R/$ at 11.95 and R/$ 12.00 on the cards. There is a strike at MTN this morning with MTN offering a 5% salary increase, 4% annual bonus and a guaranteed 13th cheque. Unions want 10% wage increase and a 16% bonus, it also seems that part of the reason for the strike is for the union to be recognised by MTN.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment