"What of course has helped their business a lot has been continued technological innovations in the hardware space, i.e. in the same way that many technologies are only as good as the supporting hardware and software around them. Following up from the mesofacts above, healthcare and technology still have not collided in the ways that many patients and healthcare professionals would have liked"

To market, to market to buy a fat pig. Whoa. Janet Yellen's market predictions seem to have spooked the market, as Eddy Elfenbein points out in his Friday weekly piece, the Federal Reserve chair in the past and present have made bad predictions. Eddy points out that whilst Yellen suggested that the Biotechnology sector looked a little worse for wear last year, it has rallied 33 percent since then. That does not mean that her observations are incorrect, she is probably right. However, like many strategists before and in the future, the chances of perfectly picking a moment in equity markets and suggesting it is either cheap or expensive is always going to be hard. So do not beat up on Yellen, she is making the same observation that many people make from time to time. If she knew exactly what is going to happen, she possibly would be advising PIMCO, like Ben Bernanke is now. Oh, sorry, that only happens AFTER she is finished her stint as Fed chair.

The UK markets are on an absolute tear this morning. Why? The polls got it completely wrong. The conservatives have absolutely crushed it at the expensive of the Liberal Democrats, their coalition partners and more importantly at the expense of Labour. The pound is also on a tear. I guess market participants LIKE continuity, more importantly they like the idea of government being friendly to business. Capitalism might not be the ideal situation for all people, it is however one that rewards hard work. Of course those in favour of a more equitable share will favour labour, those with nothing in the first place tend to side with extreme socialism, again I understand the background of an individual will determine many times which political party they will vote for. I do however remember in one particular election, in my family, my wife, myself, her parents and my parents all voted for a different political party. True story. Anyhow, the market is cheering the win by the folks who are market friendly, that is all that you need to know.

Thanks for the feedback yesterday about the biggest changes in your life and what you think is going to happen. Mesofacts is what they are called, it is an idea introduced by a fellow called Samuel Arbesman, who styles himself as "a complex systems scientist and writer." Mesofacts are things that change slowly over time, that you need context to understand them. Bandwidth speeds improving over time, that is a Mesofact. You only notice when you have an Edge connection how rubbish your internet speed is, and used to be. Five years old, this is still relevant: Warning: Your reality is out of date.

Here are the observations of one of the newsletter’s community, Blue Steel:

"Man was subsistent for many years. He would collect his own fire wood (energy), make his own tools and possessions, plant his own crops. Only in the last 100 years or a bit more have we become utterly reliable on everyone else and globalisation to survive. The next step will probably be towards being semi-subsistent again, making/collecting our own energy with solar panels or bio reactors, 3D printing our own tools and possessions and will probably have to go back to planting a portion of our own food as the population on earth get closer to 10 billion people.

Man only needs three things to survive, water, shelter and food. Everything else is a bonus.

I think the biggest challenge humans will have in the next 10 years will be supplying water for drinking and irrigation. California is already experiencing this problem.

Thanks Blue Steel, I think that he makes some good points there. Obviously food is going to be important. I have a fledgling vegetable patch and herb garden, there are modest harvests from time to time. I do have herbs for days and days, no wonder they are so cheap, they are so incredibly easy to grow! Urban gardens are going to become important in meeting the demand side equation, Blue Steel is right there too. Water needs to get hellishly expensive, before anyone takes note.

And then this one from GT, I think all the way from Canada:

"I'm not sure that the technological changes I've experienced have made me a better person but in terms of productivity. Yes. Washing machines and tumble dryers, oh yes! Add a vacuum cleaner and blender to that too. More recently I'd say a smartphone and GPS and affordable, frequent flights and spellcheck. And vitamins. Something that has enriched and deepened me is the amazing photographic advances that can 'transport' me into the world of a bumble bee or the depths of the ocean, or take me into the mind and life of a fellow human. Recycling is making our world a better place too.

The next five years? The most amazing technological advances will have no place to be enjoyed if we don't take care of the planet we live on, if there's no clean air to breath and pure water to drink and nutritious food to sustain us, what will it matter if we can teleport across the globe."

A wide range of subjects covered there, not too dissimilar however to Blue Steel on humans becoming more conscious of their surroundings, being more aware. Which is why I think that solar technology, cleaner technologies, like those offered by the likes of Tesla will become increasingly important. People won't "do it" (become more aware of their surrounds and adapt to green technology) because it makes economic sense, that is not the important factor in the longer term. The cost of not doing it has greater economic repercussions. Thanks for the answers and predictions, the next question, what specific investments are likely to capture themes in the coming years. We mentioned Tesla, possibly Monsanto, can you think of any others?

Company corner

Cerner, the biggest standalone IT Healthcare services business in the world, reported their Q1 numbers last evening. The company is exposed in that they are susceptible to a downturn in healthcare spend on high technological products during an economic malaise. That is what happened to them in 2008/2009, like many other service related businesses. Headquartered in Kansas City and having been around since 1979, the company has seen cycles come and go. What is evident however is that all the money that they have spent on research and development, since the business was founded (36 years), is going to be replicated in the next half a decade. This is truly an exciting time for the company.

What of course has helped their business a lot has been continued technological innovations in the hardware space, i.e. in the same way that many technologies are only as good as the supporting hardware and software around them. Following up from the mesofacts above, healthcare and technology still have not collided in the ways that many patients and healthcare professionals would have liked. Indeed, procedures are met with multiple sets of forms, sometimes the same set of forms. And yet sometimes it still goes wrong, many bracelets and clipboards later. That is where Cerner seeks to eliminate the mistakes, which are all human. Another great example, an investment in technology, which is making us safer and healthier.

What exactly does Cerner do, before we take a peek at their numbers? Lucky for us, there is an about us page on their website, nobody can explain your business quite like yourself, not so? Here goes: Strategic innovation in health care, for today and tomorrow. They have multiple solutions, again you can check out their Solutions and Services, to get a view of what it is that they offer. From digital charts (no more clipboards and paper), tracking medical equipment to ensure maximum usage (ain't nobody got time for a missing ventilator), through to the complete solution, the Cerner Smart Room, the products are designed to bring technology to healthcare. In a nutshell the company manufactures products and software that save time, which in hospitals is quite simply, lives. Cerner saves human lives.

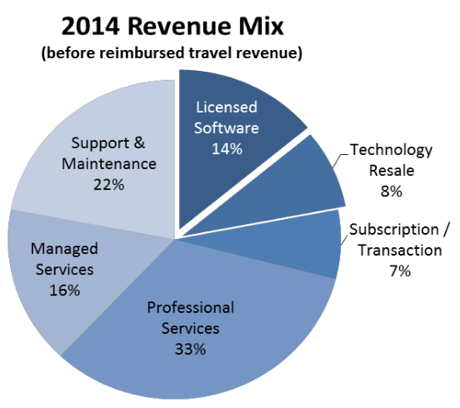

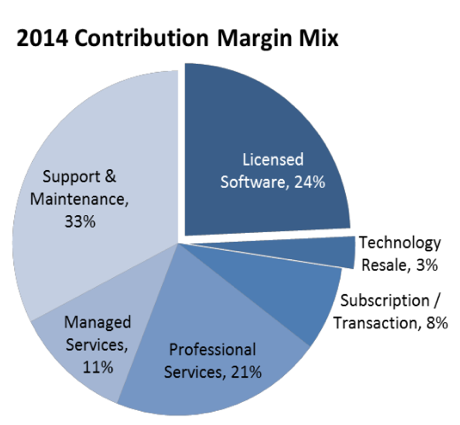

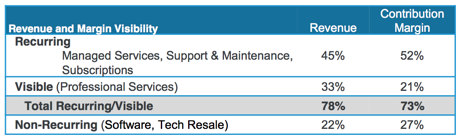

A few pie charts and pictures, thrown in for explaining a little more about this business, first things first, where the company makes their money. As you can see, and refer to the table underneath these two pie charts, whilst from a revenue point of view the recurring businesses are less than 50 percent, in terms of profits they are far higher. Which bodes really well for their business. As you can imagine, there is going to be higher levels of annuity business, as they grow.

Nice. OK, onto the recent results, which were last evening: Cerner Reports First Quarter 2015 Results. revenue was a slight miss and EPS was a meet. The market did not react negatively, bookings are at an all time high, that is why. New clients across the globe. The second quarter is estimated by the company to see revenues of 1.175 to 1.225 billion Dollars (versus 996 million in Q1) and EPS of 51 to 52 cents (versus 45 cents in Q1, which was a 22 percent increase on the corresponding quarter). At 71.25 Dollars you can see that even on FY estimates of 2.11 the stock trades on a 34 multiple, forward. That is NOT cheap. Earnings are however growing at 20 percent plus per annum, the current share price can justify the valuation. We continue to accumulate the shares of what is a very exciting company with equally exciting prospects.

Things that we are reading

It is that time of the month. Not payday, not time to pay the bills, rather US Nonfarm Private Payrolls: April 2015 Preview. Weaker than anticipated? The Texas economy apparently lost 25 thousand jobs last month, the worst month on more than 6 years, the lower oil price, as we anticipated, is starting to drag down the Lone Star State.

This is incredible. Daniel Tammet (Amazing chap) is quoted as saying: I have never played the lottery in my life and never will. Voltaire described lotteries as a tax on stupidity. More specifically, I think, on innumeracy. That is why it is surprising that Americans spend more on the lottery than on sports tickets, books and music combined, as well as a host of other things. Ah well, what can I say other than if you don't try, you can never win. To illustrate the Voltaire/Tammet point, in a related piece: Sudden lottery fortune no panacea. Losing it all.

The most amazing 40 year graph I have seen this week is also brilliantly summed up in the title: Another limitation of GDP accounting - it fails to capture improvements in economic well-being in the Information Age. LP's turned into cassettes, cassettes turned into CD's, downloaded music has eroded the sales of everything. I guess the truth is that pirated music is readily available. The other points about GDP however being an outdated measure is WELL NOTED.

Home again, home again, jiggety-jog. The market has started better, on account of a recovery on Wall Street last evening and the UK elections this morning. To get over the hump towards the end of the day, we have to negotiate the non-farm payrolls number. Your guess is as good as mine. Ed Miliband, head of Labour in the UK has resigned, that is what happens when your political alliance does not meet your own expectations. So much for polls and close, someone suggested that this was not too dissimilar to the Brazil/Germany World Cup Semi-Final, all one way traffic after much hype.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment