"But the growth in their ecommerce business has been nothing short of astonishing. Whilst Jeff Bezos of Amazon.com might be the genius of ecommerce and the first fellow to get it right, Amazon.com remains an unprofitable business. Why? Because they are investing an enormous amount in the infrastructure, Amazon spent 3.8 billion Dollars in their infrastructure, everything from automated warehouses to bigger depots. And this is where Naspers are spending all their money, in their ecommerce part of their business. Whilst there was a very impressive 64 percent increase in revenues to 20.355 billion Rand (from a mere 3.085 billion Rand in 2010), that segment registered a loss of 5.329 billion Rand in this last financial year."

To market, to market to buy a fat pig. On Friday locally we managed to eke out a marginal gain, not a lot, but with the small gain it meant another closing high for the bourse. We are now also over the hump, the winter and summer solstice has passed depending on which hemisphere you live in. It says on the Wikipedia page about the Southern Hemisphere that between 10 to 12 percent of the global population lives this side of the equator. So....... All of the action happens on that side of the equator, from here. Because of the skewed nature of developed versus developing nations, you will probably find that a larger percentage of the wealth of the world is on that side of the equator.

Being a science geek I was out at midday on Saturday and paid careful attention to the shadows. Yes, the longest midday shadows of the year were on Saturday, at least if you happen to get some sun. At one of the most Southern points in South America, Ushuaia, which is right there at Tierra del Fuego, there is a total of 7 hours and 12 minutes of daylight today. Joburg today? 10 hours and 29 minutes, no complaining about the cold please, we have it relatively easy here.

Having it relatively easy too have been the bulls, the equities market in New York touched another all time high on Friday, the S&P 500 at least. The Down Jones industrial average is within one decent session, just over one-third of a percent higher. If you suffer from market vertigo, just relax, because one of the most reposted bloggers in the financial world tongue in cheek had this tweet on Friday:

I guess what Eddy is trying to say here is pretty simple, if you are throwing the bubble world around because markets have reached a new all time high that is the wrong way of looking at it. You should rather be focusing on the valuations and whether or not markets are expensive at this moment in time. And in Eddy's mind, and I agree with him, a move from 15.5 to 16.6 represents a 7 percent increase in what the overall market is willing to pay for the next set of annual earnings. Again it is down to multiple expansion driving the equity markets with a less gloomy outlook. Whilst the Grexit from the Euro zone never happened, from the world cup football it is almost a certainty. Bother.

One of the most followed stories and right in the heart of the debate around bubbles and valuations in the local market, Naspers, reported numbers this morning. These results are for the full year to end March 31. And in so much that things stay the same, they certainly move forward with a lot of pace. There are many segments of the market that have been telling everyone else, with a lot of energy, that you should not buy Naspers and that it is completely overvalued.

From an earnings point of view, that is the case, BUT when you have a combination thereof (what the TenCent stake is worth) and what the earnings are worth on their existing businesses, then it becomes clear that South Africans are applying a discount to the Hong Kong price. In other words, South Africans inside of the Naspers share price believe that the valuations for TenCent are too high. I have seen some analyst reports that suggest the opposite, that Naspers is woefully undervalued, yes, woefully undervalued.

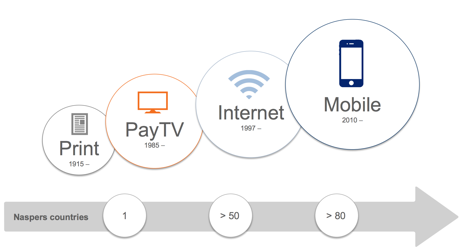

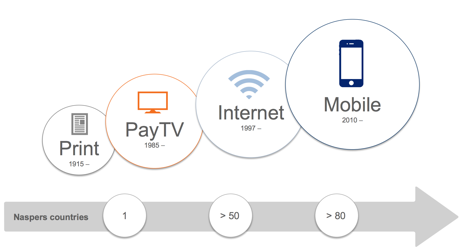

One of the reasons for this divergence of views (which you would not find with a normal industrial company established decades ago) is because of their quick progression from one business to another. You will recall in our message about when Koos Bekker announcing that he was retiring: Bekker departs as CEO, steps in as chair, we went through the four technology spurts in 29 years, meaning that there was something new to think about in terms of business evolution roughly every 8 to 10 years. Currently that growth spurt is in the form of ecommerce, which Naspers set their starting point as 2008.

And as we pointed out, Bob van Dijk, the new Naspers CEO (who is only 41, around Victor Matfield's age - ha-ha!) comes from an ecommerce background, having run eBay Germany. eBay Germany are the second biggest market for that company outside of the US. In fact in these recent results there is a graphic that points to ecommerce slash mobile. Check it out:

Ironically, in their minds Pay TV is two transformations behind. Pay TV, let us focus on this for a moment, added 1,3 million to be 8 million strong. That is a massive jump and yet it hardly gets too much of a mention. Of those, the Compact bouquet (43 percent of growth) is the big driver but not as much as before, indicating that people are paying up. In fact the PVR base increased to 1.1 million. And the BoxOffice product attracts 529 thousand rentals a month. 27 Rand a movie, that translates to 171.4 million Rand per annum. This business is a mere three years old. That is all. So let me get this right, from a standing start, with the existing infrastructure they are able to roll out a business of this magnitude? After all the investment in the TV business is around 1.3 billion for the year, but the profits were only 13 percent higher at 8.5 billion Rand. On revenues of 36.3 billion Rand, increasing 20 percent over the last financial year.

What would you pay for a standalone business of that magnitude? 100 billion Rand? 80 billion Rand? Somewhere in-between? Let us settle at 90 billion for the time being, I think that is fair to value a business at around 10 times trading profit. The current market capitalisation of Naspers, as per Friday close? 529 billion Rand, so the Pay TV business, which accounts for more than half of their profits is possibly worth only 17 percent of the current market cap. Give or take a bit here and there. If you had to value the Pay TV business across 50 countries at a say more lofty 15 times trading profits, that business could be worth as much as 127 billion Rand, or nearly one quarter of all of Naspers. What is clearly currently a growth business is seen by Koos Bekker as an old business. Funny how that works. Meanwhile GOtv continues to attract many more content starved folks across our continent.

Their internet segment is a little less easy to value, first let us take the obvious one, the TenCent stake, what is that worth to Naspers? Well, that is pretty easy to work out. Naspers owns 33.85 percent of the Chinese business TenCent that is listed in China. The market capitalisation of TenCent is 1.07 trillion Hong Kong Dollars or at the current exchange rate 1 Hong Kong Dollar to 1.37 Rand, the Naspers stake is 496 billion Rand. No really. Or with the fall today of the TenCent share price, around 488 billion Rand. The difference between the Naspers TenCent stake Friday and the market cap of Naspers Friday was all of 33 billion Rand. Or roughly at the modest valuation of the TV business, around one third of that.

So quite clearly you can see that South Africans apply a discount to the price that people pay in Hong Kong for TenCent. Quite clearly, without a shadow of a doubt, we apply a massive discount to the holding, because obviously we are smarter than the investors in Hong Kong, right? Sounds too arrogant, the TenCent price is what it is, until it changes, it won't. As you saw from analysis that we did in May: TenCent numbers blow the socks off expectations. My simple analysis suggested that TenCent was not that expensive if the growth rates are maintained, herewith an extract from that message, dated 15 May, 2014:

The previous close was 513.5 HKD. Annualise (you shouldn't, if the company is growing that quickly) the quarterly earnings and the stock is suddenly trading on 29.5 times. Which is hardly a bargain, but the earnings expectations are going to have to be ramped up. If earnings grow by 50 percent per annum, then it may be quite acceptable to pay 30 times earnings. The PE unwind is simply astonishing. BUT, in order to maintain these lofty rates, TenCent will continue to have to grow their other businesses aggressively. Both their advertising and e-Commerce businesses were disappointing in the prior quarter, when compared to the previous one. Seasonality, Chinese New Year puts a spanner in the works.

OK, so if you believe like me that business (TenCent) is NOT expensive and commands a premium because of the growth rates, then it is fair to say that the major internet portion of Naspers is OK, provided that the growth rates remain. That is the tricky part you see, if growth rates fall, then it is fair to say that TenCent will take a heavy hit.

Then next onto the part of their business that is currently in growth mode, the ecommerce business. Now you will know all the businesses here locally that Naspers own, OLX (which is global), Kalahari.com and PriceCheck. How many times do you use these? And because you are reading this newsletter that means that you are definitely a little more advanced that many here in South Africa, who do not have access to the internet, you are the future of these ecommerce businesses. It is far easier to sit at your desk at home or at work (do not let the boss see you) and buy something than it is to get into your car, fight for parking, fight the traffic and queues and get that item that you want. Plus you can only do that when you are not working.

But the growth in their ecommerce business has been nothing short of astonishing. Whilst Jeff Bezos of Amazon.com might be the genius of ecommerce and the first fellow to get it right, Amazon.com remains an unprofitable business. Why? Because they are investing an enormous amount in the infrastructure, Amazon spent 3.8 billion Dollars in their infrastructure, everything from automated warehouses to bigger depots. And this is where Naspers are spending all their money, in their ecommerce part of their business. Whilst there was a very impressive 64 percent increase in revenues to 20.355 billion Rand (from a mere 3.085 billion Rand in 2010), that segment registered a loss of 5.329 billion Rand in this last financial year. Yech. That hardly sounds like a good outcome, it sounds awful in fact.

Why? Because Naspers through all their ecommerce businesses spent a whopping 5.6 billion Rands in growing them. Online classifieds, the OLX model. I have tried it and it definitely works, that is my own personal experience. And businesses like PriceCheck are marvellous for consumers, absolutely amazing. The outlook segment tells you all that you need to know, there is going to be more focus on this line of the business, the ecommerce part. And if that entails a larger spend in the coming years, then you have to accept that as a shareholder of Naspers, as a percentage of revenue spent more now, 12.2 percent on development than in any of the last five years.

It is not too different as a shareholder of Amazon. Not different at all. You are going to have to have to be really patient as the new part of the business ramps up, the speed at which this is happening is mind boggling. And as such, it is going to be difficult to value from three months, to three months. As you can see, we tried to value the above businesses. eBay trades on a price to sales of 3.9 times, Amazon.com on two times. If you use the eBay price to sales metrics, you can see that the ecommerce business (which is growing revenue at a rapid rate) is worth close to 80 billion Rand, using the Amazon.com metrics it is closer to 41 billion Rand. Either way, this segment is only valued, by those metrics at less than their Pay TV business, which is not where the future is, according to the management and development spend.

We continue to hold Naspers and acquire on weakness, believing that the sum of the parts (fast growing parts at that) undervalue the business. On a pure earnings basis the stock is expensive, but remember that, like Amazon.com, when the huge spending on their current business transition has taken place, the company will shift a few gears in that regard.

Michael's musings

One of our core holdings in the US, Google has announced that they are buy video monitoring and security company Dropcam Inc for $555 million. The actual buyer of the company is Google's subsidiary Nest, the "smart appliance" division. The long term goal is to have all your house appliances controlled by a cell phone running the Android software.

Dropcam's current product allows you to monitor what is going on in your house through live streaming of video to mobile apps and through alerts that are sent to you. Security is a big component of being able to interact with your house and environment. Looking forward a couple of years, you will be able to see what is going on in your house to know it is safe to enter, turn on the heating and geyser, turn lights on and having music playing when you walk through the front door. All this will be able to be done on your Android phone, using your voice through Google's artificial Intelligence technology called "Google Now".

In other Google news, this week is their I/O conference, which is where they get to show off their new products. Google's Android is now on every 4 of 5 smartphones sold, breaking the 1 billion mark last year. Having that many people already in the Google ecosystem, the idea will be to keep them there through expanding the places where you can find Android. The conference is expected to give more details on "Google Wear", the wearable tech products, Android in cars through partnerships with manufacturers and further development on Google Now.

Currently Google still gets 90% of its revenue from advertising, but as the Android ecosystem expands along with other products like their Driverless car technology we should see a shift in revenue flows. Even though the word "Google" is in the dictionary as a verb and is something that modern society cannot live without, I think that Google will be an even bigger part of our lives going forward, and this is the reason why we own the shares.

Home again, home again, jiggety-jog. There has been the first positive PMI read in China for a while, that is boosting resource businesses across the globe, which is to some extent being dragged lower by industrials. And in particular Naspers, that stock is down over three percent on these results.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Email us

Follow Sasha, Byron and Michael on Twitter

011 022 5440