"...when money was freely available during the go-go times, perhaps wasteful expenditure (and excess return of cash to shareholders) should have been used to make the working conditions a whole lot better for labour, it would have been cheaper and better. But instead you now have a workforce that feels it deserves better, government is essentially in that camp (if not AMCU, definitely their alliance partner) and the economics do not make sense. It is very stuck. And from that perspective makes the platinum industry un-investable in our view. It is all very nice to have the reserves in the ground. The platinum price could be worth 5000 Dollars a fine ounce, but if it costs 5010 Dollars to get an ounce out of the ground, you can't make a business of it."

To market, to market to buy a fat pig. We saw a surge at the end of the trading day here in Jozi, the good old faithful industrial and resource stocks, taking cue from a weakening Rand sent the overall index to a closing high. Yes, I suppose that is good news if you are an index watcher. I cannot stress enough that the index level should not scare you, nor should you get market vertigo. I saw a simple post from Josh Brown that attracted a lot of attention yesterday, just take a look, it will take you all of thirty seconds, it is titled (in capitals) TURN DOWN FOR WHAT! Possibly all the events and worries over the last five years packed into a list.

And the outcome? Markets trading at all time highs. So what is the moral of the story? I think that those people who are looking for another event like 2008 to either get conviction of their current strategy or justify why they are owning x or y or z. And if the markets fall six or seven percent, or even ten in the next six months, those types will just say told you so. The companies that you hold, because you are not index trackers are more important. The businesses that have better prospects than their peers, those are the ones who's prospects you follow. Ah well, I guess our approach is not everyones cup of tea.

Talking about tea, this time this specific tea has gone cold. Again. Very cold. Last evening the talks between the platinum companies and AMCU have gone cold. Much excitement had been built around the government intervention in the talks. Some seriously irresponsible comments from a person that I didn't expect to say that, seriously? ANC secretary general Gwede Mantashe blamed the EFF and "White foreign nationals" for deliberately trying to destabilise the South African economy. Really? I am presuming that he has proof of this and will present it to all of us to substantiate those comments.

Last I checked, Lonmin's biggest shareholder, Glencore Xstrata (at 24,54 percent) had initiated a secondary listing here in South Africa late last year. Surely not them, right? The best outcome, for Glencore Xstrata would be a resolution. That is what their shareholders want no doubt. The two biggest shareholders of Impala Platinum are the Public Investment Corporation (13,3 percent) and the Royal Bafokeng Nation (13,15 percent). I am pretty sure that these shareholders have engaged positively with the company. And as we all know, these are 100 percent South African. Lastly, Anglo American Platinum (or Amplats) still has Anglo American as the nearly 78 percent shareholder, their shareholders in turn include Coronation (4,97 percent) and the Public Investment Corporation (4,51 percent). So, those are South Africans, even though the majority of Anglo shareholders are not South African. Most of their (Anglo) employees are South African however, as per their last annual report 99,500 folks of the 158,900 workforce work inside of our borders.

But the point I am trying to make is that the shareholders have nothing to gain by having the situation unworkable, Anglo are stuck here. Whether or not you or I think that the salary of everyone needs to be higher, you need to match it with the skill set. Should an underground worker at a mine earn more than a school teacher here in South Africa? Payscale tells me that the average high school teacher in South Africa earns 147,609 Rand a year. If the mine workers at AMCU want 12,500 ZAR a month (I am not sure with or without benefits), then that is more than the average teacher earns.

First things first, to become a teacher, you need a Matric, a school leavers certificate that will get you into University, not just a pass. You will then need a Bachelor of Education, and to specialise in a specific subject you will need to do a post graduate certificate in Education, four years full time. And only then can you become a teacher. So, which one do you think should be remunerated better? Because it is all very nice to say that the CEO earns this or that, but what are their qualifications? What is their pedigree? To presume that the rank and file and the upper echelons of management are exactly the same is the wrong presumption. More to the point, the platinum wage negotiations website have a comparative wage settlement. That is a better comparison to teachers, one can be clear when one says that the skill sets of teachers and mine workers are worlds apart.

I am afraid that the companies will deal with this in a way that is unfavourable for everyone, all stakeholders. The Lonmin release this morning says it all, of what I think is going to happen next: "During this process the producers have sought to arrive at a fair and sustainable settlement that would preserve the future of the platinum industry and limit job losses in the country. While the producers remain committed to a negotiated settlement, they will now review further options available to them."

That is partly cryptic. But I am pretty sure that everyone is interpreting it in exactly the same way that I am. The mines that are unprofitable are going to be sidelined from production. Closed, until the platinum price is much higher. The reason why the platinum price is not higher is because there is more supply in a very small market from physical hoarding and jewellery.

Unfortunately for these companies government views these businesses the same way as parastatals, employment opportunities. And more unfortunately pockets in private enterprise are only so deep. For example, and perhaps using an airline as an example is bad, but SAA clocked a 990 million Rand loss in 2012/2013 (from a loss of 1.3 billion the year prior) but employed more people. A wage bill of 4.8 billion Rand for 11500 staffers. The average salary then at SAA, a business that has lost over 2 billion Rand in two years, is 417 391 Rand per annum. Based on dividing the one by the other. Nice work if you can get it, it seems.

A comparative business, Comair, paid 671 936 000 Rand to their 1912 employees, as per their 2013 annual report. Average wage over at Comair, a business that is actually profitable? 351 431 Rand. Comair does not have a 5 billion Rand government guarantee, they are challenging government and their guarantee, we will see. Their market cap is only 2.135 billion Rand. But they sure do a better longer term job for their shareholders. I would prefer full scale privatisation of SAA, that money can be better used on infrastructure, the government would get far better bang for their buck, we would all feel better about that. Other than SAA of course. I don't know, what are your thoughts on the matter?

There are 15 board members at Comair, 24 at SAA. I can't find the board member remuneration at SAA, at Comair it is easily available. Why do I use the Comair/SAA comparison when talking about platinum mines? Because I get the sense that government view the mines as employment opportunities and that miners ought to be paid more, because historically labour was taken advantage of, there is no escaping that the argument for higher renumeration for past exploitation is not a valid one. There is no denying that. But relative to the skill sets, and separating the idea of a private enterprise relative to a public one is important in my mind. Very important. If you want to read a very, very long analysis of why platinum mining is important to all of us, read Cees Bruggemans piece in Biznews -> Why platinum crisis affects every South African.

Michael makes a good point, when money was freely available during the go-go times, perhaps wasteful expenditure (and excess return of cash to shareholders) should have been used to make the working conditions a whole lot better for labour, it would have been cheaper and better. But instead you now have a workforce that feels it deserves better, government is essentially in that camp (if not AMCU, definitely their alliance partner) and the economics do not make sense. It is very stuck. And from that perspective makes the platinum industry un-investable in our view. It is all very nice to have the reserves in the ground. The platinum price could be worth 5000 Dollars a fine ounce, but if it costs 5010 Dollars to get an ounce out of the ground, you can't make a business of it. No business = no employment, no taxation, no returns for anyone = no investment.

It is a good thing that we have amazing businesses outside of this core industry for South Africa. We really have amazing potential and superb captains of industry. They need reasons to invest here locally. We punch comfortably above our weight. And that is a good thing. Unemployment, the official number might be more than one in four, but that also represents a massive opportunity for many people. It is easy to get down on yourself when thinking deeply about the solution on the platinum belt as being unobtainable. Equally apply your mind to prospects of existing businesses here, businesses that are expanding across the borders and selling South African products to the rest of the continent. Those opportunities are real and many local businesses have pursued them, with mixed successes.

Think, twenty years ago MTN did not exist, today the business is worth 430 billion Rand. Vodacom did not exist 21 years ago, now they are worth 188 billion Rand. Both these businesses have provided an enormous amount to the Treasury coffers and have employed thousands of people. Aspen Pharma has only been listed since 1998 and is worth 129 billion Rand. Discovery is a little over 20 hearts old, covers around 3 million South Africans and is worth nearly 54 billion Rand. So whilst you may feel down in the dumpsters about the situation along the platinum belt, know that the mix of the country has changed, in terms of different parts of the economy. And that we can continue to produce quality in other sectors, that will be profitable and contribute to the state coffers and provide gainful employment for thousands of people.

Michael's musings: Sasol moving forward

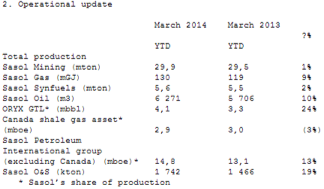

Yesterday Sasol released their trading statement for the first 9 months of their financial year. Below is their operational performance.

The financial details are vague due to this being an interim statement but most of the numbers seem to be pointing in the right direction. Their production numbers are up and the Rand is 20% weaker this year compared to last year. Having the selling price of their goods guided by what the Rand is doing a weaker Rand is a good thing.

The first number to stand out is the 3% drop in their Canadian Shale Gas asset. The Canadian assets consists of Sasol's 50% share in two gas fields. These are the same gas fields that they took big write downs on previously, caused by lower natural gas prices.

The biggest rise in production is in their ORYX GTL plant located in Qatar which they own 49% of. The reason for the big increase in production is due to the plant having been down for maintenance in the previous period. It currently runs at 93.5% capacity and they expect it to be higher in the remaining months of the year.

The most important number though is their synfuels business which accounted for R28.6 billion of their R40.6 billion in operational profits. Comparably the synfuels operation is up 4%, and for the full year they expect to be at the top end of their volume guidance.

A feather in their cap would be "Based on our interactions with Standard and Poor's (S&P), and after having performed a sovereign stress test, S&P revised its outlook on Sasol from negative to stable on 15 May 2014"

There was nothing major in the announcement, which was seen by the share price not moving much. The reason to buy the company is if you think that natural gas is the future for energy generation in the world. As it is from where I sit, natural gas will be the step between fossil fuels and renewable energy.

Home again, home again, jiggety-jog The Rand is weaker, there is potentially a ratings downgrade coming our way towards the end of the week, as far as I am led to believe. Does it matter? Yes and no, anyone doing their homework on investing in our government bonds will know this news in the same way that everyone else does. Not new. You know what.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment