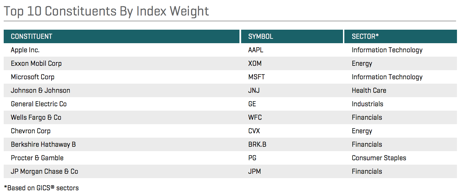

"Of all of those companies, Apple (the biggest by market cap) through to JP Morgan, only Apple and Wells Fargo are not Dow Jones Industrial Average components. Wells Fargo I can understand, the definition of Industrial companies is non financial, and whilst Apple might well be considered by some as the largest hedge fund in the world (all that cash 150 billion Dollars of it), the company is a hardware and software one. I suspect that in a matter of months we will see a review and Apple will replace one of the other companies in the Dow, the question is, which one? Intel or IBM? Or Cisco?"

To market, to market to buy a fat pig. It was a number that the trading people would have hated, the unemployment report was almost dead inline with what expectations were set at. The very biggest data release and nothing for them trading types to do. US markets did however end at an all time high, the S&P 500 printed 1949.44. That is pretty apt, reason being that all the jobs "lost" during the last recession have all been added back. I wonder however if anyone has done a detailed analysis of what jobs were shed (construction is an obvious one, government is another) and what jobs have now been added back. Healthcare is obvious. I am guessing that some jobs do not come back. Ever. Because mechanisation replaces people. Government in the US alone however is 637 thousand jobs off the highs, that is around three months worth of additions at the current run rate.

In advanced societies much of the manual work is replaced by robotics, in Japan I saw Friday that Softbank CEO Masayoshi Son unveiled Pepper, a robot that knows how you feel. No really, see this Mashable article with the headline that says it all: SoftBank's New Robot Knows Exactly How You Feel. (That's Creepy.) Did you see those applications? The last line of the article suggests that robots like Pepper could be unveiled (at a cost of 2000 Dollars each) in some of Softbank's retail outlets. Softbank are of course a mobile service provider, imagine a friendly robot giving you advice on a mobile handset, or tablet, would it be impartial advice or would the robot be exactly that, clinical? All it means however is that if you have a job in a retail outlet at Softbank, the company is looking to replace you with a machine. Which is not good news for that person, but very good news for the company.

Back to these jobs numbers Friday. Those are important I think. The reason why I say I think is twofold, the trend is important, it is better to be adding jobs than to be shedding them and secondly, whilst this may be seen as the single biggest number for traders, this is a reflection of the US economy. But trying to work out whether this report is more important than the prior one, that is too hard. One thing I am glad for is that Bill McBride has decided to shelve his "scariest jobs chart ever", check out his post: U.S. Employment at All Time High. See that table, the 8.7 million jobs lost in 2008 and 2009 have all been wrestled back. And if you explore the nonfarm payroll employment data, you will see a much bigger trend, that we alluded to earlier. Healthcare jobs.

It is only the start, in our opinion that is. Over 20 percent of the populations of Italy and Germany are over the age of 60. Now there are people over the age of 60 that can run the Comrades probably faster than I will ever be able to, but the point is that if your population is ageing, you will need to spend more as a percentage of GDP on healthcare. In the US the number is higher than in any major developed nation in the world. It makes sense however that if you look at a map of Europe (this one specifically -> Ageing of Europe) shows you that all the young people are in the East. So migratory patterns could open up in due course. But of course, there will continue to be greater mechanisation in Europe, to help with manual tasks.

On the same topic of employment, but this time much closer to home. And there is absolutely no way of sticking lipstick on this pig, being the relations between labour and business. Government were somehow seen as power brokers and everyone seemingly got excited about a quick resolution. The new minister, Ngoako Ramatlhodi said on the weekend basically that his work was done -> 'Enough work done' to resolve South Africa mines strike: minister. I cannot see how both sides will suddenly meet in the middle. More especially when I saw a story like this from MiningMX on Friday: Gulf in SA productivity rules out wage hikes. Oh dear.

In fairness to labour in this part of the world, we have the deepest mines in the world. And as such, because in Australia much of the bulk mining is open cast, costs will be lower and productivity will be higher. What is marginally amusing for us South Africans is that the Aussie flag is upside down there, or down under, I wonder why that mistake was made. I am pretty sure that champions of capital will use this report, from Roger Baxter and the Chamber of Mines to further their argument of why the two are connected. Productivity and pay. But then again, the people making the argument do not have to don a pair of overalls and a hardhat, descend over 2000 metres below the surface of the earth (basically below sea level) and work for a pretty ordinary wage.

But then again, companies cannot attract more capital if there is no return. Shareholders of companies cannot be forced to put money to work if the only result is for the "stakeholders" to lose in the medium term. It simply will not happen, because the shareholder register has changed dramatically, many, many times over at the same businesses being asked to readdress the inequalities of the past. Plus the employees at the respective businesses, all the way up and down the corporate structures, how many of those folks are still around in the same position? The more I think about it, the more that I think that the unfortunate truth is that these businesses are not going to attract much more capital. Their risk levels have been elevated. There will be solutions and they will protect capital, that is my feeling. Whether you believe that is the right or wrong thing socially, that is another story altogether and one that is ongoing and evolving in a South African context.

Do not freak out when you see the Apple share price down 85 percent today, until of course everyone figures out that the company today does their 7 for 1 split. Why seven for one, I am not exactly sure. In the original announcement, in April this year, no reason was given: Board of Directors also Approves Seven-for-One Stock Split. The only people who really care whether or not your share price is "high" or "low" relative to one another are the folks who manufacture the index. If you read the DJ indices website Overview section, I notice something strange about the inclusion mechanism. The 30 stocks now in the Dow Jones Industrial Average are all major factors in their industries, and their stocks are widely held by individuals and institutional investors.

So why would Apple, with their nearly 580 billion Dollar market cap not get a look in? The last reshuffle was done in September last year, with Nike, Goldman Sachs and Visa coming in. But the folks creating the index, that is supposed to represent industrial America, have not included Apple because of their "high" share price. There is a divisor, which takes all 30 share prices, adds them together, and then multiplies by that number by 0.125552709. I don't know about you, but this seems like a made up index that was good a number of years ago, but perhaps not as relevant today. I expect Apple to be included in the index soon, but that may mean nothing but bragging rights.

More important for the average investor is to follow the broader market, the S&P 500. As per the fact sheet, which you download from there, then find Methodology Construction, the quick facts represent something easier, from a level point of view. Biggest company, Apple. Check it out, from the fact sheet.

So. Of all of those companies, Apple (the biggest by market cap) through to JP Morgan, only Apple and Wells Fargo are not Dow Jones Industrial Average components. Wells Fargo I can understand, the definition of Industrial companies is non financial, and whilst Apple might well be considered by some as the largest hedge fund in the world (all that cash 150 billion Dollars of it), the company is a hardware and software one. I suspect that in a matter of months we will see a review and Apple will replace one of the other companies in the Dow, the question is, which one? Intel or IBM? Or Cisco? Or will another non-industry related company exit? Coca-Cola? United Technologies? We will see sooner than one thinks.

Home again, home again, jiggety-jog So Nadal won 9 French Open titles. Well done to him, that is amazing. Martina Navratilova won 59 Grand Slam Titles, 18 singles (including 9 Wimbledon titles), 31 Doubles titles and 10 Mixed double titles. There are 12 of these a year. That means, she basically shut every single person out of a title for a full 6 years, bar for one. That is more amazing than any other sporting record, and I am talking major sport here. Taking if which, why do India and China not have football teams that compete? Great article sent to us by a client and friend: two halves. Amazing, only 6 million Indian folks watched the 2010 Football World Cup Final.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment