"The product turns your cell phone into a bank and your cell phone number is your account number. The system will allow you to send money from your cell phone to another cell phone (once they have registered). You will also be able to withdraw or deposit cash at Pick 'n Pay stores, or top up your account with EFT."

To market, to market to buy a fat pig. Boom, we got thrashed yesterday. Resource stocks were the ones most hurt, inside of the broader resource complex were the platinum miners getting crushed, down 4 and nearly one quarter of a percent. Yowsers, that is a bit of a drubbing right there. Sometimes, no, let me rephrase, all of the time it is painful to look for a reason why equity markets sell off, or go up for that matter.

I read a Jack Bogle (the founder of the Vanguard group) piece in which he quite clearly made one of the best observations I have ever seen about the market. Corporates create wealth, the stock market does not. Ironically those very companies that the ordinary person finds is try to get one over them is possibly in their pension fund creating value for them. And many public officials who tell you that x or y or z company should do more for society use the tax payers money to support private enterprise. The stock market represents the collective corporate value afforded to them by savings and retirement money.

And then another one that I read, on the Psi-Fy Blog is that you are not in control of the market, and in fact nobody is. I guess that is why, like flying and being a passenger on an airplane, we always want control of our destiny and are scared of the event. Being invested in companies that trade freely on a stock market, with people having a separate agenda, we can never be in control. Relax. Many times I am astonished at how few people there are as shareholders in some businesses. Remembering that institutional shareholders are beholden to their clients, who indirectly own these shares too. Take Famous Brands, that is a good example.

There are only 7381 shareholders of Famous Brands as per their annual report for 2014. Of those, 5877 are individual shareholders. The Public Investment Corporation owns 7.28 percent of the company, Famous Brands. The PIC also manages 1.4 trillion Rand worth of assets on behalf of their clients of which 1.252 trillion (as of March 2013, it mud the higher now) is managed for the Government Employees Pension Fund, or the GEPF for short. As per the GEPF website there are approximately 1,2 million active members from more than 325 government departments and some 300 000 pensioners and other beneficiaries.

All I am saying is that through the PIC and by function the GEPF holding in Famous Brands, there could be as many as 1.5 million people who entrust their savings to the business. Obviously 7.28 percent of Famous Brands is only 726 million Rand (only?) and not the biggest holding of state pensioners, but the point is worth making that there are many shareholders who do not know that they are shareholders. Ironically all these pension holders, any pension holder who is invested in companies should always wish that they are as profitable as possible in order to maximise returns in the long run. If corporate South Africa is in a better place then your retirement savings are going to be a lot higher than if law makers fiddle and mess with private enterprise.

Of course this only applies if you have retirement savings, there are many South Africans without retirement savings and only possible to qualify when they retire for a government old age pension, which is 1350 Rand a month. Once you hit 75, that amounts rises to 1370 Rand, an extra 20 bucks a month for being a year older. 1350 Rand on food per old person does not go really far now, but it is better than NO government pension at all. And that, the old age pension, you and I have the current government to thank for, whether you like that or not.

Google are having a proper go at their competitors, currently there is the Google I/O developers conference on the go at a place called the Moscone Center, a 65 thousand square meter centre in San Francisco. Day 2 of the conference ended yesterday. If you want to watch the Google I/O 2014 - Keynote, of course you can do so on YouTube.

There is a fellow by the name of Sundar Pichai, who is the senior VP for Android, Chrome and Applications, delivering the keynote speech. Pichai was born in India, in Chennai for all you MS Dhoni fans out there, has been at Google for over ten years which is a lifetime at a relatively new company like that, I guess. Google is only 15 years old, turning 16 in September. So if you have been there for this long, you can call yourself there at the beginning.

Enough about the personalities at Google, you know them well. What Google announced in a nutshell is a smart watch, Android TV and Android Auto, taking the existing Android software and expanding it across to other devices that we know well. Cars, watches and TV's. Google through their fragmented hardware market running Android software has the biggest ecosystem, it makes sense that there is a standard for all of the hardware manufacturers to be able to run later versions of the software. And the launch of Android One, a cheaper smartphone (around 100 Dollars) with the first place to be launched in India. Eric Schmidt, the chairman of Google took to Twitter and had this to say:

Particularly excited about Android One, launching first in #India. Affordable smartphone technology for the next billion. #io14

— Eric Schmidt (@ericschmidt) June 26, 2014

There are some interesting notes to emerge from the conference, one being that Android users check their phones around 150 times a day. Or, in a 14 hour day that the handset is with you, around once every 5 minutes and 36 seconds. Wow. For what? Does it matter, you are missing out if you do not check your handset, right? Yes!! Fear of Missing Out, or FOMO is real.

All you need to know about Google is that in time, and perhaps sooner rather than later, they will start to monetise other platforms of theirs, with the initial intention to connect the world. That of course is not too different to Facebook, coincidently, the whole idea of connecting everyone. I suspect that with more connectivity society will get back to self inflection and making sure that we police ourselves, in a similar sort of way that Wikipedia does, the community keeps the outliers in check. The exact opposite of a few bad apples spoiling the crop.

What is going on with Steinhoff? A late announcement on Monday and the headline read Steinhoff announces secondary offering of shares in KAP Industrial Holdings Limited. Steinhoff offering institutions a discount in a book-build for 400 million of their KAP shares, thereby reducing their stake in the company to 45 percent from 61.8 percent. If you recall, Steinhoff quite simply have taken their South African assets and injected them separately into KAP and JD Group.

January 2012 -> Steinhoff looking to take control of JD Group. What happened is that Steinhoff gained control over both JD and KAP:

Steinhoff swapped their PG Bison, Unitrans and Steinhoff raw materials business in return for "1 912.8 million (new) KAP shares at R2.50 per share", that announcement was on the 18th of October. "And .... KAP credit(ed) a loan account in favour of Steinhoff in an amount of approximately R4 139 million"

So they, being Steinhoff used KAP shares to pay for a control premium in JD Group, reduced their stake in KAP from 88 to 61.8 percent (back then) and all the shareholders agreed that was a wonderful idea.

Fast forward to June of 2014. So now Steinhoff International are selling down their KAP stake and taking a full go for the rest of JD Group. After the rights issue, where JD Group shareholder stumped up another 1 billion Rand, Steinhoff now own 86.19 percent of JD. Not quite the 98 percent that they are looking for. For the record, on Tuesday the 400 million shares were sold at 3.85 Rand a share. So, Steinhoff extracted 1.54 billion Rand from this deal. Steinhoff injected their industrial assets into KAP in exchange for 1.9128 billion shares at 2.5 Rand a share. 400 million sold now at 3.85 Rand a share around two and a half years later. Sounds like a decent return in a short period of time.

Inside of the announcement, the KAP announcement of Steinhoff International selling their stake, was a one paragraph that could have huge implications for shareholders. Here goes:

"Steinhoff also announces that it has received formal approval from the Financial Surveillance Department of the South African Reserve Bank within the framework of the Exchange Control Inward Listing Rules, to seek a listing on the prime standard of the Frankfurt Stock Exchange. Steinhoff intends to commence with the listing process as soon as possible, subject to prevailing market conditions, after the release of its 30 June 2014 audited annual results in early September 2014. Once the Frankfurt listing has been implemented, Steinhoff will continue to be listed on the JSE Limited ("JSE") through an inward listing. The Bookbuild will support the preparation for the proposed Frankfurt listing of a focused retail group."

What? First of all, what is an inward listing? Inward listings by foreign entities on South African exchanges is explained via the Reserve Bank piece. The headline however tells you that this applies to foreign entities on South African exchanges. What Steinhoff are looking to do here is almost the exact opposite of what Glencore Xstrata did last year. Or is it? When that announcement was made it was a secondary listing. So that is not an inward listing. So that would not be an inward listing. The Reserve Bank have a segment on Inward listings. It is still as clear as mud to me.

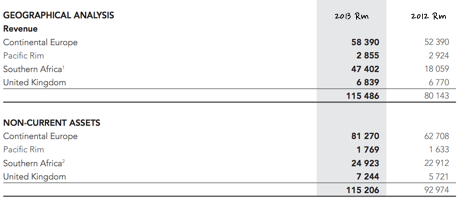

I think for the purposes of trying to understand why Steinhoff have applied to do this is simple. The business as it exists now, post the Conforama purchase in March 2011 and reshuffling of South African assets in 2012 and now again this year, the rump of the business is no longer South African. As per the 2013 Annual report, you can see the evolution of the business from a small company here to a giant company with global operations. At the last results, 55 percent of their revenue was derived from Europe, 6 percent from the United Kingdom, 2 percent from the Pacific Rim and the balance, 37 percent, from Southern Africa.

On an assets basis however they are not a Southern African business. They (Steinhoff) quite possibly picked up Conforama for what was a generational low in asset prices in the developed world. Check the re-rating that the European assets have got over the last 18 months or so:

What has happened is that this business has become a European one. And as such wants their principal listing to be in Frankfurt. Not just any listing, but a prime standard listing, follow the link for more information from the Frankfurt exchange, prime standard. I have no way of knowing what the nitty gritty details, if you can still own them here, then why worry about this? What could happen though next is important for existing shareholders. More German and European investors looking to own another business with a developed market platform and a developing world presence. That might be very attractive for European investors.

It is hard to get to grips with the furniture sector, in the US there are no big listed businesses and equally I cannot find any across Europe, many of them seem to be private businesses, family owned. Businesses like Ikea, which itself has enormous history and is the only furniture business, in the world, that is bigger than Steinhoff International. Ikea has revenues of 28.5 billion Euros, profits of 3.3 billion. There is a VERY long way for Steinhoff to go to get close. But they have laid down their marker and investors may just give this company a higher multiple than they currently are afforded by the market. Sadly this means that the high energy team at Steinhoff has taken the view that their empire belongs in the old world and not here. But hey, you can still buy the shares, and there are extra buyers who will no doubt want the shares.

Michael's musings: Companies joining forces to add value

Yesterday MTN, Pick 'n Pay and Visa announced that they have joined forces to launch a new mobile money product. The product turns your cell phone into a bank and your cell phone number is your account number. The system will allow you to send money from your cell phone to another cell phone (once they have registered). You will also be able to withdraw or deposit cash at Pick 'n Pay stores, or top up your account with EFT.

An optional extra will be to get a Visa card linked to the account, which comes with unlimited swipes and no card fees. Basically this product is the same as a "normal" bank account, except your bank is your cell phone and your account number is your cell number.

I think that this product is a great way to reach many unbanked people in South Africa. According to Google, 67% of South Africans are unbanked, but the large majority of people in South Africa have cell phones. There are more subscribers on the mobile networks than there are citizens in South Africa. The account can be opened from your cell phone, so no need to go into a branch which in rural parts of South Africa could be a fair distance away. This a great way to remove the risks of keeping all your savings in cash, and it makes it easy to transfer cash from one family member to another.

The model is based on Vodacom's M-Pesa, which is thriving in East Africa. Currently 40% of Kenyan GDP goes through M-Pesa! The start of using your phone as a bank came when air time was being used as a proxy for money in the Kenya by people. This is when Vodacom and Safaricom stepped in to have a more formal structured product.

Vodacom has brought M-Pesa to South Africa, but it hasn't had nearly the same success as in Kenya. I think that the MTN and Pick'n Pay system will be more successful because it is being promoted by two large South African brands. Also the new system can work with any cell number even if it not MTN, it just costs more, where as far as I can see you can only have a M-Pesa account if you are on Vodacom.

The move towards a cashless society is one of the main reasons why we own Visa in the US portfolio. The trend towards not using cash for security and convenience reasons will continue. Mastercard estimate that 85% of all retail payments is still done with cash. This deal is great for everyone involved, but only time will tell if it will be taken up by the target market.

Home again, home again, jiggety-jog. Markets have bounced off the lows from yesterday. The Rand has weakened, US GDP, the second take yesterday was awful, markets rallied in the US on the basis that the Fed will continue to be accommodative for as long as the metrics are not inside of their mandate. Companies will continue to innovate or get left behind, allocate capital where it can grow quicker and hopefully that continues to attract greater employment and remuneration of employees over time. Those that cannot innovate and cannot grow capital at the rate desired will not attract any. Capital only takes one side.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment