"I suppose that with the strike coming to an end (hopefully) and with a credit rating scare, this could force quicker action from the powers that be. As ever, one should not place too much hope on the powers that be. Talking about hope, do not stress if you suffer from fear of Friday the 13th. If you get that, then watch out for next year, three Fridays on the 13th. But what makes today special is that there is a full moon too, that doesn't happen until 2049."

To market, to market to buy a fat pig. There is not much company news around, which is always the worst part of the market for me, the lull. This is when there is scratching around looking for reasons why the market is either up or down. If the market closed for a whole day and there was no trade the headline could stupidly read, "market flat as trade cancelled." That is a reason why it is flat, not so? But I guess rising oil prices in the spotlight are reason for concern. And why are oil prices rising? Well, it turns out that a militant group, a splinter of al-Qaeda in Northern Iraq are making progress on their way to Baghdad.

And how does that impact oil markets? Well, although four-fifths of Iraq production are in the Southern part of the country, the town of Mosul, Tikrit and refining capabilities are in the northern part. I will never be able to understand how people can't just live alongside one another, but that seems like Utopia. Unobtainable when everyone has an agenda that is millennia old. I shall choose the line to stay completely away from religion, that is where I draw the other proverbial line. All you need to know is that oil prices are rising because it looks like some supply is definitely going to be off line for some time.

Brent crude oil hits a 9 month high this morning, closing in on 114 Dollars a barrel. Ironically OPEC met this week, see the statement -> OPEC 165th Meeting concludes, in which as a collective the oil producers decided to keep supply at 30 million barrels per day. And the next OPEC meeting is in November, I think. So all this means that you and I in time, because of the risk associated with the production areas of oil, will have to pay more for fuel. And the knock on impact of higher food prices as a result, someone needs to transport the stuff around, not so? And because the Rand is weaker, against the Dollar, in which commodities are priced in, there is another whole lot of pressure there.

I guess the only good news is that an agreement will be forthcoming in the platinum belt soon, staying on the subject of commodities. There is fresh news added to the platinum miners offer to employees, the subsequent meeting last evening (in which the workers chanted for Joseph Mathunjwa to sign), with the same said AMCU leader saying that a Wage deal was "imminent".

Now the only bad news (other than the strike being nearly 22 weeks) is that the union said the deal will be null and void if there were job losses. I honestly think that a modest wage reduction at an executive level, of somewhere around 5 percent. Although ironically with executives NOT taking a wage increase it amounts to the same thing, inflation eating at income. I still maintain that is a non issue. It really is. We can use Amplats as an example.

You will recall my message a few weeks back titled AMCU, corporate pay and skills which laid bare all the wages earned by the executives and the whole workforce. See that the total remuneration for executive directors and prescribed officers was 100 million Rand last year. Pay the bosses five percent less and it is 5 million Rand. The total wage bill, for 46,139 employees and 14,528 contractors, 60,667 souls in total (I am pasting and copying from my own stuff, that is fine) is 15.6 billion Rand.

Increasing the overall Amplats wage bill by 1 percent overall is 156 million Rand. A five percent increase is nearly 790 million Rand. Or nearly 8 upper management additions, the entire lot. So it does not really matter if you increase the base of the overall, or deal with management issues around remuneration. I think Chris Griffith tried to convey that. Anyhows, the knock on impact is that eventually motor vehicle manufacturers will have to pass on the price of motor vehicles to consumers.

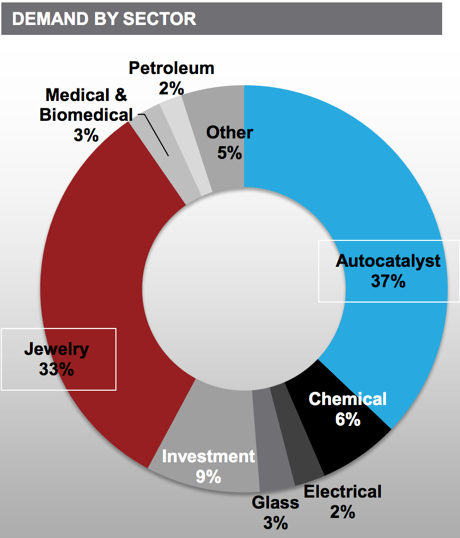

All the while, I read "stuff" on how folks are working hard to find an alternative to fuel cells as they exist currently, with expensive autocatalytic being exactly that, too expensive. Check it out: Non-Precious Metal catalysts outperforming Pt-based one by UNIST Research Team. The consumer will decide in the end which is the cheapest autocatalytic convertor, and if it is a world without platinum in autocatalytic convertors (something else a whole lot cheaper), then the demand side will be impacted seriously:

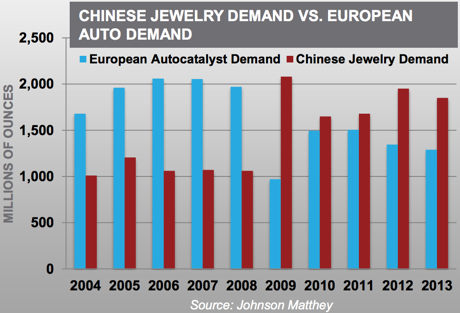

Where did I get this image? From a presentation given by a platinum business that operates here in South Africa, but is Canadian. Called Platinum Group Metals, you can access their presentation (download), which cites Johnson Matthey as the source. Now in recent years we can see that Chinese jewellery demand has outstripped European autocatalyst demand. The other graph on the same page, page 7:

So Chinese demand is huge, jewellery that is. And that should hopefully, for the producers, become more profitable so that they can meet this demand, and make sure that the demand does not turn to gold, because supply cannot meet demand. The next piece is just as interesting and although it does not mention platinum, specifically, it is key for longer term demand.

What is Elon Musk doing? Would you do that? I am talking about his business, Tesla Motors, and what was released on his blog yesterday: All Our Patent Are Belong To You. Huh? Quite simple:

"Yesterday, there was a wall of Tesla patents in the lobby of our Palo Alto headquarters. That is no longer the case. They have been removed, in the spirit of the open source movement, for the advancement of electric vehicle technology.

Tesla Motors was created to accelerate the advent of sustainable transport. If we clear a path to the creation of compelling electric vehicles, but then lay intellectual property landmines behind us to inhibit others, we are acting in a manner contrary to that goal. Tesla will not initiate patent lawsuits against anyone who, in good faith, wants to use our technology."

I think that this is clever. Why? Because if Tesla release their patented technology to the folks that produce huge numbers of vehicles and have massive production facilities that will provide run of the mill motor vehicles (the ones we like to drive in this office) then where does that leave Tesla? As a luxury goods manufacturer in the industry. BMW have great margins, relative to their peers. Ironically Hyundai have very good margins too.

But Toyota, General Motors and Volkswagen (better than the first two) have much lower margins. But this is where I think it will be awesome for Tesla. Tesla will be the winners in the luxury market, where the most profitable parts of the automobile market are. And the more people who drive "ordinary" motor vehicles with battery capabilities, the bigger the pool is for the luxury market eventually.

And of course, I do genuinely believe that Musk has the planet and the collectives best interests at heart too, he confirms in the blog that Tesla will benefit.

"We believe that Tesla, other companies making electric cars, and the world would all benefit from a common, rapidly-evolving technology platform."

I agree. More motor vehicles that are electric means that Elon Musk did what he wanted to do. Wiki says that he works 100 hours a week. Yowsers. That means 7 days a week for 14 hours and 15 minutes, more or less. Wow. It must be hard for the family around him, five sons live with their step mom as far as I understand it. And to get home and back must take some time too, eating in-between and time for a shower too. He last had a long bath in ...... well, never. In the long run this is good news for Tesla shareholders, but not necessarily a positive immediately. The share price hardly budged.

Home again, home again, jiggety-jog. Brazil won, not without a fight and not without controversy, I cannot believe that I cared so much to have a debate with Byron around that penalty. Can you believe it, what should I care! One likes to see the host country do well however, I wish we had qualified this time around. It certainly brings a different dynamic to the tournament. Ah well, here is hoping for next time. About that opening ceremony, I would have definitely had Michel Telo singing Ai Se Eu Te Pego.

Back to markets, Fitch placed South Africa on negative watch, but did not downgrade our credit rating. Our outlook, GDP outlook that is, has been downgraded. Our GDP per capita is forecast to fall by ten percent from 2011 to 2015. Government debt as a percentage of GDP is expected to rise to nearly 50 percent.

National Treasury issued a response: "Government is alive to the growth challenges South Africa faces. It has therefore, prioritised the accelerated implementation of the National Development Plan, with reforms that are aimed at unlocking South Africa's growth potential. Government will redouble its efforts to improve the regulatory environment, reduce the skills shortage and accelerate its infrastructure investment programme so as to reduce the bottlenecks constraining growth."

I suppose that with the strike coming to an end (hopefully) and with a credit rating scare, this could force quicker action from the powers that be. As ever, one should not place too much hope on the powers that be. Talking about hope, do not stress if you suffer from fear of Friday the 13th. If you get that, then watch out for next year, three Fridays on the 13th. But what makes today special is that there is a full moon too, that doesn't happen until 2049.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment