"So by some measures the SABMiller market cap is over one trillion, if your presumption is that the Treasury shares are not going to be retired and rather used by the business (I mean the shareholders) as remuneration for the top management. But technically, the short answer is that SABMiller did not really cross that mark yesterday, even though I had tweeted it earlier in the day."

To market, to market to buy a fat pig. Whoa, lift off at around three in the afternoon, I do not have access to the figures that might suggest foreign participation being higher, but I got the sense that a weakening Rand sent industrial stocks firmer. SABMiller was the star that stole the show, up 5.58 percent on the day, sending the all share index up 1.2 percent. I was convinced that the market cap had crested 1 trillion Rand, that of SABMiller.

In the last annual report there are 1.671 million shares, multiply that by the closing price of 615.34 Rand and you get to 1,029 trillion Rand. But, diluted shares (share awards plus basic shares, which is ordinary minus treasury, basically) you get to 1.617 million shares in issue. That then equals 995 billion Rand. So basically another 5 billion in market cap to go, from here. Or a 3 Rand and 9 cent move in the price.

So by some measures the SABMiller market cap is over one trillion, if your presumption is that the Treasury shares are not going to be retired and rather used by the business (I mean the shareholders) as remuneration for the top management. But technically, the short answer is that SABMiller did not really cross that mark yesterday, even though I had tweeted it earlier in the day.

But wait, the last, the very last total number of voting rights SENS release (and I guess by extension the market cap) is 1,607,171,200 ordinary shares and 66,055,947 ordinary shares held in treasury mean that the combined number of ordinary shares is 1,673,227,147. Which means that the market cap is COMFORTABLY over one trillion Rand. But this is a case of when a trillion Rand is not quite a trillion Rand.

A few days ago SABMiller put out a SENS in which "Directors and Persons Discharging Managerial Responsibility" were provisionally allocated nil cost awards. Now a provisional allocation sounds like a seat at the theatre or a sporting event that you need to pay for, but in this case it is remuneration. From Alan Clark, the CEO through to Catherine May, the Corporate affairs director, 376,629 shares were awarded. Not a lot, or it does not sound like a lot, but in Rand that is 231,75 million Rand. Again, not enough to shift the needle in terms of market cap over that mark, but you get the whole picture, for these 12 individuals it is amazing.

But the other point that is worth making is that 1 trillion Rand in a global sense is not that much. Don't get me wrong, it is an enormous amount of money, but when you say, oh, SABMiller has a market cap of 55.78 billion Pound Sterling, it does not have the same impact of saying one trillion.

I guess in the same way that we struggle with South Korean market capitalisations, Samsung Electronics has a market cap of 185.5 trillion Won, it is 206 billion Dollars, that number. Both enormous numbers, but the brain is unable to quantify trillions. The Koreans should chop a few noughts off, for all of us. So should the Japanese, just for us, just so you can be reasonable in terms of the numbers. In the end it all boils down to what you are prepared to pay for the business today.

Some folks are talking about a merger of sorts, between a European company and this British company, SABMiller. This "British" company has an American business and as a result of that deal, Altria is the biggest shareholder. I cannot see a massive business merger, even if they (Anheuser Busch Inbev) at a market cap of 134 billion Dollars do actually have a go. Only real overlaps are the US, and companies know how to deal with that, unbundle! Nah, I would be very surprised if this happened.

OK, now that we have established that 1 trillion Rands is not as many Pounds, and that shares in issue for earnings and market capitalisations exclude treasury shares, that are eventually used either for transactions or remuneration, we can move on. There was another point I wanted to make on the platinum companies yesterday, but I ran out of time. I briefly touched on the supply side and a lack of constraints currently.

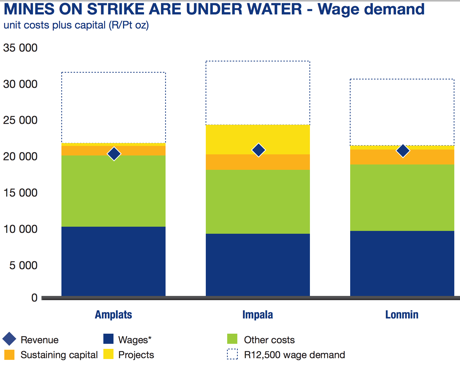

How is that possible? On the Platinum Wage Negotiations 2014 website, the lost revenue number is nearly 22 billion Rand and the employees earnings lost is now at 9.773 billion Rand. That other picture, the MINES ON STRIKE ARE UNDER WATER - Wage demand is pretty telling:

The dotted number is the 12,500 wage demand. The diamond represents the current revenue levels. So, either all projects must be put on hold and that will translate through to less production down the line, a bit of a toxic mix, or something needs to be squeezed out of those other costs, even without the mining companies accepting the 12,500 wage demand.

What needs to happen, if that wage demand is going to continue to rise is that the revenue line needs to rise. In other words, the platinum price needs to go upwards from here, and in a hurry. And in-between now and then, companies will also be under pressure. With Lonmin there is a rumour that they are going to have to go back to their shareholders with cap in hand and ask for more money. Wow. The Platinum and Palladium price should/could start moving soon.

I think that this next paragraph is worth highlighting. Like with any business, without any customers for your product or service, you basically have nothing. Then come the shareholders and other funding mechanisms, the debt holders, they provide the capital for the business. No capital = no business. And then come all company employees. No competent people, no proper business. Without all of these people, there would be no revenue to generate and no wages to pay, and as a result no taxation for government.

The reason why government are looking for a swift conclusion now is because I think the longer term implications of higher borrowing costs and lower revenue generated from these businesses is a real problem, not a temporary one. Government of course protects property rights and provides an infrastructure. Government is in the same boat as other investor, they need to borrow money in order to maintain and grow an infrastructure in order to collect more down the line. And if the cost of borrowing rises and you cannot build an infrastructure as effectively as you can, coupled with a downturn in tax receipts, it is tougher.

This is all coming to a head quite quickly, by the end of the week we should have a clearer idea of when ordinary people are going back to work. To get some insight into the lives of the ordinary people, check out this page from the Platinum Wage negotiations and scroll to the "How the strike affects me and my family" part. I am not sure whether all these messages are verified, but they are pretty heartbreaking, real stories of people seemingly wanting to go to work.

Byron beats the streets

I must say we work in a very interesting industry. Well for us anyhow, everyone at Vestact is very passionate about markets. One of the things that fascinates me the most is watching consumer trends, where the demand is coming from and why these changes are taking place. In fact the way we consume things is being turned on its head by ecommerce and the internet as well as online payments and social networks. Of course we have put our stock selections where we feel these trends are growing. Naspers, Google, Visa, Facebook, Apple and Cisco all sit at the very source of our new consumption habits.

What spurred me to write about this theme was an article I found in the Wall Street Journal titled Global Hunger for Protein Fuels Food-Industry Deals. There are 2 drivers here. Firstly, as developing nations get wealthier they eat more meat because meat is considered a luxury. Makes sense. The irony is that meat was more abundant in the very old days, you just needed to know how to catch it.

The other driver is the shift in what people perceive as healthy. Most of us have heard of Tim Noakes and many people I know follow his protein diet vigourously. But he is not the only one. Diets in the US and in Europe are also very protein intensive and hence there has been big interest in protein manufactures in the market as the demand increases. As you will see from the article grains such as corn and soybeans which are used for feed have also been increased heavily by farmers who are anticipating increases in demand. Producers of eggs, dairy and especially yoghurt have also been doing well thanks to these diets, fascinating stuff.

So how do we benefit from these trends? We are already heavily invested in this theme. Woolworths, Holdsport and Discovery are all strongly involved in a more healthy lifestyle amongst South Africans. Tiger Brands are the number 1 processed meat producer in the country. Globally businesses like Nike, Nestle, Under Armour, Johnson and Johnson and now Apple with their health software, all stand to benefit. We have it covered, it is certainly a trend we see growing over a long period of time. People love to look good and love to be healthy.

Home again, home again, jiggety-jog Markets are higher here. Mainly due to the weaker currency. Sadly. US futures are marginally lower here, just a bit. And although the S&P 500 registered a negative close, it was around one third of a percent off the lows. The Euro continues to weaken, that will be an interesting period methinks, and let us see if over the next six to nine months that there are slow signs of a European recovery.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment