"First, it has possibly never been a better time to be a global traveller, provided that you can afford it of course. Air travel is still unaffordable for many people, but is distinctly middle class and above, in terms of affordability nowadays. Secondly, it seems as if from an investment point of view, that this is almost never an industry to be invested in. The first commercial flight in the US carried a single passenger on the 1st of January 1914 (my late grandfathers birth date) from St Petersburg (Florida) to Tampa, all of 23 minutes. And the cost? 400 Dollars, in the open, and on a wooden bench."

To market, to market to buy a fat pig. Another day of push and pull, markets in New York recovered strongly from their worst points around midday, but still finished lower albeit slightly on the day. Locally the same was about true, a relatively small fall on the day, the Rand still remains weak, which does not really bode well for what was an improving outlook for local inflation. There was seemingly some afterglow in the Apple share price, post the delivery of the new software, which is only really available for us come spring time here, I guess that is in the fall in the US. The fall is seemingly a better way of describing the season where the leaves fall down, the word Autumn originates from the inhabitants of modern Tuscany, they were called Etruscans. Not too much is known about them, seemingly they left little other than a few artefacts here and there. Oh well, thanks for the word! I suppose that means another excuse to visit the region again.

OK, Apple and Autumn aside, this is a big week for jobs data. Today we have the ADP number, which is always the precursor to the big unemployment data from the department of Labour on Friday. The jobs report, where guessing the number is some kind of a sport, the only blood spilt I guess is on the screen where the trading gladiators battle it out. There are also European Services PMI numbers out this morning, the ECB will no doubt cut rates at this next meeting. And that next meeting announcement is today. If you want, you can watch the webcast, if you have no access to a television.

Mario Draghi is an amazing guy, the ECB president. A PhD in economics from MIT in 1976 is about as good as it gets, academically speaking. His credentials speak for themselves, professor at University of Florence for nearly a decade and a half, A brief stint at Goldman Sachs International (as vice chairman), but then central banking, governor of the Bank of Italy and finally the top job at the ECB from 1 November 2011. He is possibly single handedly responsible for the start of the charge at the Euro sceptics, thus reducing the borrowing costs of Spain and Italy and in the process seeing Europe return to growth after a lengthy period of austerity.

Deflation is actually the worry now. Italian inflation was actually zoning in on 4 percent in 2011. Now there are very modest growth rates with plunging inflation. Cheaper prices mean that the soft demand side delays their very necessary purchases and the cycle sometimes can perpetuate. Added to that is the debt issues which have hardly gone away, the wolves however have been booted from the door and it is safe to go outside. There is set to be the unusual reduction of interest rates to a negative rate, which should then spur banks to lend the money out more aggressively, rather than "earn" negative interest parking it at the ECB.

But are bank customers and businesses inside of the Eurozone ready to borrow money? That is more important than any stimulatory response from the central bank. As this WSJ article points out however -> ECB Seen Ready to Tackle Europe's Weak Inflation Problem, QE is not a subject that the Germans are willing to tackle head on, just as of yet. You know, the whole Weimar Republic hyperinflation. But that was as a result of the victors breaking Germany and demanding more, the London Ultimatum, the Germans forced to send 26 percent of export revenue to the allied powers. The original schedule had the World War One reparations at 33 billion US Dollars (that was 1921), that was 132 billion Marks. Germany in the end paid the equivalent of 21 billion marks, I guess a sum roughly equal to 5.2 billion Dollars, in todays Dollars, around 67.1 billion. Not really that big relative to the economy of Europe now, but no doubt massive then, when Europe was also on their knees.

So, is this something that you should get anxious about? No. Because the ECB are on it. And they care more about Europe, quite simply because they live there. We do not. And as such, this should be viewed in the same way as us solving the problems of another country, we all have many obvious solutions, but we do not live there.

I am subscribed to the IATA news releases, in the hope that there may be something useful there. I think that you cannot ever be accused of reading too much or knowing a little more than someone else. Perhaps in the future we will have advisors that are robotic that will learn human investing better than, well, humans I guess. Until then, we have to do our best to find the most compelling investments for our clients. You can never and will never own all the right stocks. That is just the way that it goes. What I find refreshing about the most famous and talked about investor, Warren Buffett, is that his motivations are almost certainly not material things. He could have everything that money could buy, but he rents jets, admittedly from himself, NetJets is one of their/his investments. But his salary, his annual salary, has remained unchanged for a quarter of a century at 100 thousand Dollars. His security costs however are counted and is around three times more than his annual salary. I guess you want to keep him safe, I can definitely understand that. But not being motivated by money and being the richest investor is kind of ironic, don't you think?

Back to the IATA (International Air Transport Association) releases from their annual shindig in Doha, this year, there were some fascinating facts about human air transportation that I thought were worth sharing. If you think about it, this is one of the most difficult businesses to operate in, there are many and frequent stories about airlines going bust. The quote from Warren Buffet (what, him again?!?) is worth sharing: "The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down." Ha-ha, that is just mean, but the recognition that this is a difficult industry to operate in is well noted.

IATA looks out for 84 percent of all passenger traffic globally, the member of that is. Since 2004 when global oil consumption picked up, jet fuel prices have been high, historically. Industry profits have improved over the last five years, as EBIT margins have stabilised, but somewhere around 3 percent hardly makes it an industry worth investing in, right? Last year we crossed the 3 billion mark of scheduled passenger numbers for the first time, this year the expectations are for 3.304 billion bums on seats in the sky. It is then strange to think that in 2004 there were only 2.067 billion scheduled passengers.

But for all of that, and there is a financial forecast from IATA, the net profit for the entire industry per departing passenger is a mere 5.65 Dollars. So. The next time that you are experiencing the miracle of flight, 10km up in the sky, reaching your destination in a fraction of the time it took your ancestors on a horse, think that all the airline made from you is a red note, and a green note with a lion and rhino respectively printed on them. In 1800 it took four weeks to get from New York to New Orleans by horse, it must have been much shorter by sailing ship. But on an inflation adjusted basis, surely flying is much cheaper today? It is a 3 hour and twenty minute flight and one way can cost around 270 Dollars. 270 Dollars on an inflation adjusted basis in 1800 would have been around 20.31 Dollars, not a small amount of money. A horse would have cost you (if you believe everything you read on the internet) around 10 Dollars in 1800. That is half way there already, forget travelling alone for the better part of 28 days.

I guess this all points to two things. First, it has possibly never been a better time to be a global traveller, provided that you can afford it of course. Air travel is still unaffordable for many people, but is distinctly middle class and above, in terms of affordability nowadays. Secondly, it seems as if from an investment point of view, that this is almost never an industry to be invested in. The first commercial flight in the US carried a single passenger on the 1st of January 1914 (my late grandfathers birth date) from St Petersburg (Florida) to Tampa, all of 23 minutes. And the cost? 400 Dollars, in the open, and on a wooden bench. In 1956 (according to Wiki -> Boeing 377 Operational history) a one way seat in that aircraft in "tourist class" cost 290 Dollars, one way from New York to London. That cost is now, on an inflation adjusted basis, is 2452.48 Dollars by the end of 2013. A return flight, nowadays (giving myself three week breathing room) is less than 1000 Dollars. Return. One way? Not much difference really.

The second point is that this is an industry which is very necessary for the global economy (it represents around 1 percent of global GDP) but is completely a no-no from an investment point of view. Locally we have Comair, who probably are about as good as it is going to get, so credit must be given there. It is not an industry that I ever wanted to work in, nor is it anything that I would want to own, directly. Having said that, SouthWest Airlines stock price is up nearly 92 percent over the last 12 months. But only up 75 percent in the last ten years. Best to avoid the whole industry, too cyclical, too many outside factors that you have little control over.

Byron beats the streets

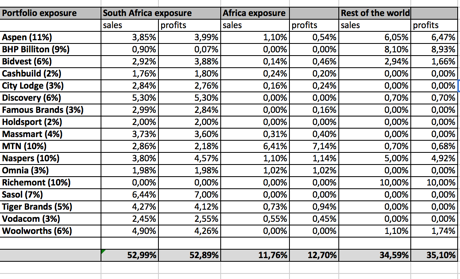

I was chatting to a potential client the other day and one of the first questions asked by investors or potential investors is what is our global vs local exposure. That got me thinking, what is the Vestact model portfolio's exposure to the various regions? As you can imagine this has taken me a while. I have read through annual reports and financial results, scoured websites and even contacted a few Investor relations people. I plugged all the numbers into a spreadsheet and came out with the below figures. It must be noted that this is not our exact recommended portfolio, it varies per client but based on the weighting of our overall holdings this is the most accurate assumption I could come up with.

Before we look through the numbers let me explain the spreadsheet in more detail as well as the numbers behind the spreadsheet. Lets use Aspen as an example. 35% of Aspen sales come from SA. Aspen constitute 11% of our portfolio, therefore their revenue in SA contributes 3.85% (35% x 11%) to the overall Vestact portfolio revenue in SA. Make sense? I hope so. The rest is applied in the same manner.

Ok so here are the interesting facts. Firstly the portfolio is nearly 50-50 local vs foreign. That is a good mix in my opinion, especially when you consider that the majority of these businesses are 'South African'. Ironically the biggest contributor to both the local sales and local profits is Sasol (they make R40bn a year here, wow!). That is because their big overseas operations make no money yet. But they will and will soon become very dependant on their US sales. They are also a natural Rand hedge and benefit when the Rand weakens, that is why I say ironically.

The least South African Businesses amongst the mix are Richemont and Billiton. Apart from a couple of luxury stores in Sandton and The Waterfront, Richemont have no exposure here, not nearly big enough to note. Billiton get about 10% of their revenues from their South African operations but only 0.81% of their profits. Wow. That divesting from SA has been real and effective. Because the Naspers share price is so correlated to Tencent at the moment it is also very unSouth African. As its ecommerce assets around the world start becoming more influential the focus on Tencent will decrease in my opinion (as far as the total reliance on that share price is concerned). Woolworths is also about to become a whole lot less South African when they purchase David Jones. Of course that does not yet reflect in the numbers.

As far as The Rest of Africa is concerned MTN is by far our biggest contributor (7.14% of profits). In fact MTN contribute more than half of Vestact's exposure to the rest of the continent. Naspers, through Multichoice, Omnia and Tiger Brands are also decent contributors. You would expect these to grow, all the companies mentioned have big expansion plans in the continent.

All in all it has been a very interesting exercise. Companies like Aspen, Discovery, Famous Brands, Massmart, Naspers, Omnia, Sasol, Tiger Brands and Woolworths all have massive expansion plans outside of South Africa. So I suspect, without us changing a thing, the balance will shift outside of South Africa in time. That is one of the beauties of owning shares, capital follows growth. If we see the South African economy turning the capital flows will certainly come back. Having said that, a big chunk is still reliant on SA and always will be. Our country is still riddled with opportunities.

Home again, home again, jiggety-jog Markets are higher. We have breached that not so all important 50 thousand mark again. Just a question, why is any level really important. ADP later, ECB later, lots of things to always talk about.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment