"Part of the condition on the offer for Country Road is that the David Jones deal goes through, which means that it is in Lew's interest not to upset the apple cart. The rationale for Woolies was that they had to offer a big enough premium to Lew on the Country Road shares so that he wouldn't turn down the offer."

To market, to market to buy a fat pig. 5 months to the day and we are presented with an agreement, that will be inked today we are told, on the platinum belts of South Africa. We are told that this is a victory for the working class, I for one do not know what to think. All I know is that the workers feel like they deserve so much better and have been through extraordinary hardships to reach this point. There have been many lives lost, at the hands of police and worker on worker. That sort of violence is not forgotten, nor should it be forgotten in a hurry. Money can be made up, the website Platinum Wage Negotiations 2014 has an estimate of what that financial impact was/is on all involved. And because this impacts all South Africans as a result of a weaker or stronger trade balance, it is important that the strike has come to an end.

So, how hard did this impact on the shareholders? We know that companies forfeited 24 billion Rand in revenue, employees forfeited 10.669 billion Rand in wages. But how did the five months turn out for the shareholders of these businesses? Well, it turns out very differently for each of the major three platinum mining companies, if you held Lonmin for instance five months ago, and you still hold them, in Rand terms you are down 20.3 percent. If you held Implats through the strike, then you are down 10.42 percent. However, if you held Amplats, you are up 12.67 percent. Huh?

It turns out that all mines are not exactly the same. Of course not, because each ore body is not exactly the same. And each individual mine worker is not the same either, we are after all individuals. For a little more information on the nearly there deal, read David McKay's piece in Miningmx titled AMCU extracts 3-year platinum wage deal. I think that once this has been signed, once victory is proclaimed by all sides, once everyone is back at work, we will see the real landscape when the proverbial dust has settled. The long lasting impact of the strike on broader society and in particular the people who live around the mines. What decisions will be made by the mining companies when allocating capital to new projects, that will be interesting to see.

It feels hollow, as if there were no real winners really. Although workers will eventually move towards that mark that AMCU drew in the ground, I suspect that many marginal mines will be mothballed. What worries me about the consumers of the metal, specifically on that autocat side is that they may be making different plans, perhaps reengaging with the Russians (on palladium usage), or finding new supply in North America. What was pretty amazing about this strike was that the likes of Johnson Matthey having built in lots of supply prior to the event, and were able to withstand a very rocky time. Rocky time for their customers. I keep asking the question though, with recycling being more and more important for the producers of autocats, what does that mean for the primary supply side?

On the Johnson Matthey conference call of their 2014 results, they said as much, that they are investing money in their refining business:

"We're investing money in this area. It's a very strategically important area for us. We're the biggest pgm refiners of secondary material, and that's a very nice place to be when there's uncertainty in supply from the primary producers."

There is a certain irony in that with every motor vehicle that is scrapped and extra demand comes into the market, the supply of recycled platinum increases. There has to be a point (seeing as the first commercial autocatalytic convertor was only fitted in 1971) where there is enough of the metal above the ground to meet the demand. I am just not sure when and where that is, because whilst I think that jewellery demand will remain strong, there are many richer people in the world now than at any other time in humanity. And rich people like nice things, which is very understandable, most people like nice things. Equally the threats of alternative energy can change the motor vehicle industry, the Tesla opening of their patent books is a good example. Do not always think that your customer is there forever, and their loyalty is only as good as their demand, equally what the price is currently.

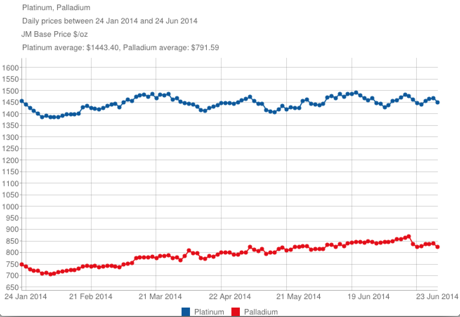

So what has the platinum and palladium price done over the last five months? It turns out that the platinum price is flat, whilst the palladium price has been a little more active, up nearly ten percent over the five months, below is a graph courtesy of Johnson Matthey from their website.

The next big question is then, why has the platinum price been flat for the last six months? You can take a two year graph and the price of platinum is DOWN from a high of over 1700 Dollars a fine ounce, the low being around six months ago. Because there is strangely enough supply around, everyone had provisioned for this event.

Michael's musings: 3 to become 1

This morning Woolies announced that they have made an offer for the outstanding 12% of Country Road, which is listed in Australia. The offer is at a premium of 21.4% to yesterday's closing price, will value the offer at A$213 million, which based on today's Aussie Dollar of R9.99 (let's call it R10) is R2.13 billion.

The reason for the offer is due to an Australian business man named Solomon Lew, who has been a thorn in the Woolworths side since they tried to delist Country Road back in 1997. Solomon Lew owns the majority of Country Road shares that Woolies doesn't own and has been blocking a delisting.

The other big deal on the table for Woolies is the purchase of David Jones, where they have already had the voting date for the deal pushed back by two weeks due to Lew. Lew owns 10 – 15% of David Jones and threatened to block the purchase.

Part of the condition on the offer for Country Road is that the David Jones deal goes through, which means that it is in Lew's interest not to upset the apple cart. The rationale for Woolies was that they had to offer a big enough premium to Lew on the Country Road shares so that he wouldn't turn down the offer. They would rather "overpay" on a A$200 million deal than have to raise their price on the A$2.2 billion David Jones deal.

All in all, owning 100% of a company is much better than owning 88% and the funds for the purchase will come from Australian banks, which Woolies say will not impact on their dividend. The share price has not done much on the news, unlike when the news of David Jones came out and the share price dropped below R70 a share. Currently the share price is around R78 which will means that Woolies will be able to offer fewer rights to raise the cash to complete the David Jones purchase. So a higher share price does not only look god on your statement but will also mean you as a shareholder gets less diluted with the rights offer down the road.

If all goes according to plan David Jones and Country Road will fall wholly in the Woolies stable, adding 40% to the current market cap and in the process creating the Southern Hemisphere retailer desired.

Home again, home again, jiggety-jog. Markets are lower here this morning, US futures have sold off. I guess the strike being officially over means something, the currency has strengthened somewhat. All good, keeping calm and carrying on in the mantra here.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment