If you needed a gentle reminder, take the TenCent market cap in Hong Kong, which right now is 1.09 trillion Hong Kong Dollars. Naspers owns 34.5 percent of TenCent, that translates to 376.05 billion Hong Kong Dollars. Now one Hong Kong Dollar is equal to 1.39 Rands. So, quite simply, multiply 376.05 billion HKD by 1.39 and that equals 522.7 billion Rand. Naspers closed at 1290 Rand last evening, which translates to 536.5 billion Rand. The rest of Naspers is worth less that 14 billion Rand, according to the market participants. Businesses like their pay TV business, which generated 4.5 billion Rand in trading profits, for the half year to end September basically as valued at zero. I suppose that their ecommerce business registered a trading loss of 1.8 billion Rand, that counts for something! Mail.ru, their other significant investment made Naspers 601 million Rand for their first half.

So why is TenCent then given a discount by the South African investor crowds? Do we (South Africans) feel that somehow the Hong Kong investors stretch the valuation of TenCent too far and we should really show them how it is done? Discount a valuation that another market already values. It does not really make sense that Mr. Market here discounts what I think is a pretty efficient market there in Hong Kong. I think it does smack a little of conservative arrogance or perhaps it is a misunderstanding of TenCent growth, either one or the other. Whatever it is, I still think that Naspers is a buy, but will from time to time go through periods of extreme volatility, because the TenCent multiple is so aggressive. Which ever way we do not have to wait too long until we find out a whole lot more about TenCent and their full year numbers for their 2013 financial year, pen into your diaries the 19th of March.

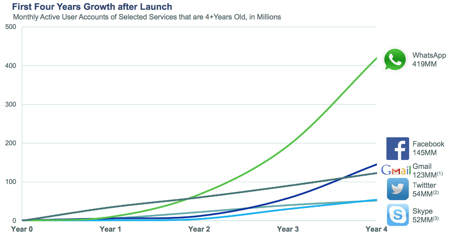

I still think that a lot of investors struggle to understand what TenCent is exactly. Well, they are a chat service, they are a gaming service, they are a music service, they offer other online services that includes film, fashion, there is a search engine (soso.com - recently merged with sogou.com), the biggest of the lot of course is the QQ.com portal. Tenpay and Paipai are both online web portals, one is ecommerce and the other offers payment systems. Perhaps if all the platforms were in English, the English speaking investor community would understand these businesses better.

If you want to understand how TenCent actually monetises their platforms, search no further than here, a fabulous breakdown: Tencent Service Offerings. so whilst you have seen a slowdown on some fronts with regards to paid for services, the potential base could grown tenfold (on the paid side). We continue to hold the company and we are really thrilled to see what Koos Bekker comes back with once his head and mind are cleared of the day to day fog of running a business.

OK, it is terrible to laugh at the demise of Mt. Gox, the crowd that was supposed to enable you to trade your BitCoins, but really, ....

All withdrawals from Mt. Gox Bitcoin exchange were halted on the 7th of February and just this morning we heard that the website had been turned off. For good seemingly, over, gone for good. If you try and browse there, you are met with a blank page. Money laundering allegations, security concerns, withdrawal irregularities, concerns about the exchanges solvency and the list goes on leaves Bitcoin "investors" feeling probably a little battered and bruised right now. The other major exchanges released a joint statement saying that there was a tragic violation of the trust of users of Mt. Gox. Yes, yes, thanks for that guys.

If you want to have alternative ideas of the world of "investing", I think that the world of digital currencies is the Siberia for explorers. It makes whatever leverage used in currency trading seem like fishing in a goldfish bowl. I will rather stick to buying real companies that offer real services or make real goods that real people want and use. And the fact that they make real money, that helps too.

Do I think that digital currencies will disappear? No ways. Do I think that authorities will force the users to comply with real world rules to prevent money laundering? Yes. It has happened already. And whilst the users may think that the regulators can never interfere, I think that they are wrong. The only question I am left with is where has the money gone and does this mean that more Bitcoins can be mined? Nearly half of the Bitcoins ever mined have been made. Sigh ... you really cannot understand everything, or NEED to understand everything, let alone something as way out as this.

Michael's musings: Paid for your economic contribution

I read two articles this morning about inequality, not intentionally it just happened that way. The first was about the inequality that is rising in San Francisco. The summary version is that long time residences are complaining about the rising cost of living in San Francisco due to all the tech companies growing and bringing many new, highly qualified people to the area. The result is that the "middle class" there now earn more than $110000 a year, which translates into more consumption (demand) and then higher prices. One of the main areas that people are feeling the increased prices is in property prices. The biggest problem is the divided that is growing between skilled and unskilled people and that is why people are complaining.

A bus driver in the city makes $50000 a year, yes in rand terms he is better off than 99% of South Africans, but his purchasing power is a lot less than it is for South Africans with the same amount of money. This is compared to the average "techie" who is earning twice that straight out of university. Is that fair? Yes. Who contributes more to moving the human race forward? Who contributes more to the economy?

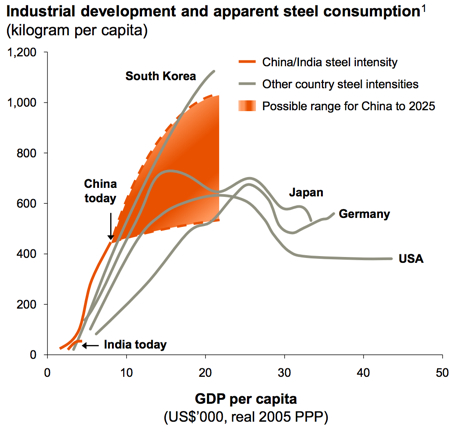

At the end of the article it was mentioned that the bus drivers two children where at university, one was studying medical engineering and the other had a job at one of the tech companies. This is the key to the future, unskilled people are going to have to bite the bullet now so that the next generation is skilled. In China for example their unskilled are taking the pain now but the life that the next generation will live is going to be far better than the current generation.

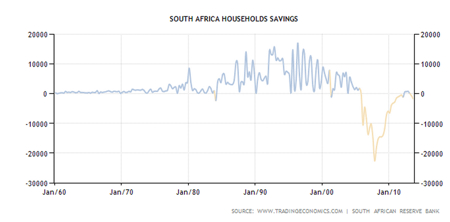

The biggest problem (in my opinion) for South Africa is the number of unskilled workers. One of our strengths should be our cheap labour but stats show that we are moving toward mechanising. If the current generation bites the bullet and essentially work for pitifully low wages, but that results in economics growth, higher number of people employed and a skilled generation to follow, is that not better than slow economic growth and large unemployment for generations to come.

There are 16.5 million people on government grants, compared to 15.2 million people employed and being funded by about 4.3 million tax payers. Those 16.5 million people are essentially getting a pitifully low wage from the government, isn't it better if they were employed and earning the same amount? If that were the case we have a higher GDP, higher corporate tax income, lower government grants but more government expenditure on education. If the unions view formal employment remuneration as "slave" wages, I am not too sure how this would be palatable however, these extremely low social grants.

Imagine if 20 years ago government went to the people and said that we are going to create an investor friendly environment and lower labour regulations. The result will be that you will have a job, your current circumstances will not improve much for now but in a generation your children will be out of the poverty trap. What would South Africa look like today? There is no easy solution to the problem and if you are unskilled the future does not look bright.

I want to add to Michael's piece, but at the same time leave it alone. Those are his thoughts entirely and because this is an opinion piece, we are entitled to our opinions. His background is economics and therefore he would be looking for the absolute best from a resource utilisation point of view. Michael is younger than myself and therefore does not have the same reference points with regards to the history of South Africa, he only knows what he is told and reads, on the other hand I can say that I was lucky enough to vote in the first free and democratic elections in South Africa.

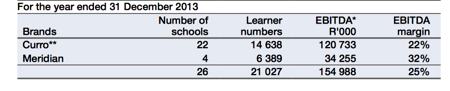

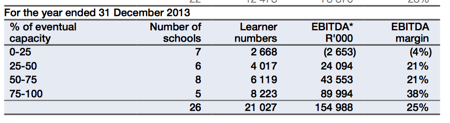

The piece is no doubt going to touch on elements in society that make people angry, a lack of resources usually leads to a vicious cycle. The answer is simple, solve education and you solve everything in my opinion. You can't take away someones thoughts and intelligence, that will enable skilled individuals to create employment opportunities for others. We need more education, more learning centres, more celebrating of excellence, more private sector, less government.

Home again, home again, jiggety-jog. Poor Byron is man down in hospital for over a week, which means unfortunately he is not well. I have interacted with him, he seems all good, but of course nobody wants to spend that amount of time in hospital. For starters in the local market we are lower, not by a lot.

Sasha Naryshkine, Byron Lotter and Michael Treherne Email us Follow Sasha, Byron and Michael on Twitter 011 022 5440