To market, to market to buy a fat pig. Ummm.... what happened to our crisis? You know, the one about emerging markets, the fragile five, the Argentinean Peso meltdown and so on? Well, it still exists. We sail very close to the wind from a public accounts point of view, we really do. But the most important thing is confidence in the financial systems that exist inside of these separate economies and in particular, cost of funding.

For instance, if you take a one year view you can see that the cheapest funding was at six percent in the last part of last year, but that number has quickly unwound to 8.6 percent. And over the last year it has become a lot more expensive to raise money. But ... the same "problem" has existed for all emerging markets. But it was much, much worse in a higher rate environment back in the late nineties in South Africa. In fact is was awful, the ten year bond traded with a yield of above 20 percent for a brief period, but averaged in the teens all the way through to around 2003. 8 percent has been about the average since the middle of 2005, a brief spike beyond 10 percent during the financial crisis, but this recent rise has obviously set the cat amongst the pigeons. If you want, or are interested in all of South Africa's economic metrics, Tradingeconomics has an absolutely fabulous database: SOUTH AFRICA | ECONOMIC INDICATORS.

So what worries you the most there? The budget shortfall? The cost of funding? Both? Is it structural? What can be done to stem what looks like one way traffic, surely the powers that be in National Treasury and Ministry of Finance will whisper in the politicians ears that currently this is unsustainable. But, fix growth and everything changes. Strong growth equals solving the unemployment problem which equals fewer people inside of the social security net (less obligations) and more importantly, tax receipts grow and the gap closes.

It is very nice to want a deep and wide social net, but the reality is that you HAVE to find the money to pay for it and to keep pace with inflation. Growth fixes all of these problems. A funding problem is a serious one, because the reality again is that you cannot fight against the market. Nobody has the arsenal for that. And not just that, perception eventually becomes reality, ask the Greeks! I do not personally think we are anywhere near that, but I do think that we are treading a very fine line, along with many other countries in the developing world, who have similar dynamics to us. Global growth luckily is heading in the right direction for the time being.

Markets locally ended the day higher by over a percent, this morning stocks are up again and we find ourselves now "only" two percent away from the all time highs. Perhaps a touch less. Whilst resource stocks have enjoyed the best start to the year and have surged ahead of the rest of the market, in particular the gold sector (up 31 percent YTD), the top 40 is about flat for the year. Hardest hit in this emerging market angst are the retailers and banks, which is completely understandable as those have the biggest foreign share ownership. If you are looking for exposure to an emerging market, retail is simple to understand, it is more likely to attract the least amount of government regulation.

General Retailers peaked in January of 2013, the index that is. Since then, the general retail sector is DOWN 24 and a quarter percent. Down over a quarter. Of course it is up 150 percent over the last five years, so if you have been invested in the index for that period of time, this does feel nasty, but not THAT bad. The food index, which is far smaller in number of constituents (Shoprite, Spar and Pick 'n Pay) also peaked in January of 2013, but since then then same has applied, the index is down 20 percent since then. Five years however, up 144 percent. Again, it depends where you draw your line in the sand. And ten years? Up an absolutely astonishing 916 percent. Now, do not tell me that the social security net in South Africa and investments in food companies are not linked, because of course they are, they are joined at the hip.

Shorts. No eating of these.

McDonald's reported same store sales numbers yesterday, that were somewhat of a surprise for the market, but many remain unconvinced. Here is the release: Global Comparable Sales Increase 1.2% In January. At the same time, the company announced that they were opening their first store in Vietnam, in Ho Chi Minh City. Bringing their total Asian, African and Middle East footprint to 10000. Kind of ironic that McDonald's founder Ray Kroc is associated with American success and capitalism and Ho Chi Minh was the first president of communist, single party Vietnam. Ironic, don't you think. Although Wiki tells me that Ho Chi Minh actually worked for General Motors in the US as a young man, or at least he claimed that. He did work as a baker at Boston based Omni Parker House, a famous hotel and monument. Ho Chi Minh worked all over in many different countries, before finally leading his countrymen to independence. Perhaps the place will be renamed Saigon, we will see.

What we will certainly see is whether or not Vietnamese people are receptive to the ways of the West, if I could use that terminology. Western culture being drive through and 24 hour foods. Wow, this facility is certainly a megastore, 350 seater. Is that big? Yes, I guess it is. There are of course the normal menu tweaks with pork being a preference in Asia. What this does mean to McDonald's, which is a slow beast, is that it still remains a growth company. Vietnam has a population of 90 million and this is their very first taste of McDonald's. Imagine when North Korea opens up! Mind you, there are 300 stores over the border in South Korea. For the record, this becomes the 122 territory that McDonald's operates in. The first African McDonald's was opened in 1992 in Morocco, in Casablanca.And believe it or not, we have more or less the same number of McDonald's here as there are in Switzerland. More than Singapore (understandable) and Portugal. The figure is around 153 stores in total. Nice.

Kumba Iron Ore have reported numbers for the full year to end December 2013. Production was 8 percent lighter than than the prior period, Q4 was much better than Q3 though. Export sales were essentially flat. But the kicker for main shareholder, Anglo American, is that the total dividend in Rand terms is 26 percent higher for the full year at a touch over 40 Rands. A second half dividend of 19.94 ZAR a share. The reason why I make that Rand increase observation is that essentially the Rand is about that much weaker in Dollar terms over the last year, and whilst the company has their product priced in Dollars, they earn Rands. Byron will take a more detailed look at these results tomorrow, I guess that many would be saying that this is as good as it gets.

Byron beats the streets: L'Oreal and Nestle

Last year November Sasha wrote this piece titled L'Oreal earnings ok, the Nestle stake is a big hurdle. It is a really interesting article and funnily enough I still remember reading it word for word in Santiago Chile while I was still travelling. I was at a Sushi restaurant with free wifi and read it while waiting for the food to arrive.

A big part of the article goes threw L'Oreal's history and the ownership structure. Give it a read to refresh your memory. Rumours started hitting our screens over the weekend that the two businesses had been discussing a deal. Well this morning there was an official announcement.

"Nestle and L'Oreal announced today that their respective Boards of Directors, in meetings held on February 10th, 2014, have approved by unanimous decision of their voting members a strategic transaction for both companies under which L'Oreal will buy 48.5 million of its own shares (8% of its share capital) from Nestle. This buyback will be financed: Partially through the disposal by L'Oreal to Nestle of its 50% stake in Swiss dermatology pharmaceuticals company Galderma (a 50/50 joint venture between L'Oreal and Nestle) for an enterprise value of 3.1 billion euros (2.6 billion euros of equity value), paid by Nestle in L'Oreal shares (21.2 million shares) For the remainder, corresponding to 27.3 million L'Oreal shares held by Nestle, in cash for an amount of 3.4 billion euros."

So basically they are disposing of their 50% stake in Galderma and the rest will be cash. The shares bought by L'Oreal will be disposed of which would be 5% earnings accretive. In other words, fewer shares in issue on the same earnings would juice up earnings per share by five percent after the deal was done. In the bigger scheme, the deal is still small. Nestle's stake will decreases from 29.4% to 23.29% while the Bettencourt's stake will increase from 30.6% to 33.31%. But it does indicate their intentions going forward and I would suspect this will not be the last we hear from these 2 companies and the respective deal.

The L'Oreal ADR we invest in was up 7% on the news.This is certainly positive for earnings and a good place to put their cash. As for Nestle, another stock we invest in, the share price has not moved much. It is such a big business at $240bn market cap that a transaction this size has not had much of an effect. But their focus is more on their core products and cosmetics does fall within that realm. Galderma on the other hand which focuses on Nutrition, health and wellness falls more within their future plans. With the cash received they are putting it towards their own share buyback.

Michael's musings: Our Greatest flaw

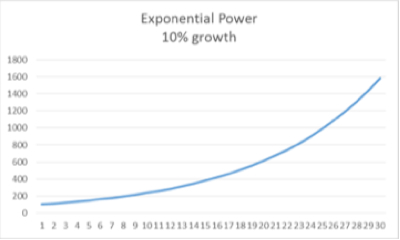

I came across a quote recently that I found very interesting, "The greatest shortcoming of the human race is our inability to understand the exponential function" . The quote is attributed to Albert Bartlett, I also hadn't heard his name before; he was a professor of physics at the University of Colorado. The exponential function he is talking about is in relation to the world's population, but an exponential function is an exponential function, so I am going to borrow it to talk about investing.

In the world of investing the exponential function I would say is where you start investing money regularly with the returns as an absolute measure being low, but as time goes on your returns start to become significant, until the point is reached where you are able to live off the returns of your investment instead of living off a salary.

Whenever looking at an exponential curve it always strikes me how long it takes to build momentum and then once there is momentum, how quickly the momentum heads skyward. For investing it means that you need to invest as much as you can while you are on the "flat" part of the curve and then not sabotage yourself by spending capital when you reach the steeper part of the curve.

I think that the point that Bartlett was trying to get across was that we don't realise how big an impact our actions today have on our future. If the end goal of investing is to have enough capital to retire and then live on dividends alone, then the money that you invest today determines if you live on cat food or drive a Ferrari. In order to live off dividends alone, you would need about R16.5 million in today's money to get about R500000 a year in dividends. Then when you die, you have a big capital amount to leave to your children which automatically puts them further up the curve, thus creating generational wealth.

Another cool quote is from Einstein (Google seems to think though that he never said it, in any case it is thought provoking); "Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it. "

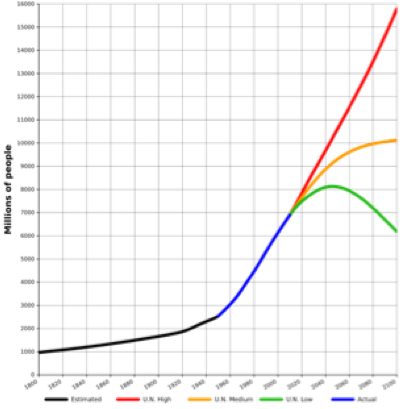

On a side note here is a population graph which Bartlett had in mind; how many more people are on the planet since you were born, how much do you think those extra people have fuelled consumption growth? (You can find it here on Wikipedia http://en.wikipedia.org/wiki/File:World-Population-1800-2100.svg)

Home again, home again, jiggety-jog. Markets are higher here again this morning, I said that earlier. Off the best levels. The Rand is on firmer ground, which I guess is good for all of us. Hey, we saw an unemployment report which was better than anticipated, I am wondering why StatsSA have come out saying that these jobs were in the informal sector and temporary in nature. We can have a closer look at these tomorrow.

Sasha Naryshkine, Byron Lotter and Michael Treherne Email us Follow Sasha, Byron and Michael on Twitter 011 022 5440

No comments:

Post a Comment