To market, to market to buy a fat pig. Our market closed within sniffing distance (human, not bloodhound) of the all time closing high and above 47 thousand points on the Jozi all share. The top 40 shares by market cap, the ALSI 40, did manage to close at an all time high, boosted by resource stocks that have been on a tear. BHP Billiton results this morning will underscore why this is justified, there have been some thoughts that retail slash banks and all interest rate sensitive stocks are on the sell list from a valuations point of view, whilst the opposite is true for commodity stocks. But I think that many of the retailers are offering value at these depressed (historically) levels. When the foreign investors decide to come back to our markets (and realise that the downfall of emerging markets has been grossly overdone), they will no doubt be buying cheaper retailers at better levels.

Our markets have turned a little this morning, from starting positive, around one third of a percent better to now being in the red. I guess that could change a little later this morning when German ZEW numbers are released, those always have an impact one way or another. European motor vehicle sales were positive again for the fifth month in a row, that is good news for the platinum industry no doubt -> Europe Car Sales Rise a Fifth Month on Volkswagen Models.

Japanese GDP failed to impress yesterday, whilst Chinese credit numbers yesterday certainly raised a few eyebrows, but I guess it was business as usual. I suspect that some time in the next decade we will see more than just a few eyebrows raised on the Chinese credit numbers, I hope that I am very wrong. Markets across the seas and far away in New York were closed for presidents day, the action returns today with futures pointing to a very modest gain.

BHP Billiton have released their first half numbers this morning in Melbourne. I guess the results were released all over the inter webs, so in essence it is a global release, but the company is still headquartered in Melbourne, Australia. The sporting capital of the world we are led to believe, I suppose that they host many events of global importance, including the Aussie Open tennis and the F1 Grand prix. Add to that the annual AFL final (Aussie rules) and the MCG test match and I guess you are spoilt for choices. It is strange then to think that the city had to wait so long to have their own super 15 rugby team.

It is according to the Economist Intelligence Unit the fourth most expensive city in the world to live. Wow. Tied with Oslo, Norway. The three cities ahead are Sydney (3rd) and then Osaka (2nd) and Tokyo the most expensive. Bizarrely in the top ten is Caracas, the capital of Venezuela, the only city in the top ten that I would not live in.

The company traces it roots back to Dutch investors in the year 1851, a tin mine in Indonesia on the island of Belitung. See, Billiton/Belitung! The BHP (Broken Hill Petroleum) part was also initially connected to tin mining in Western New South Wales. In 1891, according to the BHP Billiton website the Australians were selling lead to the Chinese, exporting it across the seas. The merger of the two became official in June of 2001, the 28th of June to be exact. At the time the SENS release said that the enterprise value was around 38 billion Dollars, run by Paul Anderson. Brian Gilbertson was appointed as deputy CEO.

Today the business has a combined (limited and plc) market capitalisation of 175 billion Dollars, has half year sales (these results) of 33.948 billion Dollars, attributable profits of 8.107 billion Dollars. Basic earnings per share increased by nearly 83 percent to 152.4 US cents, with the dividend modestly higher at 59 US cents per share. If you translate that back to Rands at the current exchange rate (10.806), that translates to 1646.83 ZA cents of basic earnings per share and 637.55 ZA cents of dividends, payable on the 26th of March. When the weather unfortunately starts getting cooler round these parts, sad but true.

Reminder, the stock closed at a record high of 346.32 ZAR. In ZAR it is a record, in Australia that record was set back in May of 2008, when the stock nearly crested 49 Aussie Dollars. This morning the Australian BHP Billiton Limited share price is 38.89 Aussie Dollars. Up 2.3 percent. In London the all time high price was December the 24th 2010, 26 Pounds and ten pence. The close yesterday was 19.12. See how the Rand has juiced up the stock here locally! I am guessing that with these results that the share price could crest 350 ZAR for the first time today.

Operationally the company registered record production performances at ten of their thirteen key commodities, ironically the one they have invested a lot of money in, Natural Gas, was the worst performer from a production point of view. In fact, across their portfolio there was a ten percent increase in production. And cost savings too, as a result of increased productivity on bigger volumes. As much as nine percent increase in EBIT. Astonishing. Whilst many of their peers are struggling with rising costs, the quality of the asset base that BHP Billiton possesses has enabled the company to continue to scale up and contain costs.

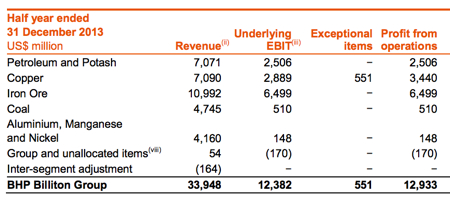

So what are the key assets here that BHP Billiton have? Well, there are the onshore and offshore (in the Gulf of Mexico) US oil and gas assets, the huge earner in the form of Western Australia Iron Ore (WAIO) and their copper assets, with the major one being Escondida in Chile, one of the largest mines anywhere in the world. See the major contributors from a table in their results release -> Half year ended 31 December 2013.

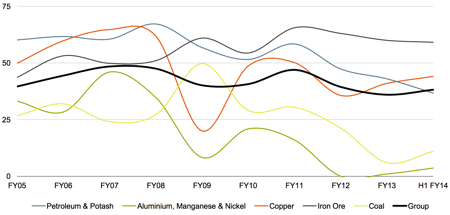

OK, so quite quickly you can see where is the very profitable part of their business, the Iron Ore division is 32 percent of revenue, but 52.5 percent of EBIT. Copper on the other hand is nearly 21 percent of group revenue and 23.3 percent of EBIT, whilst the petroleum business contributed nearly 21 percent to the group with EBIT of just over 20 percent. Add these three key groups together and they represent nearly three quarters of revenues, but 96 percent of profits. Phew. All the other businesses, including the coal businesses work exceptionally hard, but are barely profitable. In fact, in that same presentation if you look at the EBIT margins of their key commodities, you can see that the petroleum business is still a fabulous one to be in, even though margins have been sliding. BUT. The margins in Iron Ore blow everything else away nearly one third better than their group margins. Slide 34, here it is slimmed down for our needs.

I guess that it is no surprise then that the company continues to invest in the commodities that they think have the best outlook. Spending on their Copper assets in Chile (modest), major capex on their WAIO operations, whilst in the short term most of the spend will be in their petroleum projects. A lot in Australia, a big ramp up in natural gas, these projects are key to energy demand ramp up in China. It is cleaner, and in a country which is starting to take pollution really seriously, gas and solar is the obvious next choice.

So what next for BHP Billiton? CEO, Andrew McKenzie suggested that the global economy is skewed to the upside, suggesting that the early green shoots seen in Europe, coupled with stronger than anticipated US growth and of course China which continues to grow their economy at a rate that is the envy of the world. Do not get pulled into the line of thinking around Chinese growth slowing. Yes, in percentage terms, but not absolute terms. Would you rather have 15 percent growth on a 257 billion Dollar economy or 7.8 percent on 8.227 trillion Dollars? That was 1984 versus 2012 in China. The difference in growth is nearly 17 times more added to the economy in 2012 when compared to 1984. Or, a better way to look at it, the value added in 2012 is roughly 2.5 times times the absolute Chinese economy in 1984. It takes a LONG time to build up a base of size and scale.

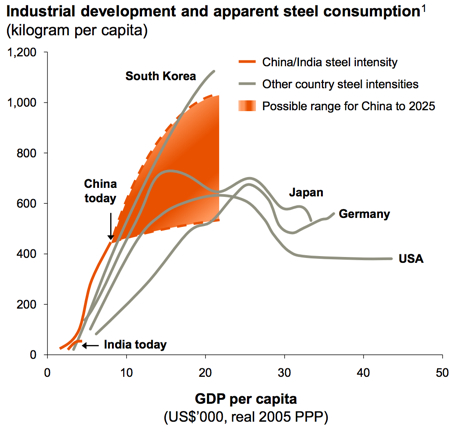

Will China continue to show signs of strong demand for their products that they produce? Slide 27 answers some of the concerns that people have with regards to copper and iron ore. Expectations are for the iron ore price to moderate and flatten out over the coming years. Copper, well, that market is much tighter with a deficit expected in 2017, which is not that far away. There are signs that the Chinese economy is changing, becoming more services and consumer based and less heavy industry and manufacturing. Not that consumers do not require raw materials, in fact the more industrialised and advanced societies become, the more steel they need. See this old graph, from a BHP Billiton steel outlook in September 2011:

The range for China (the orange shaded area) is so different. Would China become the new South Korea, or is it more likely to level off like the other major economies of the world, Japan, Germany and the US. China continues to urbanise at a rapid rate, that should attract a big demand for durable goods. There is a fairly detailed commodity and economic outlook (for what it is worth) in the BHP Billiton Results for the half year ended 31 December 2013 release, that is always worth a read.

Here goes the economic outlook, the important line I think: "China's growing share of services within economic output and the United States declining trade deficit are further indications of more balanced and sustainable global growth. We view this as a positive development and expect this trend to continue into the long term." And then in the commodities outlook, this is of course longer term: "In summary, the global economy is expected to strengthen over the balance of the 2014 financial year, providing continued support for commodities demand, albeit at more moderate rates of growth. In the longer term, the fundamentals of wealth creation and urbanisation should benefit general commodities demand, although the transition to consumption led growth in the emerging economies should provide particular support for industrial metals, energy and fertilisers."

We continue to stay long BHP Billiton on the basis that there will be continued demand for their core products. Their portfolio remains the best of the diversified miners, both in terms of quality and positioning, as well as geographical presence. They mine quality scale assets in what are mostly investor friendly territories where importantly the rules do not change all of the time.

Byron's beats, Curro results

This morning we received results for the year ending 31 December 2013 from South Africa's biggest private school operator, Curro. Wow this business is flying. Learners increased by 69%, Revenue increased 80% and HEPS increased 87%. Of course there is a reason for this growth. Last year the company spent R1bn on acquisitions, development and expansion. That is big when you consider that the company's market cap sits at around R8bn. But throughout last year that number was closer to R5bn. Yes the share price has done that well.

The funding for this R1bn came from that rights issue they did last year (R600mn), that R397mn funding programme arranged by Old Mutual and the PIC (I wrote about this a while back: Curro announces big school push) and various debt programmes.

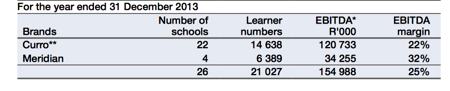

The company compromises of 31 schools with 26 463 learners as we speak. For the year of 2013 for which the numbers are attributed to, the company had 26 schools. Within these schools there are 2 brands namely Curro and Meridian. The Curro brand is more focused on higher LSM groups with an average class size of 20-25 learners and monthly fees of R3700. Meridian has larger classes of 30-50 and lower fees of R1400 per month. This gives poorer people the opportunity to give their children a private school education. Below I have added a table of the brand structure within Curro.

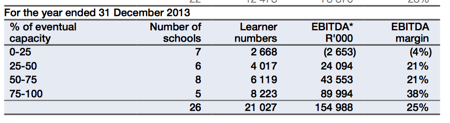

Another interesting table they put in their presentation looks at the % capacity of their current schools and the kind of margins they make.

Clearly it is imperative to fill up these schools as soon as possible to get that EBITA margin as high as possible. That is where the demand for their services come in. If you have read my writing on this stock before you will know that I am a firm believer that there will be huge demand for this product because there is such a big gap in the market left by an inefficient government.

But the company is not stopping there. They are going to carry on acquiring and developing. As I suspected last year they have announced yet another rights issue. They are planning to raise R589mn by issuing 1 right to every 10 shares held at R20. A fat discount to today's R28.

Diluted Headline earnings per share came in at 13c. Trading at R28 the stock trades at 215 times earnings. But this is the first year of profits, I wouldn't worry about valuations at this stage, especially when they are raising money on a yearly basis, seemingly. I still like the company and I like the sector. I would advise all shareholders to follow their rights.

Home again, home again, jiggety-jog. Markets are mixed here to start with, resources and retailers higher, industrials and precious metals lower. Wow, that is exceptionally boring writing for the closing line. Apologies. I will try be better tomorrow!

Sasha Naryshkine, Byron Lotter and Michael Treherne Email us Follow Sasha, Byron and Michael on Twitter 011 022 5440

No comments:

Post a Comment