To market, to market to buy a fat pig. Markets settled in Jozi at a closing high for the all share index, 47438 points was both the intraday and all time high for the overall market. Today of course we will start lower, the reasons are in part the Chinese PMI read, the worst in seven months and below 50. And then of course the commentary from the Federal Reserve which of course said that rates were going higher. And that they would continue to wind down the bond buying program. Of course. Provided of course that the economic data looks OK. I can tell you that some of the recent data is not all that great, perhaps the terrible weather has got a lot to do with it. In fact, that weather is still iffy.

US markets turned after the Fed statement: Minutes of the Federal Open Market Committee, which I read, and was not too sure where everyone was spooked. Talking central banks and being spooked, at first glance it seems that political interference has led to the suspension of Central Bank Governor in Nigeria. Sanusi Lamido Sanusi has been suspended by Goodluck Jonathan, the president of Nigeria. Phew, seems crazy. For the time being the FX markets and bond markets remain closed after the Naira was slammed.

It comes just moments after MTN indicated that they expect earnings, HEPS, to be between 25 to 30 percent higher for the full year to end December 2013. There was a positive impact (1.1 billion Rand positive versus 2.7 billion Rand negative) from the weaker currency through the course of the year. Remember that FX losses of 178.5 cents were incurred in Iran, Syria and Sudan. Now the way I see it, Syria is worse, Sudan is worse, perhaps Iran is a lot better than before and that is probably where the positive impact was. HEPS last year was only 1089 cents, flat on the prior year because of those currency headwinds. So by my simple calculations HEPS should be in the 1361 to 1415 range. The stock initially popped, but the Sanusi news is negative and indicates that although Nigeria has come a long, long way in cleaning their banking sector, much is still to do.

Wow, this is absolutely huge. No, it is one of the biggest tech deals done in a while, a 19 billion Dollar transaction in which Facebook will acquire WhatsApp. The deal will be structured as follows: 183,865,778 A class Facebook shares worth 12 billion Dollars (at 65.2650 Dollars a share), 4 billion Dollars in cash and the balance, 3 billion Dollars in restricted stock (45,966,444 units) to WhatsApp employees, that will vest over the next four years. The shareholders and employees of WhatsApp will now own 7.9 percent of Facebook, you will of course be diluted as a Facebook shareholder, but will get WhatsApp, of course.

Why? I mean, why would Facebook acquire this business for that sum of money? And anyhow, some of us readers (OK, perhaps just a few) might not know what the WhatsApp service is. As per the WhatsApp website, it is simple:

WhatsApp Messenger is a cross-platform mobile messaging app which allows you to exchange messages without having to pay for SMS. WhatsApp Messenger is available for iPhone, BlackBerry, Android, Windows Phone and Nokia and yes, those phones can all message each other! Because WhatsApp Messenger uses the same internet data plan that you use for email and web browsing, there is no cost to message and stay in touch with your friends.

And then as per the Facebook presentation, Facebook + WhatsApp, these are the key metrics of WhatsApp:

You could argue that it was not quite Samsung or the iPhone that blew Blackberry to smithereens, but rather WhatsApp, that took the dominance of BBM away, and the niche functionality that it had in order to offer any handset on any platform the ability to interact with all their friends, no matter what their handset preference or affordability. Yes. WhatsApp killed the BBM star.

For Facebook this means that whilst the Facebook messenger might be a valuable tool, this acquisition goes a long, long way to being able to offer a more complete service. What changes for the users of both platforms is nothing, not much at all. Facebook, like when they bought Instagram, allow the business to operate as they were. It does make founders Jan Koum (a Ukrainian by birth, moved to the US in 1992) and Brian Acton fabulously wealthy, as well as funder Jim Goetz from Sequoia Capital.

The story of the people involved, in particular Koum, should see you say, gosh, these guys deserve every single cent they made. They had nothing, didn't draw a salary, used blankets to keep warm, working on really cheap furniture. Some very useful insight into Koum and Acton here in a Forbes article: The Rags-To-Riches Tale Of How Jan Koum Built WhatsApp Into Facebook's New $19 Billion Baby.

Some choice swearwords in that article, in fact even on the WhatsApp website. You can read the blog from Jan himself on the WhatsApp website, simply titled: Facebook. The company has 450 million active monthly users, 320 million daily users and is grown at around 1 million users per day. It is free, the initial service, but then you pay 99 US cents per year thereafter. But this is how valuable it is, the company handled 54 billion messages on the 31st of December, there could/must be a way in future to mine this database, or do advertising across the platform. For now, however, as per the WhatsApp website: What are WhatsApp's subscription fees? 450 million users at 1 Dollar a year equals 450 million Dollars.

What are the costs of the business to operate? Other than to pay their employees and their server network must be high tech in the extreme? My simple calculation tells me that they (Facebook) bought this business on a 40 multiple forward, in order to kill the opposition quickly and to welcome them to your side of the fence. With a big, big cheque. Everyone has a price, Koum and Acton as per the Forbes article applied for a job at Facebook (but were rejected) before they decided to start WhatsApp. But like many have said, they may have paid way too much here.

But what happens in two or three years time, if they have 1.2 billion, or 1 billion users and decide to charge them 2 Dollars a year? And then 3 Dollars in another two/three years time. If the app has all sorts of added functionality, people would be prepared to pay more for the functionality. And quite quickly, Facebook could have paid less than 10 times forward. Think about it, groups inside of your broader "friend base" on Facebook using the WhatsApp functionality.

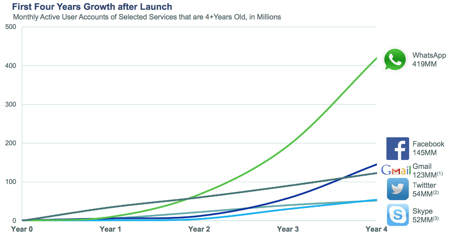

Or perhaps Facebook paid too much, I remember the same folks bleating when they bought Instagram. People laughed. Mostly people with no vested interest that must be said. I think that the Zuck is smart and exceptionally quick. This is a big transaction, obviously well thought out. Lastly, let us leave this piece with a chart from that same Facebook + WhatsApp presentation, remembering that WhatsApp is a paid for service, after one year. Astonishing growth off a very small base:

Home again, home again, jiggety-jog. OK, we are lower here today, SA inc has sold off again. The Ukrainian protests are starting to get folks spooked about the broader emerging markets. And not helping of course are the lower PMI reads in Europe this morning, with only the German services PMI beating. Ah well, volatility must be good for some people, not us of course.

Sasha Naryshkine, Byron Lotter and Michael Treherne Email us Follow Sasha, Byron and Michael on Twitter 011 022 5440

If handled properly, WhatsApp can turn Facebook's fate in mobile competition just like how WhatsApp's creators fate got turned around. http://www.21stcenturynews.com.au/middle-class-immigrants-app-purchased-19-billion-facebook/

ReplyDelete