To market, to market to buy a fat pig. I am starting to read headlines that are asking whether or not emerging markets are a strong buy at all, but then again I am also seeing headlines like this, with evidence that there are still many sellers in our markets: Investors Are Spilling Out Of The Emerging Markets At A Record-Setting Rate. See the graph from that BusinessInsider story, this is the worst bout of selling in all emerging markets since August of 2011, and February of that same year.

But then again, that could be the point to act with the most conviction, when those folks reading the headlines are sellers, Barclays via FT Alphaville have said that on a price to book basis that Emerging Markets are as cheap as they were back in the crisis of 2008/2009. Check it out, via Cullen Roche at Prag Cap: Charts O' the Day: Emerging Markets on Sale?

But then again I am reminded that Turkey is not Brazil is not South Africa is definitely not Russia. In Russia they are hosting the Olympics and it is sort of cold. It is warmer here. But the point that I am trying to make is that all these economies are different from one another. They are not the same, the structure of their economies are different, the companies are unique to the territories.

But global investors taking a large macro view are likely to view all these markets exactly the same. Emerging markets are the same as far as many are concerned, I am keeping it a little simple, but for all intents and purposes the same liquidity concerns in China are supposedly impacting us, and Turkey and so on. So whilst it is not fun to be caught in the same waterfall as the other liquid markets around the world, it does provide opportunities from time to time, the flows will no doubt determine the levels. The stories about oversold EM is starting to appear on my screens and that could mean that toes start to dip back into the water.

As Paul said sarcastically this morning, I thought Turkey and the anxiety around emerging markets was supposed to see the markets halve? And whilst this "crisis" is by no means past us, it is fading from memory. And perhaps now for a while the anxious too and fros can get their knickers in a knot about the lack of growth in Japan. As I write this, our market is basically at the best closing level for the ALSI. Which is bizarre. Having said that, resources have led the charge, up over 12 percent year to date, whilst retailers and banks are down 14 and 7 percent year to date. And the Rand has strengthened over the last week, with the print now at 10.80 to the US dollar. It might be too early to jump the gun now, but it seems that we are heading back into the risk on mode again.

I found this post fascinating. I should not say that, my colleagues are going to laugh, but it was. This is a post from the Calafia Beach Pundit, titled Savings deposit growth slows as confidence returns. That first graph was the one that I was most interested in, the US Savings deposits, which grew from around 1 trillion Dollars in 1995 to above 7 trillion Dollars now. That is a massive number. Bank savings ironically surged in 2008/2009 as folks were pulling in the horns.

It makes sense, it really does. The more risk averse you are, the less you spend, the more you save and repair your own personal balance sheets. But 12 percent annualised growth in savings over the last five years, that is simply astonishing!!! But if you read further in the post, you can see how the savings rate is slowing, and whilst the purists might say this is a bad thing, this is good for growth. It means that people are starting to save less, and spend more.

But that was not what I got interested in. Whilst I was surprised by the surge in savings and that the level was 7.1 trillion Dollars, I wondered what the ratio would be between gross savings and GDP, and of course debt more importantly. Because it suddenly struck me that perhaps whilst everyone would be focused on the household debt and then government debt run-up (government acting as backstop for the US economy in the financial crisis), there was a neglect of real household repairs of their monetary affairs. Stop spending on the unnecessary and paying down of debt mode. But now, this means that the consumer is spending more, and that is good for the global economy.

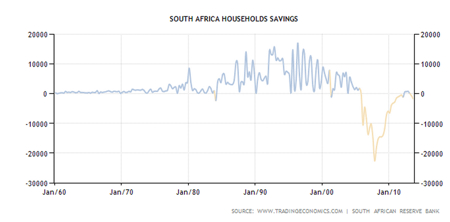

Now, about those Chinese consumers saving less and spending more. Chinese people save as much as 30 percent of their disposable income. Wow. Much higher than the 20 percent of disposable income norm, for savings rates globally. Locally, we are bad savers. Very bad. We prefer to consume. But I guess when many are living under tough conditions, and living standards and salaries are pretty low, it is very tough to expect people to save more. Courtesy of TradingEconomics, this is household savings locally:

AMCU are going to have their leadership tested this week. And their finances. Let us say that government, nor business has the most friendly relationship with AMCU. Of course AMCU are not part of the tripartite alliance, it is COSATU, even if all the unions in COSATU are NOT that comfortable with their members voting for the ruling party. It is politics, complicated at the best of times. The announcement that I have heard from yesterday is that Anglo American Platinum intend to sue AMCU for 600 million Rand, turning to the courts of South Africa for protection as damages (loss of revenue) and increased security during the protected strike weigh on the company's finances.

I hear you say, what the hell, this is a protected strike? Yes, but in the wake of the death of an AMCU shop steward last week: Anglo American Platinum regrets the death of one of its employees, the company has decided that enough is enough. With intimidation, the right to work has been breached. And as far as we understand it here in this office, the company would have the support of Government here. Why? Simple, AMCU are in many peoples eyes a militant union that is not good for economic growth, and are offering unrealistic wage promises to their members. So what now? I guess that this is good for business, very good for business, because it means that shareholders are taking matters into their own hands. I like it.

You can download the Mark Cutifani/Anglo American interview on 702, download the podcast here. Plus the best part is that you can listen to Paul's weekly business blunders. If you have never heard those, then you had better tune in to 702 on Friday evenings. Come on! Listen around 6 odd minutes into the podcast, for the strong words from Cutifani, saying that the platinum industry is standing their ground, because this is in the best interests of all South Africans. OK. So we will wait and see what happens from now, but it is certainly a very, very big week for platinum miners, both labour and business.

Byron's beats, tourism is cooking

There is one sector in South Africa that seems to be thriving despite tough economic conditions. That sector is tourism. This morning Stats SA released accommodation statistics for December 2013. Total income in the accommodation industry increased 11.1% in December 2013 compared to December of 2012. Actual nights sold were up 5.9% while the rest was due to price increases.

I pay a lot of attention to this industry because I believe it has an extremely important role to play in the South African economy. First and for most we have the natural resources to have a thriving tourism industry. That is very fortunate and we need to take advantage of it. Secondly it offers good sustainable employment. Being a tour guide is a lot more fulfilling than sitting in a factory or 3km underground digging for gold. These are long term, quality jobs.

It is one industry which certainly benefits from a weaker Rand. Not much explaining needed there. But it is not just because of more foreigners visiting our shores, but locals exploring their own country as opposed to going overseas because a weaker Rand just makes it too expensive. As the South African middle class gets bigger, internal travel is going to go from strength to strength

As investors how do we benefit from such a strong growing industry? We hold City Lodge, Michael covered their results on Friday. I really like the business, they are like the Mr Price of hotels. Quality at a decent price. We also hold Famous Brands which indirectly benefits from more travellers and tourists in the country. Within the stats they state that camping and caravanning was up a whopping 51.1% for the month. Holdsport should benefit from that kind of growth. Lets hope this growth carries on at these strong levels, I suspect it will.

Michael's musings: Sasol's two extremes

On Friday just before the market closed Sasol released a trading statement for their 6 months ending 31 December. In the office we agree that the statement is "balanced", with the following statement highlighting the extremes of the results "Excluding the impact of the impairment of our Canadian shale gas assets, EPS is expected to increase by between 44% and 50%." Actual EPS is expected to be between 0 and 6% higher than the previous comparable period.

A background to their purchase of their Canadian shale gas assets, their effective purchase price was R 7.1 billion effective from the start of 2011. The reason for buying the assets was to give greater supply to their upstream Gas to Liquid (GTL) offering. As there is a divergence in the price of oil and the price of gas, so the demand for GLT products will increase. Their long term strategic plan is solid because the price of oil has been going up and the price of gas has been going mostly sideways since 2010. What I don't think Sasol expected though was the increase in the supply of Canadian natural gas. Since they bought the Canadian assets the amount of Natural Gas produced on a daily basis has doubled, which means they would not have had a problem in obtaining supply for their downstream GTL plants. Only 20% of Canada's natural gas reserves with current technology can be extracted so there should be ample supply going forward to keep prices down.

Due to the Talisman's (the guys who own the other 50% of the Canadian asset) announcement that they are selling their stake in the asset, Sasol did an evaluation of the assets value and decided to impair the assets value by R5.3 billion. Meaning that the impairment cost is 75% of what they paid for the asset 3 years ago, the high Rand value is partly due to the weaker local currency (against the Canadian Dollar), but it still means that they greatly over paid for the asset.

On the bright side, due to the weak rand, Sasol have been printing cash and the excesses generated from that has compensated for the asset impairment. Also going forward, there are two things that are in Sasol's favour. The first is that they still have the asset which will supply their Canadian GLT plant in the future when they build it, owning the supply of the gas means that they will be hedged against the price fluctuations of gas.

Another impairment cost that hasn't come through yet is from the sale of their Sasol Solvents Germany GmbH assets, which will be an impairment cost of R 466 million, but compared to the R5.3 billion written off this period it is fairly small. I don't see the rand strengthening too much over the next six months which would mean the increased earnings generated from the weaker Rand will continue and Sasol could increase their EPS in the next half by the 44 to 50% that could have been in this half.

Sasol is still one of our favourite stocks and as oil prices rise and people become more concerned about the environment (GTL is cleaner than oil based fuels), their GTL products will become more valuable.

Home again, home again, jiggety-jog. Today is a holiday in the US, it is one of nine federal holidays in that part of the world, they work on Easter Monday as well as working on December the 26th. I guess that they are entitled to their holidays!

Sasha Naryshkine, Byron Lotter and Michael Treherne Email us Follow Sasha, Byron and Michael on Twitter 011 022 5440

No comments:

Post a Comment