Why then is so much importance placed on the number when 90 days later it is completely unimportant? The trend I am told is your friend. Until of course it is not again. But I understand too that more jobs in the US, more people spending, the largest contributor to the largest economy in the world is consumption, so that is a good thing if there are more people gaining employment. But. At the same time do not confuse companies with the economy. If there is ironically the replacing of people by machines to do labour intensive jobs, then those folks without a job cannot contribute towards the economy, and the mechanised factory can sell fewer goods because folks have less money. And no machines last I checked don't eat yogurt or watch TV. As I say every 30 days or so, sounding like a stuck record now, until this number is NOT important, it will continue to attract the hearts and minds of our industry once a month. If you are that way inclined, tune into your favourite business TV channel from 15:25 to 15:35, around that time.

Shorts. No eating of these.

This is amazing. Really amazing. Listen in really closely. What prompted me to do the calculation of what is the TenCent stake inside of Naspers worth was a client email expressing concerns around the valuation. Naspers is a difficult one to value. But my go to calculation is the stake in TenCent and then using the rest of the company and their other quality businesses to is pretty simple. Take the TenCent market cap in Hong Kong, which right now is 967.37 billion Hong Kong Dollars. Naspers owns 34.5 percent of TenCent, that translates to 333.74 billion Hong Kong Dollars. Now one Hong Kong Dollar is equal to 1.4219 Rands. So, quite simply, multiply 333.74 billion HKD by 1.4219 and that equals 474.54 billion Rand. Yowsers.

Now this is the part that you need to lean in to your screen, come on, do it. Last evening, Naspers closed at 467.9 billion Rand. I see. That means that their stake in TenCent is worth more than their market cap is right now. Which means that the balance of this market gives that market absolutely no credit whatsoever, those people in Hong Kong you know, they don't know how to value companies. Maybe. but heck, maybe not!! A company which is growing revenues quarter on quarter by around 8 percent. TenCent, as at the end of their third quarter (September) had 815.6 million users. And a net margin of 25 percent. Astonishing. So whilst everyone a couple of quarters ago was worried about how internet companies were going to monetise mobile, don't worry chaps, TenCent has been doing this for years. But at the same time, TenCent trades on a fifty (that is right 50) multiple. The growth is going to have to continue to be stellar from this point on to justify that. With ARPU's at around 6.3 Yuan a month per customer, that is around one Dollar a month. Early stages still. And when buying Naspers today, you still get all of that for free.

Meanwhile, if you want to look for something else that is outrageous, look no further than the announcement last evening that Apple had bought 14 billion Dollars worth of shares since the results disappointed "investors" (and I use that term very, very lightly). Who is disappointed now? In two weeks, just get this, Apple have bought back 14 billion Dollars worth of shares. And over the last 12 months the company had bought back 40 billion Dollars worth of stock. Which is equal to around 9 percent of their market cap. And at a cheap price no doubt, the stock is up only 13 percent for the last 12 months. And the stock trades on less than a 13 multiple. Ex growth, I think not. They just came off a record quarter. iPads and even more increasingly the Mac is making a solid comeback in a declining PC market. Thanks to the iPad and iPhone, Mac adoption is starting to happen. But yet Microsoft trades on a higher multiple.

Ah well. Back to the buyback, Apple have an amazing amount of gunpowder dry, over one third of their present market value. The WSJ article points to the Tim Cook interview: Apple Repurchases $14 Billion of Own Shares in Two Weeks, in which he also says that the board would not have a problem with a 10 figure acquisition, provided it is a good fit for Apple long term. Agreed. And also, there are new categories coming, I have read about a health device which tells you when to drink water, warns you when your blood pressure is high, and so on.

The TV device is an obvious one too, but we won't have to speculate too much longer, Cook refers to the devices (device?) simply as "really great stuff". I see. And when pushed, the illusive company culture that Apple has, Cook answered in the best possible manner, saying that anyone reasonable would consider what it is. The "really great stuff", what could it be? Lucky for us, there are whole website devoted to this, including the iPhone six perhaps having a bigger screen, and being curved, and so on. For more, go to MacRumours. We continue to add to what we think is a remarkable and innovative company.

Twitter got rubbished yesterday, the stock was down 24 percent yesterday. Yowsers. We chatted enough about that yesterday, I see that there were several research firms upgraded their earnings projections for the company, but downgraded their target prices. The one research report that I read upped their earnings expectations and actually kept their price target about the same, somewhere in the region of the mid sixties. It would be a long way back from there, but the shorts are feasting at the moment.

Staying in that Space, LinkedIn reported numbers for their full year to end 2013 yesterday. I jumped to their 2014 guidance and was quite amazed at how small these businesses are actually, from a revenue point of view. To put it into context, LinkedIn are expecting to see 2014 revenue at a little over 2 billion Dollars. Not really that much if you consider that Monster Worldwide was up 22 percent yesterday and also reported numbers, sales of 199 million Dollars for the quarter, with profits of 31 million. Monster trades at less than book value, whilst LinkedIn trades at over ten times book. Monster have been listed since forever, it traded at over 90 Dollars in March 2000, now it is 7.24 Dollars. Ouch.

But we are talking about LinkedIn. A business that listed in May of 2011, effectively the first of the new social media stocks to list in this cycle. Since listing the share price is up 140 percent. Wow. But how about their business? Well, with more than 60 percent of their business still inside of the US, I suspect that there is plenty of room to grow. Finding the next best job whilst trying to make progress in life is a big deal, and whilst LinkedIn may be great for the people that mine the database and the users alike, the stock is overvalued. But the market tells you that the growth is likely to continue. All in all, a decent business and the future of recruitment, it is going to take a long time. At 277 million users (not all active) it is sizeable already.

Byron beats the streets

On Wednesday we received a trading update for the first quarter ending 31 December from African bank. They start the update elaborating on the tough conditions in the economy.

"The South African economy continues to prove increasingly challenging for consumers and consumer led demand businesses. The consolidated impact of the fuel price hikes, interest rate increases and food inflation against the backdrop of a weakened rand has and will continue to present challenges that the group needs to address."

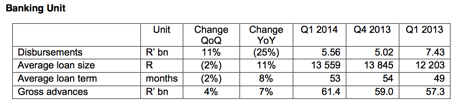

Yes unfortunately at a time when Abil were aggressively growing their loan book the economy started to turn out of favour for the business who almost exclusively target lower end consumers. Below is the table they put out with movements within the banking unit.

As you can see they are still suffering the consequences of their aggressive growth spurt but the commentary is still very much focused on ironing that out and focusing on the future.

The quality of new business written has improved, based on early performance indicators and vintage curves and our new pricing initiatives are positively impacting the incoming yield. Income yield after suspension of interest on affected non-performing loans (NPLs) continues to stabilise at FY2013 levels. While collections remain challenging, particularly over the December and January periods, the stabilizing trend over the last few months remains intact.

I'd expect to see weak numbers throughout the year and maybe some sort of stabilization next year as that ironing out takes affect.

The retail unit is still struggling. Merchandise sales were down 21% year on year while credit sales declined 32%. They are desperately trying to sell the Ellerines business while keeping the credit book. Shoprite and Steinhoff are names which come to mind but the asset will have to be given away at a big discount to be worth anyones while. The unit has been poorly run.

I still feel that micro lending has a very important role to play in a developing market economy. It's a very complex topic and the business model is a really good one when it comes to making money. In fact Finbond, a tiny micro lender was the best preforming share on the JSE last year. Ironic when you consider how badly African Bank have done. Investors certainly have a love hate relationship with the sector and a lot depends on where you find yourself in the sector. For me there is still too much uncertainty in the sector and specifically the company.

Michael's musings: All in the number

So this week has seen two data releases relating to jobs, and a third one this afternoon. This afternoon is the big number Non-farm Payrolls, which will set the mood in markets for at least a couple of hours after its release, and maybe into next week. If you are a trader you hope that the estimated figure is missed either up or down, casing market movements and volatility, thus creating trading opportunities. We find the importance that the market puts onto the non-farm number laughable because the number is revised numerous times. This quote from the US Bureau of Labor statistics says it all, Seasonally adjusted estimates back to January 2009 were subject to revision.. The number that comes out today can be revised four years later! One market commentator said that the only certain thing about today's number is that it is wrong.

Breaking down Non-farm payrolls, it is produced by the US department of labor's bureau of labor stats. The figure covers 80% of people who produce the country's GDP and it is released on the first Friday of each month. To compile the data one third of people are surveyed and the rest estimated based on what the one third said. The expected figure is for 180 000 new jobs to be added to the US economy over the last month.

The other data released this week was the ADP employment change. This figure is a number compiled of using actual payroll data and represents the non-farm private sector employment. The ADP figure is also released monthly and they use data from 24 million people who use their payroll platform to extrapolate their figure. The ADP figure says that 175 000 new jobs were added to the US economy over the last month.

The third job stat for the week is the "Initial Jobless claims", which is released every Thursday by the US Department of Labor. The figure is the number of new people who filed for unemployment benefits over the last week. According to the release on Thursday there were 331 000 new filing for unemployment benefits last week, 20 000 less than the week before. If you wondered what the figure is of people on unemployment benefits for the US, it sits at 2.9 million people.

Part of the Non-farm payrolls release is the current unemployment rate, which currently sits at 6.7%, an impressive number considering that at the end of 2009 it was at 10%. With the economy growing the rate has been dropping but there is another reason as well. In order to be considered unemployed you have to actively looking for a job. So if you are a discouraged work seeker you are not considered unemployed, which is a problem with the unemployment figure. Since August there have been about 1 million people who have dropped out the labour force, which might sounds like a lot but it the grand scheme of things where they have an economically active population of 154 million, it is only about 0.4% points. Part of those 1 million people are people who have left the labour force due to their age.

The US is growing and their unemployment rate is dropping, very good news for companies and their earnings. Don't forget to catch this afternoons figure, people will be talking about it until next month and then totally forget about it.

Home again, home again, jiggety-jog. Non-farmville payrolls out this afternoon. The day will no doubt be about that.

Sasha Naryshkine, Byron Lotter and Michael Treherne Email us Follow Sasha, Byron and Michael on Twitter 011 022 5440

No comments:

Post a Comment