To market, to market to buy a fat pig. It was not a day for the bulls yesterday, the bears stood front and centre. In part as we said yesterday to do with the Chinese PMI number, the HSBC preliminary one that showed that the countries manufacturing was contracting and also the Fed indicating that the glide path into an era where they are NOT participating in the markets. As far I thought, the second one is what everybody wants, less stimulus and letting the economy stand on their own two feet by itself. That could probably take place right now, but the assurances are sometimes what Mr. Market, at least the participants need.

It is astonishing that the longer I do this, the more that you see quality individuals saying the same thing over and over again, whatever the flavour topic is right now in the market. Yeah, it is absolutely terrible that the Greeks were allowed to get away with fudging their public accounts and gave their civil service benefits that were ultimately unrealistic without growth rates equal to that of China. But it happened. At the time, and cast your mind back, how many individuals and institutions predicted that Greece was out of the Eurozone by a specific date? Many. Citi predicted that Greece would exit on the 1st of January 2013, well they did say that there was a 90 percent chance. The very term Grexit was coined up by two analysts, Willem Buiter and Ebrahim Rahbari, who published a paper just over two years ago.

Now, I have not been to Greece since 1986 when they used Drachmas, I am pretty confident that they are still in the Eurozone. In fact, the same Citi crowd changed their mind in late May 2013, saying that the chances had fallen to basically nothing. But day after day, over two years ago, there was a crisis meeting between the Germans and the French over what to do with the Greeks. Yields in the other periphery countries in the Eurozone began to rise, Italy and Spain were the elephants in the room. Portugal and Ireland were manageable.

The PIIGS, remember? Portugal, Italy, Ireland, Greece and Spain. And what happened? Humans intervened and squashed the chattering classes. In fact it took the ECB president to quite simply wave a giant stick at the nay sayers and say that they (the ECB) would do everything possible to "save the Euro". And all along, it was the Europeans that eventually solved European problems, not outsiders. For the outsiders had not experienced hardships associated with wars that had been fought in Europe for centuries.

The only listed conflict in Europe at the moment (on Wiki) is the Euromaidan conflict in Ukraine. That is the official name. But the last official conflict in Western Europe was in 1993 where the British Royal Navy and French fishermen had a scrap around fishing rights. Yes. And that was serious. For the time being Eastern Europe still has places where tensions run high, Georgia/Russia and now Ukraine. But they want and need unity. It is better for Europe, they are the ones who remember the great wars more than anybody else, because it actually impacted on their families lives.

What exactly am I trying to say though? A crisis can come and go. A crisis is normally always an opportunity. There are many. Most of them, the vast majority however, do not impact on asset prices in the long run. If you have held a stock for longer than ten years, get the graph and try and identify all the moments that made the financial markets anxious along the way. Go back further and you can of course see the Dot Com crisis, the Asian debt crisis, the collapse (or near) of Mexican debt, the Japanese asset bubble explosion, Black Monday and so on. But that is less fresh in our minds as the Financial Crisis of 2008/2009. The 2010 European Sovereign Debt crisis. Less fresh. And that is why as human investors we are somehow looking for repeats, so that we can see a drawdown in prices to get stocks cheaper than they are now. Just stay invested in the quality, capitalism will do the rest for you.

Company corner

I suddenly wondered to myself when I heard the Cell C advert saying that a certain network provider was taking the regulator to court for not liking the regulations. That perhaps more time is needed to be focused on getting their network better, rather than advertising like crazy. Everywhere I look, I see Cell C adverts and their new building is nothing short of very swanky over at the Buccleuch Interchange. Very, very nice guys. But in fairness to the company, they HAVE actually been spending heavily on their infrastructure, and have attacked the market from the point of view of pricing on voice calls. They are by numbers the third biggest network in the country and have wrestled market share away from MTN recently. Check the legal battle, courtesy TechCentral, from yesterday: Why we really sued Icasa: MTN

Yes. It goes to the heart again to that point that I made earlier in the week. Vodacom and MTN have been hugely successful where the alternative, the government has failed terribly in connecting people. If the service was so prohibitively expensive, nobody would use it. The market has adapted accordingly where ICASA, the regulator was protecting the states interests in Telkom, and now that dominance has gone. Although, remember that governments stake in Vodacom is more valuable than their stake in Telkom. Ironically, the very best thing that the regulator could have done for the countries consumers was to leave business to their own devices. That would have benefitted the consumer the most.

That one paragraph written by MTN South Africa CEO Zunaid Bulbulia that I want to share with you is telling:

"There are documented economic, social and employment benefits in ensuring broadband for all. Every government understands this and all are proposing targets and policies to deliver these benefits to their citizens. South Africa is no exception, and our government has set very ambitious targets in terms of broadband for all. Such ambitious targets will require significant further investment."

But Cell C have done more than that, jostling and taking MTN on in the public domain. How can you tell though that MTN are under a little pressure? Well in the last set of Blue Label Telecoms results, in the pre paid market, Vodacom market share was flat (51 to 50 percent), Telkom Mobile was nowhere flat too (1 percent), whilst Cell C (12 to 17 percent) gained from MTN (36 to 32 percent). My only question is, in the quest to attract people to the Cell C networks, what quality have they managed to pick up? And lastly, if Cell C are going to tell you that MTN is taking the regulator to court, perhaps they can throw in that MTN has invested 26 billion Rand over the last five financial years. Tell it as it is.

Byron's beats: Interims

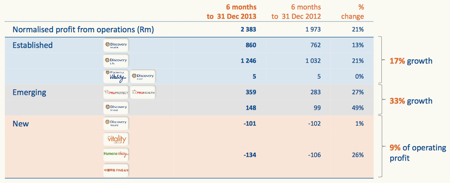

Yesterday we received interim results from Discovery for the 6 months ending December 2013. Here are the financial highlights.

"The period saw normalised profit from operations up 21% to R2 383 million; normalised headline earnings up 22% to R1 650 million; growth in new business annualised premium income up 19% to R5 883 million; excellent performance in the key drivers of new business, loss ratios and lapses across all of Discovery’s businesses; growth in embedded value of 19%; and cash generated from operations over the period of R1.3 billion."

The company is still growing at a strong rate off what is becoming a very high base. But as you will see below, the opportunities and potential are huge. Before we look at the business per division, here is a graphic which lays out the different businesses by profits.

Health. As you can see from the table, Health is the second biggest contributor to profits (R860mn). New business increased 15%. As a member myself I can see why new business is growing so strongly in a fairly mature market, the product is great. What else was impressive was that loss ratios continue to decline as the Vitality product succeeds in making customers healthier. Because believe it or not, it is a general rule for insurers to pay out more than the premiums they receive.

Life. Life is the biggest part of the business (R1246mn) which grew earnings 21%. There are huge synergies here between the Health division and Vitality. Firstly Vitality users who are healthier live for longer and therefore pay premiums for longer. Secondly it makes perfect sense that if you have Discovery Health, you will do your Life insurance through Discovery and visa versa. Of course the company makes that decision a lot easier with all sorts of incentives. It is also nice to have all these products under one umbrella.

Invest. Again people who are not in the know (otherwise they would all come to Vestact) and want to keep all their products under one umbrella will just use Discovery Invest to manage their money. Assets under management grew by 35% to R36bn. It is still small and has plenty room to grow.

Insure. Sasha recently insured his car with Discovery. He loves it because he drives like a granny and gets plenty benefits. Remember they install a tracker and monitor your driving. It is a very innovative product. New business grew 40% to R257mn.

The UK. Business is starting to take off in this region. Profits grew by 27% (now the third biggest contributor) and new business grew 35%. The national health system in the UK has a bad reputation and people who can afford it are insuring their health and going private. We already know that the Discovery product is quality, especially with the addition of Vitality. Those Brits need to exercise!

Ping An.The Chinese market has huge potential. 37% of healthcare spend comes from out of pocket. Discovery own 25% of Ping An health which is a subsidiary of the biggest insurer in China, Ping An Insure. The business is still small but new business doubled for the period so expect this to become more influential in the future. 3-5 years according to Adrian Gore.

Vitality. Now this the exciting part. Both in the US and in Asia, Discovery are leasing out their Vitality intellectual property, mostly to corporates for their employee wellness solutions. A healthy body is a healthy mind which means more productivity from employees. I am a strong believer of that, plus it is win win because the employee gets healthier at the same time. This is taking place in Singapore, Australia and the US. I suspect that we will be seeing plenty more of this adoption going forward.

Valuations. Embedded value sits at R39.8bn. The current market cap sits at R45.8bn, a 15% premium. And rightfully so. The growth rates and potential are huge. Earnings came in at 307c. Very simply, if you annualise that we get R6. Trading at R77.50 the stock seems cheap at 13 times earnings. I remain conviction buy.

Michael's musings: Tesla powering ahead.

Yesterday Tesla finished up over 8%, significantly breaking the $200 mark for the stock. If you bought the stock today a year ago, you would have paid ... (wait for it) ... $35 a share. Yes a year ago you could have bought Tesla for $35 and today they are worth $210, so you would have made a cool 500% in a year.

If you haven't heard of Tesla, they are an electric car company selling the first cool and stylish electric car, and are run by one of South Africa's greatest exports, Elon Musk. So why is the stock up 8% yesterday and up 500% for the last year? Tesla are the disrupter in an established industry and are run by one of the greatest innovators of our generation, so people are paying for the companies potential (I also think for bragging rights, nothing like an ego boost to say around the braai that you own Tesla).

The results yesterday beat the already high analyst expectations, their revenue is up 43% compared to the previous quarter with margin growth to 25% from 23% in Q3 (Q1 margins were 14%). So this company is growing at breakneck speed and they are growing margins while doing it. Both those metrics are expected to continue growing, with Europe and Asia market expected to grow and as production numbers increase, economies of scale will improve their margins further.

In terms of their growth, Tesla are a North American based company and in their words, "Towards the end of the year, we expect sales in those regions (Europe and Asia) combined to be almost twice that of North America. To give you an idea of how far ahead Tesla are of the rest of the industry in terms of margins, Fords current gross margin is only 15.5%.

Would I own the stock? Yes. Make no mistake that the stock is very expensive because investors are expecting big things from the company, but I would still have a small part of my portfolio in the stock. Tesla are a pioneering company whose battery technology can be adapted to other industries. Also in the transportation industry Tesla are talking about their driverless car technology being only a couple of years away, and talk of potentially coming up with electric aeroplanes. Elon Musk was one of the founders of Pay Pal and one of his other companies SpaceX is developing rockets and have the goal of enabling people to live in space. Tesla is in the position to not only revolutionise the car, but many other industries and they are led by an innovator who already has a proven track record.

Home again, home again, jiggety-jog. We are better to start with. The volatility is testing in the short term. Year to date, the S&P 500 is down half a percent. We are up over two and a half percent.

Sasha Naryshkine, Byron Lotter and Michael Treherne Email us Follow Sasha, Byron and Michael on Twitter 011 022 5440

No comments:

Post a Comment