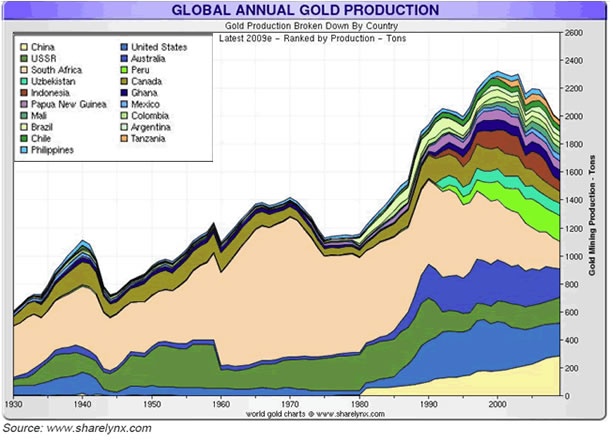

To market, to market to buy a fat pig. Up, up and away we went, flying into positive territory for the year again. That is right sports lovers, 116 days into the year and we are struggling to break even year to date. No thanks to the resource stocks, and in particular the precious metal stocks. The gold stocks are experiencing their worst year since I don't know when. Perhaps 1984 or 1985, my data does not go back that far. Platinum stocks have had a crazy ride, since the highs of early 2008 it has been bumpy at best. Retail stocks have also been struggling this year, perhaps the lofty valuations are finally telling. Earnings growth rates for the retail stocks sit in the low to mid teens and the yield underpin is still very decent, so I guess we are in a wait and see type pattern for now. Woolies, Massmart, Shoprite and then lower down the market cap ladder, Holdsport and Cashbuild are all companies that we continue to recommend and hold. That is for out and out retailers, of course there is also Tiger Brands and Richemont, two totally different companies, the one sells rice the other sells thing that are nice.

US markets slipped away towards the end of the session, but still, the Dow is up around 12 percent YTD. The S&P 500 is up 11.15 percent year to date. We are not even flat for the year. That shows you where the flows have been. A fall off in weekly jobless claims, a much better read than anticipated was greeted with both hands. Microsoft has been on a tear lately, whilst everyone has been hating on them. The stock is trading near a 52 week high, and year to date are up nearly 20 percent. Phew, that is pretty amazing. After hours it was revealed that George Soros had taken a stake in JC Penney. The plot thickens. Why? First a few days ago Reuters runs an obituary, when Soros was still alive and well. And the way that the holding was filed suggests that he is happy to hold it for a while. Bill Ackman must be happy about that. With Ron Johnson amazingly (not really) unable to produce the same results at JC Penney as he was at Apple, Ackman must have been second guessing himself. Or not. It seems there is no shortage of ego there.

What does a siren with a crown, two fish tails, long hair and your favourite morning brew have in common? Starbucks. A company founded in 1971 in Seattle. Their first shop was in Pike Place Market, next year the company plans to have 20 thousand shops across all six continents that you could have customers. Ironically, the continent that their brew might be most appreciated, Antarctica, does not have any stores. Just to show you how quickly their home market continues to grow, Starbucks plan to open 3000 new stores in the Americas alone. The source of the Sleeplessness in Seattle of both Tom Hanks and Meg Ryan might well have been too many lattes or espressos from Starbucks. Maybe. I can't remember how the movie plot runs, but I remember that the end is all too familiar with movies of this nature. Boy gets girl, girl gets boy. The end. No story of him leaving the toilet seat up and her forgetting that the big match is on this weekend. None of that.

But back to Starbucks, because we are interested in the business of business, and the business of selling what is quite possibly the only daytime drug that nobody frowns upon. I mean, a glass of wine at lunch or a cigarette on the street do not attract the same positive feedback that a warm steamy cup of coffee does. The smell for starters is better. The company is not only all about coffee, they also own bakeries and tea brands/outlets. Teavana, if that is your thing. Personally I drink both, tea and coffee. Starbucks have their own home coffee systems, so that at home you can feel as if you are there. At home I have the Nespresso machine, at work we have one too. The coffee is awesome. Bad coffee unfortunately is really bad, and that is both a problem and a good thing. A good thing because premium coffee is awesome, a bad thing because you become a coffee snob.

For the quarter ended 31 March 2013, total net revenues grew 11.3 percent to 3.555 billion Dollars, operating income was 26.4 percent higher at 544.1 million Dollars, net earnings grew to 390 million Dollars, an increase of 26 percent. This translated through to 51 cents a share for the quarter, an increase of 27.5 percent. There are fewer shares in issue as the company continues to buy back stock, 12 million shares less than this time last year. Which is around 1.5 percent fewer shares in issue. The plan is to buy back another 26 odd million shares, thus removing about three percent of the free float.

The quarterly dividend was hiked not so long ago to 21 cents a share. The stock sank afterhours, so perhaps we should use the indicated opening price today, 58.95 Dollars for the purposes of valuation. The yield is 1.43 percent, hardly a positive yield underpin. The forward multiple (using the number that I have seen for the full year by the company, 2.18 cents) is around 27 times earnings. But what are the growth rates? The expectations are for earnings to increase by 22 percent per annum for the next three years. So the PEG ratio (a like for like measurement for any company) comes out at 1.2 times. PEG measurement is simple, price to earnings multiple divided by earnings growth. Slightly more expensive than you would hope, but earnings are growing at a fair lick. Earnings could surprise on the upside. Astonishing margins, which are expected to continue to grow by as much as 30 odd percent to nearly 20 percent EBIT over the coming four to five years. Amazing. Just coffee.

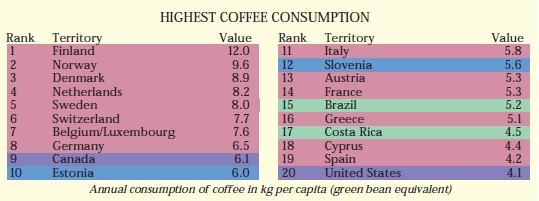

And I say, just coffee, but this is even more amazing than I thought, the coffee consumption per capita statistics. I would have off the bat assumed that the Americans drink as much coffee as the French or the Italians. And I would have assumed that those two proud nations of coffee drinkers would easily drink more than everyone. But it quite simply comes down to simple geography. The Scandinavians slurp enormous amounts of coffee. Huge. More on that in a second, I wanted to understand coffee production, because that would give useful insight into the demand side. In the year 1990/91 all the countries that grow the stuff managed to collectively grow their output 93.253 million bags. Last year, and this information is courtesy of the International coffee organisation statistics page, the producers managed 144.646 million bags. That is a pretty massive increase in coffee production over a twenty odd year period.

And this is more impressive, Brazil (50 million bags) and Vietnam (22 million bags) account for half of all production. Do you ever hear of anyone refer to a Vietnamese coffee blend> Nope. I learnt something new too, there are three different growing seasons for coffee, April, July and October. Different climates means that beans are harvested at different times of the year. Ironically, Starbucks opened their first store at the end of January in Ho Chi Minh City. Of the producers of coffee, Brazil is one of the few countries that enjoys high consumption. Back to that map of global consumption, because I think that this is important. From the document, Coffee Consumption, I have ripped the table out by way of an image:

Normally you would think that the Americans would be higher up on the list there. But their consumption on a per capita basis is 50 percent lower than their northern neighbours, Canada. That leads me to believe that there could be good growth opportunities for the company in the US, and there is evidence of that in the fact that the company are opening a huge number of stores in the coming years in their home territory.

And I have not even mentioned India or China, the homes of the tea drinkers once. Increasingly though, these two huge nations are becoming coffee drinkers. The US is 75 percent of their revenues, and there is still major growth here. Their Asia Pacific business, which includes China, is growing revenues and profits at 35 odd percent. Coffee is a soft luxury, Starbucks is a brand that people aspire to consume. The company is in good hands, Howard Schultz is 59, so I guess there would be some continuity questions. But he seems in good health and aggressive. The board is power, there are some really good members, including two ex Pepsi board members. And Robert Gates, the ex secretary of Defense. We continue to favour Starbucks as the correct entry point into what is a strong growing emerging market story, as well as well entrenched consumer culture in their home markets.

Byron beats the streets

After covering Amazon for a few years now I am sure you get the point that these guys are not focused on present earnings. Somehow Jeff Bezos has managed to convince shareholders that the earnings will come and that they must just be patient. Not much has changed as the company who trades at $265 reported earnings of 18c for the quarter. This comfortably beat expectations of 10c but it is revenues which show the real picture here.

These were a little light verse expectations, $16.07bn vs $16.14bn. This showed a net sales increase of 22% compared to the first quarter last year. I'm not even going to get into valuations because there is not point. But let's assume that once they are finished their big capital expenditure spree they manage net profit margins of 10%. With expected revenues of $75bn this year that means profits of 7.5bn. The company has a market cap of $125bn meaning that even at these assumed profit margins they would be trading on 16.7 times earnings.

But investors are expecting sales to grow at an alarming rate. Not only are Amazon sacrificing profits by investing in massive distribution centres, they are also selling hardware at nearly cost so as to sell people their content. This short term margin killer has good long term prospects. From their presentation Business Insider have come up with some exciting highlights where Amazon are gaining exposure.

TV and movies seem like a big theme for the company. This is of course very exciting. Nobody likes to wait a whole week to watch a series and let's be honest, series are very popular. So are movies and being able to stream them on your Kindle is convenient and cheap. Of course books is how the business started and as a client myself I love the convenience of being able to buy a book on my Kindle app. This is expanding to short pieces and any other readable material. Reading will never go out of fashion.

There is also talk about an Amazon set top box. They have so much content to sell, the more exposure they have to their clients and the easier they make it for clients to buy things, the more they will sell. It sounds similar to Apple TV where you plug the set top box into your TV and basically you can stream Amazon content.

The options are endless. eCommerce is the future and Amazon is the biggest player in this space. In this case the bigger the better because you become the most reliable and the all the big retailers have to come to you if they want to be in the eCommerce world. Therefore you have best selection too. It is certainly not for your conservative investor seeking yield but we still like it for clients who have a strong stomach.

Crow's nest. Today is actually the birth date of Marcus Aurelius, born in 121 AD. I hear you say, but I have heard that name somewhere. Of course you have, in the Gladiator movie, a classic if you are a sucker for historical movies like me. But the story in Gladiator about Lucius Verus was warped a little, he might have died of smallpox. Before Marcus Aurelius died, who outlived him by a country mile. And despite my best efforts to find the gladiator, I could not find him. Russell Crowe, I know he exists. It all seems familiar, Italian politics. But they have a new prime minister. And more importantly, yields on the 10 year fell below 4 percent three days ago. In July last year it was 6.6 percent. Before the Europeans decided that it was good to be European, all together. Not finished. Keep calm and carry on.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440