To market, to market to buy a fat pig. Markets rocked on Friday, the overall index added a percent and a half. Resource stocks were the main drivers. It has certainly been a return to a period of volatility. A five day volatility graph confirmed that, and the US market experienced their first weekly fall of the year. The weakening Yen I suspect has caught everyone off guard, that market is at a five year high in Tokyo. Try and find someone who can explain that one to me, if you wish to. I guess we do not talk about that country, Japan, enough. Just this morning I was saying to Byron that I have to visit Tokyo, all their gadgets and high levels of human advancement. I guess that they have to, because space is at a premium. Capsule hotels. 30 Dollars a night. I might have to sleep in a box, sing karaoke, read manga kissa, visit the fish market, eat noodles from a street vendor, watch sumo wrestling, visit the national gardens (I am a useless but passionate bonsai grower) and perhaps hang out at Shibuya Crossing for a bit. Shibuya Crossing as far as I understand it is the most checked in place on Foursquare in the world. Young and hip Japanese folks make it so!

US markets were mixed, the Dow Jones Industrial Average demonstrated the skew nature of a price weighted index, with some key stocks sinking, IBM down after the first earnings miss in nearly eight years. Down a whopping 8 percent. I suspect that Buffett would have stood up and noticed and now be buying some more. Some late quarter skittishness seemingly. McDonald's also weighed on the index, down nearly two percent. Google screamed ahead after their results, up nearly four and a half percent on the session.

One of our most widely held US company holdings is McDonald's. Possibly one of the most recognisable brands across the world, seventh on last years Forbes list, behind Apple, Microsoft, Coca-Cola, IBM, Google and Intel. All powerful names in their own right. McDonald's operates 34 thousand outlets around the world, managing one in five of those, creating employment for hundreds of thousands of people that serve nearly 70 million people daily. That is amazing, because that means that McDonald's will basically serve the population of the planet every 101 days or so. 25.2 billion people served a year.

Not the most glamorous company to work for, but Jeff Bezos, Jay Leno, Sharon Stone, even Pink and Carl Lewis have worked there at some stage. Why not, as a youngster, it might give you a good grounding to understand "how it all works". The company has not lowered their dividend payment for a single year since the inception of their dividend paying history, and that stretches back to 1976. That is always a good sign, the most recent news on that front was an increase of the quarterly dividend to 77 cents, announced by the board back in January.

That is all very nice. But McDonald's stock fell nearly two percent on Friday, so I suspect that the market was less than impressed with the results, which you can find here: McDonald's Reports First Quarter 2013 Results.

And it is glaringly clear there why the stock sank, revenues and profits flat to slightly lower. Earnings marginally higher, buybacks strong, but expected. At 1.26 USD for the quarter, that annualizes to somewhere around 5 Dollars worth of earnings for the year. 77 cent dividend, that means 3.08 Dollars worth of dividends. And that I think is the key in all of this, the dividend. Because, the stock price was above 100 Dollars a few days ago, but post this report dropped below it. You don't need to be a mathematical genius to work that yield out. The company has always rewarded their shareholders for being exactly that, holders of the company. The yield is more than three percent at around 100 Dollars a share.

But the outlook is wishy washy: "As we move forward, top-line comparisons will begin to ease while the challenging global environment and bottom-line pressures are expected to persist. For the month of April, global comparable sales are expected to be slightly negative. We are confident that we have the right plans in place to differentiate the McDonald's experience and strengthen our business momentum for the long term." What does that mean? I guess it means business as usual.

I suspect what might happen is that the growth expectations for this year are probably waning, the global consumer is feeling stretched. Easing commodity prices will be helpful for the business and their consumers, that is what I would think is a hidden positive. But for now the mood around the company and their stock is like flat coke, it is drinkable but leaves you feeling not quite satisfied. McDonald's still wants to be in every neighbourhood on the planet. They still innovate their menu items to stay abreast with consumer needs, tweaking the menu in different places for needs of their customers. The menu in Jaipur is not the same as the menu in Jakarta. Or Joburg, our menu is pretty boring. This is a keeper, and like their product, it is always going to be a consistent performer. We continue to hold and will accumulate if any negative sentiment pushes the stock much lower than current levels.

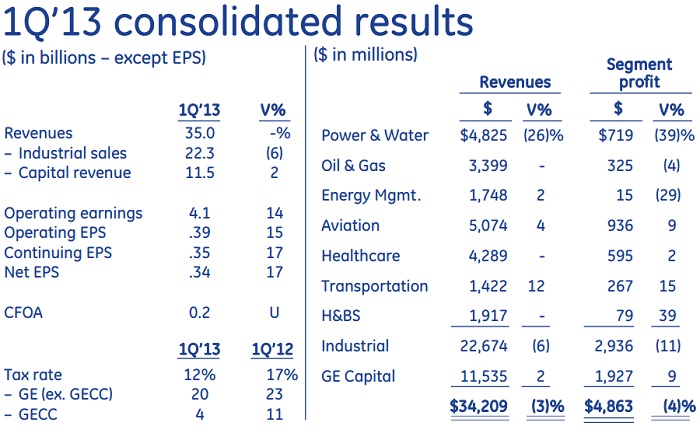

Byron beats the streets On Friday we saw first quarter results from one of the most fascinating companies around, General Electric. Why are they so fascinating? We will go into the details later but first let us refresh our memories of where this massive conglomerate makes its money. This table below from their presentation shows where earnings came from in the first quarter.

It is an interesting mix. Power and water have taken a large hit because of weakness in the European market. But this number is volatile and has been factored into the price. Analysts look at future orders and in this segment we saw nice growth. But as you can see the rest seems to be doing alright. Oil and Gas, Energy management, aviation, healthcare and Home & Business solutions are all sectors we like and have good growth prospects as global GDP grows. The bank still has a huge influence on earnings but a bit of banking exposure in a growing US economy with a strong housing market is not necessarily a bad thing. The company is working on reducing the overall size of the bank.

Although overall sales were down operating earnings increased 14% compared to the first quarter last year to $0.39. This was thanks to cost cutting and the sale of their NBC stake. The company is expected to make $1.67 this year which trading at $21.59 puts the company on a forward PE of 12.9. I would say that is fairly reasonable, especially for a solid defensive operation. If the company were to sell of its separate divisions there is definitely value to be unlocked.

More importantly the order book grew nicely, this from CEO Jeff Immelt. "Our equipment orders were strong in the quarter, growing 10%, with Oil & Gas orders up 24%, and Aviation up 47%. In growth markets, equipment and service orders grew 17%. We ended the quarter with our biggest backlog in history."

I guess this is a company that really benefits from confidence. If countries and businesses are confident they are going to spend on the industrial equipment that GE sell. And why do I say the company is so fascinating? Take a look at this link, it lists the products that GE sell. It goes on forever. And with a motto of "Imagination at Work" I am told that the kind of innovation at this company is mind blowing. And if you are a Greeny check out the link http://www.ecomagination.com/" target="_blank">Ecomoagination which looks at all the GE initiatives which aim at helping the environment.

We continue to add to this stock, it looks cheap and is well geared to providing the world essential products efficiently and economically. If it were to break up into separate divisions the shareholder will certainly unlock good value, as we have seen on a smaller scale with the NBC sale. A must have in our portfolio.

Shorts. Digest these.

Ha, ha! Buffett was right. Remember when he bought Burlington Northern, with their freight railway business being their major edge over their peers. Or perhaps just their edge, if not over their peers. Everyone questioned what he, Buffett, was doing. But he knows business, and knows it well. Then I guess that you would not be surprised to read: Oil shipments by rail have doubled in two years and have helped the revival of a new 'railroad age'. Incredible. A January piece suggests either he was lucky or clever, possibly both: Oil Industry Beats Buffett in Railroad Investments Surge: Energy. Meanwhile however, as Cullen Roche points out: Rail Traffic Continues to Trend Lower. No worries, amazing timing already.

The copper price has gone into a bear market, meaning that it has fallen more than 20 percent from its recent high. I was a little bemused to read this piece in the New York Times: If It's Underground, Maybe Its Price Is, Too. I am not too sure about the conclusion, more people in urban areas must mean durables continue to tick higher, meaning resource intensity should continue. I am not too sure there is going to be a glut. A glut emerges when prices are high and everyone continues to bring new production online. But what happens, classically, is that as soon as these projects come online, the prices are lower. So, I suspect that going with quality is the key here. And we are happy to be long BHP Billiton.

Who would have thought? We said many times over the last few years that the fiscal position of the US would improve, as the economy did. Because businesses would be making more, governments would be spending a little less than they wanted and jobs would be fewer in the public sector. So, I wasn't surprised when I read: Update: Federal and State improving Fiscal Situation. See that? Turns out that recency bias led us to believe that it would always be worse, from this point on.

Remember last week when we pointed to emerging markets having taken a pounding, relative to the US markets. This Jason Zweig piece over the weekend was good: Here Comes the Next Hot Emerging Market: the U.S. Interesting, because the investment professional, van Agtmael, still suggests that Americans have 25 percent of their portfolios in emerging markets. Surely that should have changed? Because as we often point out, around half of S&P 500 revenues are from around the world, including big gains in emerging market over the last decade. So, I suspect whether you like it or not, your investments are diversifying themselves. The FT had this piece over the weekend: Data shift to lift US economy 3%. It is amazing that when a subtle change is made in the measurement that the outlook improves. Perhaps those French were onto something, when Sarkozy suggested that happiness be included in GDP. Problem is, how do you measure that? You know the old one: The Fisherman and The Investment Banker. Funny, aint it?

Xi Jinping gets it. He knows that in order for the communist party to continue to rule the country, there needs to be some stability. And as we have documented, since he came to power he has toned down the lavishness that exists inside the party. The luxury goods makers have felt it already. Xi Jinping urges party to 'toe mass line' to win over public. I suspect that the "biggest" political event of the next couple of decades will undoubtedly be a real democratic event in China. It has to be. As people get wealthier they want more choices, including democracy. And that will be good for all of us. But how this actually happens is important too. There is always pushback from those folks who have vested interests and the most to lose.

This is true, but you knew it already: How Twitter is becoming your first source of investment news. Barry Ritholtz obviously is talking his own book, but it is true. In these recent Boston events from Friday, in which the second fellow was captured, who was the best person to follow on Twitter? Joe Weisenthal. Yes. Plugged in everywhere. Twitter is not to tell people what you had for breakfast, although that is kind of fun. It is a customizable news feed, for real informal news. Facebook is for your mates. Instagram is for your photos. The first time that I watched CNN in about half a decade was Friday. Get on twitter, even if you are not active and just use it as a news feed.

Crow's nest. Markets have started better here. Some commodity stocks have recovered, which is good news for us down here in Joburg.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment