To market, to market to buy a fat pig. New strain of bird flu, dead fish floating down the river, both in China and the North Korean pasty faced man flexing his ummmm.... muscles? I said to Byron yesterday, sigh, I miss the Cyprus crisis, something that seems a distant memory now. Although I guess we will still hear loads about this country for the coming years as they struggle with a giant debt burden. The non-farm payrolls number, which was as recent as Friday seems to have also passed us by a little, some folks still wondering why the labour force participation rate is so low, some obvious answers, some not so obvious.

Markets here rebounded following a recovery on Wall Street late Friday, when the rest of the world was idle, at least from a markets point of view. I am not old, but I am too old for Friday night, if you know what I mean. Resource stocks were put to the sword again, but this time because the Rand strengthened, this morning it is trading at around 8.96 to the US Dollar, more a sign of Dollar weakness than anything else really. Those weaker employment numbers are weighing a little on the greenback.

Industrials enjoyed a decent day here locally, although in this category there are the large industrial companies like Richemont (strictly speaking a retailer of luxury goods) and SABMiller (strictly speaking a retailer of beer and soft drinks) trumps the local heavyweights, Bidvest and Remgro by quite some margin. The broad definition of an industrial company is one that deals with the manufacture of goods, so of course SABMiller and Richemont fall into that category. Bidvest, well services and transportation do not strictly fall into that category, but industrial goods and services. Remgro, well, their own website says that they are an investment holding company, with investments in banking and financial services companies.

Hey, I guess they need to be categorized somewhere, that is what humans do, compartmentalize things. That drawer is for z and this drawer is for y. I can't imagine searching for a non paired set of socks each and every other day. Session end the Jozi all share index had added one fifth of a percent, still down 1.7 percent for the year however, 9th of April is the 99th day of the year. In a non leap year of course. Only the aforementioned industrial stocks are keeping us with our heads above water for now. And strictly speaking, Sasol, the only company really in the sector "oil and gas" and that is with all due respect to Oando, which is less than 1 percent of the market cap of Sasol. Oh, and I forgot to mention Sacoil, the favourite crazy wild west stock. Possibly one of the wilder rides you are likely to see, Sacoil. In the last three years the stock went from 18 cents to 257 cents, back to 28 cents. In the last five years the company has lost around 165 million Rands, against a market cap of 286 million presently. Prospecting companies are not for the faint hearted and are more likely to present folks with jaundiced views of what the market is supposed to be, as investors that is.

There were disappointing announcements from some usual suspects yesterday, firstly Harmony Gold announced that production for the quarter that ended March 31 was likely to be 15 percent lower than the previous quarter. This was largely as a result of the closure of Kusasalethu, for reasons well documented. And a "ventilation challenge" at their Phakisa mine. If that was not enough, their other operations experienced a slow start up post the festive period. Productivity, let us not talk about that. The next quarter is set to be impacted by the same issues at the two mines in question, from June onwards Kusasalethu is expected to return to normal production, a term that I guess is used lightly. Our piece titled Harmony, up today, down last year and the year before that, we laid out the ugly truth when talking about surging cash costs and tumbling production, a toxic mix, from a decade ago:

- It is sadly a lot more, for the same quarter a decade ago, cash operating costs were 68,302 Rands per kg, cash costs have increased four times over. Back then, for the half to end 2002, ounces produced, 1.57 million, the yields were 3.5 grams per ton, the gold price was 103,362 Rands per kg with a very weak Rand at that point, assumptions were for 10 ZAR to the USD. Presently, fast forward (DeLorean DMC-12 style) to these numbers, ounces produced for the half were 613 thousand ounces. WOW, that puts "things" into perspective. If you annualize that lost production you get to roughly 1.9 million ounces of gold no more. I guess that part is all you need to know about the declining gold production picture in South Africa. The ounces produced however are of higher quality I guess, underground recovered grades improved in the quarter to 4.77 grams per ton. Now listen in closely, the gold price received for the half is 460,244 Rands per kg. The Rand gold price is nearly four and a half times more than it was a decade ago. But, cash costs are about four and a half times more than they were a decade ago. And as you know, production is wildly lower than it used to be.

In the prior quarters production was 291 thousand ounces. Which itself was 9 percent lower than the prior quarter, which had registered 321 thousand ounces. So 15 percent lower is somewhere around 250 thousand ounces. Now production for this corresponding quarter just finished, this time last year was 281 thousand ounces. Cash costs had ballooned 18 percent from the prior December quarter (to end 2011) and production was lower against that quarter by the same percentage. The company is falling perilously close to an annualized production number of below 1 million ounces per annum if the current once off production problems continue. Not an investable company sadly. Just to put it into perspective, in the quarter that ended March 2004, the company produced 795 thousand ounces of gold, what we have seen is a full almost 70 percent drop in 9 years. Wow. Just wow.

Another serial underperformer is Telkom. Their announcement yesterday was without detail and way too simple to satisfy me, for one. Check it out: "shareholders are advised that Headline Earnings per Share ("HEPS") for the year ended 31 March 2013 is expected to be at least 20% lower than the 324.7 cents of the prior year." They do say that a more detailed trading announcement will be made closer to the results, which are due 14 June. At least? And at most? 50? 75? Who knows really, we don't hold any stock, either long or short, so perhaps this is just an exercise in seeing how poorly a business performs when the state fiddles, even if they are only a less than 40 percent shareholder. It suddenly struck me that the state might be interested in taking out the rest of the shareholders when the stock hits rock bottom, whatever that is. Avoid the stock, there is little clarity at the business, not enough to feel confident.

But perhaps the biggest news event yesterday, non market related, was the death of Margaret Thatcher, the former PM of Britain and a statesperson that defined a generation of Britons. My absolute favourite quote from the Iron Lady: "The problem with socialism is that you eventually run out of other people's money." Quite true, no wonder we have such high regard for her around here, the libertarian in us wants to believe that she set the United Kingdom on the right path. But of course the Labour party had a completely different opinion of her, and I am pretty sure that her vision of Britain was not exactly the one that turned out, perhaps greed trumped the collective.

Thatcher was the daughter of a grocer, so essentially she understood the hard work required to be a successful business person, empowering people in the way that they needed. Instilling self belief and less reliance on the state. Crushing organised labour, as she saw that segment of the population self promoting their interests over that of the country. Phew, I tell you the similarities and parallels that you can draw between Britain and the Europeans right now are many, perhaps not quite as acute now. And strangely, here too, labour has too much say in economic policy round here. There are several really good pieces, the WSJ on her European Vision. Strangely that is further away for Great Britain, seemingly wanting to pull away from the zone.

The tribute that I liked the most though, to her policies and beliefs was the one from Mark J Perry: Margaret Thatcher (1925-2013): Video and quotes. A great leader for all the libertarians, because she was not afraid of the truth about the human spirit. And for labour, the truth hurt.

Talking about perverse societies here is a great example of how the socialism over capitalism fails, from the BusinessInsider: A Crazy Comparison Of Life In North Korea And South Korea, via a great spreadsheet that the Guardian put together: North Korea and South Korea data. What amazes me is that in a society where everyone is striving to be the same the corruption index puts North Korea top of the list. And in a society where greed is encouraged, there is seemingly more civility. And even though military spend in the South is more than three times that of the North in absolute terms, it makes up only 2.8 percent of GDP in the South but a whopping 22.3 percent in the North. The charade of attempting to be in control of everything requires a huge spend on your military seemingly. So much for personal freedoms and everyone being equal, but you knew that already. I am sure that Baroness Thatcher was against the regime in North Korea in the same way she saw policies of Eastern Europe and Russia.

Byron beats the streets. I saw two pieces of news on Billiton yesterday which I thought were interesting enough to share with you. The first was a statement released by the company themselves regarding copper and how supply may exceed demand this year. As you can imagine the demand for copper over the last ten years has surged like never before. How do miners react? They ramp up production. Last year Chinese demand grew by 11.7%, according to analysts this number will only increase by 5% in 2013.

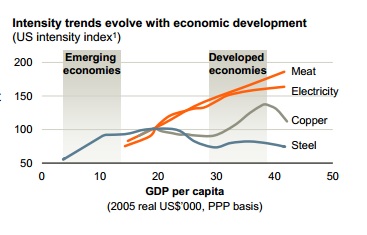

Billiton have been expanding heavily on their copper assets increasing their 57.5% share of Escondida (biggest copper mine by production on the planet) by 32% last year. Is this an issue for the copper price? Probably in the short run but as we always say, we are in this one for the long term and that picture still looks bright. I will never forget that graph Billiton inserted in a presentation called Building momentum in Base Metals which they released in June last year. I will insert it again to remind you

You see that copper demand actually accelerates when an economy becomes developed. China's GDP per capita is just above $6000 so they are still comfortably within the developing market section. That growth in demand is still due a big acceleration.

The other piece I saw also ties in with this graph. You see how electricity growth is almost linear. That makes sense, the richer you are the more energy you consume. The other article that caught my attention was an update on the joint venture between Billiton and Exxon to build the world's biggest floating natural gas processing and export plant North West of Australia. Here is the article from Reuters which is certainly an interesting read. The plant will be half a kilometre long and easily the world's largest floating facility.

It is only expected to start producing in 2020 but it reminds me what a big part of our future gas is going to be as an energy source. This project could cost Billiton up to $12bn along with the big bucks they have already spent on ramping up their gas assets. If they are willing to spend this much money on the energy source along with other big companies you know that the ramp up in supply is going to be huge in the future. I am not too worried about demand, we know that the world is increasingly hungry for energy.

I do wish however that these kinds of projects were being planned on the Mozambique border where massive gas reserves can be found. This would benefit us immensely, especially if Eskom started embracing gas as an alternative to coal. A bit late for that now though.

Remember last week when we said that social media had been accepted as a dissemination of information for company announcements by the SEC? It turns out that many are going to have to adapt, even as Twitter Arrives on Wall Street, Via Bloomberg, the story explains that Wall Street is not exactly receptive to this new form of dissemination. The problem of course is that there have been many #fail events on twitter that did not quite turn out right. I would think that for the time being it might be an approach of "follow only" and use twitter passively as a tool to see quick news from different sources, rather than interact. Sorting the wheat from the chaff is always the hardest part, or so I am told, I have never actually done it. Is the inner circles exclusivity just been bust wide open, or has that happened already?

Crow's nest. The Bank of Japan is on an unending splurge, which may, or may not work, time will tell. If you need a better understanding, Wonkblog does a great job: Why Japan is the most interesting story in global economics right now.

For the time being we are all alright here. Stocks are up around one third of a percent mid morning. I miss Cyprus, the shorter and hungrier North Koreans are getting me down, but as we are all reminded there is very little that they can really do in the long run. Stuck. And losing friends. A B52 should unleash their payload of 32 thousand kg's with Oreos and Peanut Butter cookies over Pyongyang. With a short line, this is what you are missing because of the tyrants in power.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment