To market, to market to buy a fat pig. Local stocks took a drubbing around two in the afternoon, there was of course the ECB decision where they did nothing at face value. There is not too much to do I guess other than assure the markets at the post announcement presentation, but there are signals that there might be a rate cut soon. He suggested that the deposit tax in Cyprus was not smart. There, the most suave central banker in the world said it, not smart. Draghi is the James Bond of central bankers. I bet that he is really witty in private, his answers are always to the point. Imagine having to think in Italian, or any other language and then to articulate that in English, or any other language.

I saw the Twitterati light up, including a quote from the first ECB governor, Wim Duisenberg. I really liked Duisenberg, a Dutch politician, economist, academic, bureaucrat and central banker all in a life that ended too soon. He had a heart attack and drowned in his pool whilst having a vacation at his house in France in 2005 at the age of 70. He also looked a little like Barry Richards. Anyhow, the Duisenberg quote went something along the lines that the European Central Bank was the most independent from politics than any other central bank in the world. Perhaps at the time of the quote in 1998, but that looks less likely in a world where politicians do look at central banks for stimulating their way out of holes. Japan. How has that worked? That is a whole other story, George Soros suggests that the Europeans are heading in that direction. Introducing nicely Byron's piece for the day.

Byron beats the streets. Yesterday the ECB decided to keep rates unchanged and announced nothing really that excited markets. That sparked criticism that Mario Draghi was being too conservative. That he was focusing too much on crisis management and not being innovative enough so as to stimulate the European economy. I guess they are comparing the ECB to the Fed and how Ben Bernanke has used innovation and out of the box thinking to successfully stimulate the US economy.

I feel this is unfair. The situation in Europe is very different. The ECB have many more loopholes to get through as well as the very tough task of keeping each separate nation as happy as they possibly can without upsetting the next. That leaves them with the only option but to be a crisis manager. They are there to keep interest rates low so that the separate countries can maintain their debt levels.

This should allow the nations themselves to innovate, to sell state assets, to loosen labour laws and if they must, tax bank deposits. I guess I am having a little rant here but nations need to step up and be held accountable for their own mistakes. Building up unsustainable debt levels, paying state employees too much for too long and promising social security which you cannot afford is deemed a mistake which requires accountability. The citizens reaped the rewards when times were good, this was however never supposed to happen if countries were managed properly.

I know there are many social implications here and being promised one thing but given another can change one's life drastically. We could get very detailed about the flaws of democracy but this is not a political debate. I am just saying it how it is, countries need to step and take accountability without crying to big daddy ECB.

I commend the ECB for what they have done so far and don't expect them to be anything more than a crisis manager. When things get desperate human nature will kick in and people will work harder and longer to get out of this rut. As long as they can maintain lending rates so that things don't spiral out of control. That is the crisis management that the ECB are responsible for.

Back home again. Locally for the first time since late February our market dipped into negative territory again. The first two weeks of March saw the local Jozi market add nearly 5 percent, only to reverse all of those gains since. We are now trading at levels last seen before Christmas, in the local market that is. Holy smokes, the gold stocks are down nearly 25 percent this year, having lost 20 percent last year. Meanwhile the Dow Jones Industrial Average trades near the record highs, and the S&P 500 reached that all time high a little earlier this week. Year to date the S&P 500 is up 9.4 percent, year to date the Rand is 7.7 percent weaker to the USD. The Brazilian Real is 1.6 percent weaker to the US Dollar so far this year, the Indian Rupee is actually 8.57 percent stronger to the US Dollar this year, after having been crushed last year. Over a five year period the Rand and the Indian Rupee have performed exactly the same to the US Dollar, the Brazilian real has performed much better than the Rupee or the Rand. The Real has been real.

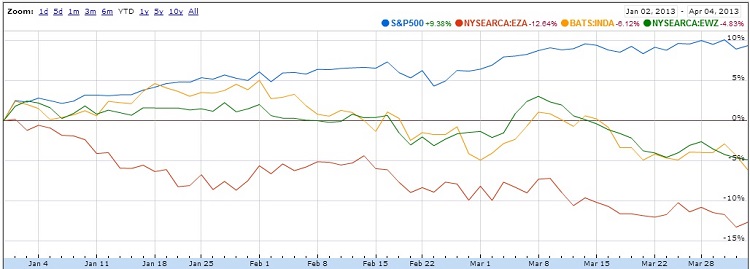

The MSCI Brazil Index, in Dollar terms is down 4.84 percent this year. The same index that tracks Indian stocks is down 6.13 percent. The one that tracks South Africa, EZA is the code in New York, is down 12.64 percent year to date. You are starting to get the picture as to why the local bourse is in the dog box this year when compared to the S&P 500. So here goes a comparison of the S&P 500 and then EZA, which is South Africa, INDA which is India and EWZ which is Brazil, year to date all measured in Dollars of course. I think that by representing the year to date moves in dollar terms it crystallizes that thought process that US assets have been attracting the flows this year. Here is a link to the graph below, follow it to extend the time frames.

So, whilst we have sold off more than the other two markets that are quite nice to compare to, the truth is that over five years the Brazilian index has been crushed, down nearly 40 percent. We are basically flat in Dollar terms, the Indian index is new, so there is not enough data, whilst the S&P has outperformed them all, up nearly 14 percent. There is only ten years worth of data for Brazil, up an incredible 380 percent and South Africa up an impressive 202 percent, whilst at the same time the S&P is up 77 percent. Again, sadly there is no India. Indonesia, issued by the same crowd has only been around since early 2010, but has performed admirably. The last ten years, the first half was absolutely spectacular for emerging markets, but the US has been much better for the second half.

When trying to get a sense of stock market participants it sometimes makes me mad when really smart people talk of the flavour of the week, normally something that has flared up recently. That is why the overnight Eddy Elfenbein piece, a specific paragraph is so important. Subscribe to get it: Crossing Wall Street Market Review, it was not yet in the archive. But let me copy and paste that paragraph:

"Let me give you the briefest summation of Wall Street over the last six months: Investors worry about something that's unlikely to happen, the financial media amplifies said worry, calming voices are ignored, the markets trends downward, the financial media then calls for civility and public-spiritedness to address the needless worry they just promoted, incredibly the world doesn't end, the worries fade away, volatility falls and the market quietly rallies.

We've repeated this dance so many times I'm beginning to lose count. There was the Fiscal Cliff, the debt ceiling (remember the $1-trillion coin), the elections in Italy, the fiasco in Cyprus and the Great Rotation out of bonds. The latest worry is war rumblings from North Korea. While the rhetoric is disturbing, the reality is that Pyongyang's bark is far worse than its bite."

Exactly. These little moments that everyone hangs onto. In three weeks time we won't talk about Cyprus at all. Maybe. Remember when Iceland and Ireland were going to bring the system to its knees. And a Greek exit that was definitely going to happen, you know, it is just inevitable. And now? Turns out the Greeks are better off with Euros than Drachmas even if the current pain is too much. That is the points I think Eddy is making, get sucked in at your peril.

This is quite interesting. Some fellow has done research on what are the worst industries to work in from a pay stability point of view. So, if you are in a specific industry, how does it pay over your working career, can you expect steady pay, or will your paychecks be volatile? Check it out, it is possibly not even surprising to the folks in the industry that construction comes out most volatile: Do volatile firms pay volatile earnings? Evidence using linked worker-firm data.

The list I guess is not too surprising, the least volatile jobs from an earnings point of view are management, transport & warehousing and then accommodation & food services. You can probably find that as investments, if you find companies specializing in these industries, they are likely to exude the same sort of characteristics. Makes sense, stable pay for employees points to steady earnings by the businesses. Reliable industries. In the US, consumer non cyclical has slightly outperformed the S&P 500. There are some monsters in that sector, from Procter & Gamble to Unilever, Colgate-Palmolive to Coca-Cola. Steady, stable and reliable businesses. However, as an investor searching for something special, a transformative industry, this is not where you are going to dig around. Equally, as an investor looking to skate around earnings volatility you can do so by avoiding the sectors with long cycles, deep troughs and high peaks. Construction of course is one of those. So perhaps if your chosen industry is unfortunately a more volatile paying one, at least avoid investing in that sector.

Crow's nest. Less of North Korea today. Cyprus, who knows how that is going to turn out. The most important thing to note today of course is the non-farm payrolls. So watch out for the one event that will change the day, from a trading point of view.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment