To market, to market to buy a fat pig. Whoa, what a day for the precious metals and the associated stocks. Their shareholders could have easily believed that Freddie Kruger and Jason had come early. Because of course Friday was the 12th of April. Gold miners sank as much as four and a half percent, platinum miners shed over three percent to reach levels not seen in some time. The overall resources sector fell 2.4 percent. But the gold companies as a collective are down over 30 percent this year alone. Platinum stocks have fallen 23 percent plus this year so far. Resources as a whole are down nearly 13 percent year to date. The broader market, after enjoying gains, is down over two and a quarter percent.

And if that is not enough for you, then today is going to show the miners up again sadly. Worse than anticipated Chinese GDP numbers were released this morning, although it really depends who you are and how you read it. AngloGold Ashanti for instance, this is the worst price levels for the stock since the period September through to November of 2008, when everyone was getting red ears and sore kidneys from all the beating. I suddenly thought last week, this is terrible when I use the body blows analogy, it seems like I am a serial beater or was beaten. Not the case, violence is extremely low on my agenda, if not completely nonexistent. You have to however for AngloGold Ashanti go back to the middle of 2004 to find when last the price was at these levels. Spare a thought for the Harmony shareholders, the stock has not been this low since late August of 2005. 50 Rands. Phew. The GoldFields share price, adjusted for the unbundling of Sibanye, experienced a similar financial crisis swoon to that of AngloGold Ashanti, and similarly was at current share price levels in late winter of 2005.

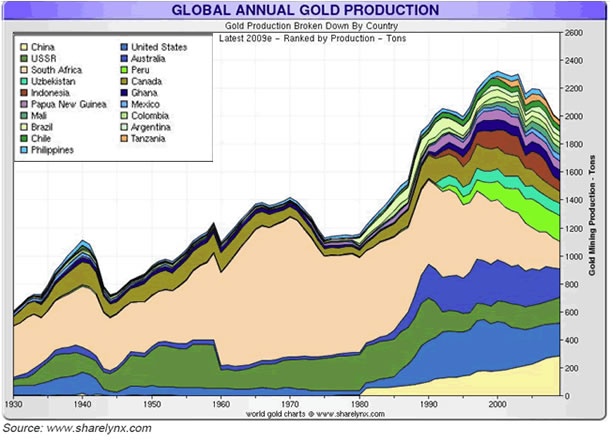

Basically all the gold stocks are trading at levels not seen for 8 odd years. GLD, the Rand price of gold is up 400 odd percent since debuting in November of 2004. Over the last year however, the Rand gold price is flat. Listen in a little closer here, in 1970 South Africa produced 1266 metric tons of gold, 79 percent of global production at that time. Amazing hey? In 1999 however, we produced 2130.4 metric tons of gold, but that was only 21.1 percent of global production at the time. It really was Australian and US gold production that ramped us up to what looks like a peak, for now, in 2001. That was the best year for gold production. Like I said, so far. Check out this graph:

I found it via an article Gold: Two markets, one price... for now, a pretty recent one at that, I was just looking for historical context really. What it does represent however is that you must not feel too bad about falling gold production here, it is a global phenomenon, all the gold producers above us on that graph have also been struggling. My only worry is the hot money which flocked to gold as an investment, sure there will always be someone to buy it, but at what level. A stronger Dollar and a better feel for the US economy in the coming months will reflect badly for the yellow metal.

For the local producers however, this is not good news at all. At the same time labour unrest, above inflation labour wage increases, Eskom increasing costs, the companies are under immense pressure. I don't know what the number is, but I would like to see analysis of that, almost on a shaft by shaft basis. What companies are experiencing right now, which shafts are profitable and which ones are not. I did a search and came up with an ancient article from Mineweb, written by two old friends, Gareth Tredway and Stewart Bailey. Stewart Bailey is coincidently quoted in a Bloomberg story from last Thursday: AngloGold's Asset-Split Plan Said to Be Rebuffed by South Africa. See that? AngloGold Ashanti's shareholders are pushing the group for a separation of the assets, but the government of South Africa thinks that it is a bad idea. Hmmmmm.... there are many government economy meddling that business thinks is a bad idea, but that influence is exerted by expanding businesses to other economic destinations.

As an example, South African company Aspen in 2003 had annual sales of 1.9 billion ZAR, of which nearly 1.5 billion was in South Africa. Fast forward to the last half year, the half year to end December, and South African sales were 37 percent of total sales at 3.565 billion out of nearly 9 billion ZAR in total. Firstly what is eye popping is the sales growth in ten years, and secondly how the International business has surged. Clearly there are international opportunities that have presented itself, it is who has taken them. It is time to think global, not inward thinking that was self imposed. The world owes us nothing. You choose your own economic paths.

And China chose a different one in 1978. And chose economic reforms, which are still ongoing today. Remember in the Mao era that during the Chinese famine in the terrible years from 1958 to 1961, there are different estimates on mass starvation. Because of state controls. There are stories of people who starved to death outside of grain silos. Disaster. 20 to 43 million people starved, the figure goes as high as 70 odd million people starving to death. The Russian purge accounted for 1.2 million souls. Sis. And what do both of these have in common? Communism. Cast your mind back to this piece: Capitalism has lifted humanity out of the dirt and is greatest value creator in history of the world. It is Jim O'Neill that said that African countries should try to emulate South Korea as how to emerge from poverty. Check out the Economist from last week: Gems from Jim. That leads into Byron's beats well, he looks at those Chinese numbers.

Byron beats the streets China GDP Growth slows to 7.7% was the Wall Street Journal headline. How I wish our GDP was "slowing" to that type of growth. None the less everything is relative and expectations were for 8%. One of the main reasons for the miss seems to be a slow down on consumption which was spurred by the authorities who have put a crackdown on luxury spend. Fair enough, they are focused on ensuring Chinese growth remains sustainable. You know what human nature can do, people over extend themselves when times are good and this can create bubbles.

Talking about bubbles the Chinese property market has also been a big concern of late. Sasha has covered it extensively but the world has taken notice of what seems to be a huge speculative bubble in the Chinese property market. And so have the authorities who have started to talk about policies which will clamp down on the speculation.

Business Insider have put a table in this piece headed A Complete Look at China's Latest Disappointing Data in One Chart which has a look at all the data released as well as consensus. Quite a few misses there but again I will reiterate the long term picture. The days of double digit growth for China are over but every year their overall impact on the global economy gets bigger. I'd rather have China growing at 7.7% than say India growing at 10% because the base there is so much higher being the second biggest economy in the world.

And yes we will see misses and beats but the Chinese government are focused on long term sustainable growth which can only be a good thing. If they grow at 12% for the next two years but then crash because credit extension was too aggressive billions will be lost. And that is why the government are being more conservative which is actually a breath of fresh air. Sasha again eluded to which countries around the world are dependent on China last week. He concluded that it was not only Australia and that we are all very much linked to the nation's economy.

We are confident that China still has legs for strong long term growth. Their GDP per capita is still well below any developed market. The Chinese government have targeted 7.5% growth for 2013 so 7.7% for the quarter is just fine with me.

This is really worth thinking about for a long time. What Are The Top Five Facts Everyone Should Know About Oil Exploration? Of course there is a big desire across the spectrum to move towards a non oil based economy, a greener economy. But perhaps we are being way too hasty as human beings, there is this resource that is available to us right now, don't ignore its importance.

Half of the worlds energy needs come from oil and gas. But it goes further than that, as the article points out: "Oil/gas powers 100% of all transportation, within a few significant figures of rounding error. Transportation, in turn, directly accounted for 1/6th of world GDP in 1997 and is heavily involved in every other type of economic activity." True again. Renewable technology accounted for 0.07 percent of power generation over thirty years. Sad but true. What is more amazing when you scroll down the story to point three, oil is wealth, is that 200 years ago almost ALL energy consumption was bio fuels. Initially coal changed everything and then oil and natural gas added to that massive change. The more we burn fossil fuels the richer ironically we have got. Out with whale oil and in with natural gas. Where to next, your guess is as good as mine. Natural gas of course is the obvious answer, whilst we have already seen that coal will become less important globally, but still VERY important for us here. As I was told Friday, by someone in the know, the Karoo fracking is just a matter of when and not whether it is going to happen.

Crow's nest. A massive week of earnings is ahead of us. 10 Dow components report and around 100 S&P 500 stocks report this week. I don't care who you are, there is no way that you could cover all of those stocks. There are of course overlaps, but still, 20 stocks a day? Can't do it. Google, IBM, JnJ, McDonald's, Intel, Pepsi, Coca-Cola, amongst some heavyweight financials are all due with numbers this week. But of course there are some strange happenings that will capture peoples imaginations, including the 101 year anniversary of the first supreme ruler/emperor/lovely ruler/have-to-stand-and-clap-when-his-name-is-mentioned, Kim Il Sung today. Ironically Kim Il Sung was thrown out of the Korean Communist party for being too "nationalist". And of course he holds the rule through terror award for having under his rule around 1 million folks having died in camps. Yeah, that is awful, completely awful. The first grandchild of the man above expresses guilt apparently for his grandfathers sins. Meanwhile over the border, PSY released a single that broke YouTube records. 51 million views in around 40 hours. 20 million in the first 24 hours. That is the kind of history that I prefer.

Markets are selling off globally, the commodity stocks are getting caned. Collectively off three and a half percent this morning, being led lower by the gold stocks, which are off a whopping nearly nine percent today only. Wow. That is certainly very sad.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment