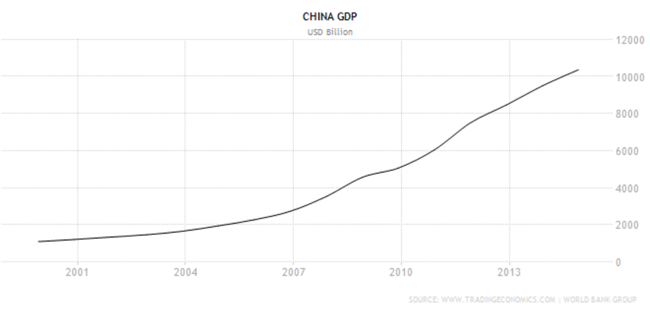

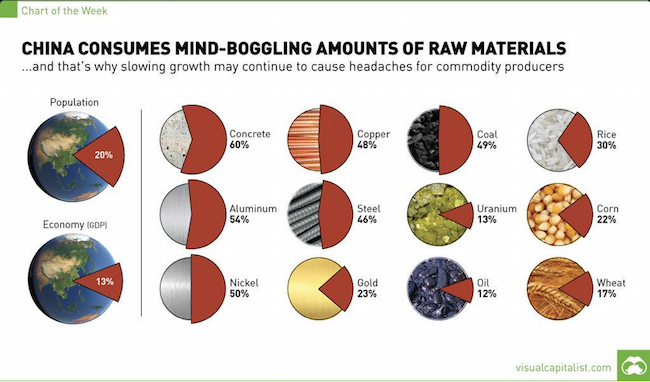

"Basic Materials (Commodities) as a collective on Wall Street have fallen nearly 20 percent in the last three months, here in Jozi over the same time frame, the Resource 10 index is down nearly 19 percent. Wow, that has been part of the story, China "slowing", weaker manufacturing reads. A lot of worries about the health of the second biggest economy, the reason why I put slowing in inverted commas is that any country in the world of half, one quarter or even one-tenth of the size of the Chinese economy would love that problem of slowing to 6 or 7 or even 4 percent growth. The Chinese will be fine in the end, they will emerge all the better for dealing with their debt issues."

To market to market to buy a fat pig. As we head into the close of the worst quarter since the financial crisis, it is always a time for reflection on why it was the worst. More importantly, what is to come not only in the next quarter but in the coming years? It is always the most incredible thing when I read really detailed reports with revenue projections three years out, the recent incidents (less dents, more smash like) at Volkswagen are a stark reminder that even the most "trustworthy" company can of course surprise all and sundry. And in this case, not in a positive way.

The impact of consumer behaviour on the company will undoubtably be negative, I do not believe that it will be bad for the whole "made in Germany", do you? I still trust all the German companies, perhaps I bat more for big business than most consumers. Most people I speak to colloquially always think that business is trying in some way to "screw them". My response is always to say, then don't use the service. The look on their faces is priceless, my other answer is, "why don't you then own the shares?"

Over here in Jozi, Jozi, stocks were lower by 0.22 percent on the day. We are about down 4.8 percent for the last three months, as they say in the classic, not a pretty picture. What has been the problem, Volkswagen and Glencore aside? I guess Glencore is more directly linked to the root of the equities market sell off, a leveraged commodities trader and miner. With China "slowing" and shuffling to a more consumption based economy, away from building on the grandest scale every witnessed in humanity, the victims have been the likes of Glencore.

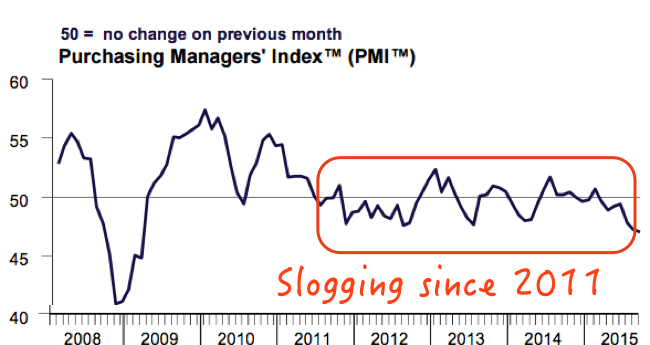

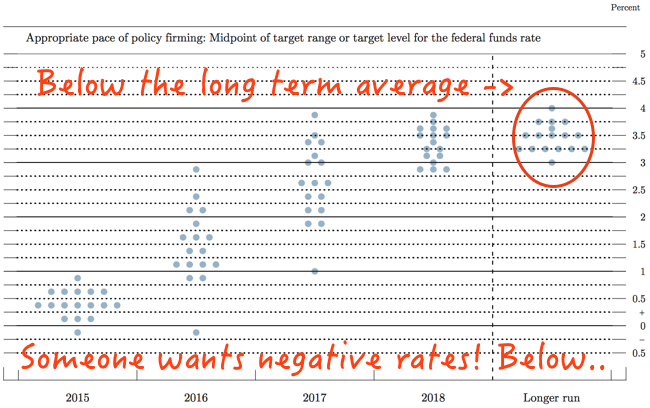

Basic Materials (Commodities) as a collective on Wall Street have fallen nearly 20 percent in the last three months, here in Jozi over the same time frame, the Resource 10 index is down nearly 19 percent. Wow, that has been part of the story, China "slowing", weaker manufacturing reads. A lot of worries about the health of the second biggest economy, the reason why I put slowing in inverted commas is that any country in the world of half, one quarter or even one-tenth of the size of the Chinese economy would love that problem of slowing to 6 or 7 or even 4 percent growth. The Chinese will be fine in the end, they will emerge all the better for dealing with their debt issues.

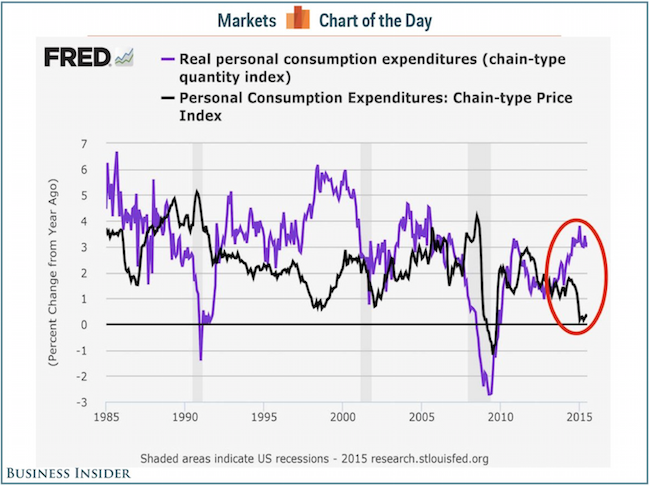

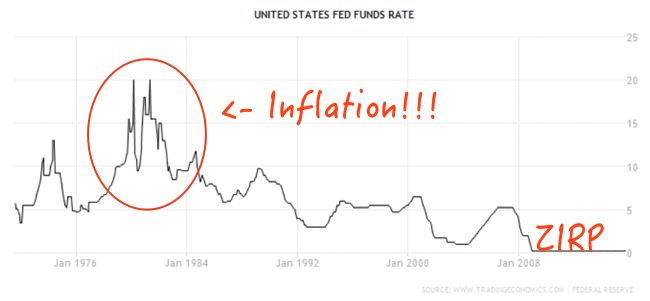

The other major concern has actually mostly been associated with good news. Now you might find it hard to believe that is the case when the equity markets across the globe have fallen since the middle of August, it is however the same concerns around the Fed and when they are likely to raise interest rates. Every word and speech is watched closely, and unfortunately all Mr. Market participants can talk about is the FOMC and when the Fed are going to raise rates.

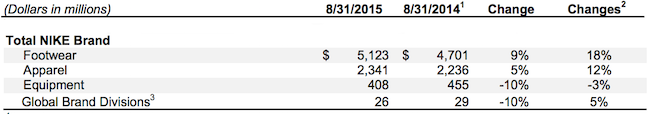

That seems far more important than Nike and Apple selling like crazy in China, far more important than Caterpillar hitting the skids and selling far less in China. It seems far more important than a shift in the energy supply and demand balance across the globe and what it means for long term prices of crude, iron ore, copper and closer to home platinum and gold prices. I am afraid that the super cycle that we became used to has returned to a lower for longer price environment. So in short, whilst China is to blame (if you are looking to point fingers) for lower commodity prices, the other reason Mr. Market has decided to take a Northern Hemisphere break for the bulls, look no further than the Fed and anxiety over the interest rate environment.

At least we should close out the last day of the third quarter of 2015 in a better light, stocks across Asia are up sharply, the Japanese stock market is up nearly three percent. Perhaps in response to a really positive speech by Prime Minister Shinzo Abe in New York yesterday, hosted by Michael Bloomberg at Bloomberg HQ, he was really positive about a new golden age for Japan over the next five to ten years. Of course he would say that, he is of course a politician! Stocks in Hong Kong are one and two-thirds of a percent higher on the day.

There have also been high ranking meet ups during the UN shindig, US president Obama and Vladimir Putin shook hands, we saw an interview this morning with the Russian president and Charlie Rose. Putin spoke of his father's side of the family during World War II losing 4 of the 5 brothers, indicating that the wounds (even 70 years on) are still relatively fresh. We might say, forget it, for many the scars still run deep, which is even a bigger reason of why Europe must work for everyone in it. Less conflict, more trade, more similarities and less differences. Having said that, the last quarter has been less about Europe than the prior ones for the last five years. That was pretty refreshing not to hear about an exit from Europe by the Greeks, phew. And they even had an election in that time.

Company corner

This is pretty incredible. Want a part time job, want to earn 18-25 Dollars an hour? Or until the drones replace you, someone quipped on Twitter, then become a delivery person for Amazon -> Amazon Flex. What are you going to deliver via your own transport? Yes, your own transport. It turns out Amazon Prime Now packages, for those who really can't wait. You can work 12 hours a day, 7 day a week, earnings 2100 Dollars a week, or 109,200 Dollars a year, provided you work each and every day for 12 hours a day, presuming you changed that to 5 days a week, the annual salary would still be an acceptable 78,000 Dollars a year.

So Amazon is basically applying the collective need and desire, as well as cutting out traditional companies (UPS, DHL and the like) to provide services for their customers. I mean, do you care how your package gets to you? Does it matter that a sweaty unshaven teenager delivers your package or a middle aged delivery person dressed in company regalia? I am pretty sure that there will be scoring (the Uber/Tripadvisor/Booking.com stars) for the delivery people, and Amazon will likely use higher rated people first. The same age old strategy of, the better you are and the harder you work at your job, strangely the more you seem to get paid. Amazon continues to shake things up a little, each day at a time for people to enjoy the benefits of lower prices and convenience at the same time.

Companies create value by allowing humans to use resources more efficiently. The concept of Uber and the likes of AirBnB allows us to "share" or cars or houses with other people while we are not using them, the result is that we have less idle capital and resources. Amazon is doing exactly this, with this new service. Quick deliveries will mean less of a need for brick and mortar stores and the ability to build warehouses out of the way and on less valuable land, with the result being cheaper goods and more money for the consumer to spend on other things, the BusinessInsider has this take - Amazon goes after Uber and a slew of other on-demand startups with its own delivery service.

Linkfest, lap it up

Given how important the internet is to our global society, helping people who can't afford it is a great initiative - Google is bringing free WiFi to train stations in India

It is the small things that make a car - Tesla's new Model X has a 'bioweapon defense mode' button. "Because what else do you want from a futuristic, semi-autonomous, all-electric car that's as fast as a Porsche than the ability to survive biological warfare?"

You will read this, nod and agree It is not a coincidence that people who are positive in their outlook in life are more successful. You know our mantra around here, "Be Optimistic". A research paper from Oxford University titled Particular brain connections linked to positive human traits points out that "Those with classically positive lifestyles, behaviours had different brain connections to those with classically negative ones".

We tend to think of equality in society between men and women as something that is a given and converging towards equal pay is only a matter of time. Yet we forget for the vast majority of recorded history that women were second class citizens (and still are in some parts of the world), only 150 years ago did Britain have their first female doctor. She was also the first woman mayor in Britain. It seems like a terrible waste of resources to have half the population unable to participate in the economy, don't you think? Good thing it is 2015.

Home again, home again, jiggety-jog. We have started today 1% up, with Glencore up 9% leading the way. We may just close out the quarter in positive territory, some good news in a pool of difficulty. Are you excited about the ADP numbers today? Yeah, maybe. The Rand has been stronger over the last 48 hours, which coincides with consensus being that emerging market currencies will fall further. I remember the bottom for Euro in recent times was when people were saying Euro/Dollar parity is about to happen, almost a given. . . Head down and carry on.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

087 985 0939