"Can you imagine the conversation: "That manufacturing PMI from Portugal/Greece (whoever) is useless, absolutely useless, we should drop that country from the Eurozone." Or, "Italian labour reform is pathetic, I don't even understand how that country is in the combined economic area". Or, 'I can't believe that Mario Draghi can't see the obvious problems, they are all there to see and most certainly any asset buying programs are definitely not going to solve it, he is USELESS!'"

To market to market to buy a fat pig. Ha-ha. I saw in the Friday Eddy Elfenbein note that two percent of the S&P 500's revenues were reliant on China. That is it, 2 percent. Obviously emerging markets as a whole combined will be more of those revenues, two percent hardly sounds like a lot now, does it? Enough to send the S&P 500 (if that is the reason) down ten percent from their recent highs, and in a real hurry.

I look around, what is not to like, gasoline prices for Americans are at their lowest levels at Labour Day (Monday) for 11 years, thanks to oversupplied markets, thanks to fracking. American ingenuity in changing the landscape of supply of oil and gas has meant that all global consumers benefit, somewhat, however. The reason I say somewhat is that many markets are net importers of crude oil, their currencies as a collective have been hammered relative to the US Dollar, and last I checked oil prices, all commodity prices were quoted in US Dollars. And not Bitcoin. Remember anyhow that Bitcoin is quoted in Dollars, so how does that make it "different"?

Equally motor vehicle sales are at a decade plus high. The two do not seem to tie together now do they? Human innovation, lower gas usage, same motor vehicle, Americans feeling better about the future are buying cars, housing starts are at the best level since before the financial crisis. A non-farm payrolls number today is set to reveal once again that the health of the US economy is better than most people anticipate. For the record, stocks were flat after a great start in New York, New York. I saw a headline suggest caution ahead of the jobs report. Bleh.

Earlier in the week we saw the lowest European unemployment number in an absolute age. The ECB however yesterday lowered their growth outlook for the whole area to 1.5 percent. Which sounds like "not a lot", yet at the same time, for all the issues plaguing the collective biggest economic zone on the planet, it seems better than in years gone by. The ECB will continue to do what they need to, some of the smartest minds on the planet as we often point out, just be happy that it is them and not the collective voting, like a sports fan.

Can you imagine the conversation: "That manufacturing PMI from Portugal/Greece (whoever) is useless, absolutely useless, we should drop that country from the Eurozone." Or, "Italian labour reform is pathetic, I don't even understand how that country is in the combined economic area". Or, "I can't believe that Mario Draghi can't see the obvious problems, they are all there to see and most certainly any asset buying programs are definitely not going to solve it, he is USELESS!" Be careful what you shout at the TV, we are all guilty of it.

Locally in Jozi, Jozi equity markets bounced hard and closed above the 50 thousand mark on the ALSI, for what it is worth. Up 2.4 percent on the day. We are anticipating, as a result of lower US equity market close, a weaker opening here. The Chinese markets are closed today, as they were yesterday for the 70 year celebrations of the end of World War Two. I wonder how the citizens of Germany and Japan approach these dates? Sure, the victors share the spoils of war, 70 years on with grand parades in Beijing and Moscow, what message does that send? We won, we won, you lost!!

Company corner

Can Sibanye Gold really sweat the Anglo American Platinum assets in Rustenburg better? The release is so very simple from the company: "Anglo American Platinum confirms that the Company is in discussions with Sibanye in relation to the sale of its Rustenburg operations, which may or may not lead to a transaction. This is in line with what we have publicly stated, that we continue to pursue both a sale and listing option. No further detail can be provided at this stage." Either the assets are going to be floated separately or they are going to be sold to suitors like Sibanye.

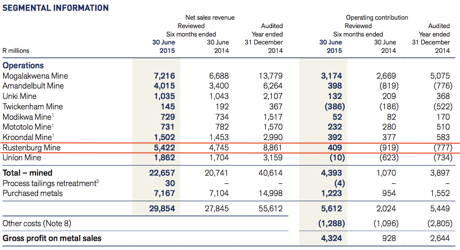

The asset was tarted up for a sale in the interim results: Bathopele Mine, Thembelani Mine, Siphumelele Mine and Western Limb Tailings Retreatment were consolidated into Rustenburg Mine. I have taken a slide from the interim results presentation and I have separated Rustenburg. Of course Union Mine is below that. That is also up for sale. Check:

David McKay from MiningMx has written an article that I urge you to read: SA platinum cuts under-estimate the urgency. The quote at the end from Investec Securities about a crash in slow motion is apt. And the fact that none of us can do anything about it, the price is set as a function of supply and demand. Costs have been running up too hard, demand has been muted. I went through a recent Johnson Matthey presentation, recycling of older autocats will continue to supply the market heavily, in other words recycling continues to be a bigger part of annual "production", the older ones on the scrapped cars have more platinum than is currently required, you know, human innovation!

To conclude, the Sibanye announcement sent the Amplats share price 9.28 percent higher on the day, floating all of the boats. Impala Platinum after their results and announcement of a capital raising had earlier in the session seen their share price down 14 odd percent ended the day only down 2.77 percent. We continue to avoid the sector.

Linkfest, lap it up

I quite liked this, Are News Organizations Using Twitter Effectively? (Infographic). The short answer is that they could all try a lot harder.

Society changes, slowly mostly, in their outlook towards specific "issues". As we have gotten richer and resources are more abundant for rich people, obesity has become a problem. You will recall that we sold Coke as a result of this pending groundswell. Preferring to own health and wellness businesses. I was interested to see this story (subscription only): Jamie Oliver back on campaign trail with 'absolute war' on sugar. Have you changed your outlook on sugar at all? Personally my wife and I (Sasha here) eat none. True story.

Thanks to social media many of us have seen the immigrant crisis facing Europe. Here is an economic view on the matter - The Economics of Immigration: Who Wins, Who Loses and Why. I think South African's forget that we face a similar situation here where there are many people from other parts of Africa coming to RSA to better their lives. If you nail your colours to the capitalism mast then opening boarders to have the free movement of labour makes sense. Why should a country "protect" the jobs of people just because they were born in that country? Surely you want to hire the hardest working person at the cheapest price? Increased competition where labour can move to the areas that provide the biggest opportunity.

The problem though is that if there are strict immigration laws, the people that do get through the boarder are there illegally and as such have no rights. The result is that they are then exploited. Which is really bad for local jobs because then you have no chance of getting a job if the person you are competing with is being exploited. Lets also not forget that some of the illegal immigrants are skilled workers, who if they did the job they have the qualifications for would be paying income tax. It would seem again that less regulation is better for everyone.

Some fun facts from the Spring day market fall - When 499 of the S&P 500 fall in a day

Thanks to lower commodity prices, lower energy prices, innovation and a weakening Yuan (making Chinese imports cheaper), we are seeing inflation stay at low levels and the word deflation coming up very often. With inflation basically zero in Europe and if deflation does come around, those negative interest rates suddenly don't look too bad. In our current environment, the best rewards are for those who innovate, disrupt and create new things - World faces third deflationary wave

Home again, home again, jiggety-jog. Other than the obvious flurry towards the end of the day, we should see quieter (or should I say cautious) markets ahead of a US holiday on Monday. That holiday officially marks the end of summer there, although having said that, the US Open temperatures look real hot. Markets in Europe are all expected to open around one percent lower, we will too!

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment