"There is almost always a lot going on with this company, I suspect in the next couple of years that they will work hard on their existing businesses and use the springboard as an opportunity to expand into higher margin therapies. Something that Stephen Saad said in a radio interview takes 4 to 5 years to roll out. He also suggested in a CNBC Africa interview that Aspen was in a better position to acquire than any other time before."

To market to market to buy a fat pig. Whoa, what a crazy day for stocks globally, the Nikkei rallied by seven percent after some generous tax cuts for Japanese businesses. Having said that, the corporate tax rates still look a little too high in one of the most advanced countries on the planet. And then over in the US markets slumped after a better than anticipated JOLTS report, the job openings indicates strength in the US economy. And there you thought good news was good news, however Mr. Market is concerned about one thing only, a rate hike pending from the US Fed as early as next week. What nonsense, I guess there is very little that we can do about it, until the meeting happens and whatever Mr. Market thinks in the short term.

Markets across Asia are lower, the Chinese authorities are doing their best to suggest that there is no chance of a hard landing in China. CPI numbers looked a little hot this morning, the PPI numbers looked awful, much, much lower. Prices at the factory gate falling, not great for Chinese companies. The way I see it, and Warren Buffett was interviewed saying that China would be just fine. I loved the look on the interviewers face, it was like "What, are you serious?" Yes, China will always be there and as we have said over the last few weeks, it will always be there and do better than most people suggest. Well, let us wait and see what the Fed thinks next week and how they act. For one, I don't really think it is as important as many other people think.

Company corner

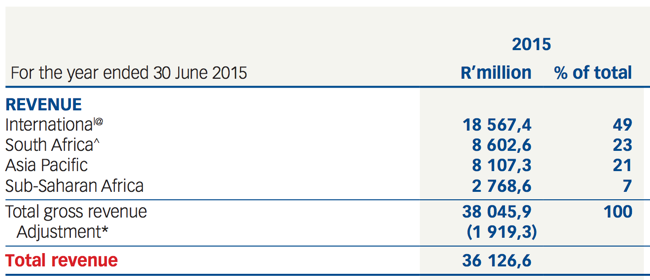

Aspen released results for their full year to end June 2015. This is a company that operates in 70 countries across the world and distributes their products across 150 countries. Wow. They have divested 800 million Dollars in a number of transactions, equally they have done three large transactions in the same year, not ideal to do them all in the same year said the CEO Stephen Saad. Revenue grew 22 percent to 36.1 billion Rand, operating profits increased by 14 percent to 8.4 billion Rand. Of that, South Africa is now around one quarter of revenue (23 percent to be exact, 21 percent of profits), as Stephen Saad says, it will always be their home. See segmented revenues below per region:

Normalised headline earnings per share was 15 percent higher at 1219 ZAR cents, headline earnings adjusted for specific non trading items (their accounting words, not mine) was 5.6 billion Rand. Net debt in Rands increased to 30 billion Rand, 2.5 billion as a result of "unfavourable" exchange rate movements. Net foreign exchange losses were 479 million Rand, no thanks at all to the strong Dollar against the Euro, the Aussie Dollar and the Rand. Imported chemicals (to manufacture) impacted heavily by a strong Dollar. The group will do a capital distribution of 216 cents (hardly a kings ransom), payable 12 October this year. And I think most importantly, at least in the short term, the cautionary had been withdrawn: "negotiations have not progressed to a satisfactory conclusion." That was around an infant formula business in China, sigh, that was a big one that got away.

Aspen actually has quite a large business in Venezuela, true story and as a result of the hyper inflationary environment in that crazy country, revenues were up 143 percent in Rand terms. There are actually different account rules when dealing with the Venezuelan economy, as the company describes in their results release: "The Venezuelan economy is regarded as a hyperinflationary economy in terms of International Financial Reporting Standards. There are three regulated exchange rates which are applicable in Venezuela"

How can you have three different currencies? I recall that in the dark days of the Republic here, we had two different exchange rates, not so? Nuts, the sooner the bus driver drives himself off into the sunset, the better for all Venezuelans bent on following revolutionary Marxist economic "policies" that lead to total destruction. I guess they are closer to losing now than ever before with the oil price having fallen in a heap.

There is almost always a lot going on with this company, I suspect in the next couple of years that they will work hard on their existing businesses and use the springboard as an opportunity to expand into higher margin therapies. Something that Stephen Saad said in a radio interview takes 4 to 5 years to roll out. He also suggested in a CNBC Africa interview that Aspen was in a better position to acquire than any other time before. Small in global pharma terms, which means that there is still many opportunities. They are very focused in optimising their business, sweating the current assets and improving margins. As he also said, you cannot make any mistakes when producing their products, they are going into peoples bloodstreams.

Whilst the currency issues impacted negatively twice, with the imported products and secondly with their trading geographies, Stephen Saad suggested that perhaps they need Dollar based revenues. Although at the same time, the US market is hard and tough, lots of legislation and not something Aspen haven't explored, they just have not found the right business. Whilst the market saw these results as disappointing, I suspect that the currency translation will work its way out of the system over the next twelve months. This is a fabulous business with one of the best dealmakers and managers in the country, whilst the price has definitely disappointed as of late, the longer term opportunities that remain make this company a solid part of each and every portfolio. We maintain our buy recommendation on the stock. We will continue to monitor the news flow over the coming days.

Apple unveiled their new product line yesterday, as expected the iPhone upgrades on both the smaller and the bigger model happened, better camera, faster chip and something called 3D touch on the phones. Something called peek and pop, you can watch the film via the Apple website. Jony Ive speaks at the beginning of the video, it sounds like a sales advert, pretty cool actually. It recognises hard pushes, to enable other menus, things you do frequently.

Pretty awesome and not just a subtle upgrade to a touchscreen. If you watch the video, follow the link above, you can appreciate the complex engineering that goes with the new press screen. Pretty awesome, these phones with the "new" screen, improved speeds and better cameras are available for pre order from Saturday. So I am guessing that we will have a weekend sales number on Monday/Tuesday next week. It looks like a time saver, the new peek and pop and I think that it will be well received. When will it be here? I am guessing in time for Christmas, I may well be wrong. Do you want one?

Next was something that nobody expected, they knew that there were iPad refreshes coming, not something called the iPad Pro. It is much bigger than any iPad you know, it comes with a stylus (costs extra) and a keyboard, which also costs extra. Thin and light, more screen area than the other iPads you know. It also includes the most advanced display that they have ever made. Ever. Better energy efficiencies means longer battery life. It looks more like an enterprise product, i.e. in order to penetrate deeper into the world of business. It looks pretty amazing, and looks like it may have an educational element too. Again, Jony Ive speaks in the iPad Pro film. Do you want one?

Next was the new Apple Tv, and it has a Siri remote that you can ask questions about new shows, new movies, old movies, gaming, apps and a swipe. All starting at a price of 149 Dollars. I guess different movies for different parts of the world and of course you have to have a decent high speed internet connection in order to enable optimum streaming. The cheaper old model starts at 69 Dollars. I have had one for a long time, the biggest issues are the bandwidth, mine has improved subtly at home, which enables a bigger range of viewing.

Lastly (actually first in the order of events) was the watch, a new operating system, a multitude of apps, Siri integration and new bands for the watch, working with French luxury goods business Hermes. Plus new alerts on your wrist, the ones that you want. All in all, the watch looks like a device that can enhance medical studies and already is doing that. Imagine being able to collect data real time, all of the time instead of extracting that delayed. People going about their business. Do you have one? Do you want one?

The balance of the market was apparently unimpressed with the new products, the company always seems to attract the idea that they must be constantly clearing two and a half metres (to use a high jump analogy) at these meetings. The price fell nearly two percent, in fairness along with the rest of the market, around half a percent worse than blue chips. With the stock trading on a low teen multiple that includes the cash, the product refresh looked great to me and the newly introduced upgrade (iPhone Upgrade Program) once a year should be pretty cool for a ramp up in immediate sales. And give Apple the opportunity to sell the refurbished phone again. We maintain our buy recommendation on the company, it is for the time being a one of a kind business.

Yesterday we received news that, Anglo American Platinum Limited Announces The Sale Of Its Rustenburg Operations. The basics of the deal are that Sibanye will buy the asset for a minimum of R 4.5 billion and a maximum of R20 billion, with an upfront payment of R1.5 billion.

Why the range in the sales price? Sibanye will pay out 35% of the distributable free cash flow from the mines over six years. So if the platinum price goes up over the next few years the payouts will be higher and Amplats can go to their shareholders and say we didn't sell at the bottom. The current book value of the operations sits at R7.7 billion, so the sale price is below that but could be well above that depending what happens to the platinum price in the next few years.

I think this is a good deal for both parties, Sibanye got the asset at a good price and for Amplats they get to move out of the labour intensive area and focus more on mechanised mines. Sibanye have shown they have a great skill at operating labour intensive mines, if the platinum price doesn't drop further, they say there won't be any jobs on the line. A better operator means the mines are more profitable, which is a good thing for all the workers. Part of the deal is that Amplats will also be the ones refining the platinum coming out of the mines. The Sibanye share price is up 22% since the cautionary last week, Amplats is only up 0.7%, they were up around 5% for most of yesterday. You can see who the market thinks won in the deal but both stocks are up.

The deal will take place from the latter of either the 1 January 2017 or completion of the transaction, as you can see the parties don't expect things to move quickly due to all the hoops they are going to have to jump through.

Home again, home again, jiggety-jog. I saw that S&P cut Brazil's credit rating to "junk". The other two major ratings agencies have yet to act, S&P suggest that there may be more cuts. Ah well, you see what happens when you are not business friendly enough and have a socialist bent, corruption of epic proportions. Unfortunately it is ordinary citizens that are impacted by the repercussions of higher borrowing rates. Well, they elected the guys, they can boot them out at the next elections. The Workers Party has now been in charge since 2002, I am guessing that at the next elections there may be a change. We will see. Next thing to look forward to is the Rio Olympics, I am pretty sure that they will put on a good show.

Markets across Asia are down, futures markets in the US are marginally higher. So we should get a little bounce today, later of course. Discovery have results this morning, some collaboration with Apple and the Watch and potential to make sure that their members are all good and well. More on that tomorrow.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment