"Since the great depression there have been 20 periods where the equities market has fallen by 20 percent or more. Over 85 odd years, roughly every 4 years the equities markets fall 20 percent or more. Yet retail investors act with poor judgment, another unbelievable stat: "2007: $85 billion put into stock mutual funds. 2008-2009: $230 billion pulled out of stock funds. 2013: $68 billion put into stock mutual funds." So when the market goes up, retail investors pile in, when it goes down, they head for the hills faster than before."

To market to market to buy a fat pig. Up is better than down when you are long companies, when you stay the course with the quality. Our local market ended a mere 5 points higher here in Jozi, Jozi, after a day mostly spent in the red. At one point stocks were down 1 percent. The drivers on the day were industrials, the results from Bidvest were well received, that stock ended at the top of the leaderboard of the biggest 40 companies, up 4.55 percent. The stock is up a little less than five percent (in Rand terms) for the year, the broader market is about flat. The question always arrises with this company, do they have a peer to be measured against in the local market? The short answer is no. Globally, perhaps Sysco in the US, a food services business, not to be confused with the router and switch manufacturer Cisco.

Helping the cause too was Aspen, the company released a trading update late Friday, after the market had closed. During ordinary trade yesterday the stock jumped nearly 3.8 percent, year to date however the stock is down 15.6 percent and it is comfortably off the 52 week highs reached in late January this year. As ever, it depends where you bought a company and for how long you have held it. The five year return on the same company is 326 percent. That is rather amazing. Over ten years it is a more astonishing 1063 percent, a ten bagger, the term coined by Peter Lynch which is a ten fold return on a specific company.

Nobody cares about that this morning, the historic moves are exactly that, as you wake up the stock is 342.51 Rand. Yes. Whilst the valuation remains stretched for many value people, the growth rates match the multiple and as such the PEG ratio (Price to Earnings over the expected growth rate, you can take a smoothed three years) remains closer to what represent value. The long investment case for Aspen, as the business grows and matures more, is that you are likely to be rewarded with higher dividends. Lots of acquisitions, sweat the assets harder, borrow money to pay for them, pay them down quickly, use the excess cash to reward shareholders.

I was reading this piece from Felix Salmon, titled: Ban daily stock market reports, which contained this nugget: "On the other hand, if a big move happens and there's no obvious news event which precipitated it, then it's idiotic to start hunting for some spurious reason for why the stock market is doing what it's doing. Most market moves are random, much as the news media hates to admit it." True. Markets go up and down as a function of the collective, a reason is this or that, Greece, China, the broader Euro zone and the yields at the periphery, inflation, deflation, lack of growth, the list goes on and on. Oh, and I forgot another hot topic, when are the Fed going to raise rates.

It would be unwise to say, I do not care when the Fed are going to raise rates, higher borrowing costs impact on businesses. It is however a sign that things have improved to the point where the people tasked with monetary stability recognise that rates should normalise. And I suspect that by normalise, in the technology age with more efficiencies and cost savings leading to lower long term inflation, that means a lower high point. You know, the opposite of Lesotho, which have the highest lowest point on the planet of any country. This is the opposite, instead of rates in the Us being at 5-6 percent, expect 3.5-5 percent. Anyhow, what do I know?

All I know is that you should not make the Fed part of the reason why you buy companies. You buy companies to share in the rewards and the spoils, the better run the business, the better the products and services, the more receptive customers are to those said products and services, the more they are willing to pay which means fatter margins for those said companies, the more money you make. Or so the theory goes, obviously lots of different things can happen that prevent that from happening.

I read a great piece from Morgan Housel yesterday, titled What Makes Us Bad Investors? Again, some very interesting pieces or snippets in there. Like this one, about the S&P 500: 64% of stocks underperformed the index. and 25% of stocks were responsible for all the market's gains. Wow. If you had just held the "wrong" companies over a thirty year period it makes a massive difference. What it does not mean is that you would not have outperformed treasuries, cash, gold, property and so on.

In fact, further down the article tells you what your returns would be. $1 invested in 1900 was worth $1,016 by 2013 (annual return of 6.3%). $1 in Treasuries was worth $6.36. $1 in gold worth $1.92. $1 in cash worth $0.07. Equities, notwithstanding their incredible volatility and perceived risk are far better investments than treasuries (the risk free rate), gold and most certainly cash. So, cash may be king for snippets in time, presuming that you can time the markets, cash over the medium and long term is more like the court jester. Cash is the court jester. Stocks are not only King and Queen, quite possibly Ace, Jack and ten. Trumps everything else.

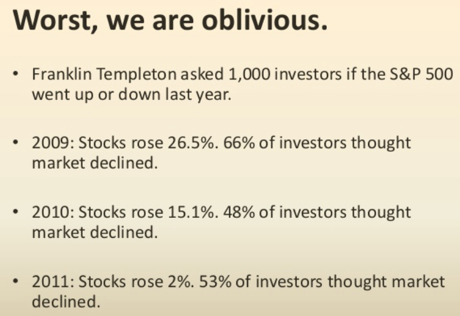

Since the great depression there have been 20 periods where the equities market has fallen by 20 percent or more. Over 85 odd years, roughly every 4 years the equities markets fall 20 percent or more. Yet retail investors act with poor judgment, another unbelievable stat: "2007: $85 billion put into stock mutual funds. 2008-2009: $230 billion pulled out of stock funds. 2013: $68 billion put into stock mutual funds." So when the market goes up, retail investors pile in, when it goes down, they head for the hills faster than before. Fear is far more gripping than the rewards. The worst of all, notwithstanding the daily bombardment of news of what is up and what is down, this slide sums it up:

I guess that some people take their personal experience and project that on the equities markets. Obviously the people that Franklin Templeton asked were not following the market that closely. Perhaps the hardships from the period before has skewed their perception of the equities market. The equities market is not the economy, equally the economy is not the equities market. What is the conclusion? As we often say in this daily message (yes, it is daily), do nothing. Do very little. Own the best companies. In market turmoils all stocks get sold. Stay the course. Be calm and invest on, take the lower prices and embrace them, utilise your cash to buy quality at lower prices.

Linkfest, lap it up

This is a great way to get new customers and to build brand awareness - Uber is offering Mad Max rides in Seattle. To drive in those cars I would pay a premium for the service.

How do you measure an increase in the standard of living? GDP is a poor measure because it can't account for the increase in technology and the benefits that come with it - Why our children aren't doomed to being poorer than we are. The other point to note is that even though incomes have been growing slower than some people would like. That income can buy you more because technology has made some big tickets items cheaper and better at the same time, for example washing machines (100 years ago it would take many hours to hand wash everything, then on the introduction of the washing machine only the rich could afford them, now they are common place in the household).

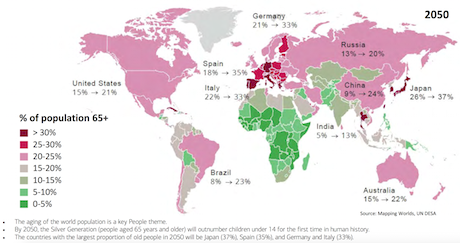

Immigration is a hot topic at the moment given all the people fleeing Africa and Eastern Europe. This is what the global population will look like in 2050, based on current trends.

As you can see the developed world will have a large "old" population and the developing world will have a large "young" population. I think going forward we will see immigration policies loosening to attract more people from the developing world, which is probably a good thing for all involved.

Home again, home again, jiggety-jog. US Futures are lower, stocks across Asia are a whole lot lower. As such you should expect a lower open here today. Do not let that stop you from reading, carry on reading all the quality. Read more annual reports and fewer market reports.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment