"Now if life expectancy is 78 for a woman in Brazil (according to the World Health Organisation), she could potentially be on the government payroll for 32 years, longer than she worked in the first place. For men in Brazil, life expectancy is 71 years, that means that if they also started working at 16, and were eligible for their ending salary (plus inflation increases) when they were 51, the government would have to oblige for 20 years."

To market to market to buy a fat pig. A rally for stocks across the globe ahead of the Fed. The other Fed still licks his wounds from Sunday evening, I suppose a 1.6 million Dollar paycheque for two weeks of work is not all bad, it is not as good Novak Djokovic's 3.3 million Dollars. What you do need to know about this rivalry and what makes it so great is that each has beaten the other in all four majors. And currently it stands at 21 all in 42 matches. Good work you two, keep it up! Keeping up the good work, stocks locally in Jozi, Jozi rallied as a result of US markets, at the end of our trading day, closing around one quarter of a percent higher. Over the last 12 months, stocks as a collective in Rand terms are flat here in Jozi, down 3.3 percent actually. The going has been more than a little tough, this happens from time to time however, stay the course.

Part of the reason is that emerging markets have seen outflows as their prospects have dimmed relative to developed markets, who have undergone their fair share of change and hardships over the last half a decade. Brazil unveiled massive austerity measures to plug all sorts of holes, as far as I could tell, it resulted in a positive impact for all emerging market currencies. Freezing the salaries of civil servants, some job letting (not much, some), spending cuts and tax increases, this does not bode well for their economy. The expectations are that the Brazilian economy is set to endure economic contraction until the end of 2016. The government has shed a whole lot of departments too, which begs the question, were they necessary in the first place?

Also, as a WSJ article points out: Brazil Unveils Nearly $17 Billion in Austerity Measures, the constitution says that women and men can retire after 30 and 35 years of work respectively, with some public servants getting 100 percent of their last salary, adjusted for inflation for the rest of their lives. So, if (as the article points out), a woman begins working at the age of 16, by the time she is 46, she can retire. The constitution says so.

Now if life expectancy is 78 for a woman in Brazil (according to the World Health Organisation), she could potentially be on the government payroll for 32 years, longer than she worked in the first place. For men in Brazil, life expectancy is 71 years, that means that if they also started working at 16, and were eligible for their ending salary (plus inflation increases) when they were 51, the government would have to oblige for 20 years. Equally a big number. For labour this is a major hurdle, they are strong in Brazil, after all the workers party is in charge. Raising retirement age is a no brainer, 60 at least (Australia is busy increasing their retirement age to 67). That would enable greater contributions to public pension systems, enabling the state to afford such generous payouts.

I suppose that the problems of Brazil and Greece are not that dissimilar. Too many worker rights (I'm going to get into trouble), not enough contributions over time and definitely not enough money to meet these ever increasing obligations. I did a similar search for the word retirement in our constitution, it is not bound there to any age. According to the Government Employees Pension Fund, retirement age is 60 years old. And these are based on your contributions over time, not on your last salary. You can say many things about South Africa, we are prudent for the time being, I am guessing that crunch time itself will come and our own austerity will have to be implemented.

Over the seas and far away in New York, New York, stocks rallied hard ahead of the two day Federal Open Market Committee meeting (that takes place today and tomorrow). The Dow Jones added 1.4 percent, the broader market S&P 500 was up just over one a quarter percent, the nerds of NASDAQ were the worst of the lot, still, they gained 1.14 percent in the session. Microsoft saw a bump in their share price, the payout ratio (profits percentage paid to shareholders by way of dividends) has now risen above fifty percent. If Apple did that, their yield would be close to four percent. Microsoft is twice as expensive as Apple (and some more).

Talking Microsoft and Bill Gates, we were looking at Berkshire Hathaway's board (Bill Gates sits on their board) and at the age of 60, Gates was a spring chicken compared to some of the others. Buffett's own son, Howard, who is also a board member, is also 60 years old. Warren Buffett is 84, Charlie Munger is 90, Ronald Olson is 74, some of the non execs like Thomas Murphy and David Gottesman are both 89, Walter Scott is 83. Susan Decker is the youngest board member at the age of 52, the average age of the board (12 of them) is 70 and a half. Leading one to think about that retirement age thing and whether or not age is just a number. I think in the modern world that is the case, thanks to improved nutrition and healthcare improving at a rapid rate each and every year.

Company corner

Hey, this caught my eye yesterday, an announcement by Visa -> Visa Introduces EMV Chip-based Biometrics. Visa is teaming up with ABSA here in Mzansi (why not, for sho!) with biometric cardholder verification. That is fancy for fingerprint technology. So as far as I understand it from the release, you will stick your card into the ATM and instead of being asked for a pin, you will place your fingerprint there and hey presto, the cash will come out of the machine. It will verify that you indeed are the person who owns the bank account and the funds are yours. No more hands covering the pin pad, nobody can steal your fingerprints. Hopefully very soon the card itself will be nowhere, Apple Pay and Android Pay (its newer, check it out: Android Pay) can solve the physical card issue.

The release fleshes it out more and explains why this is important in emerging markets: "Absa Bank, a wholly-owned subsidiary of Barclays Africa Group, will be the first to use Visa's specification to develop a proof of concept trial beginning this fall. Cardholders will use fingerprint readers at select Absa-owned ATMs in lieu of a PIN to complete transactions. In order to prevent potential fraud as well as encourage easier access to banking, there is strong interest in biometric solutions in South Africa and other developing countries where banking and electronic payments may still be nascent."

I am sure the people understand their fingerprints better than a pin number, or not, have I got that wrong? Either way, payment technology is moving fast, full steam ahead. I still think that the entrenched networks and methodologies will evolve to adapt and meet market demand. Whilst at the fringes other technologies will evolve, like Bitcoin etc. those are priced in Dollars last I checked, not so?

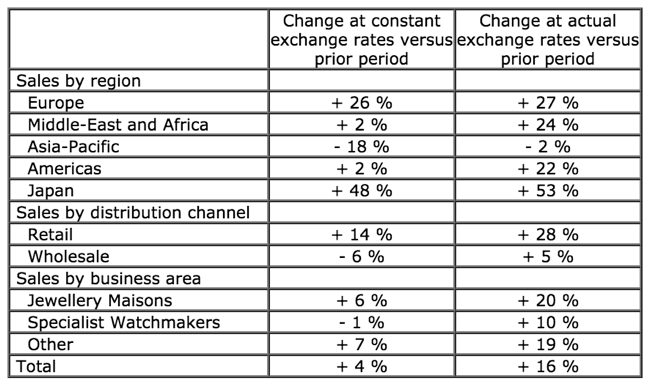

Richemont have released a five month trading update this morning. Whilst the currency swings were negative on the way down (for the Euro), they have been equally positive on the way up. At real exchange rates sales only increased 4 percent, in reported currency (Euros) sales increased 16 percent. Europe itself has made a massive comeback, confirming once again that the European recovery has been in full swing here.

Plus, as the release points out, sales were further helped thanks to good tourist numbers (the weaker Euro made it more attractive) in Europe. Equally Japan had a big contribution, that was however as a result of once off factors last year where the sales tax made people buy loads of luxury goods in the first half of the year. The huge blot and confirmation of a slowdown in China is an 18 percent slump in Asia Pacific Sales (minus two percent in Euros). Here goes the table:

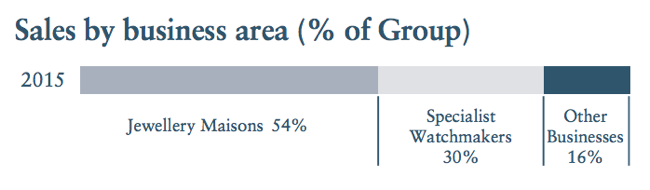

If you need to know the contribution from each segment, look no further than the last annual report.

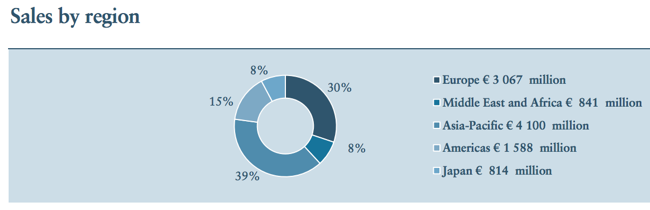

And then of course, sales by region for the full year, as per the annual report:

So what is telling here is two things, one their watch sales is their second biggest division and sales were flat in constant currencies, whilst people went gaga for jewellery (their biggest division) and their "other" segment. Peter Millar, Lancel, (perhaps even Purdey), Shanghai Tang, Chloe, Alfred Dunhill, Alaia and Mont Blanc. Clothing, bags, accessories and even shotguns? Fragrances, wallets, purses, the lot. The other notable thing is that whilst Asia Pacific got spanked, it was Macau and Hong Kong, regions of opulence in China. The release says: "Mainland China resumed growth with retail sales growing at a strong double-digit rate, overcoming lower wholesale demand". As one of our readers pointed out with tongue in cheek,"Must be because China is going backwards???". Well said, on the ground companies are still reporting strong numbers out of China.

So China is regional if you needed reminding, and the story is intact for mainland China to continue to be a bigger contributor in time. We need to wait until the 6th of November to see the first half of what has been a wild currency ride and concerns about China. Although that seems to be confined to the areas of opulence (they be having it as per the DirectTV adverts), which is important. I am not too sure what markets are going to think of these numbers, their costs in Swiss Francs may have risen with the Euro depeg, so their profits might not reflect that really good sales number, albeit in Euros. Still, pleasing to see a major comeback from their second biggest market in Europe.

Linkfest, lap it up

In USD terms, every asset class that you could invest in is down for the year - Nowhere to Hide. . . . Roche says that if you were in cash you would not have gone backwards but he is forgetting about inflation (It is basically nothing but is still there nonetheless), so even cash went backwards.

This technology is still probably about a decade away but it may allow wireless networks to be 100 times faster than they are today - Researchers develop key component for terahertz wireless

As the world moves online, I expect to see more court cases like this. Officials are going to fight hard for taxes on revenues generated by people in their borders, being online makes it hard to determine who the taxes belong to - Netflix and Amazon users sue to stop Chicago's 9% streaming tax

A bit of fun for the mid-week slump, where do you get the most bang for your buck on a per gram basis or on a per calorie basis - How to Eat at McDonald's When You're Monumentally Broke. Having a look at the menu there are very few items that I recognise, a "Southern Style Chicken Biscuit" sounds good.

Home again, home again, jiggety-jog. Stocks across Asia are higher in response to a good session on Wall Street. European futures are all pointing higher, US futures are a little lower, just a smidgen. From the recent highs, just a reminder, the S&P 500 is off 7 percent. The local market has fared far worse, having both a strong commodities focus and of course we are an emerging market. We are down less than one percent year to date. Yes, when the going gets tough, the tough get going. Or so said Billy Ocean.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment