"There is a quote from American comedian, Groucho Marx, who sat for a full hour at the home of cricket, Lords, and asked the person next to him: "This is great. When does it start?" I guess the same could be said of the Fed rates decision, it is like watching extreme slow motion. For those who don't remember, I don't blame you, the Fed last raised rates in June of 2006 when Ben Bernanke had just assumed the job from Alan Greenspan."

To market to market to buy a fat pig. In Jozi, Jozi markets rose to over a percent. Not too much in the losing column, Discovery saw strong moves northwards in their share price, that stock up nearly three percent on the day and no too far away from their all time highs. It was all about waiting for the most highly anticipated announcement for global equity markets for the year, or that is how it was being touted anyhow. Everyone was able to throw their five cents worth around as if it actually meant something. The Fed will do what they need to, that is almost always the case.

Yawn. After all the hype, all the people getting so excited about the most anticipated Fed meeting in around 9 years, nothing was done. There is a quote from American comedian, Groucho Marx, who sat for a full hour at the home of cricket, Lords, and asked the person next to him: "This is great. When does it start?" I guess the same could be said of the Fed rates decision, it is like watching extreme slow motion. For those who don't remember, I don't blame you, the Fed last raised rates in June of 2006 when Ben Bernanke had just assumed the job from Alan Greenspan. The mantra back then was one and done. Meaning that rates had peaked and were unlikely to go any higher for a while.

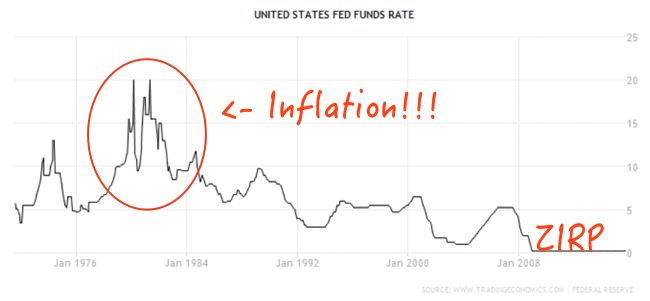

It wasn't until around the time the market peaked in October 2007 that it became apparent that the subprime lending crisis was something to watch out for, before the New Year rang in 2009 we had ZIRP, a Zero Interest Rate Policy. And since then it has been exactly like that, for nearly 6 years. And this was in stark contrast to the inflationary years and high rates of the late 70's and early 90's. No wonder the music was so "good". I'm kidding! It was excellent, Neil Diamond, Billy Joel, The Eagles, Michael Jackson, you had it all back then. Kramer vs. Kramer, The Deer Hunter and Annie Hall (never saw that one!). Anyhow, enough nostalgia, here is a 45 year representation of US interest rates, courtesy of Trading Economics:

If you must read it (try in your best Brooklyn accent, like Janet Yellen) September 17, 2015, there you go. Short, sharp and sweet. Only Jeffrey Lacker voting against. And Stanley Fischer? Voting to keep rates where they currently are. So much for that Jackson Hole speech, right? The closing line: "The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run." Your guess is as good as mine. Inflation, no problem, only problems are problems abroad that could impact on the US economy. No need to move right now, as you were. Time for the pundits to worry about the next meeting, which will be the most important in the history of all Fed meeting until the one after that. Sigh.

I enjoyed this and no doubt you will enjoy it too, the post is from Bob McTeer, a former Fed member, who wrote before the meeting started in a blogpost titled An Obvious Point About Fed Transparency: They Can't Signal What They Don't Know. Interesting. Like I said, move along, get back to more important matters of studying company annual reports, presentations, results, prospects, more reading to do. After all was said and done and over the seas and far away, stocks gave back their initial gains in New York, New York ending around one quarter of a percent lower. I noted that Eddy Elfenbein in his weekly mail pointed out the irony of it all, no 25 basis point hike, markets down 0.26 percent. He said that maybe they were just messing with us, of course he does not mean it.

Company corner

Some notable news out yesterday from AdvTech who announced Accelerates Growth Strategy With R82 Million Acquisition Of Summit College. You can understand why management were not keen to be taken over by Curro, they still have big growth plans for the company. There were two other big acquisitions relatively recent, with the R450 million Maravest purchase (4 443 students) on the 24 November 2014 and the Centurus Colleges acquisition of R750 million (3080 students) on the 16 September 2014. Summit College which is based in Kyalami has 590 students with the capacity to grow to 1 000.

This is a very exciting sector to be in and is well positioned to take advantage of the boom in the South African middle class as well as the increase in numbers of the current generation. From an outsider looking in, it would seem that Curro arriving on the scene and showing what can be done in the sector has awaken AdvTech. A bit of competition improving the RSA schooling sector.

Linkfest, lap it up

The general theory goes that your best long term/ risk adjusted returns should come from owning a proportion of the universe of assets out there. Clearly there are problems with assuming that we can all own a fraction of a Picasso, so most people opt instead to compare their asset growth to a large index like the S&P 500. It is a nice number to find, easy to use and covers some of the largest assets on the planet - 4 Reasons to Stop the S&P 500 Comparisons

Experience matters and the newer you are to something the more important it is to get some experience. At some point though the impact of more experience is very limited and may even hamper your performance by having past biases/ experiences push you in the wrong direction - The Experience Fallacy

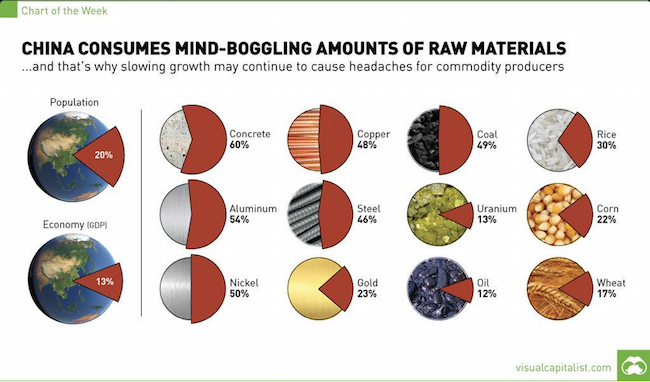

I found this graph on twitter yesterday. It is a bit mind blowing to see the amount of commodities that China consumes!

Home again, home again, jiggety-jog. Oh, and the Greeks go to the polls again this weekend. Perhaps that will be the biggest and most pressing story de jour next week. Or perhaps story de semaine (that is week in French for those who didn't pay attention in class). Syriza may be pressed hard by some folks that look a little more reasonable from an economic stand point, the breakaway party with the ex communist finance minister is polling really low. Perhaps people do not want crazy people in charge. That is almost always the case, it seems like a good idea at the time, implementation is hard. The mighty Japan stand between us and points, hopefully a solid display can mean we are real contenders, set the bar high.

Stocks across Asia are mixed, Japan is much lower, China is higher and Hong Kong is up around half a percent. US futures are a little higher, European futures are flat to lower. As baseball legend Yogi Berra (Yankees for life) said It's tough to make predictions, especially about the future. How right.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment