"Why raise the money this way? Part of the answer is that they intend to list the bonds on the open market segment in Frankfurt. Sound familiar? Sound like Steinhoff? The same person in common between Steinhoff and Brait is Christo Wiese, who is represented in both companies through his holding entity, Titan. Titan has a nice sound to it. The entity that represents the empire of Wiese (perhaps not all of it), as per the Brait annual report, owns 179.9 million Brait shares. At 130 Rand a piece, his stake in Brait is worth 23.38 billion Rand."

To market to market to buy a fat pig. On the local front in Jozi, Jozi stocks closed the day down 1.2 percent Friday, over the seas and far away stocks were higher by around half a percent, spread across the indices. Over in Asia this morning stocks are lower, some more evidence for Mr. Market that the Chinese economy is weakening. That has sent markets in that part of the world lower. What was interesting is that money supply in China is increasing, retail sales were better than anticipated whilst fixed asset investment is only growing at 10.9 percent year-on-year.

How terrible. I am definitely no economist, when I see gross capital formation at roughly half of GDP and growing at only 10.9 percent, that hardly seems like a hugely worrying number. I mean, the word plunge and cratering cannot be used in the same context as this release. Anyhow, the most encouraging part of the release over the weekend from China is that retail sales grew at 10.8 percent. If the country needs and is moving towards a consumption based economy, this sounds like a good number. What do I know, the general consensus on the box and everywhere is that China is "slowing", admittedly off a very high base.

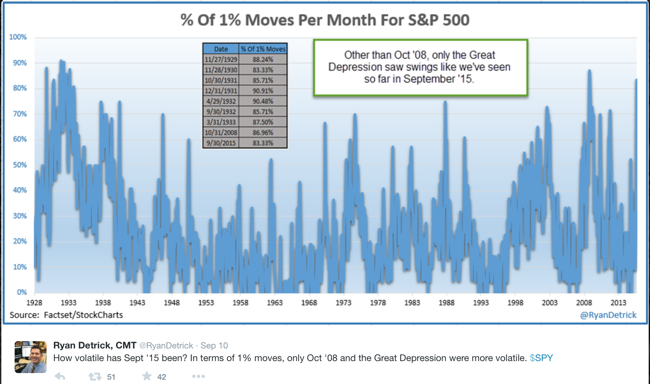

So China slowing still remains a concern until of course it is not, the other more sizeable issue that will dominate markets today and for the balance of the week is the Fed FOMC (Federal Open Market Committee) meeting. September 16-17, which is Wednesday through Thursday. The announcement and subsequent press release will reveal the current thinking. And no doubt be a huge market moving event, one way or another. I saw via Abnormal Returns daily message and linkfest that in terms of the recent moves in equity markets and the associated volatility, this recent period (September so far) has only been eclipsed by October 2008 and the Great Depression. The measure used by Factsheet and Stockcharts are 1 percent moves, be that up or down on a day, inside of a specific month. And we all know that this month has been very volatile. Of course the next 10-12 trading days could be the most boring ever. Here goes.

I am guessing that with the Fed meeting this week, volatility should continue for the balance of this week and then onwards to Thursday. And then I am hoping that "things" settle a little after the Fed have tucked Mr. Market into bed with their comfort blankey. Looking for reasons why markets have been volatile lately, look no further than the Fed and this meeting, which will be touted by the people on the box as the most important ever. It is always important, it should however never determine what companies you are going to own through the interest rate cycles, both on the way up in tightening and when monetary policy becomes looser. Keep calm and stay fully invested, watch these "things" with interest, know that with the businesses that you own very little else changes on a day to day basis.

Company corner

Whoa, what happened to Brait on Friday? The share price was slammed in early trade as the company announced a convertible bond offering, the terms themselves were announced in the closing auction of the market. The closing auction is around ten to five in the afternoon, the uncrossing price settles just after 5pm. This is when all the volumes on the buy and sell ends of the market match each other. Not only does volume dictate, more importantly, the price of the volume dictates where the share price will uncross in that last trade.

In the second announcement of the day the company announced that they had raised 350 million Pound Sterling via a convertible bond offering, carrying a semi annual coupon payment of 2.75 percent per annum. The conversion price i.e. where the bonds, the debt, converts to Brait equity is 7.9214 Great British Pounds, which at the current rate of 1 to 20.93 (wipe that tear away) is 165.82 Rand a share. Or, as Brait points out in the release, a 30 percent premium to the current trading price. Under the terms of the agreement from Brait and the bondholders, the company has the right to select whether or not they (the bondholders) get cash, shares or a combination of both.

Why raise the money this way? Part of the answer is that they intend to list the bonds on the open market segment in Frankfurt. Sound familiar? Sound like Steinhoff? The same person in common between Steinhoff and Brait is Christo Wiese, who is represented in both companies through his holding entity, Titan. Titan has a nice sound to it. The entity that represents the empire of Wiese (perhaps not all of it), as per the Brait annual report, owns 179.9 million Brait shares. At 130 Rand a piece, his stake in Brait is worth 23.38 billion Rand. The annual report also points out that "Dr CH Wiese also has an indirect beneficial interest in 1.5 million preference shares and 30 000 single stock futures with a nominal exposure to 3 000 000 Brait ordinary shares."

I suppose those may, or may not be open, I'll have to check the SENS closely. Total number of shares in issue as at the end of the financial year, 516.49 million. OK, so perhaps a listing in time in Frankfurt too, thinking out loud here. Michael has done a lot of math here across the desk from me. He worked out that each bond issued = 12624 shares (at that price of 7.9214 Pounds). Multiply that by 3500 and you get to 44.184 million new shares, should they be all issued. That represents a dilution of less than 9 percent on the current shares in issue. That was then the reason that the stock price found itself at that closing level of 130 Rand. Of course the board may choose to convert half of those, or none, or all, the resources are going to be yours as a shareholder.

And what to do with the money? i.e. What do you get for the dilution as a shareholder? "The Company intends to use the GBP350m proceeds from the offering for general corporate purposes with a primary focus on funding strategic acquisitions in line with its stated strategy of driving sustainable long-term growth and value creation in its investment portfolio." More unlisted businesses of size and scale and fewer listed businesses, it is their intention to sell their stake in Steinhoff around the listing of the shares in Frankfurt. They would then realise the funds in order to pursue other interests.

At the same time of this announcement Brait updated shareholders to three smallish deals, two businesses exited and one investment. Southern View Finance Limited, which represented 3 percent of their last NAV update was exited above the carrying value (as per the last update). They also exited a business called Chamber Lane Properties at above their last reported carrying value, the transaction represents only 1 percent of their total NAV. And lastly, an acquisition of 41 percent of a business called DGB (Pty) Ltd, representing 2 percent of total assets. Nothing earth shattering, just an indication that the company is twitching and moving fast. Who are DGB? The Boschendal and Bellingham farms, South Africa's largest independent wine and spirit producer and distributor. Which way Douglas Green? Now you know, in the Brait stable. The Bellingham farm dates back to 1693. This recent drop in the share price (like many others) is an opportunity to own the stock if you do not already.

Linkfest, lap it up

The saying being used a lot these days is"It's about time in the market not market timing". This saying is true if you own an index or a company with a bright future, not so much if you own a dud that only goes one way. You will be surprised at how many companies go the wrong way (about 40% according to JP Morgan) - Totally Absorbed. Note though that the research was done on the Russell 3000, which has many small companies in the index, small companies are more likely to blow up.

Would you invest with someone who said they probably wouldn't out perform the index in the year to come? Probably not. Most investors like to think that they are better than the average, same outcome if you ask people about their driving skills - Something Most Investors Simply Cannot Accept

Here is how the new iPhone stacks up against it's rivals, we will have to wait to see how they function in the real world because that is where it counts - Here's how the new iPhone 6S and 6S Plus compare to the top Android phones

Home again, home again, jiggety-jog. As we mentioned earlier, stocks are trading lower in Asia, US futures are mixed to flat. Metal prices are lower, I saw that Goldman Sachs had lowered their oil price to 20 Dollars a barrel, in their lower for longer environment. I also saw that extra production in the US is expected for this year and next year, the fracking revolution really has shaken things up. As for the Labour Party victory in the UK, who cares, they seemingly have been losing for a while. Talking about losing, that Serena loss on Friday evening was sad, I wanted her to "get it", the Grand Slam. Novak moves to 10 Grand Slam titles, in all 4 finals this year, that is pretty special too. Additional stimulus in China is all you will hear today on the box, the other story that dominates the headlines will be the Fed. And the mantra on Wall Street for decades has been, don't fight the Fed. And the tape for that matter, don't fight the tape.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment