"Volkswagen shares slammed on the brakes. No, no, they were skidding out of control. No, that is not it, they were Thelma and Louise'ing it. Why? It turns out that they were lying. Fudging emissions controls inside of the controlled environment, whilst on the open road the diesel emissions were far higher. Cheating and lying exposed is never nice for anyone (don't do it in the first place), most especially on a brand that you associate with quality and affordability."

To market to market to buy a fat pig. Stocks in Jozi, Jozi fell 0.6 percent, catching up to the worse session on Wall Street Friday evening, counterbalancing against the US Futures market that pointed to a better session later. And better it ended in New York, New York, the broader market S&P 500 closed nearly half a percent higher, blue chip stocks, the Dow Industrials closed up over three quarters of a percent whilst the nerds of NASDAQ closed nearly flat on the day.

Some of the bigger biotech companies have been taking a haircut as valuations become a worry. I suspect that in the coming weeks it will become apparent that with Dollar headwinds, we may well see the third quarter showing lower earnings in aggregate to the same quarter last year. And hence the market correction may well be justified to some extent. As a client and I chuckled about on a call yesterday, I don't care about the rest of the market, I only care about our stocks we agreed. You are never going to own the market in a portfolio that is well diversified. For the balance of the week we have the last read of 2nd quarter GDP to look forward to in the US, here locally we have the MPC deliberating on rates, in light of recent events globally we may well see the Reserve Bank stand back on rates for a while. No need to move higher for the time being. We will see tomorrow, most folks are expecting that.

Company corner

Volkswagen shares slammed on the brakes. No, no, they were skidding out of control. No, that is not it, they were Thelma and Louise'ing it. Why? It turns out that they were lying. Fudging emissions controls inside of the controlled environment, whilst on the open road the diesel emissions were far higher. Cheating and lying exposed is never nice for anyone (don't do it in the first place), most especially on a brand that you associate with quality and affordability. Mr. Market participants have bailed heavily, the stock lost the equivalent of the maximum fine of around 18 billion Dollars in market capitalisation yesterday. Ouch. Sounds worse than an Uno jam.

What may be worse for the company is that in the coming months, those folks who were interested in buying a VW would be swayed by public perception and turn their back on the brand. That is likely to impact on the workforce, who may well look for alternate employment. And in seeking alternate employment that may mean that the company fails to attract quality people, that would have a long lasting impact. Having said that however, the fellows over at BP survived possibly the worst PR and human environmental disaster (documented of course) of our time, the Deep Horizon Oil spill and subsequent fines were nothing short of staring over the precipice. It is a toss up for the regulators, you don't want to remove a powerful business that contributes to the global economy, yet you want them to pay for what they have done.

Shareholders bear the brunt (ordinary citizens' lungs have been filled with noxious gases too), it is their cash that goes to pay the fines and as such they will collectively make sure that this does not happen again. I suspect that the whole board will be replaced in time, internal management structures will come under scrutiny. And from that point on, you can be sure that the company will be more compliant than ever before. Too late, the horse has bolted. This is an incredible reminder that no matter how bulletproof you think a specific brand or how excellent your perception of corporate governance is of a specific company, that can all break in minutes. Decades and decades. Exxon will always have the Valdez oil spill of 250 thousand barrels of oil in the sea. The Bhopal gas leak tragedy in India, Union Carbide India Limited is to blame, as far as I understand it, that leak has never be cleaned up. Is that right? Recently there has been the Tianjin explosions, fingers pointed at Ruihai Logistics for warehousing the goods.

I suspect that it will get a whole lot worse for VW until it gets better. Rather late than never in exposing the wrong doings. A pretty dark day for German engineering and high standards that consumers are used to. And now for the fine. I guess that the dividend may be under serious threat, making them less appealing for institutional investors who are reliant on the cash flows. We wait and see, the stock looks cheap, it could get dirt cheap! Another remainder that as well as you may think you know a company, there is always something under the bonnet that is beyond your reach.

Apple's worst kept secret, project Titan was laid out in a WSJ article last evening -> Apple Speeds Up Electric-Car Work, the work force is expected to triple to nearly 2000. In fairness to Apple to have a crack, and others like Elon Musk, the combustion engine has not really evolved for decades, the same principles still applies. A self charging vehicle using the greatest energy source known to man (the sun) whilst you are driving (or the car is driving you) is first prize for me. No recharging stations, or getting supercharges of 2 to 3 minutes maximum would be the holy grail. And I am presuming that Apple will be competing in the company of Tesla, producing beautiful products that are functional and that work well. I think that there is enough space for new entrants. Or am I wrong, will Apple want to build a peoples vehicle?

For interests sake, Tesla has a market cap of 33.8 billion Dollars and sells less than 55 thousand (admittedly beautiful) motor vehicles a year, Volkswagen after the beating yesterday has a market cap of 62.64 billion Euros (70 billion Dollars) and sold 9.7 million vehicles in 2013. Some sort of disconnect between new and old technology and the future as perceived by investors. Total workforce, sales presence (Tesla sell their cars very differently) and of course maintenance networks. Tesla aims to sell you a car that you basically never need to service, good work if you can afford the price tag. A pre-owned Tesla S60 as per their website retails costs just under 60 thousand Dollars. That is the cheapest. The cash price for the vehicle for delivery late November is 75 thousand Dollars. Wow. It is going to take a long time for adoption, it is happening already. Time saving, energy savings, the future is here sports lovers.

Linkfest, lap it up

If you only read one thing this week read one or both of the following articles (we have shared both articles before but they are so good we thought we should share them again!). Here is the first - Everything Is Amazing and Nobody Is Happy.

Here is the second and probably the most mind blowing - 50 Reasons We're Living Through the Greatest Period in World History. I think many people are far too short sighted when looking at living standards and global wealth. Going back only 100 years, things were vastly different! Here are a couple of the facts that stood out the most for me.

"5. The average American now retires at age 62. One hundred years ago, the average American died at age 51. Enjoy your golden years -- your ancestors didn't get any of them."

"17. Median household income adjusted for inflation was around $25,000 per year during the 1950s. It's nearly double that amount today. We have false nostalgia about the prosperity of the 1950s because our definition of what counts as "middle class" has been inflated - see the 34% rise in the size of the median American home in just the past 25 years. If you dig into how the average "prosperous" American family lived in the 1950s, I think you'll find a standard of living we'd call "poverty" today."

"25. Relative to hourly wages, the cost of an average new car has fallen fourfold since 1915, according to professor Julian Simon."

"31. The average American work week has declined from 66 hours in 1850, to 51 hours in 1909, to 34.8 today, according to the Federal Reserve. Enjoy your weekend."

"32. Incomes have grown so much faster than food prices that the average American household now spends less than half as much of its income on food as it did in the 1950s. Relative to wages, the price of food has declined more than 90% since the 19th century, according to the Bureau of Labor Statistics." AND "In 1950, the average household spent 30% of its budget on food. Today, less than 13% of an average budget has to be devoted to food."

"44. From 1920 to 1980, an average of 395 people per 100,000 died from famine worldwide each decade. During the 2000s, that fell to three per 100,000, according to The Economist."

"48. In 1990, the American auto industry produced 7.15 vehicles per auto employee. In 2010 it produced 11.2 vehicles per employee. Manufacturing efficiency has improved dramatically."

"49. You need an annual income of $34,000 a year to be in the richest 1% of the world, according to World Bank economist Branko Milanovic's 2010 book The Haves and the Have-Nots. To be in the top half of the globe you need to earn just $1,225 a year. For the top 20%, it's $5,000 per year. Enter the top 10% with $12,000 a year. To be included in the top 0.1% requires an annual income of $70,000. America's poorest are some of the world's richest."

Despite conventional wisdom things are getting better for the average household in the US. The one key trend being observed is that people are using these low interest rates and payments to pay down existing debt, resulting in the average household leverage to be going down instead of up - Good news trumps bad news

As the global economy grows, innovates and changes, there are some areas that will benefit and other areas that will fade away - Wanted: Pilots to Fly Looming $5.6 Trillion Jet-Order Surge. According to the article, "Airlines across the globe will need to hire 558,000 new pilots over the next two decades to keep pace with surging travel demand". Think of how many more support staff will need to be hired. Change always brings opportunities (and pain) with it, you will probably find that the losers in this equation would be unskilled factory workers at the Boeing and Airbus plants.

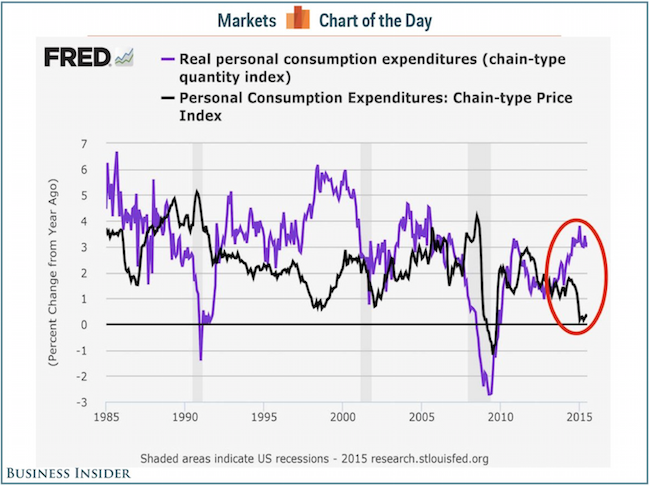

When looking at US consumption there are two ways of looking at it, the first is to compare the total amount spent on goods. The second way is to look at the total quantity of things bought - Americans are buying tons of stuff. The graph highlights how things are getting better for the consumer, things are cheaper! So the absolute amount spent on goods may not be rising but the number of goods bought is heading north.

Having a look at all the above data, things are far better than we generally perceive them to be.

Home again, home again, jiggety-jog. Stocks across Asia are mostly higher, as are European stocks. US futures are marginally lower. We should open higher here too, that would be a good thing, it feels like the great trudge through winter, that is what we can call this period, the great trudge.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment