"Nearly 65 percent of all sales come from North America and Europe, this is still very much an aspirational brand in many parts of the developing world. China for instance, Nike sales grew 30 percent in Dollar terms (yes, it sounds like China is finished), yet on a quarterly basis Nike does not even do one billion Dollars worth of sales. China sales are around half of Europe, roughly ten percent of global sales."

To market to market to buy a fat pig. I trust you all enjoyed heritage day yesterday. I didn't turn any meat of any sort, I am very sorry, tomorrow before the rugby, I have been invited by friends to turn some meat over hot coals. One thing that has struck me about this Volkswagen emissions scandal (lies) is twofold, one the headline from Wednesday was wrong, it was meant to say the "company's lies" and not the "companies lies." Thanks Paul for picking that up, apologies all around on our part.

Secondly and much more important, if we are seeing headlines like the diesel motor industry is called into question long term, what does that exactly mean for the platinum industry in South Africa? No wonder Impala Platinum was hit sharply Wednesday. Amplats too. The news goes from bad to worse for the platinum producers, if more battery operated motor vehicles are adopted by emissions conscious customers (of which there are very many in the developed world), that means less diesel engines, lower demand. In fact it is all above ground. Jewellery is becoming more important, a rising customer across the globe might underpin the industry, will it be enough to pick up the slack? Eish, I sure hope so for the sake of South Africa and the platinum sector that not too many changes are made, I fear the worst however!

Anglo American touched a new low in the UK yesterday, trading at nearly 621 pence. Many research reports that I have seen trade at a significant discount to their enterprise value, as much as around 40 to 50 percent. No wonder the value guys thought that the company offered significant upside not so long ago, however, their price in London is down a whopping 48 percent year to date. The Rand has cushioned the blow a little here in South Africa, the stock is down 36 percent in Rand terms on the Jozi all share. Possibly, on that price action in London today the stock will be plumbing lows seen 11 years ago. As far as I can tell, Coronation is the biggest shareholder of Anglo, with over five percent. And as far as I can tell, Coronation holds Volkswagen through the parent company, yech, it has been a tough time for them lately. Having said that however, Qatar Holdings saw a drawdown of more significant value with their much more significant stakes in Volkswagen and Glencore. It happens.

Company corner

Nike, one of the core Vestact recommended stocks reported numbers last evening, this was for the first quarter of their 2016 financial year. On a currency neutral basis sales increased 14 percent, up 5 percent in Dollar terms to 8.4 billion Dollars. Diluted earnings per share clocked 1.34 Dollars, up an astonishing 23 percent, due to higher gross margins, lower tax rates and most importantly a reflection of stronger revenues. Future orders in Dollars up 9 percent, excluding currency changes, up 17 percent. Yip, this is certainly, as their landing page of their investor relations says, a growth business. Tick that box! That is corny.

What is not corny, and the jeans manufacturers have alluded to this, is that the athletic leisure segment is increasing markedly. People wearing athletic wear as it is comfortable and stylish at the same time. The person wearing the clothes enjoys the comfort, the added bonus is that they are definitely stylish. And like Apple, they are not cheap, they are very expensive. CEO Mark Parker's comments in the Press release sum it up: Our relentless pace of growth is driven by our proven strategy of putting the consumer first, obsessing innovation in everything we do and leveraging our powerful portfolio. We're well-positioned to continue to deliver long term growth that is both sustainable and profitable.

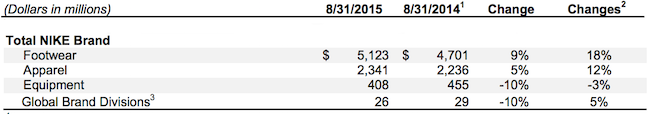

After all is said and done, Nike is still very much a footwear company, selling more than 2 Dollars worth of shoes for every one Dollar of apparel. Check it out from the sales breakdown for product line:

Nearly 65 percent of all sales come from North America and Europe, this is still very much an aspirational brand in many parts of the developing world. China for instance, Nike sales grew 30 percent in Dollar terms (yes, it sounds like China is finished), yet on a quarterly basis Nike does not even do one billion Dollars worth of sales. China sales are around half of Europe, roughly ten percent of global sales. Emerging markets as a collective are 11 and a half percent of total sales. There is clearly much room for growth, bearing in mind that you can't replicate quality at a cheaper price. Otherwise of course it would have been done.

Brand recognition is key, association is also key. All NFL teams are sponsored by Nike. The Indian cricket team is sponsored by Nike, perhaps they need to sponsor Bangladesh too (and Pakistan) to be branded in front of the most cricket eyeballs globally. Manchester City in the Barclays Premier League, no more Arsenal or Man U. They do have Barca FC however! As well as the national football team here. Only one rugby team, the Argentina team, and Saracens, well done Johann Rupert. The real Fed (Roger), Venus Williams (arguably the greatest tennis player in 25 years), Rafa and Maria Sharapova all are sponsored by Nike. US College sponsorship is strong, Byron once told me a story of a basketball team having to change to Nike to attract young athletes. True story.

The numbers crushed expectations, with the stock up as much as 8% in after hours trading. With many things in life, you get what you pay for and Nike is no different. The stock is not cheap at 30 times current earnings but is well positioned to take advantage of the growth in the global middle class, the shift to healthier living and the athletic leisure sector. Still a buy in our books.

Linkfest, lap it up

How big is our solar system? The video is 7 minutes long but shows how big our solar system really is, the earth is the size of a marble in the model that spans 7 miles from one end to the other - Earth is a marble in this scale model solar system in the desert

Instagram has added 100 million users this year, to reach 400 million. Instagram is also going to ramp up its advertising services which could see it hit $600 million in advertising for this year, a great purchase from Facebook for $1 billion - Instagram Hits 400 Million Users, Soaring Past Twitter

Facebook still dominates the smartphone with the average person spending 50% of their time using the app - You really only use three apps on your phone. The more that people adopt smartphones, the more eyeballs advertisers get access to and the better for the likes of Google and Facebook - These are the 25 most popular mobile apps in America

Home again, home again, jiggety-jog. Our market is slightly up with Gold stocks leading the way. Anglo is down 2.7% planning catch up from the movements in London yesterday. The Rand weakened to R/$ 14.00 while we were donning our traditional clothing and having a "chop an dop", it has recovered slightly to R/$ 13.86. Good luck to the Boks tomorrow!

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment