To market to market to buy a fat pig. There you have it folks, a downgrade from S&P and a 'we will probably downgrade you after the budget speech in February' from Moody's. Here is one of the reasons S&P gave for the downgrade, "reflects our opinion of further deterioration of South Africa's economic outlook and its public finances,". One of our readers sent me a document last Friday confirming that to be removed from the Citi Emerging Markets index, both Moody's and S&P have to downgrade us. So for now we are 'safe'.

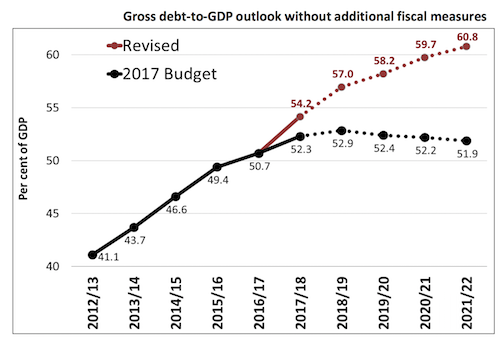

Here is the graph that summarises our problems. The red line needs to get back to the black line, which can either be done by increasing GDP growth or by lowering government spending. Compounding our problems is the under collections by SARS, in part due to leadership issues. The one saving grace is that around 90% of our debt is Rand denominated and not Dollar based. Thanks to our strong financial market, there is enough capital in the system to support the debt needed. Strict adherence to the constitution was another reason given for keeping our debt above junk, knowing that at some level the government is not a law unto themselves is positive.

Moody's has given us 90-says to try to get the red line back to where it needs to be; well at least pointing in the right direction. The two key factors in changing things will be who wins the ANC leadership in the next few weeks. More importantly though, will the hard choices be made when government tables the next budget. Changing a country's trajectory is likened to trying to turn a super-tanker around, it is possible but takes time. Having three months is basically no time at all. Cutting expenditure is very difficult, I wonder if the VAT increase to 15% is back on the cards again?

Economic growth will solve all our problems; it will bring our unemployment rate down, increase our tax collections and increase the denominator in the 'Debt/GDP' ratio. Economic growth is driven by confidence, and as the economy grows so does confidence. It is a self-reinforcing cycle.

Market Scorecard. It was a half day for US markets, enough time though to get back to all-time highs. The Dow was up 0.14%, the S&P 500 was up 0.21%, the Nasdaq was up 0.32% and the All-share was up 0.04% Woolies was the standout stock for Friday, up over 4%. I'm not sure the reason for the rally, maybe because their webpage was one of the only sites that didn't crash during Black Friday mania?

Linkfest, lap it up

One thing, from Paul

This week: $500 million to take out the trash; odd drug names; Koos Bekker leaves R20 billion on the table; and an advent calendar promotion that's gone wrong - Blunders - Episode 80.

Byron's Beats

I know I have been going on about Nvidia but the news coming out relating to the business is just too exciting to ignore.

GE has a very large healthcare division which manufactures all sorts of devices, more specifically scanners. Anything that processes images will improve it's quality with a Nvidia GPU.

This Business Wire article explains how GE and Nvidia have formed a partnership which will push AI into healthcare. Especially relating to image processing - GE and NVIDIA Join Forces to Accelerate Artificial Intelligence Adoption in Healthcare

Bright's Banter

Michael Milken is an American investor, former fund manager, and philanthropist . He helped develop what we know today as high-yield bonds. He's the guy that saved Howard Marks' career after he got fired as the equities head of research when he worked at Citi Bank.

By the looks of things, Milken's influence and legacy has inspired many hedge fund managers and financiers in the Los Angeles area.

Junk bond king Michael Milken looms large in L.A. finance industry

Home again, home again, jiggety-jog. Asian markets are all red this morning; expect a red opening for our All-share. Tiger Brands released their Full-year numbers this morning which looked good on the surface, their margins are growing again. Not much to speak of today for economic data releases. Looking at the week ahead, Naspers releases their six month numbers on Wednesday.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment