To market to market to buy a fat pig. It is one year on since we found out that Trump was going to be the next president of the US. In a speech he gave this morning in China, he took the opportunity to remind people of the 25% rise in the stock market over the last year, which has created $5.5 trillion in wealth. If he is taking credit for these record highs, what will he do when the next market crash happens?

It still hasn't fully sunk in that he is president, it probably won't for his whole 4-year term. I remember watching the US futures market tank over 4% on the news of his victory, a very temporary decline. By the time their market opened, things were well in the green and if memory serves the market was up around 2% on the close.

Market Scorecard. It was another quiet day on Wall Street, the market there actually started the day off in the red. The Dow was up 0.03%, the S&P 500 was up 0.14%, the Nasdaq was up 0.32% and the All-share was down 0.17%.

The saying 'when it rains, it pours', applies to Steinhoff at the moment; Steinhoff shares down on allegations of $1bn non-disclosures in Europe. The company released a SENS yesterday afternoon saying that they have complied with all regulations; time will tell if they are investigated around the allegations. Dr Wiese bought R120 million worth of shares last week, which tells you what he thinks of the current value being offered in the stock.

Company corner

Byron's Beats

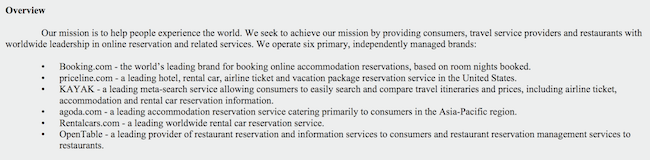

Many people do not know Priceline. The name of the of the company is not synonymous with it's strongest brands. In reality, this is an $80 billion online travel booking behemoth. Who better to explain what they do than the company itself. The following comes from their latest results report.

Incredibly, out of the brands mentioned above, 88% of Priceline's profits come from outside of the US Expedia (a competitor) is the biggest US player. Booking.com is Priceline's largest brand with nearly 1.5 million listed properties. The company reported third-quarter results yesterday which were horribly received by the market. The stock fell 13.5%, ouch. Let's take a closer look.

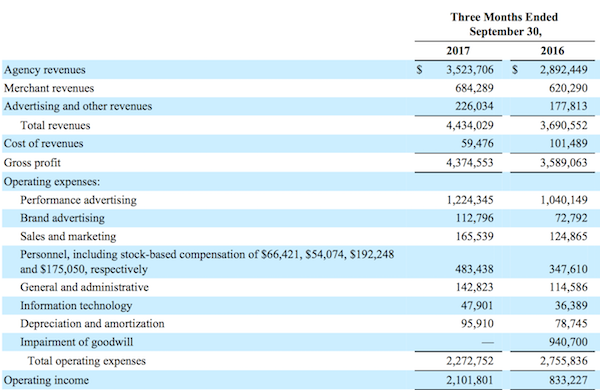

Agency revenues are travel related transactions where the group does not facilitate the payment. For example, if your guest books a hotel room via booking.com but pays directly to the hotel.

Merchant Revenues are derived when the payment is actually facilitated by the group.

Advertising and other revenues are derived mostly from KAYAK which is big referral system used by travel agents. OpenTable the restaurant booking service is included here.

The numbers were pretty good and beat expectations. Bookings increased by 19% to $22bn. Room nights increased 19%, while gross profits increased 22%. Earnings for the full year are expected to come in at $71 a share. That puts the stock at 23.5 times earnings after the share price drop. Not expensive at all for a fast growing tech stock with low capital costs and high profits.

Why did the share price fall so much then? It all relates to costs going forward. Sound familiar? I remember when Facebook shares fell heavily last year when management stated that margins would come down because of reinvestment in the business. Short term "investors" are fickle.

As you can see from the numbers above, their biggest cost is advertising. A vast majority of that actually goes to Google. Priceline is trying to take on Airbnb in the smaller home market. The problem with this market is that there are fewer rooms per advert. One advert for a 500 room hotel covers 500 rooms. An advert for an exclusive guest house with three rooms, will cost the same but result in fewer bookings. Priceline plans on spending big on advertising to continue growing their business; this will include TV commercials in over 30 countries in 2018. Those increased costs, pushed forward earnings guidance down and is why the share price took so much heat.

We see this short-term pullback as great buying opportunity into a world class business.

Linkfest, lap it up

Michael's Musings

Yesterday we spoke about Tencent's new listing of China Literature, which created about $6 billion in value for Tencent. There is another listing coming to market this week from the Tencent stable, their search engine Sogou - Tencent Could Repeat Its China Literature Trick.

Sticking with Tencent, it was revealed yesterday that they have at least a 12% stake in Snap Inc - The Chinese giant behind WeChat, Tencent, is taking a 10% stake in Snap. This means that owning Naspers means that you also have a small stake in Tesla and now Snap.

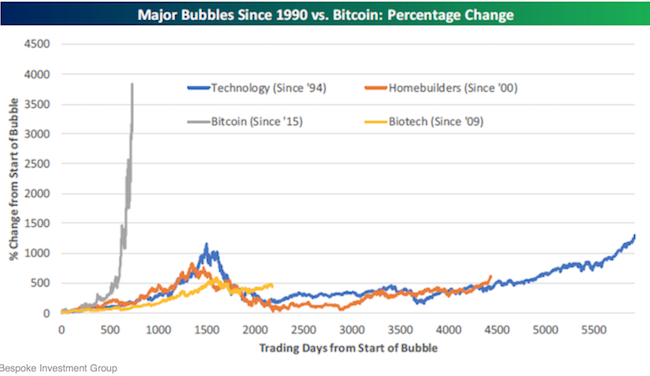

Are you brave enough to buy Bitcoin now? I avoided it when it was below $1 000, so I am definitely avoiding it above $7 000 - Bitcoin's 'bubble' is unlike anything we've seen recently. The price action around cryptocurrencies is fascinating; time will tell where these things settle.

Bright's Banter

What I am reading this morning:

- Gupta Leaks Are Finally Public

- In Saudi Desert Worlds Business Leaders Follow The Money

- Companies To Watch In 2018

- Russian Influence Reached 126 Million Through Facebook Alone

- What Could Apple Buy With Its Offshore Cash

You will find more statistics at Statista

You will find more statistics at Statista

Home again, home again, jiggety-jog. Data out today, pertinent to us in South Africa is our Manufacturing Production, Mining Production and Gold Production numbers. Moving across the ocean, it is Thursday so that means Initial Jobless claims from the US. Lastly, Apple finished off yesterday's session with a closing value above $900 billion for the first time! Onwards and upwards.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment