To market, to market to buy a fat pig. A big day Friday, markets locally had a fabulous day, courtesy of the interest rate sensitive stocks, resources and gold as a collective, the best performing sector year to date on the JSE. All around it was a great day to be long the equities market. The market ended the day within a whisker of the all-time high. I am starting again to read the headlines asking whether or not emerging markets are good value at current levels, this one from Barron's over the weekend: Emerging Market Stocks: Have They Hit Bottom? The author of the article is not exactly an expert, rather a volatility trader writing in his personal capacity, but often this line of thinking comes along with everyone else starting to wonder the same thing.

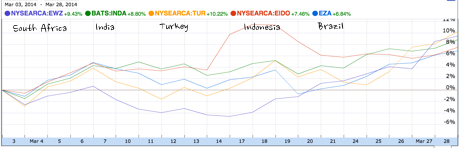

He talks about the fragile five in this article and if you take a closer look at the ETF's of the fragile five it is revealing. Turkey, Indonesia, India, Brazil and South Africa form the so-called fragile five, a term coined by a fellow by the name of Alan Ruskin, who is a global macro strategist at Deutsche Bank. The image below (because of space constraints) does not tell the whole picture, but basically it is the five ETF shares prices of the countries above. And as you can see quite clearly, they have "caught a bid" over the last month. The term "catching a bid" I saw was defined as institutional investor lingo for "moved up a lot".

A hard coded link to Google finance (all free of course) which will plot these five instruments (in Dollars of course) against one another: NYSEARCA:EZA, NYSEARCA:EIDO, NYSEARCA:TUR, BATS:INDA, NYSEARCA:EWZ. EZA = South Africa, EIDO = Indonesia, TUR = Turkey, INDA = India and EWZ = Brazil. Brazil of course have recently had a ratings downgrade, just one rung on the ladder above what falls into non investment grade, no thanks to S&P. BBB- and a stable outlook for Brazil, from the fellows at Standard & Poors.

Spain, India, Uruguay and the like fall into the BBB- category, India however has a negative outlook. Turkey? BB+. Ourselves? BBB. Indonesia? The same as India and Brazil, BBB-. So of the fragile five, we have the best credit rating, Turkey the worst. Turkey, a place where Twitter and YouTube are not constant. Imagine a weekend without that? Triple B minus up to Triple B plus have a ratings description of "Lower medium grade". All the way up to "Prime", Triple A rated, there are two other ratings, "Upper medium grade" (A+ to A-) and "High grade" (AA+ to AA-).

OK, So why should emerging markets be flavoursome again? I guess it is because people forget about the problems that faced us, and the flows are fickle. That is not great news for predictability and we know that the exchange rate is notoriously volatile, but at the same time the strengthening Rand is good from an inflation point of view. And remember that the MPC said that there had been a tight vote, 4-3 in favour of keeping rates on hold. Who would want that job? I am sure that there are many perks (there were probably many in the old days) but it is tough and perhaps you do not quite apply yourself in the same way you would as an academic. Perhaps our Reserve Bank needs a dual mandate, to find ways to stimulate growth in the economy!

Anyhow, whilst Barron's sends that article far and wide, the one from the FT (subscription only), titled Reports of death of EM are exaggerated possibly has more impact. The conclusion is that whilst EM stocks as a whole appear cheap, they are certainly not a bargain by any stretch of the imagination, but comparing the price difference between 1997 to current valuations, I think that is wrong too. But then again, who am I am to argue with the global chief investment officer at BlackRock, the author of the article, Russ Koesterich? You will be amazed to know that Blackrock has 4.3 trillion Dollars worth of assets under management.

Lynx, I'm reading this, you should too

I really liked this. Watching The Market Is Not Investing. The quote from Jack Bogle, the ETF punter and Vanguard founder: "The stock market is a giant distraction from the business of investing" is priceless and ranks right up there with the Warren Buffett one that you know well: "If you focus on the price, you're assuming that the market knows more than you do."

This one also follows on from the piece above, titled Shut up already! It's not 1929, it has the line: "It's a bull market for bearish forecasts". Meaning that the alarmists are in the ascendancy. Oh well. Be careful who you listen to is the conclusion.

Sometimes you turn the corner so many times that you bump into yourself. I saw an analyst reaffirm his rating of Blackberry, with a target price of 6 dollars a share. Currently the stock trades at 8.41, down 7 percent on Friday. Why? Shocking results, less shocking than anticipated, but revenue fell by 64 percent when measured against the corresponding quarter. Avoid, see the Barron's piece: BlackBerry Risky Despite Smaller Fourth-Quarter Loss. A 64 percent fall in revenue is nothing short of disastrous.

Very bad. I did not turn the lights off this weekend, but I am very good at turning lights off in general. Two interesting articles, firstly, examples of poverty as a result of wonk economic policies: North Korea: The winner for every Earth Hour since 2003; Odds favor them to be the winner again this year. I had no idea that there was an organisation celebrating Human Achievement Hour (HAH), who urged people to: "enjoy the benefits of capitalism and human innovation: Gather with friends in the warmth of a heated home, watch television, take a hot shower, drink a beer, call a loved one on the phone, or listen to music." -> Human Achievement Hour 2014.

Home again, home again, jiggety-jog. The market has turned, we were doing MUCH better earlier and now we are lower. I guess a few worries about French political outcomes over the weekend and inflation in the Eurozone heading in the "Japanese" direction. You know, deflation. And the Russians as far as I understand it from Paul (he saw a Tweet - it must be true then) are withdrawing a little from the Ukrainian border. The very best thing about today is that the Europeans have pulled themselves another hour closer to us, as have the English, meaning that all of our markets start at the same time.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment