To market, to market to buy a fat pig. We are still facing the prospect of the "regional power" (President Obama's words) Russia looking to muscle their way into the rest of the Ukraine whilst the rest of the world (the chaps with the money, of course, Zimbabwe and Malawi have been very silent on this Crimea matter) is dead against this. So much so, that they are willing to shunt through the IMF bailout quickly, in order to bring the Ukraine over to their side, read the FT article: IMF rushes through $15bn Ukraine bailout. Markets in the US turned tail after a fabulous start, the nerds of NASDAQ were at one stage up a lot at the start (two percent), but ended the day about flat, whilst the broader market S&P 500 sank 0.7 percent after being as much as half a percent higher at the open. So our market, which closed over half a percent higher on the day, would have to catch up today, expect a poor start.

In the background however is the Reserve Bank, which meets today, and the likelihood of rates staying on hold has risen in recent days. Like bread. Enough of that! So financials, banks and retailers have roared ahead as the prospects of a "normal" rate rising cycle not coming to fruition. The local economy is still weak, weaker than we would all want. So the demand side looks more than average, but not much more. The inflationary pressures that have been building as a result of the weaker Rand and steady to strengthening commodity prices, those are real. And if the Reserve Bank wants to be on top of inflation, then they must act when they see fit. But I envisage them, the Monetary Policy Committee to stay where we are for the time being. To stay steady.

Whoa. Pinnacle Technology stock has been crushed this week, I had to wait for the dust to settle a little before trying to make sense of it all. The 52 week high for the stock was 2662 ZA cents, that was in August last year. Yesterday the stock closed at 1145, down another 23.6 percent on the day, after having been down 25 percent the day prior. 10.7 million shares traded yesterday out of a total of 170 million shares in issue. Wow. That is a lot. That is around 20 percent more than the average weekly volume. In a day. The announcement from the company came after the market already knew, well done to Duncan McLeod and TechCentral for having leaked the news, before the company announced it. An executive director, in the form of Takalani Tshivhase was arrested an age ago by the Hawks (5 March), but the formal charges were only brought against him on Monday, this week. Tshivhase has been an executive director since 3 December 2003, a long time ago. And is also the chairman of the social and ethics committee of Pinnacle.

The official SENS that hit the screens said the following:

"The Company hereby informs its shareholders that Mr Takalani Tshivhase, an executive director of Pinnacle, has been charged with alleged attempted bribery of a Lieutenant General of the South African Police Service, with R5 million. This alleged incident occurred some 14 months ago, around 16 January 2013.Mr Tshivhase denies all allegations of attempted bribery, and will defend the charges.

From the evidence thus far available to the Company, the Company is satisfied that there is no reason to doubt the veracity of Mr Tshivhase's denial of the allegations."

Fair enough, the company has their trusty director and his side of the story and they (Pinnacle) will monitor the news flow. Tshivhase has according to Duncan McLeod and TechCentral (Scandal pushes Tshivhase from Pinnacle) taken a leave of absence from the company.

So all of that has led to roughly 40 percent smashing of the share price, but leaving even more unanswered questions than before. The company and some other shareholders have put on a brave face, BUT the unanswered questions are specifically around director dealings from the fifth of March all the way through to last week. From both Tshivhase AND Arnold Fourie (the CEO) have sold shares since then. Now surely this counts, as per the CFA ethics part titled Material Nonpublic Information the definition is pretty simple: "Members and Candidates who possess material nonpublic information that could affect the value of an investment must not act or cause others to act on the information." I might be mistaken, but I am presuming that neither Tshivhase and Fourie are CFA candidates or CFA charter holders, but the course itself and the ethical standards that it holds you to are pretty much covering all. I admit that I do not know what the JSE rules are on this, but if there is a violation, I am pretty sure that in days to come they will reveal all.

The quantum of the sales are simple enough to understand, 4 million Rand sold by Tshivhase (at 2000.06 cents a share), 23 million sold by Fourie (at 1917 cents a share) and a further two deals done by directors of subsidiaries of just over 1.6 million Rand (at around 20 ZAR). All in, it is around 0.85 percent of the shares in issue, Fourie did some more aggressive selling (and buying) earlier in February and January this year, as well as in December.

The company put out another announcement last evening. Titled: Update announcement. Very detailed. Which deal with these sales of shares by the directors. "The matter is now sub judice and the Company has been advised that it would not be proper to elaborate further on this aspect of the matter."

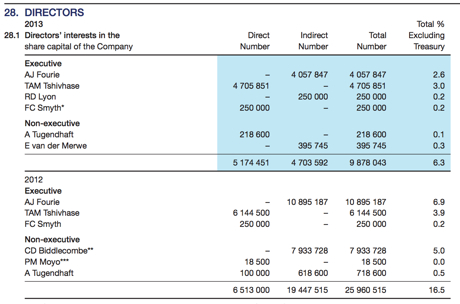

The 2013 Pinnacle annual report reveals that whilst the directors might have sold shares just the other day, they still have significant stakes in the business, check:

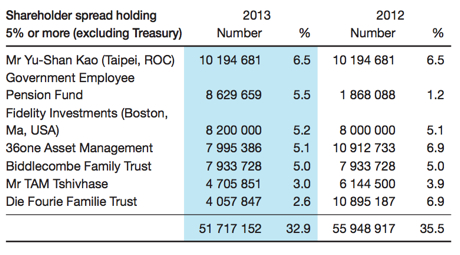

It seems that from 2012 to 2013 the directors had receded their collective holding to the company by ten percent overall. The total bunch of material shareholders are as follows, also as per the annual report, who knows how significantly it may have changed over the last few months:

But one of my last points is to show how the shareholder mix changed from 2012 to 2013, as many retail investors did not want to "miss out" on what became a market darling. Check how the number of retail (I am presuming because of smaller quantities) investors went from around 4500 (out of a total number of 4900) in 2012 to 7200 (out of a total of 7500) in 2013. And the way that I quantify that is simple, folks with under 50000 shares would be considered retail investors in my book, there is significant value further up, but the company says in their shareholder analysis that over 7000 shareholders were classified as "other investors" in other words , not insiders, not funds and financial institutions and not the PIC. Collectively those seven thousand shareholders own 38.5 percent of the business. Those are the folks (along with the institutions no doubt) who would definitely have very little knowledge of this news that no doubt the company and insiders knew that this was brewing.

What are the longer term implications for the company? The market is presuming that there is something afoot here. According to the annual report, Tshivhase had "a successful and varied career in government and commerce" before he came to Pinnacle. That means nothing really, I guess, that could be anyone. The dangerous presumption that everyone makes is that he, Tshivhase, is guilty, before he has had a chance to appear and exonerate himself in a court of law. And if indeed that is the case, he is found guilty, then plenty of question marks will abound with regards to any government business that the company has. Or business practices themselves. But I would hesitate to jump to conclusions, innocent until proven guilty.

And as such, the market is doing what they do, sell first and ask questions later. And I guess that those questions could be asked already behind the scenes with their customers, who perhaps would prefer to do business with ANOTHER business, even though these allegations have not been proven to be true, or false for that matter. Probably comfortably overdone, in terms of the selling, but there could be many geared positions that were also stopped out in a rush, as well as some shorts waiting for further bad news. The only potential good that can come out of this is that many businesses will be against the temptation of bribing government officials. And on that note, in the CNBC Africa hallways yesterday Thuli Madonsela walked past. And everyone was in awe of her presence and power. She is certainly a heroine of many.

Minx links, I'm reading this, you should too

How is the world getting better? You are always hearing stories about how terrible everything is. Here is a story of how the world is getting better, slowly. You remember the whole Mesofacts thing? "Life expectancy has gone up worldwide. Child mortality has shot down. The number of kids who die before the age of five has halved worldwide in the last 20 years. The number of people dying of violence — either on the battlefield or from domestic violence or from murder — is dropping pretty much worldwide. Last year there wasn't a single declared interstate war."

"Business and consumer sentiment in Russia remain weak. In 2013, frail domestic demand dragged the Russian economy close to stagnation." This is according to a Russia Economic Report by World Bank. Well good luck with everything you have been up to lately!!

Wow, this is pretty big: Instagram Reaches 200M Monthly Active Users. And 50 million of those users have come in the very last six months. Amazing. Good timing Facebook.

Oops. Candy Crush maker, King Digital Entertainment had a horrible, no good IPO, via the WSJ: 'Candy Crush' Maker Tumbles in Debut. I for one cannot tell you anything about Candy Crush, I have never, ever partaken, but Byron was very disparaging of Candy Crush! He has never played it but thinks it's a fad. Who gets blamed? Well, Bloomberg View has this take: Underwriters Let King Digital Get Candy Crushed.

This was interesting. For all the bubble and talk of overheated tech markets, this article: Three charts that show we're not in a tech bubble (yet).

Home again, home again, jiggety-jog. Stocks are taking some tap here, down around two thirds of a percent. The Rand has firmed a little ironically. But we will have our eyes firmly on the MPC, that is around three-ish this afternoon.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment