"The company will continue to attract more and more customers as bandwidth improves across the globe. We continue to be very optimistic about the future of this business, we will have to watch the trends very closely however! We continue to accumulate, the stock has popped sharply post the results, thanks to the comfortable beat."

To market to market to buy a fat pig The Rand is firmer, that is being attributed to the deputy president standing behind the finance minister, or so we are to believe. The Dollar index is also a little weaker against a basket of currencies, I did notice that the Dollar Euro exchange rate went through the 1.10 mark. Stocks sold off, led by industrials, financials were the only stocks that were up. Well let me rephrase, of the majors, financials and banks were the only stocks that were better on the day. FirstRand and Standard Bank at the top the majors leaderboard, Richemont after a monster week last week slipped sharply, down over 3 percent. Tiger Brands also found themselves deep in the red, down over two and a half percent as the company received a broker downgrade. The more I do this the less I pay attention to the short term moves.

I told this story to one of my favourite clients yesterday (you are all my favourites), and it relates to an irritable Johann Rupert at a Richemont results presentation. It goes something like this, forgive me if I don't get it one hundred percent right. The board of Richemont is being grilled by the analyst community, asking why don't you do this, what about that and so on, smart and pertinent questions from the analyst and investor community. A visibly out of comfort Rupert pointed out that the board had years and years of experience, on average (if I remember right), close to 15-20 years each. At Richemont alone.

He then asked the analyst community in front of him, who had worked for their present employers for around five years. Two-thirds of the hands went up, he then asked who had worked around ten years, fewer hands went up. He then asked who had worked for their present employer for much longer than ten years, and said that he knew the answer. I think it was a single fellow, it may have been two. His (Rupert) point was simple, how can you possibly tell me and the board how to run our business here, when you cannot even stay at your own job for more than five years, average. We are trying to build a long term business here, not please the analyst community. And I remember being struck with his comments and thinking, you are right, here we sit and judge and suggest that they should do x and y, the managers of the business have everything to lose reputationally and for their shareholders.

It is a bit like cricket. As a batsman you can make one mistake and it is over. As a bowler, you have six balls, you go away and think about it at long leg and then you come back and start all over, with another six balls. As an owner of the business you can, as the batsman, choose to attack and defend and make sure you never "get out". If the folks that run a business obsess about the share price a lot and less about the business, be wary. Anyhows, as usual, Rupert in his own special and marginally gruff way nailed it. I think straight after that comment he lit up a cigarette during the televised meeting (he has quit smoking since then). And that is why if you and I are into ownership of a business, broker upgrades and downgrades come and go. Whilst they are important and well thought out, they are definitely not the be all and end all of investing. On the contrary. I can't believe that we throw so much weight behind what is essentially a prediction, like anyone else. Tough out there.

OK, quick market round up here, the all share fell three-quarters of a percent to end the day at 50769 points. The one year return is down 4.54 percent. The Rand is "quite strong", 14.08 to the US Dollar, 17.19 to the Pound (I can't hear the Barmy army singing now) and 15.51 to the Euro. Good work Mr. Rand. Randelas! Just remember that if you have cash and are being reckless with it, Tata Madiba is smiling at you and urging you to be more frugal. Save more!

Over the hills and far away, where earnings season has kicked off, it was a dull day for stocks. Mostly hugging the thin red line until the second half of the session, where stocks fell away, ending the day marginally lower. The nerds of NASDAQ fell a quarter of a percent, both the Dow Jones Industrial Average and the broader market S&P 500 fell 0.28 percent. Energy stocks were the main losers, down over half a percent as the oil price drifted away.

I don't think that the oil price freeze is going to stick, many of these governments have hectic obligations and were factoring in much higher prices. I have read stories about Saudi civil servants having it tough, this is bizarre though - Cash-strapped Saudi Arabia switches to Gregorian calendar to pay civil servants less. Wage cuts aplenty overtime and annual leave payouts capped. Believe it, salaries accounted for 45 percent of Saudi government spend in 2015. It is always very important to have a diversified economy and to encourage risk taking. The news may continue to be not so good for civil servants in that part of the world.

Company corner

There were a few management shuffles announced, the Caterpillar CEO Doug Oberhelman is set to "retire" earlier than planned, the journal cites ill timed bets on China. And mining equipment, read Bucyrus. Sales are down every year since 2012, mining spend has been cut back as a result of the commodity prices retreating from record highs, oversupply and the demand side cooling. It is not that the main customer has stopped buying, the rate of growth is lower. And supply is so much more. And by extension the equipment purchases have slowed. And Doug Oberhelman is the "coach", he takes the rap. I guess someone has to, right?

Visa announced a CEO succession plan, indicating that CEO Charlie Scharf would resign as he cannot commit 100 percent to spend the time in San Francisco. What the hell? Does he not like catching the tram or something? Does staring at Alcatraz give him the heebie-jeebies after watching that dumb movie with the green balls and Nicholas Cage? Is he a cyclist or runner and the hills are getting him down? Or is the family life taking strain and the commute too much? Whatever the reason, Alfred F. Kelly, Jr. (not related the Alfred E. Neuman) will assume the reigns of what is an incredible opportunity for him personally. A 23 year veteran of American Express, Kelly was in charge of Global Consumer and Consumer Card Services groups. Yes. Kelly is currently a board member at Visa, the company and the culture is nothing new to him. Scharf will deliver results for the last time next Monday evening. Look out for those sports lovers. I personally cannot wait.

Netflix reported numbers after hours, the company has certainly kept relevant with the times. They used to be a DVD mail order business. You remember mail? Oh, and you remember what a DVD was too? And I am even guessing that you remember what a Blu-Ray was too? Don't feel too bad if you still buy those things, you are certainly not alone. And you remember dial up internet, the thing that used to ping and twang and make that amazing "handshake" sound? Ha ha, those were the days my friends, when websites had very few images as the internet speeds sucked so bad you couldn't download anything except some text. And a few images here and there. Nowadays we want a pipe into our living room to serve us nothing but the best streaming entertainment. Personally I am a Netflix user, I enjoy the original documentaries. That stuff from Netflix is good, I have watched the "Chef's Table", season one and season three (the French version - not finished yet). World class, for any foodie it is a must watch, plenty fun. Dan Barber and Massimo Bottura were my favourites.

OK, I know you couldn't give a rolling donut what my favourite shows are. We are more interested in the Netflix Q3 numbers. This is the first quarter of more than 2 billion Dollars of revenues. There are now 87.78 million paid subscribers around the world, paid memberships outside of the US has clocked 40 million, growing at a breakneck speed. The company is still making a loss in their international business, it will be about scale in he end, scale and most importantly content. I am a scaredy-cat and I am unlikely to watch Stranger Things (Byron says it is good, Ill take his word for it), and the second season of Narcos, these new shows are being lapped up by the customers.

All of the metrics were ahead of their guidance, net income clocked 52 million Dollars, earnings per share for the quarter was 13 US cents. Operating margins are 5.1 percent, they are interestingly seeing margin expansion, up 90 basis points since this time last year. We were discussing the customer numbers here in the office, the slackening of the US numbers and the ramp up of the international numbers may well be as a result of the crackdown on IP masking. i.e. trying to fool the inter-webs as to where you are coming from, in order to access the full US content. As the content improves in the offshore environment there will be more and more international users. It is an amazing concept. Netflix accounts for around 35 percent of all North American internet traffic. Makes you think, not so?

The biggest risks to a business like Netflix is not being able to deliver the content. It is incredibly easy to quite simply turn the Netflix tap off. Take a break from the service to use one of the competitors. Amazon for instance are spending a lot more on content and have the ability to be able to ramp up more, they certainly have an awful amount of resources over there in JeffBezosVille. The company will continue to attract more and more customers as bandwidth improves across the globe. We continue to be very optimistic about the future of this business, we will have to watch the trends very closely however! We continue to accumulate, the stock has popped sharply post the results, thanks to the comfortable beat.

Linkfest, lap it up

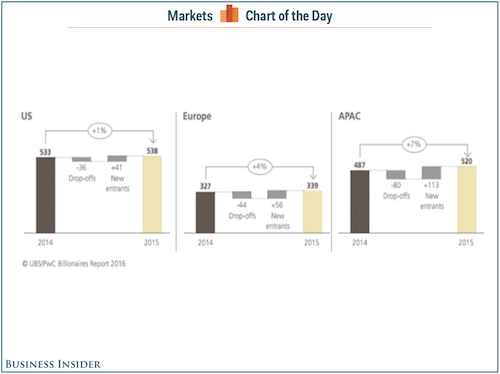

This is an impressive creation of wealth - China gets a new billionaire every 5 days.

The weakest part of any secure information, is the flesh and blood that controls the passwords - Russian Hackers Faked Gmail Password Form To Invade DNC Email System or in this more extreme case, where US and Israeli hackers managed to attack the Iranian Nuclear program thanks to someone inserting a compromised drive into their computer - Stuxnet Attack On Iran's Nuclear Plant.

I love it when marketers think out of the box. Having drones hovering above drivers, 'sledging' them is a very clever way to get your brand noticed. It is probably also illegal in many countries - Uber's Ad-Toting Drones Are Heckling Drivers Stuck in Traffic

Home again, home again, jiggety-jog. Futures are higher across Europe, this is a big earnings week across the US. There is a small matter of Chinese GDP tomorrow. More exciting is that JNJ report tonight. Stand by sports lovers.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment