To market to market to buy a fat pig. Behavioural Economics is a relatively new branch of the economics field. In economics there are many assumptions made in our models, the main assumption is that people/agents are rational. The first thing Behavioural Economics tells us is that people are far from rational.

Yesterday's winner of the Nobel Prize in Economics was Richard Thaler, one of the leaders in Behavioural Economics. You might remember him from the movie The Big Short (Before winning the Nobel Prize, Richard Thaler cameoed in an Oscar-winning film - with Selena Gomez). Here is a cool article about some of the irrational decisions you make, most of the time unknowingly - The flaws a Nobel Prize-winning economist wants you to know about yourself.

One of the things Thaler pointed out is how changing the way a pension plan is presented makes a huge difference. Going from, 'do you want to opt-in for pension' to 'pension is the default, do you want to opt-out' has made a significant difference in the US. Thaler estimated that over $7.6 billion extra is saved annually thanks to that small change.

Another irrational behaviour picked up is that we generally think we are better than the average. For example 92% of drivers think they drive better than the average. If you think that you don't make the same mental mistakes as the average person, you are probably wrong (your first mistake). Investopedia has a 12-part blog post on the different errors we make, Behavioural Finance. Some of the topics include 'Gamblers Fallacy' and 'Confirmation Bias'.

Market Scorecard, the Nasdaq's 9-day streak of record highs came to an end yesterday. The Dow was down 0.06%, the S&P 500 was down 0.18%, the Nasdaq was down 0.16% and the All-Share was up 0.52%. I would say that as long as Naspers continues to charge higher, our market should stay in record territory. Naspers is now above R3 200 a share. This week marks the start of US earnings season, if all goes according to plan, earnings will be higher which could spur a 'Santa Clause rally' going into the end of the year.

Company corner

Byron's Beats

Yesterday after the market closed, Famous Brands released an ugly looking trading update. The main focus was on GBK, their recent acquisition in the UK. That business produced a loss of 872 000 pounds. Here is what they had to say about GBK.

"Disappointingly, GBK recorded a PBIT loss of GBP872 000 for the period. This loss is primarily attributable to the prevailing adverse trading environment in the UK, however, as noted in the update, the Board of Directors ("the Board") is confident that innovative interventions currently being implemented in the business by management will have a positive impact on future performance. These measures include intensified focus on the management of new restaurants opened, improving operational efficiencies, and enhancing cost controls - including curtailing the opening of further restaurants in the short term given the high pre-opening capital costs, averaging GBP1 million per store."

Another South African company hurting in the post Brexit British environment. The problem for Famous Brands is that they used to be debt free and a good dividend payer. After this acquisition they now have financing costs of R138 million. Usually an acquisition like this would at least be earnings accretive. GBK is making a loss.

Because of this, headline earnings per share are expected to be down between 54%-63%.

Famous Brands have an incredible track record at making restaurant chains successful. We should give management more time to implement what they set out to do when they made this acquisition. The stocks is down heavily today, we do not think it is a good idea to sell after a knee jerk reaction. Let's be patient here.

Linkfest, lap it up

One thing, from Paul

I liked this blog post by David Merkel, about the virtues of keeping things simple when investing.

These are his top points: keeping things simple (like in a portfolio of direct equities) means that your holdings will be understandable and explainable. You will avoid crazy fads, so there is less risk of something blowing up, and you being accused of being "too smart for you own good". If you own well selected companies you don't need to trade them. So your tax returns will be straightforward (and you'll pay less tax). Last but not least, simple investments don't have expensive, hidden asset management charges.

You will be happy to know that your Joburg and/or New York portfolios with Vestact checks all these boxes!

Go and read the whole post here - The Many Virtues of Simplicity

Michael's Musings

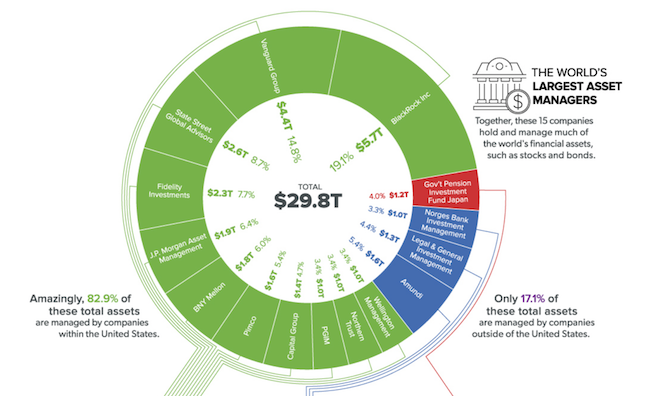

It is rather mind boggling that not one but fifteen companies have more than $1 trillion under management. Depending what exchange rate you are using, that is around 4 South Africas! - The Trillion Dollar Club of Asset Managers

Sticking with the tricks our brains play on us, I had never heard of the 'nocebo' concept but it does makes sense - Meet the nocebo effect, the placebo effect's evil twin that makes you feel pain

Bright's Banter

A friend of mine wrote this beautiful piece on transformation and feminism lite with regards to KPMGs new CEO Nhlamulo Dlomu. The gist of the story is that one of two extremes is inevitable. We will remember her as the knight in shining armour that came and saved KPMG from a near death experience or she'll go down in history as the woman who was assigned to save KPMG and failed dismally. I had the pleasure of meeting her last night, she's amazing and I wish her everything of the best in life - KPMG SA The Fallacy Of Feminism And Black Women In Leadership

Home again, home again, jiggety-jog. Asian markets are all well in the green and Tencent over in Hong Kong is up around half a percent, so expect a green start. Significant data for today is a Manufacturing Production read for South Africa.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment