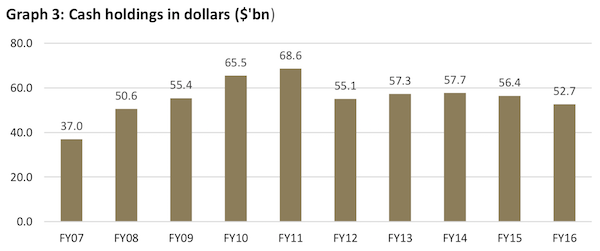

To market to market to buy a fat pig. Last month intellidex, a research firm focusing on the financial sector, released a report titled The Myth of Corporate Cash hoarding. The basic conclusion is that RSA corporations aren't holding that much more cash on their balance sheet than they have in the past.

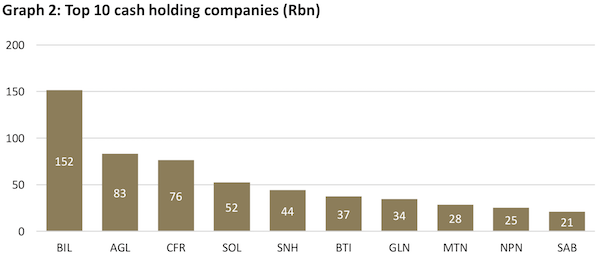

Given that the biggest companies in RSA are all multinationals, the data doesn't strip out cash holdings in Rands or international companies, and more importantly doesn't strip out investment in South Africa vs investment offshore. Having a look at the picture below of top 10 companies in the study, BHP Billiton don't have South African operations, Richemont only have a handful of stores in South African and Sasol are sending all their spare cash to the US to build the ethane cracker.

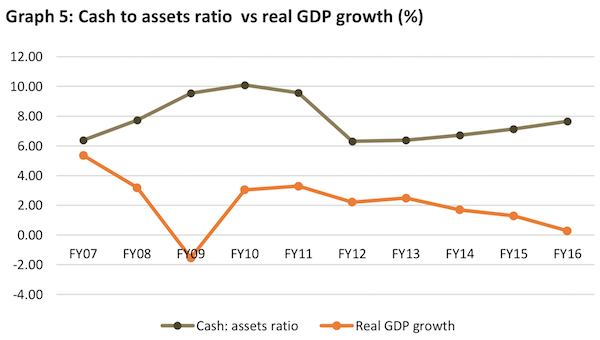

A worrying finding for jobs in South Africa, is that the expected return on new mining projects is lower than the cost of capital (interest rate on debt), which means expanding will shrink profits instead of growing them. The final paragraph of the report, sums up all you need to know though.

"Cash holdings are directly responsive to economic policy. A policy environment that promotes economic growth and provides certainty is likely to reduce firms' caution about economic conditions. That will free up cash for investment, while improved policy is likely to improve prospective returns on investments. Ultimately, company investment decisions are driven by the prospect of good returns, and the current trajectory of declining economic growth is dimming those prospects."

Market Scorecard. Our market broke into the 57 thousands for the first time yesterday, joining its US counterparts at record highs. Here is the scorecard, the Dow was up 0.5%, the S&P 500 was up 0.56%, the Nasdaq was up 0.78% and the All-share was up 0.44%.

Linkfest, lap it up

One thing, from Paul

Josh Brown is a top class blogger. He's a New York-based financial advisor, and CEO of Ritholtz Asset Management. He's a regular on US CNBC's lunchtime show Fast Money, and a great follow on Twitter.

In this post from yesterday, Josh wonders why US stocks seem to consistently trade at higher valuations than those in European markets. A similar big-cap blue chip sector leader in the Euro area trades about 70% cheaper than its US counterpart. Here are his concluding paragraphs:

Structurally, [the US] has higher margins, cheaper equity capital and a better tax system (despite the spurious claim that taxes on US corporates make us non-competitive – it's actually not true). We also have more flexible labor markets here and are better at refinancing debt at lower rates.

The most interesting question is whether or not this premium will exist forever. Or, if it is permanent, should it really be 70%? And what will be the drivers of this spread narrowing in the future – falling US price/book or Euro indices rising to meet ours at higher levels?

Read the whole thing here - Why Are European Stocks Chronically Cheaper Than US Stocks?

Byron's Beats

When Warren Buffett speaks, people listen. He was on CNBC a few days ago and as always was very entertaining. This Market Realist piece goes through each topic that he touched on. If you are interested in US stock valuations, Guessing the stock market, US taxes, Wells Fargo, Bank of America and Index funds, click on the link below - Buffett's Latest Word on Stock Valuations, Holdings and Taxes.

The Netflix share price popped 5% yesterday to an all time high of $194. The stock is up a whopping 1944% in 5 years. The reason for the share movement was because they announced an increase in the pricing of their premium products (HD and 4K streaming on various devices). Netflix is raising prices, especially if you like 4K. The market clearly thinks that subscribers will easily absorb these increases so that they don't miss out on the second season of Stranger Things.

Normally when Amazon take something on, they win. If I were a delivery service I would be worried. This Bloomberg article titled Amazon Is Testing Its Own Delivery Service to Rival FedEx and UPS explains the new efforts Amazon are taking to go more mainstream in delivery. Just cutting out another link in the retail chain in order to make things cheaper for the consumer.

Home again, home again, jiggety-jog. The Asian markets that are open today are up this morning and European futures are green. For consumers, a strong Dollar and high oil price doesn't bode well for our petrol price going forward and by extension lowers the chance of an interest rate drop when the MPC meets in November. It is that time of the month again, non-farm payrolls number will be released in the US; the number is probably less significant this month given all the noise and once off impacts created by the two hurricanes. Good luck to the Bokke and Proteas this weekend. Next week Asian markets will be back to normal.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment