To market to market to buy a fat pig. US markets continue to surge. As I look at it, I would say that Trump's proposed tax plan is the main reason. We haven't had any North Korea news for the last few days, and China is closed for their Golden week/New Year, so no news from them either.

Here is the scorecard, the Dow was up 0.37%, the S&P 500 was up 0.22%, the Nasdaq was up 0.23% and the All-share was up 1.04%. With our market within a whisker of all-time highs, it is no surprise that Naspers is at an all-time high. It closed up 2.9% at R3 058 a share, well into the R3 000's now.

Interestingly, between 2003 and 2010 the stock was already a 'ten-bagger'; it went from around R30 a share to R300. It was in 2010 when Vestact started adding Naspers to our portfolios and the feeling in the office was that we had probably missed the initial growth surge but that going forward it would still have decent growth. You know, growth where you double, maybe triple your money over seven years. Over the last seven years, Naspers has been another ten-bagger! Will they be another ten-bagger over the next seven years? Probably not but with exponential wealth creation in China and the untapped potential of the internet, who knows.

Company corner

On Monday night Tesla reported their Q3 2017 Vehicle Deliveries and Production Numbers. As expected, it was a record quarter for production, and they are on course to produce over 100 000 Model S and X vehicles in 2017. There were some teething issues with the Model 3 production meaning they only produced 260 of them instead of the anticipated 1500 for the quarter. The company are confident that they will overcome the bottlenecks in the production line though.

Linkfest, lap it up

One thing, from Paul

My favourite US hamburger chain is Shake Shack, and naturally I'm also a shareholder. The company announced yesterday that they are opening a new store in Astor Place (lower Manhattan, in the East Village). Here's why that is newsworthy: robots will replace humans and cash won't be accepted.

Customers will place orders via an app or at touch-screen kiosks inside the restaurant. Human workers called "hospitality champs" will guide diners through possible tech glitches as they place orders at the kiosks. This is the future people! Sounds delicious - Robots are replacing fast food workers at new Shake Shack

Michael's Musings

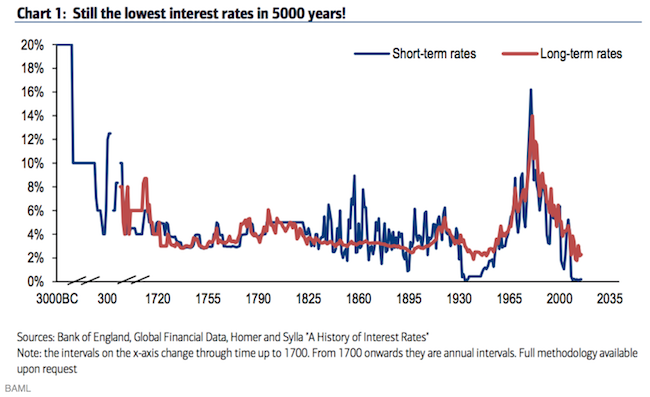

As we spoke about yesterday, interest rates are central to asset values - The 5,000-year history of interest rates shows just how historically low US rates still are right now. I thought historic interest rate would have been higher given the increased risks with a less developed financial system.

Would you fly in an aeroplane that didn't have a pilot? Most people wouldn't but in the future I think things will change - Airlines could cash in on a $30 billion opportunity that would make pilots obsolete.

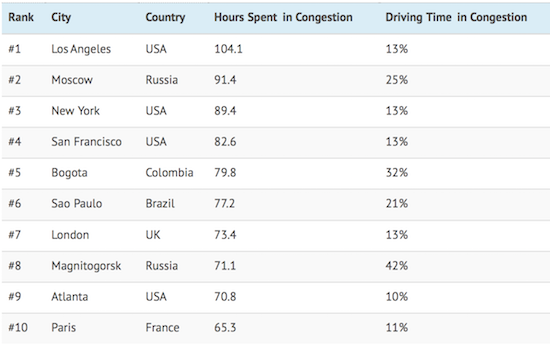

Imagine spending over 100 hours a year in traffic!? Here is a look at what congestion looks like around the world - The Most Congested Cities. Cape Town is slightly worse than Johannesburg for the South African cities.

Home again, home again, jiggety-jog. Our market is green again this morning, Naspers is up another 1%. Later today are the US's crude oil inventory numbers, something to keep a close eye on considering last nights fuel price hike.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment