"It took Facebook 25 months to get from 200 to 700 million users, it took WhatsApp only 21 months, the graphic from the link shows it all. It seems that Facebook will be a company that has two platforms (soon) that have one billion users. 300 million is where Instagram is now, surpassing Twitter, the milestone was reached in the first half of December."

To market, to market to buy a fat pig. A horrible no good day for satirists and cartoonists around the world with the tragic deaths of multiple staffers of the French satirical publication Charlie Hebdo. This is not the first time that this has happened for this specific publication, five cartoonists, one economist and two police are amongst the dead, a sad and tragic day for France and journalists globally. However, questions need to be raised about what leads people to undertake such acts, why and how can those three men do such a thing. I cannot and will never understand, nor do I think that it is my place to get involved in such acts, there are other people better suited to analysing this incident. Not me, stay away from politics and religion.

The local market here yesterday had a cracking day, ADP employment report (the precursor to the non farm payrolls on Friday) registered a pretty big number (241 thousand) and that boosted the US markets. The trend has been a stronger recovery in the US, less austerity. Michael and I were having a discussion around the number of employees in the oil and gas sector, where would those folks be categorised? Surely with lower energy prices, there will be some folks let go across the sectors, that is the way that free markets work. We shall see, perhaps a little more data in the coming months might point to a slowing in hiring in that segment specifically, perhaps more retail jobs being created. More tomorrow afternoon! Oh and dash it all, I didn't make the Proteas squad for the world cup either, better luck to me next time.

Company corner snippets

Rhodes Foods, ever heard of them? They listed last year, the company has been around for a while, 125 odd years. I actually passed by the head office this holiday, for those in the Western Cape you would be familiar with where it is, on the Pniel road from Stellenbosch towards Franschhoek, on the that corner where you turn right to Franschhoek. The Rhodes is actually Cecil John Rhodes, as per the history of the company via their website: History. Turnover for the company headquartered in Groot Drakenstein is 2.44 billion Rand, operating profits for the full year to end September grew strongly to 236 million Rand. I guess then you could say that the announcement yesterday of the acquisition of a fruit juice business, Pacmar, to compliment their existing purees and concentrates business. Purchase consideration? 165 million Rand in total, Rhodes paid 7.43 times EBITDA, not cheap. Running the whole fruit juice business will be a chap by the name of Pieter Hanekom, who worked at Ceres for 13 years. More pleasant surroundings for a head office in South Africa, I am not too sure you get better.

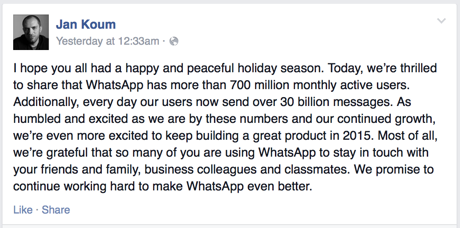

Facebook bought WhatsApp for 19 billion Dollars, remember that acquisition? We wrote about it back in February last year, the company has not even been in the Facebook stable for a full year, here is the refresher - Buying WhatsApp. WhatsApp is now closing in on the parent company in terms of number of users, having yesterday (announced by their chief and founder Jan Koum) passed through the 700 million user mark. Astonishing, here is the post from Koum:

Statista is a great service, their daily email had this post yesterday: WhatsApp Closing In On A Billion Users. See how it took Facebook 25 months to get from 200 to 700 million users, it took WhatsApp only 21 months, the graphic from the link shows it all. It seems that Facebook will be a company that has two platforms (soon) that have one billion users. 300 million is where Instagram is now, surpassing Twitter, the milestone was reached in the first half of December. The median price to earnings multiple forward is less than 40 times earnings now (expectations of 1.7 Dollars of earnings), with the Facebook share price having about doubled since the IPO in May of 2012. It is hard to believe that Facebook has only been listed since May 25 2012, and as a business it has only been around for 11 odd years.

Monsanto released their numbers yesterday, you can follow the link to have a look at what the company managed to do in the quarter past, as well as their future plans: Monsanto First-Quarter Milestones Reinforce Foundation for Growth in FY15. Soya beans were great, corn, not so good. The reason for the better than anticipated earnings is that Soya Beans margins are much better than the Corn division. It is a great business, we really like agriculture, the company is as much a technology one as it is a agricultural business, at the cutting edge of finding solutions to feed the world. If you have a moral issue with eating GMO foods, I hope then you are a vegetarian. A cow would drink their own body weight in 50 days, 25 days for a milk producing cow. Mind you, we must drink a lot of water too! Anyhow, our obligation to one another is to make sure that we are well fed, if science can be important in all of this, then so be it, it must happen. We will connote to analyse this company over the coming days.

What is going on with Google? When people in our circles ask that question, they would normally be talking about the share price and not necessarily the business, those are almost always two different things. Obviously the longer term prospects of the business will determine whether or not the share price delivers better than market returns for their shareholders, as a result of rising and better quality earnings. Google has under performed the rest of the market as well as their peers, if there is a business to compare them too. Google has under performed the NASDAQ by nearly 20 percent over the last year. Even the five year performance of Google relative to the index is starting to look like Google is maturing. I would be patient, Google is a fabulous business (and currently has a super one trick pony), it is probably the fact that many of their projects that they are working on (robotics, home integration, driverless cars) have yet to be monetary successes that leads many to be fairly impulsive about the shorter term prospects. My overwhelming feeling is to maintain a holding in what is a quality business.

Things we are reading, we think that you should read them too

The human mind is a powerful thing but it has certain biases when looking at the past - "I Knew It All Along". It is always dangerous to think that the winners were very easy to spot and that is was as clear as day that the losers were bad companies.

The JHB skyline is set to change again - Construction starts on Gauteng's 'Manhattan'. Development is a good thing for the local economy, creating a bigger pie to split among everyone.

Google still dominates search but a little less so than they have - Google Loses Most U.S. Search Share Since 2009 While Yahoo Gains.

Old trying to fight off the new - China Cities Crack Down on Illegal Cabs Using Car-Hailing Apps. Uber has faced opposition in many cities around the world and the people most threatened by the app are current taxi drivers. I think Uber style taxi services are inevitable it just depends how long it will take.

Home again, home again, jiggety-jog. Markets are higher here, thanks to much stronger markets overnight in the US, the markets in that part of the world jumped over 1 and one quarter of a percent.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment