"It feels strange at an elevated share price of nearly 129 Dollars pre market to suggest that this company is just potentially scratching the surface. The company has tripled in price since their "disastrous" IPO in May 2012, which is not that long ago. I pity the fool (Mr. T) who sold the stock in August of 2012 at around 18 Dollars when they were not able to monetise mobile. Mark Zuckerberg is not finished. Heck, he in many senses has hardly started."

To market to market to buy a fat pig Markets in the city founded on gold (and of a twister) ended the session way off the mid afternoon highs, nonetheless, it was another day of gains. Up just short of one-quarter of a percent, stocks were reaching for that 54 thousand mark an hour before the session closed. It was not to be, resources added comfortably over a percent with industrials holding us back, ever so slightly. Hey, we will take it! Amplats and GoldFields were at the top of the pile, the #winners on the day so to speak, following hot on their tails was a big performance from Richemont and Shoprite.

AB InBev was having a horrible, no good day, that stock in Rand terms was off over two and a half percent. Aberdeen Asset Management is asking for more of the monies in the current deal, I suppose the execution risk as the deal drags on, heightens. In fairness to all Pound investors, their Dollar amounts have diminished, they have a point. AB InBev could even cough up another pound or two and the amount would not change from the beginning of the deal. The WSJ reports - SABMiller Pauses Integration Work With Anheuser-Busch InBev. It is not as if the deal is on the rocks, all the hard yards have been done and the finish line is in sight, the old adage that a deal is not a deal until the money is in the till is still one of my favourites. Bless his soul, the client that told me that many years ago. We watch it with interest.

Paul was on the wireless last evening, talking about the intricacies of the deal, and the hedging of the currency (seemingly in the wrong direction), see this article - Pound's fall threatens to can AB InBev takeover of SABMiller. It turns out that AB InBev hedged in the wrong direction. As far as we know, they may have a lot less wriggle room and that is the reason why the price is taking some hammering. Eish. I suspect that the deal will be done.

Stocks across the seas and far away in New York, New York closed the session mixed. The nerds of NASDAQ were boosted by a monster move in the Apple share price, up 6.5 percent by the end of the session. It has still lagged the broader market, the stock is down 2 percent year to date and down 17 percent since this time last year. Apple stock is interestingly up 83 percent over the last five years, not the kind of return that I would have expected to have seen, the ten year return is the one that really jumps out at you, over 1000 percent. On a less than 12 multiple and with a 2.2 percent dividend yield, the stock certainly looks very cheap. Still.

There was still the small matter of the Federal Reserve and their meeting finishing, which culminated in what we now see a questions and answers session. In the old days the Fed was more secretive, less releases from their members, fewer public appearances and definitely fewer access points. The WSJ reports - Fed Leaves Door Open to Move as Soon as September. At session end the Dow Jones Industrial Average lost a point and a half (which is not much nowadays), the S&P 500 ended the session down 0.12 percent. Results overnight from a whole slew of companies, we will cover the biggest below.

Company corner

Whoa! Facebook just blew the market away in such a huge way last evening with earnings that comfortably topped estimates. This has, in my opinion, become the most watched company in the world, possibly eclipsing Apple. We are living and learning as humans to deal with issues of privacy and what is acceptable and not on the internet, most especially social media. Whilst you can post whatever you want, you should think about it deeply.

The revenue number for the last quarter at Facebook is less than the profit number at Apple for the last quarter. As of the close last evening, the Facebook market cap was over half of that of Apple. You can't compare Apples and Facebooks, stop it, that is silly as the great Monty Python characters would say. Let us jump head first into the important numbers. The company recorded revenues of 6.436 billion Dollars for the quarter, an increase of 59 percent on the year prior. Not bad for a company with a disastrous IPO.

Advertising revenues were a whopping 63 percent higher when measured against the same quarter this time last year. Astonishing! Mobile advertising revenues represented 84 percent of advertising revenues, up from 76 percent from this time last year. Remember a time when the company was going to struggle to monetise mobile? They just owned it! Operating margins increased to 43 percent from 31 percent, cost control in place at the social network.

Net income topped 2 billion Dollars (2.055bn USD), up 186 percent from this time last year. Non-Gaap diluted earnings per share clocked 97 US cents. Consensus for the full year has shifted beyond 4 Dollars a share, way higher than anyone estimated a couple of years ago. Like four times higher. Like. And like again. You CapeTonians and Durbanites invented "Like". Except you were too busy watching average rugby teams, that you forgot to patent it, some young geek in a study dorm was liking your like. Like shwow. Ouch, sorry, that was mean. The stuff about patents, not the rugby team.

On a users basis, this company stands heads and shoulders (and knees and toes) above the rest. Remembering that their core and first business is Facebook itself, the (very dumb purchases at the time, remember) other platforms, Instagram, WhatsApp and Messenger are all big hitters in their own capacities. As one stock analyst put it, Facebook has a product roadmap that has no peers. It really doesn't. And monetisation of the other major platforms have basically just scratched the surface. To think that 66 percent of all users of Facebook (monthly users - 1.712 billion) use it daily. And that mobile only monthly users (i.e. no desktop or laptop) is closing in on one billion, 967 million currently, having more than doubled in two years.

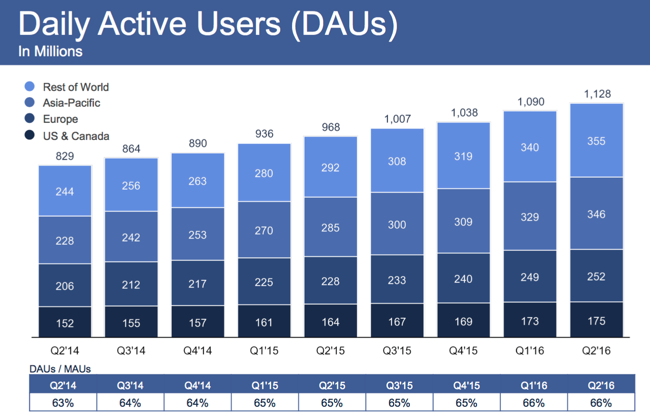

A few slides are worth taking from the presentation, firstly there is Daily Active Users by Geography, just to show the diversification of the business -

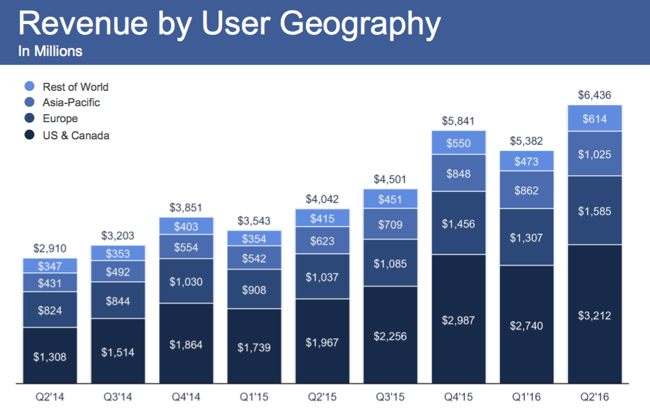

Half of Europe and half of the US and Canada (roughly) using Facebook daily. Which means that there are many others not using the service. Makes you think, not so? And then this graph, whilst there are many users all around the world, logging on daily to check the more awesome lives of their peers and friends, some spend more to advertise than others. It is not surprising that the US and Canada attract larger amounts of advertising than their European, Asian and rest of the world peers.

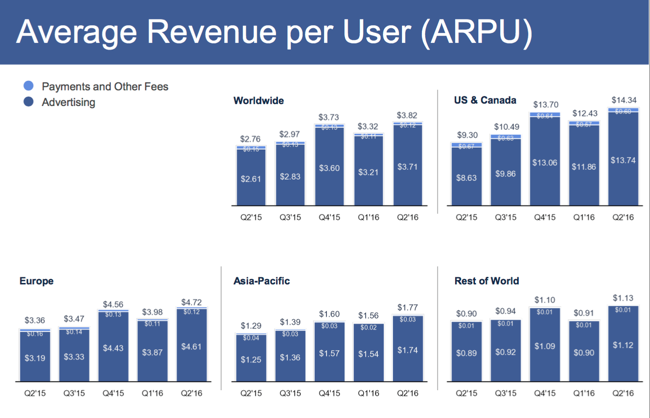

And then lastly, Average Revenue per User, which will beat home the idea that this definitely is a growth business. Note that this is the monthly income earned by the company per each user, in their respective territories. In the same way that the usage numbers for mobile phone companies is measured in ARPU's, the same applies here for Facebook, except it is the advertisers that are supplying the revenue and not the cell phone airtime buying.

It feels strange at an elevated share price of nearly 129 Dollars pre market to suggest that this company is just potentially scratching the surface. The company has tripled in price since their "disastrous" IPO in May 2012, which is not that long ago. I pity the fool (Mr. T) who sold the stock in August of 2012 at around 18 Dollars when they were not able to monetise mobile. Mark Zuckerberg is not finished. Heck, he in many senses has hardly started. He is a long, long away from being close to his vision. We need people like that. We continue to accumulate what is now a stock that is much cheaper than it was before they listed, even though the price has tripled. Capiche?

Linkfest, lap it up

Incredible. We know that the VW Beetle was an iconic product. So was that 80's toy thing, the Rubik's Cube. The iPhone blows them all away. Check this out from a blog you should follow, Horace Dediu from Asymco - The most popular product of all time. I am embarrassed to say that I don't know what a Honda Super Cub is, other than knowing (before I looked it up) that it is a mode of transport.

The age of the electric cars is well with us now. Car makers are trying to play catch up to Tesla, who are blazing a path for the vehicles - Porsche's Tesla rival on course for 2019. I took to Google to find out how the i8 sales have been, it seems that they have been a bit disappointing - The BMW i8 is a shining example of bait and switch car launch sales hype

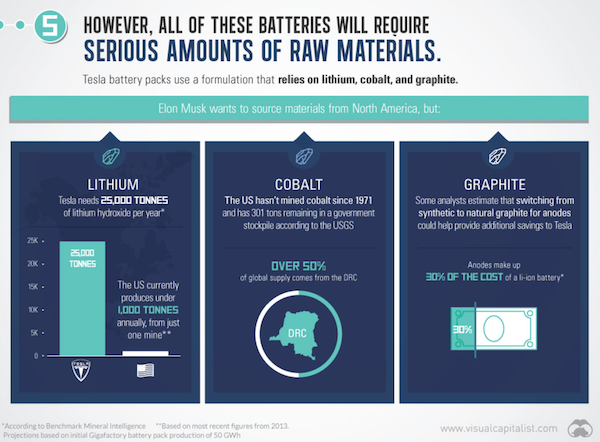

Sticking with Tesla, this week is the grand opening of the Gigafactory. It is a very impressive building which will bring a new level of mass production to the alternative energy market - These 9 Slides Put the New Tesla Gigafactory in Perspective

I wonder how many people will book flights through Airbnb? If I wanted a flight, Airbnb would not be the first place I would look. It is a clever way to get noticed though - Lufthansa is selling seats on flights through Airbnb.

Home again, home again, jiggety-jog. Stocks are mixed across the globe. Stocks in Japan are down, stocks in Hong Kong are down, believe it (yes you do), stocks in Shanghai are up. Ha ha, I commented that Garmin was up over 11 percent yesterday, remember them. Twitter was dissed, down over 14 percent yesterday. I thought that in 2016 the results delivered by those respective companies would have delivered divergent reactions, obviously both sets of shareholders (and subsequently reactions) would have differed on the outlook. One of our other stocks reported yesterday, Amgen, and L'Oreal report today, we will keep covering these stocks in time and deliver the report back. Stand by!

I recall when watching cricket in Australia that the commentators where extremely one sided and most especially Bill Lawry. Richie Benaud, also an ex Australian Cricket captain and perhaps the man who made modern day commentary what it is today, was a firm favourite. He would often say, "Marvellous". One of my absolute favourites however was "And Glenn McGrath dismissed for two, just 98 runs short of his century." Poor McGrath. He had the last laugh and ended up with 563 test wickets, only making 641 runs. That is also 641 more test runs than I will ever get. It is a little like owning stocks and just commentating on them. It is easy to make throwaway comments like this one is useless, or that one is great, having actual money in harms way is what sets you apart. So start saving and make it a priority today. If you needed reminding of one of the greatest messages that has ever come out of this office, thanks Paul, from nearly a year ago - Why save? There, pep talk done.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment