"The model is pretty simple. Movies and series on demand, as and when you want to watch them, you pay one monthly fee. The company has also evolved from other peoples content to their own original content, some pretty awesome series too."

To market to market to buy a fat pig The BusinessInsider graph of the day suggested that the Dow Jones Industrial Average has a chance to do something that it (it being the index) has only done 6 times since 1980. And that is to close up nine days in a row. I wonder if closing up nine days in a row and setting new all time highs every day would make it unique? Whilst the post Brexit rally continues, we are up around 8 odd percent since (we are told) the most earth shattering thing to happen in Europe since the fall of the Berlin Wall. I suspect that the conversion to a new currency across the length and breadth of Europe was a better thing, not so? That was more earth shattering.

Still, as Michael pointed out yesterday, Americans don't like stocks (subscription only) from Barron's - The U.S. Has a Misguided Faith in Real Estate. Americans, ordinary ones, don't like stocks. They have been burned twice, in 2000 and in 2008, and enough is enough. In order, according to the Barron's article, it goes House and Real Estate, then cash and CD's, stocks are as good as gold investments. True story. Well, that should make things pretty interesting when (if) the average Joe ever decides to come back to the stock market.

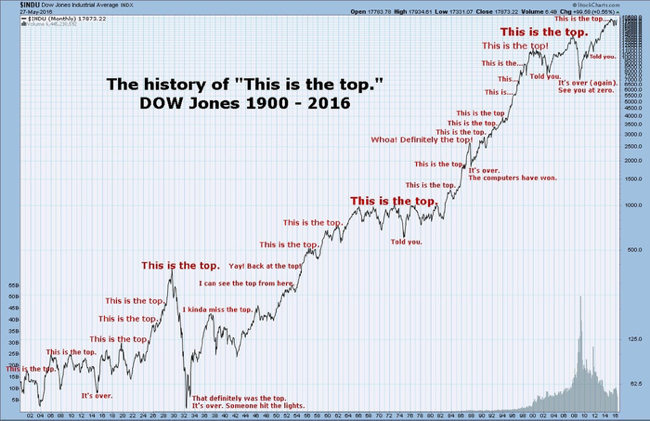

I did find, via the same platform (Barron's) that it is the eleventh time that the Dow Industrials had cracked 7 straight all time closing highs since 1925. There are now strategists, whose job it is to make big bold and non accountable predictions year in and year out, who are scrambling and looking at their targets again. Setting targets tells me all you need to know about that person, they are only looking out for this year or next. I expect that innovative and well run businesses with compelling products and services that humanity needs and wants will continue to print earnings higher and higher (if not consistently each and every year) for the next decade and beyond. The market will continue to rate those particular companies with higher valuations than their peer grouping. I found this very funny, it was a graph that Paul sent us the other day, titled "The history of this is the top" on the Dow Industrials from 1900 to present.

There are always going to be moments to worry about equity market investing. That may be today, that may be next week, next year, in the next decade. You may think that the European Union is a failure, I may think that it is going from strength to strength. As ever in markets, one can always agree to disagree. Every seller needs a buyer, every buyer needs a seller. There are divergent views each and every day, pension funds have obligations to meet for older retirees, younger people with gainful employment are saving for the future, their pension fund (or themselves) are buying the same shares. Conclusion? Don't worry about the headlines. Read them, enjoy them, you are an investor, not a trader.

Company corner

That person who doesn't have consensus. Elon Musk. And perhaps that is a very good thing. If your number 1 priority is to change the world, and to really, really change the world, then best you deliver on your promises/forecasts/plans. Best you do that. Last evening the fellow reminded us of the original Masterplan from ten years ago - The Secret Tesla Motors Master Plan (just between you and me). As you could imagine, he does admit to flying by the seat of his pants, as all great inventors do.

The reminder is ahead of the next stage in the company and their next ten year plan, which he introduced - Master Plan, Part Deux. Again, in the introduction part he points to the milestones. It is interesting that he says, in talking about the plan to make an expensive car that "I thought our chances of success were so low that I didn't want to risk anyone's funds in the beginning but my own." This was the first bunch of plans:

Build sports car

Use that money to build an affordable car

Use that money to build an even more affordable car

While doing above, also provide zero emission electric power generation options

Don't tell anyone.

In unveiling the next leg, he says that the Tesla and SolarCity tie up must happen. He also said that they would build a bus and a truck - "In addition to consumer vehicles, there are two other types of electric vehicles needed: heavy-duty trucks and high passenger-density urban transport. Both are in the early stages of development at Tesla and should be ready for unveiling next year.". He also spoke about ride sharing - "In cities where demand exceeds the supply of customer-owned cars, Tesla will operate its own fleet, ensuring you can always hail a ride from us no matter where you are.". In short, like when he unveiled the first plan, the goals are ambitious, he keeps it very simple however:

Create stunning solar roofs with seamlessly integrated battery storage

Expand the electric vehicle product line to address all major segments

Develop a self-driving capability that is 10X safer than manual via massive fleet learning

Enable your car to make money for you when you aren't using it

I still think that the biggest risk to Tesla is not running out of money, I suspect that people will always back Elon Musk. He eats elephants. He hurdles the Burj Khalifa. I am not going to bet against him. The share price and the valuation of Tesla may well be another talking point altogether, you are never going to time this one properly. The biggest risk to Tesla is without a doubt something happening to Elon Musk. I know that there are other people who work there and share his vision, unlike at Apple which is much older and more established, Tesla is still pretty much an entrepreneurial "feeling" business. I suspect that all the people who work there may tell me otherwise, they (and all humanity) are in the same boat. For the sake of all of us, the kids now and those born in half a century time, I hope Elon Musk is very right.

Another company that has morphed along the way, and is older than you think is a business called Netflix. You may already be a big fan, provided that you have the streaming capabilities here in South Africa. Like the providers of smartphones, you are only as good as your service provider. Netflix will be 20 years old next year at the end of August, the company is the same era as the Amazons of the world, listing at a less opportune time in 2002 after the tech bubble had popped already. It is hard to believe that Netflix has been listed longer than Google. With the advent of high speed broadband, the company was able to change from a simple mail and pickup of DVDs (remember those) to a streaming service. It is so big that the company accounts for one-quarter to one-third of all US internet traffic.

The model is pretty simple. Movies and series on demand, as and when you want to watch them, you pay one monthly fee. The company has also evolved from other peoples content to their own original content, some pretty awesome series too. "Orange is the New Black" and of course "House of Cards". The original of the originals. My watching patterns are erratic at best, sport mostly outside of business TV. That always needs to be watched live and always needs to be watched. There are plenty of people looking for different entertainment, and so far, not only have Netflix been able to deliver, they are a leader. Plus, importantly, you can watch the content across all hardware platforms. PC, Apple TV, Xbox, most set top boxes.

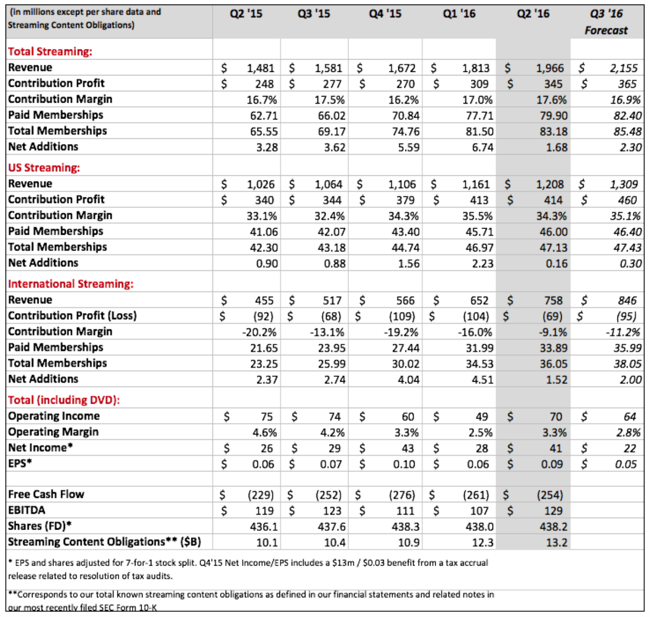

The company announced their numbers post the market two evenings back - Netflix Releases Second-Quarter 2016 Financial Results. Their subscriber base growth for the quarter missed expectations. As they said "We are growing, but not as fast as we would like or have been. Disrupting a big market can be bumpy, but the opportunity ahead is as big as ever and we continue to improve every aspect of our business." Personally, I don't like the word don't and neither do I like the word but. There is lots of competition, they are right. From Amazon, from Hulu, heck, even from YouTube. In fact, YouTube is the biggest streaming service provider in the world, untouchable currently.

Their non-US (what they term international) business is growing like gangbusters. Their core business revenues are growing, perhaps not as much as they would want. And they admit that they are not growing subscribers by the amount that they need and want. Reed Hastings suggests on the conference call that every household in the US may have the service in the coming decades. As ever, the only thing that matters is content, whether it is good or not. Live sports events such as the Olympics are going to disrupt their subscription numbers in the current quarter. These are all the Netflix numbers that you will need, as you can see, the company is profitable, not by too much.

As you can imagine, it matters not whether you have one million or 1000 million (that is a billion) customers, what matters is your ability to be able to continue to grow profits relative to the market valuation. Netflix is NOT going to be a company to own for everyone, there are many questions to answer over the coming years, I am sure they will answer most. The ride is going to be very volatile. Reed Hastings, the founder who stuck in 2,5 million Dollars of his own money at the start (he is now worth over 1.1 billion Dollars). Good work Reed, good work.

Linkfest, lap it up

It is amazing the advances that we make in technology every year. Healthcare advances are the ones that I am most pleased about, if we are going to live close to 100 I would want to be in a functional body - The Top 10 Emerging Technologies of 2016. All these advancements are made possible due to computers but also in part due to our large global population. Our large population means that there are more researchers working on new technologies and more consumers.

Another company joined the unicorn club - Unilever Buys Dollar Shave Club for $1 Billion. It is amazing that selling razor blades for $2.50 can be worth so much, the company only has 3 million customers at the moment. If you have 1 mins 33 sec then watch this great advert from Dollar Shave (Our Blades Are F***ing Great)

Here is a great example of striking while the iron is hot - The world's first 'Pokemon Go' dating service has launched. How many weeks/months do you think the Pokemon Go fad will last?

Home again, home again, jiggety-jog. Stocks are mixed, a little lower actually to begin with. The Dow futures are flat. C'mon there earnings, boost this one higher!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment