"And all the while the George Clooney lookalike will be forced to act quickly, whilst Italian banks look like they are on their wobbly walking stick that needs some sticky tape. Rooney is home early to get his Irish passport (he could if he wanted to), Clooney has no time to enjoy a Nespresso with Jack Black (with Lake Geneva in the background, I think) and the mantra might well be from Carney just 'What Else?' rather than 'double what else?'"

To market to market to buy a fat pig Do you know the Bank of England Governor? He is nicknamed George Clooney by the market masses, he does have that look about him. He is actually Mark Carney, a Canadian fellow with a pretty quick marathon time and the first non-Englishman to run the joint in their history. A brief history by English standards of course, Stonehenge and all that. Having said that, a little snooping reveals that the Bank of England is actually the second oldest modern reserve bank in the world and eighth oldest out of all banks. It is only recently an independent public organisation, that change taking place back in 1998. Carney is, according to Wikipedia, going to serve a 5 year term (he is three years in) and will then seek UK citizenship in order to complete the balance of a normal term, 8 years.

Another bank is in the news, this one being the Banca Monte dei Paschi di Siena (or just Monte Paschi), which also happens to be the oldest surviving bank in the world, founded way back in 1492 when the idea of a helicopter was being formed, by a strange resident of Florence, Leonardo da Vinci. Leonardo to his friends. I have actually seen a "branch", in a little town I drove through on a Sunday afternoon in Tuscany, without having to use the wayback machine (the one from Mr. Peabody and Sherman). Why then is Monte Paschi in the news? It turns out that, if you read the Bloomberg artifice, that Italy Considers Capital Injection in Monte Paschi.

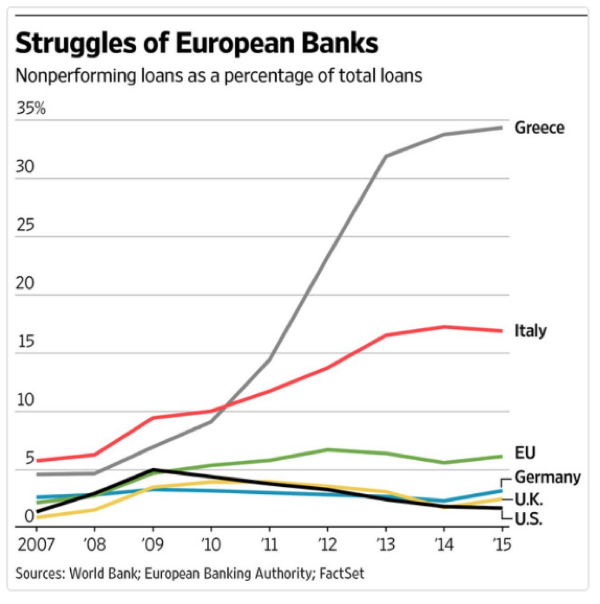

Why? Italian banks are looking shaky, a rise in non-performing loans. The number of impaired loans have risen fourfold since the financial crisis. As much as around 16 percent of all loans outstanding. Phew. In Greece it is higher at nearly 35 percent. These two sick old Mediterranean empires of yesteryear have the most fragile of all the banking systems in Europe. Italian banks are old school (real old school) and have been struggling in an environment where interest rates are so low, and the economy so sluggish. They don't have other businesses like asset management and investment banking, it really is old school (or old skool if you are a RocoMamas fan). So when there is a crisis of confidence, as there has been with the "Brexit" event, the weak areas close to home are exposed. When the ground rumbles, the weakest walls are exposed.

Not only is there the Brexit event to deal with for the people of Europe, there is now a borderline crisis in the Italian Banking system, some could argue that it has been there all along. The banking system has been recapitalised twice, a third time is not seen by the masses favourably. And with a pending constitutional reform referendum in October, this may not be the best of timing. According to the Borsa Italiana website, the bank employs over 28 thousand souls and has a customer base of 5.6 million, as well as 215 billion Euros in assets. Time to split up and bad bank/good bank it, you think? Yesterday the stock fell nearly 20 percent, for those holding the company since the financial crisis, it has nearly gone to zero, down 99 percent and some change. Bloomberg has it as from January 2008 to present as being down 99.52 percent. Sis. A fellow by the name of Tommy Campbell tweeted this not so good looking graph via the WSJ -

So what does the George Clooney lookalike suddenly have to do with an ancient Italian bank, that possibly needs to update their reality, and how does this all fit into one discussion? Call it post Brexit blues, call it post the event remorse, call it unintended consequences. At the same time as Governor Carney was speaking yesterday, warning that there would be a slower economy, a tougher outlook, there were stories starting to emerge that several property funds in the UK were unlikely to pay out any time soon. It may not be "big", it is 11.9 billion Dollars in assets that have seen withdrawals by investors "frozen". A suspension in trading of three commercial property funds which tally the above amount will spook Mr. Market without a doubt. The three parties are M&G Investments, Aviva Investors and Standard Life Investments, all of whom have paused redemptions. Mark this down as "unintended consequences".

And whilst a Canadian tries to put on a brave face (not too dissimilar to a brave Italian fellow, by the name of Draghi) and suggest that he will also do whatever it takes, you get the sense that the stink left by uncertainty and the complete absence of political leaders is sending pound based assets into the bogger. And the Pound too, which sank to levels last seen pre-internet. To the Dollar that is, levels now sit at a 31 year low. Bloomberg actually has an incredible graph, titled the Pound's 100 year debasement -

I am not too sure where on the chart, should you have removed the Great from the Great British Pound? The fact of the matter is, that in terms of recorded history, the empire has lost economic prowess to the fellows from over the Atlantic. And more recently back to the East. The moral of the story is that great grandpapa should have sold his Pounds, bought Dollars and invested in General Electric 100 years ago. He should have reinvested the generous dividends over the years and now you would spend your days wondering about whether or not you should go watch Wimbledon tomorrow, or the test cricket at Lords in a week or so. Remembering that the Dollars you have now are a whole lot more in Pound terms.

So a stable income trust, which is getting redemption requests and unable to meet liquidity, casting negative ructions across the whole commercial real estate across the UK. Which may mean some distressed sellers. Domestic investors "brexiting" themselves, looking for other assets, which may lead to a further down on property prices. They (the commercial property funds) can lever up and match the redemptions, the main problem will arise in when the value of the properties itself is worth less, the banks may be loathe to lend the investors more. Cycle complete means investors want out in a hurry. Ooops, didn't see that coming now, did you Nigel and Boris? And apparently Liz Hurley and Ian Botham. The value of your assets, at a global level, are worth less. Put this in the drawer of unintended consequences.

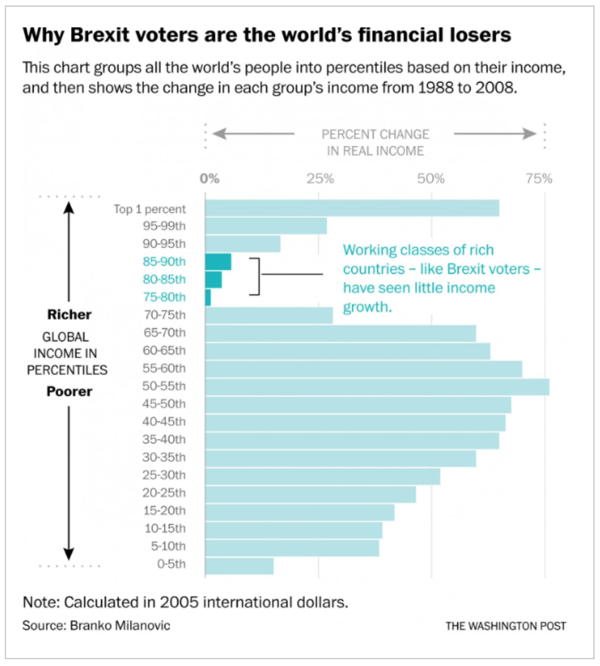

By no means worthless, I am pretty sure that if Britain is open for business, as they continue to suggest that they are (hints of dropping the corporate tax rate to 15 percent), there are many people across the globe who would salivate at the prospects of cheaper assets in what is still a big economy. I am pretty sure that there are some Chinese investors who want assets in the UK, Nigel or no Nigel and his bigotry. Money has no colour. Sorry, money is only one colour, and that is green. Lastly, remember last week when I was trying to explain why older people in the UK had voted so spectacularly for a Brexit, and had seen a table of a lack of income growth. I found it!!! By jove, here it is, actually via a positive story Twitter account and website, called Human Progress - Globalization's So-Called Winners and Losers, via the Washington Post -

What this graph shows is that the old school rich people of the developed world, by global standards that is, have not been winning as much as top of the pile people, lower middle income and low income groups over the last 30 years. The big winners globally have been class upliftment out of relative poverty. And of course those darn pesky rich people. Slippage in the world economic order has meant that old school European banking and old school wealth in the UK is being left in the dust. It doesn't meant that there hasn't been global progress. Focus and attention is always directed towards misery, less so to stories of innovation and upliftment that happens over decades (as the graph above tells you).

Whilst as shareholders of businesses are trying to make progress globally across multiple territories, we can't and will never expect a smooth ride, these types of events come along every so often. The trick is to say that whilst the value of the assets on paper may be marked down by Mr. Market, and that feels incredibly bad at the time, stay the course inside of the quality. Make sure that you "do nothing", don't get spooked and stay invested. If anything, look for bargains. And all the while the George Clooney lookalike will be forced to act quickly, whilst Italian banks look like they are on their wobbly walking stick that needs some sticky tape. Rooney is home early to get his Irish passport (he could if he wanted to), Clooney has no time to enjoy a Nespresso with Jack Black (with Lake Geneva in the background, I think) and the mantra might well be from Carney just "What Else?" rather than "double what else?"

Quick scoreboard check. Local was not so lekker yesterday, stocks in Jozi, Jozi were impacted by the continued anxieties across the globe in the Brexit fallout, we ended the day down one point five percent, financials and resources both down over two percent, in fact as a collective both indices were down 2.16 percent apiece. Unusual, like the Bryan brother twins, left and right handed combination. Except in this case Bob and Mike (Bryan) come from the same mother, investors and industry participants in mining and finance live separate worlds altogether. Shares making twelve month lows with the falling Pound were Capital and Counties (down over four and a half percent) and Intu (down nearly six percent). Remember that these two stocks used to be the Liberty International properties combined. Oh, and the Rand to the Pound? Nearly 19 Rands flat. You may well be able to afford that cup of coffee when you stop over at Heathrow on your way somewhere!

Across the seas and far away in New York, New York, stocks lost a fair amount on the day, off the worst levels though. Blue chips, in the form of the Dow Jones, dropped just over three-fifths, the broader market lost just over two-thirds of a percent, whilst the nerds of NASDAQ were beaten a little lower than that, down just over four-fifths. Energy and basic materials sold off heavily, the oil price sank heavily. In part as a result of the US letting everyone else know that they had larger reserves than Saudi or Russia. According to a new study. The report was highlighted in the FT and was produced by a Norwegian consulting group, Rystad Energy. See the Bloomberg story - U.S. Holds More Oil Than Saudi Arabia or Russia, Rystad Energy Says.

Is this good or bad news for Elon Musk and Tesla? The higher the supply of oil, the lower the price, the less receptive people are to adopting alternate energy / future technology. How far has social consciousness already shifted? The move is already afoot and as a result, the cost of Solar energy has been driven markedly lower. And simple economics will dictate ultimately that the cheaper solar storage gets (it will happen), it will cause consumers to adopt cheaper technologies. It would then mean that the dreams of Musk actually comes true, to be independent of fossil fuels. The other argument is just as valid. The greater the reserves and the greater the abundance of fossil fuels (as is the case) the less likely there is to be a rush to renewables, unless you are richer and happy to pay a premium for the green technology. I suspect we are in-between the two scenarios currently. An unstoppable renewables generation is afoot. As is motor vehicle adoption and new consumers. Check back in five years! Musk will be right is my best guess.

Linkfest, lap it up

As the globe gets richer, more money can be spent on things like space exploration. This telescope looks very impressive - China has built a radio telescope the size of 30 soccer fields

Very interesting to see the solutions that we come up with for some of our pressing global issues - How Vertical Farming Works. Vertical farms address the issue of having to bring food to cities (costly) from far off and depending on their setup can be more environmentally friendly. Going forward, people will make the farms even more efficient and find ways to lower the start up costs.

When I think of Guyana, I think of cricket not oil. That may be changing though - With Second Big Oil Discovery, Exxon Puts Guyana On The Map. Back to our discussion above, more oil means lower prices and more big 'trucks' being bought

Home again, home again, jiggety-jog. Stocks are getting paddy-whacked across to the East. Although Chinese stocks in Shanghai are up just a little. Who would have thought? The Nikkei is down 1.85 percent in Japan and the Hang Seng is down one and two-thirds of a percent. Expect equity markets to continue this bumpy ride until there is some "certainty".

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment